Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2024, vol. 15, no. 1(30), pp. 51–73 DOI: https://doi.org/10.15388/omee.2024.15.3

Post-COVID Insurance Purchase Intention: The Roles of Referral, Agent Characteristics, Influencer Credibility, Plan Value, and Trust

Agatha Jane Kristabel

School of Business and Management Petra Christian University Indonesia, Indonesia

agathajane98@gmail.com

Serli Wijaya (corresponding author)

School of Business and Management Petra Christian University Indonesia, Indonesia

serliw@petra.ac.id

https://orcid.org/0000-0003-3988-3157

Ferry Jaolis

School of Business and Management Petra Christian University Indonesia, Indonesia

ferry.jaolis@petra.ac.id

Abstract. The COVID-19 pandemic has heightened public awareness regarding the importance of health insurance. Several factors influencing the choice of an insurance brand include the plan value, agent characteristics, referrals, and consumer trust. Over the past five years, the use of influencers has expanded as they are believed to influence consumer intentions to purchase insurance services. Primary data was collected through a survey of 181 respondents who did not have an insurance policy but had seen the content of the insurance company’s marketing communications presented by influencers. Using SEM-PLS to analyze the primary data, the study found that agent characteristics and influencer credibility directly affect an insurance brand’s consumer trust and purchase intention. Meanwhile, referrals have a significant direct effect on consumer trust but not directly on purchase intention. Conversely, the plan value offered by insurance companies directly affects purchase intention but has no direct influence on consumer trust. Despite finding that consumer trust was insignificant in mediating the effect of referrals, agent characteristics, plan values, and influencer credibility on purchase intention, this study validates the role of agent characteristics, plan values, and influencer credibility in influencing consumer’s intention to purchase insurance products.

Keywords: referral, agent characteristics, influencer credibility, plan value, consumer trust, insurance purchase intention

Received: 28/12/2023. Accepted: 4/4/2024

Copyright © 2024 Agatha Jane Kristabel, Serli Wijaya, Ferry Jaolis. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

The COVID-19 pandemic has made Indonesians more conscious about their health. This shift also affects their awareness of the importance and need for insurance protection. In 2011, the government established the Social Security Administering Body (BPJS) and designated PT. ASKES (Persero) to oversee the healthcare social security program, leading to its transformation into BPJS Kesehatan (Dikiyanti et al., 2021). Besides its presence, many private insurance companies are growing in the country, leading to more intense competition in the industry (Nismawati et al., 2022). Literature has shown that consumers often seek out private insurance plans because they believe that they would obtain more comprehensive coverage and additional benefits beyond what is offered by the government program. Private health insurance companies cater to market segments, including individuals and families, who prioritize personalized healthcare options, access to a broader network of healthcare providers, shorter wait times for medical services, and enhanced customer service experiences (Rice et al., 2014). Recognizing the fundamental elements that impact consumers’ decisions to choose private insurance is essential for policymakers and healthcare stakeholders. Therefore, this study is expected to make a valuable contribution in this regard.

As of semester 1, 2022, the Indonesian Financial Services Authority (Otoritas Jasa Keuangan) reported that the market penetration of the insurance industry had reached 8%. A similar trend was reported by the Indonesian Life Insurance Association, claiming that the number of life insurance policies rose to 17.4% in the first quarter of 2022, with an increase of 23.7% in the number of insured (AAJI, 2022). Until recently, tens or even hundreds of insurance brands have scattered over Indonesia, including numerous global names such as Sequislife, AIA, Allianz, Prudential, and others. Along with the growing number of insurance brands that have sprung up and offered various advantages, a prospective consumer needs to consider many factors before determining which insurance brand to choose to provide safety and protection for themselves and their family.

A preliminary survey of thirty-seven participants revealed several underlying factors that influenced their trust and choice in insurance brands: the perceived fit between the premium and the facilities provided, the agents’ services and knowledge, and the recommendations from their social circle. In other words, factors such as insurance plan value, agent characteristics, and referrals may play a critical role in shaping the prospective customers’ trust toward insurance brands, ultimately leading to their purchase intent.

Insurance companies compete to provide the most compelling value for customers. The enormous range of insurance products and brands offered by companies or individuals frequently leaves a potential consumer perplexed, which eventually decides to choosing a particular insurance without comprehensive and transparent information (Handel & Kolstad, 2015). A prospective consumer will essentially select a brand that brings a maximum level of satisfaction. Leon and Choi (2020) found that consumer satisfaction with the services provided by the insurance sector can be measured based on two dimensions: functional and technical quality. In the insurance context, functional quality refers to the degree to which an insurance product fulfills its intended purpose and meets the needs of the policyholder, whereas technical quality relates to the underlying capabilities and reliability of the insurance provider, including plan value. Functional quality plays a critical role in shaping customer perceptions and satisfaction with insurance services where technical quality is determined by the price and quality of a product or service as perceived by the consumers.

In addition to the insurance product itself, the agents who represent and market the insurance company’s products and services play a vital role in persuading the customer to whether or not purchase an insurance product. The characteristics of an agent are crucial as they aid companies in understanding their consumers, fostering commitment, and enhancing trust (Ainiyah et al., 2020). Prospective clients can also acquire information and references about insurance products from reliable individuals. Close friends and relatives who have experienced services from a specific insurance brand may act as referrals and can be persuasive enough to ignite purchase intent on the same brand. This is true of the nature of managing brands in the service sectors, particularly in healthcare industries where word of mouth and patient experiences are critical to customer decision-making (Sirisha & Babu, 2014). This viewpoint supports Dichter’s (1966) claim that individuals often consider referrals or recommendations from others (family, friends, and relatives) when making purchasing decisions.

Referrals can also come from a specific reference group. In the last five years, some insurance brands in Indonesia have begun collaborating with public figures such as national and worldwide celebrities to become brand ambassadors (Lyna & Nany, 2023; Perkasa, 2019). Several insurance companies also collaborate with influencers to sell their products through video content on the insurance companies and influencers’ YouTube and Instagram feeds. There are insurance companies who collaborate with music producers to create jingles sung by singing talents. These practices are acceptable as long as they comply with government regulations as stated in OJK (2020). Lou and Yuan (2019) defined an influencer as a content creator who has many followers. Different from traditional celebrities who usually get their popularity from traditional media, an influencer can be only an ordinary individual who has and/or intentionally creates a unique personality through their content on social media to attract followers (Lou & Yuan, 2019). The relationship between influencers and their followers fosters a sense of ‘closeness’, enabling the influencer to wield a strong influence over their followers’ opinions and purchase decisions (Djafarova & Rushworth, 2017). According to AlFarraj et al. (2021), one of the important factors that determines whether an influencer can be trusted or not is their credibility. Credibility can be defined as the audience’s perception of the quality of someone’s communication, whether it is trustworthy and reliable (Sokolova & Kefi, 2020). The credibility of an influencer will determine its ability to persuade its audience (Lou & Yuan, 2019). However, the literature shows inconsistent results on the role of influencers in consumer purchasing decisions. Sesar et al. (2022) revealed that influencer credibility has a favorable and considerable impact on purchase intention, whereas Ohanian (1990) discovered that not all influencer credibility dimensions affect purchasing intention. Meanwhile, research conducted by Lou and Yuan (2019) demonstrates that trustworthiness as a dimension of influencer credibility has a detrimental effect on consumer purchase intentions.

Interestingly, the findings of the preliminary survey conducted informally by the researchers discovered that only three out of 37 participants agreed that the presence of famous influencers or celebrities as brand ambassadors indeed enhanced their trust in the insurance company and convinced them to choose an insurance brand. Based on the preceding contextual phenomena and conceptual gaps that have shown various results, this research, therefore, aims to determine whether influencer credibility can ultimately encourage consumer trust and, in turn, affect consumer interest in purchasing an insurance product from a particular insurance brand post-COVID-19 pandemic era. The findings of this study are expected to contribute to enriching the literature on consumer decision-making and the role of reference groups such as referrals, agent characteristics, and influencers as the reference in decision-making and trust forming, especially in highly involved financial service products of health and/or life insurance.

2. Literature Review and Hypotheses Development

2.1 Source Credibility Theory

The basis of this study lies in the source credibility theory, which was first put forward by Hovland and Weiss (1951), stating that credibility would determine whether a message or information may persuade the recipient of the message/information. This refers to the recipient’s perception of the credibility of the message giver (Hsieh & Li, 2020). Psychologically, a person is more likely to trust and receive information or messages from highly credible sources because this credible perception makes the recipient of the message feel that the information they receive is accurate (Watts & Zhang, 2008). Source credibility theory then developed and is now widely used to influence people offline and online (Hsieh & Li, 2020).The theory is relevant for this study since referrals and agent characteristics are two major sources of information consumers rely on when searching for information related to insurance brand choices.

2.2 Referral, Consumer Trust, and Purchase Intention

The insurance sector is a service product with credence characteristics, making its quality difficult to measure even after consumers have purchased it (Leon & Choi, 2020). Therefore, advice or experience from close friends and family who have used a particular insurance brand is one of the factors that can increase purchase intentions (Kumar et al., 2010). Similarly, Dichter (1966) noted that when making a purchase decision, a person will pay attention to the referrals or recommendations of individuals (family, friends, and relatives). The influence created by a person or group of people will affect the product or brand that someone selects (Kotler & Keller, 2016). One form of referral often used in the service sector is word of mouth (WOM). It is defined as communication between one consumer and another to review a product or service (Amron et al., 2018). According to Chang and Lee (2020), word-of-mouth (WOM) is a method of communicating one’s opinion regardless of the company’s marketing objectives. Positive WOM is generated by consumers who are satisfied with the service from the company. In the service sector, WOM becomes vital information since consumers prefer personal information when purchasing. Given that the service sector does not involve tangible objects for sale, word of mouth can provide potential consumers with an overview or evaluation of the product to be purchased (Chang & Lee, 2020). Referrals can be from an individual or reference group which intensively engages with a person and directly influences their behavior (Tanprajna & Ellyawati, 2020). Four indicators can be used to measure referrals: 1) recommendations from friends, colleagues, or family members; 2) whether consumers purchase items or brands based on trustworthy companies or social networking sites; 3) whether consumers are concerned when buying products that have not been referred to them; and 4) online referrals that increase confidence in purchasing a product or brand. Personal communication channels significantly influence consumers, especially when it comes to buying expensive and potentially high-risk products. In this case, someone who receives positive recommendations from others may also have a positive image of the product and is interested in purchasing the suggested product or even offering recommendations to others. Consumers will be more likely to be more secure in selecting a product if it has been recommended by people around them (Tanprajna & Ellyawati, 2020). Referrals have a positive impact on purchase intention. The same notion was addressed by Abzari et al. (2014), who stated that satisfied consumers would have a favorable view of the company, and this positive impression would be propagated by word of mouth. These referrals will influence the customer’s purchase decision. Based on the preceding discussion, this study advanced the following hypotheses:

H1: Referral has a direct and positive effect on consumer trust.

H2: Referral has a direct and positive effect on purchase intention.

2.3 Agent Characteristics, Consumer Trust, and Purchase Intention

In the insurance sector, consumers typically establish a relationship with an insurance company through a salesperson or an agent, who is someone who interacts with and relates to consumers (Ainiyah et al., 2020). As one of the intangible service products, the characteristics of the agent are essential factors in establishing the relationships between the company and consumers. Agent characteristics play a significant and critical function in the company since agents enable the organization to understand and meet the wants and even wishes of its clients, resulting in a competitive advantage (Ainiyah et al., 2020). Meanwhile, according to Panda (2013), the critical role of agents lies in creating commitment and increasing consumer trust, especially in the service sector. Ainiyah et al. (2020) state that the characteristics of an agent can refer to the personal characteristics of a seller representing a company built through numerous attributes. These attributes will form a personality, type, and behavior that significantly contribute to building a relationship between the seller and the buyer (Dion et al., 1995).

Panda (2013) assessed agent characteristics in the insurance context using broader dimensions such as expertise, power, likeability, similarity, frequency of contact with consumers, level of social interaction with sellers, length of time the agent-consumer relationship has been established, and trust in salespeople. Expertise can be interpreted as the knowledge of an agent, technical competence, and the ability to answer specific questions asked by consumers (Guenzi & Georges, 2010; Yu & Tseng, 2016). The knowledge and experience possessed by the agent will minimize the uncertainty consumers feel, so consumers will trust a service more when the salesperson or agent offers control over the products sold (Guenzi & Georges, 2010; Panda, 2013). Likeability can be interpreted as the degree to which a salesperson is friendly, polite, and pleasant in the eyes of the consumer (Guenzi & Georges, 2010; Yu & Tseng, 2016). Friendly salespeople will also leave a positive impression on their consumers, making them feel happy and content, which will eventually lead to trust (Chen et al., 2008). The term ‘similarity’ refers to similarities in lifestyle, social class, and educational level between salespeople and consumers (Yu & Tseng, 2016).

In their study on the relationship between service providers and consumers in the service sector that requires high-credence service in Hong Kong, Chang and Lee (2020) found that expertise as one of the dimensions of agent characteristics has a significant positive effect on trust, whereas likeability has no impact on trust. This occurs in the service industry because, where trust is essential, consumers may appreciate the salesperson for delivering courteous, kind, and pleasant service but may not necessarily trust them solely on this basis (Xiong Chen et al., 2008). Panda (2013) discovered that an agent characteristic in the insurance market sector had a direct and significant relationship to consumer trust. Aside from serving as a source of information, the presence of a salesperson is also a significant factor in the insurance industry. According to Yu and Tseng (2016), in the context of life insurance in Taiwan, the relationship between salespeople and consumers is frequently an essential factor influencing purchase decisions. Based on the discussion above, this study formulates the following hypotheses:

H3: Agent characteristics have a direct and positive effect on consumer trust.

H4: Agent characteristics have a direct and positive effect on purchase intention.

2.4 Plan Value, Consumer Trust, and Purchase Intention

The current rise in healthcare costs necessitates insurance coverage for everyone, providing optimal security and protection for their families. Insurance companies, which are currently numerous and varied, compete to deliver the highest quality. The wide array of insurance products and brands offered by corporations or individuals often leaves potential clients confused, leading them to choose specific insurance plans without comprehensive and clear information (Handel & Kolstad, 2015). According to Baicker et al. (2015), the complexity of selecting insurance comes from four aspects: the costs that must be paid by the consumer when a claim occurs (deductible), the amount of the premium (co-payment), the cost that the consumer must pay after the deductible is met (co-insurance), and the limits on own expenses that must be paid by the consumer (out-of-pocket).

In insurance services, consumer satisfaction is measured based on functional and technical quality (Leon & Choi, 2020). Plan value can be regarded as a function of the price and quality of a product or service (Leon & Choi, 2020). According to Handel and Kolstad (2015), insurance plans are classified as financial or non-financial. Financial plans focus on the price function, while non-financial plans focus on other aspects such as insurance service providers. Various factors can influence plan value in the insurance sector, including the source of purchase. Purchase sources in the insurance sector can be divided into two categories: consumers who are employees and consumers who are not (Leon & Choi, 2020). The difference between the two lies in the motivation and expectations for the insurance plan. Leon and Choi (2020) identified five criteria for assessing the value of a plan: reasonably priced insurance premiums, adequate coverage limits, sensible deductible limits, reasonable co-payment terms, and overall good value for the insurance plan. Meanwhile, Handel and Kolstad (2015) use three indicators to assess the characteristics of a financial plan: deductible, co-insurance, and maximum out-of-pocket (OOP). In line with Handel and Kolstad (2015), Jayaraman et al. (2017) measured plan value of health insurance services based on six indicators: insurance coverage, number of hospitals, fringe benefits/bonuses, financial burden reduction, total premiums, and policy process formalities. Based on the studies above, this study focuses on financial plans and uses deductible, co-insurance, and maximum out-of-pocket (OOP) indicators to measure plan value.

Wijaya and Wismantoro (2017) discovered that perceptions of premium quality and pricing of insurance products had a favorable and significant effect on trust. A study by Guan et al. (2020) regarding the factors that influence the purchase intention of insurance products also found that price is one of the factors that can drive the decision to purchase the insurance product itself. The pricing concept, researched by Guan et al. (2020), in the context of life insurance, is payment terms, premium prices, price structures, policy values, flexibility, discounts, and price comparability. Jayaraman et al. (2017) asserted the same point in health insurance, stating that the price of insurance premiums influences purchase intention. This viewpoint is confirmed by the research by Mirza and Ali (2017), which shows that perceived prices in the service industry have a favorable and significant influence on purchasing intentions. Based on the initial research above, this study puts forward the following hypotheses:

H5: Plan values have a direct and positive effect on consumer trust.

H6: Plan values have a direct and positive effect on purchase intention.

2.5 Influencer Credibility, Consumer Trust, and Purchase Intention

According to Lou and Yuan (2019), influencers can be interpreted as content creators with many followers. Influencers and their followers will communicate with each other via SNS platforms such as Instagram, Facebook, and YouTube, which contain stories about the influencer’s everyday life, experiences with a particular product or brand, and various events encountered by the influencer. Compared to celebrities in general, influencers can be classified as “micro-influencers” because it all depends on the relationship between influencers and their followers (Borchers & Enke (2021). Influencers provide a medium where brands or products can be promoted more naturally and unobtrusively, leading users to regard them as more credible sources than traditional celebrities (Jin et al., 2019).

The relationship between influencers and their followers will develop a ‘proximity’ so that influencers will have a strong influence on the opinion formation and decisions of their followers in purchasing a particular brand or product, either directly or indirectly (Djafarova & Rushworth, 2017). The number of influencers that have emerged now requires everyone to be skilled at identifying influencers who can serve as role models. According to AlFarraj et al. (2021), credibility is a key component in determining whether or not an influencer can be trusted. It is defined as the audience’s perception of a person’s communication quality and whether it can be trusted and relied upon (Sokolova & Kefi, 2020). An influencer’s credibility will determine his ability to persuade his audience (Lou & Yuan, 2019).

Three dimensions can be used to describe influencer credibility, namely attractiveness, trustworthiness, and expertise (AlFarraj et al., 2021; Sokolova & Kefi, 2020). Attractiveness can be interpreted as a positive stereotype of an influencer, involving physical appeal and personality attractiveness (Erdogan, 1999). According to Hassan Fathelrahman Mansour and Mohammed Elzubier Diab (2016), attractiveness is a combination of physical appearance, personality traits, and lifestyle that makes influencers appealing to their followers. Furthermore, trustworthiness relates to an influencer’s honesty, integrity, and reliability as perceived by the target audience (Van der Waldt et al., 2009). Munnukka et al. (2016) defined trustworthiness as the influencer’s honesty, sincerity, and truth, which suggests that the influencer will share his/her feelings honestly. The third dimension of influencer credibility is expertise, which can be defined as the degree to which an influencer is seen as a reliable source of information. This relates to an influencer’s expertise, experience, and talents based on how the audience perceives them (Erdogan, 1999). Munnukka et al. (2016) define expertise as a competency held by an influencer in the form of knowledge, experience, or other supporting abilities. If an influencer has adequate knowledge, experience, and skills, the audience will regard the influencer as a reputable source of information (Daneshvary & Schwer, 2000). Influencers with expertise will be more persuasive in increasing brand awareness and audience engagement (Erdogan, 1999). Based on the preceding discussion, this study proposes the following hypotheses:

H7: Influencer credibility has a direct and positive effect on consumer trust.

H8: Influencer credibility has a direct and positive effect on purchase intention.

2.6 Consumer Trust and Purchase Intention

Trust is one of the important elements in the world of marketing nowadays since it acts as a mediator in the consumer relationship with the company (Panigrahi et al., 2018). The concept of trust, however, is defined differently depending on the context being discussed (Flavian et al., 2005). Trust is created by regular encounters between both parties, creating the perception that the vendor will go above and beyond for his consumers while also acting graciously and honestly (Pezhman et al., 2013). In line with this, Panigrahi et al. (2018) define trust as a process that occurs when people interact with one another. Trust is earned and maintained over time. Trust, according to Agyei et al. (2020), is the conviction that a trusted party will be socially responsible for meeting the expectations of the party that trusts it without exploiting its weaknesses. Trust can be a person’s attitude toward another, but it can also extend to intangible objects (Delgado‐Ballester & Munuera‐Alemán, 2001). The service sector heavily relies on trust due to the intangible, heterogeneous, inseparable, and perishable characteristics of services (Ebrahim, 2020; Iglesias et al., 2020; Islam et al., 2021; Rasheed & Abadi, 2014; Thaichon & Quach, 2015). Trust from prospective consumers is undoubtedly vital when it comes to selecting insurance as an intangible commodity. Panda (2013) evaluates consumer trust in the context of insurance in India under two dimensions: the credibility of the insurance provider organization, including the individuals who represent it, and the degree to which the service provider is truly committed to the welfare of its consumers. Agyei et al. (2020), in agreement with Panda (2013), describe consumer trust as the trust granted by consumers to an insurance service company, which signifies that the insurance company selected is a company that delivers proper and reliable services.

Moreover, Arli et al. (2018) contend that a salesperson’s selling activities, with an emphasis on relationship building, enhance the trust of customers or buyers in the salesperson and influence purchase decisions. This suggests that the influence of the salespersons’ characteristics, such as personal appeal, coalition building, and legitimation on buying decisions depends on customer trust formed as a mechanism that occurs during the selling activities (Hartmann et al., 2020). Building on these previous research findings, this study also suggests that insurance agents’ characteristics, such as knowledge, personalities, or values, will influence the formation of customer trust, ultimately leading to purchase decisions.

On this basis, this study puts forward the following hypotheses:

H9a: Consumer trust mediates the influence of referrals on purchase intention.

H9b: Consumer trust mediates the effect of agent characteristics on purchase intention.

H9c: Consumer trust mediates the effect of plan value on purchase intention.

H9d: Consumer trust mediates the effect of influencer credibility on purchase intention.

H10: Consumer trust affects purchase intention.

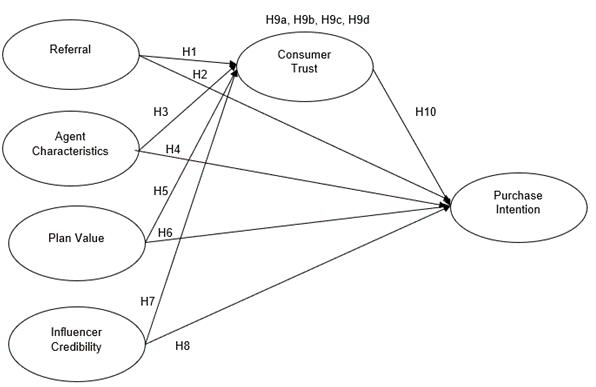

The research model guiding this study is depicted in Figure 1. The influence of four main antecedents (Referral, Agent Characteristics, Plan Value, and Influencer Credibility) on customer Purchase Intention for insurance products is first examined. The formation of Customer Trust in insurance companies is then elucidated as a mechanism resulting from the activities of insurance agents, influencers, and other customers, as well as the perceived value of the insurance products themselves.

Figure 1

The Research Model

3. Methods

This study collects quantitative data through a purposive sampling technique using questionnaires and the Populix research panel services. A total of 200 questionnaires were collected, of which 181 were used for analysis, leaving 19 responses that did not meet the sample criteria; hence the response rate for this study was 90.5 percent. This survey employs three sample criteria. First, a minimum age of 22 years is a threshold, considering that the typical age at which Indonesians finish their studies and begin their careers is around 22 years old. Furthermore, participants must be familiar with and have viewed promotional material from insurance brands shared by influencers on popular social media platforms like Instagram, Facebook, or YouTube. These influencers include notable figures such as the celebrity couple Titi Kamal and Christian Sugiyono, accomplished young business leader Putri Tanjung, comedian Raditya Dika, and singer Melissa Hartanto. Finally, respondents should not currently hold any health or life insurance policies. The measurement items of the examined variables were constructed based on previous studies and measured on a 5-point Likert scale.

4. Results

Table 1

Demographic Characteristics of Respondents

|

Variable |

Description |

Frequency |

% |

|

Gender |

Male |

53 |

29.92 |

|

Female |

128 |

70.72 |

|

|

Age group |

22–24 |

66 |

36.46 |

|

25–30 |

73 |

40.33 |

|

|

31–40 |

33 |

18.23 |

|

|

Above 40 |

9 |

4.97 |

|

|

Occupation |

Private employee |

96 |

53.03 |

|

Entrepreneur |

15 |

8.29 |

|

|

Student |

30 |

16.57 |

|

|

Others |

40 |

22.10 |

|

|

Marital status |

Single |

102 |

56.35 |

|

Married |

76 |

41.99 |

|

|

Widow |

3 |

1.66 |

|

|

Number of children |

No children |

116 |

64.09 |

|

1–3 |

63 |

34.80 |

|

|

More than 3 |

2 |

1.11 |

The obtained data was processed using SEM-PLS in two stages: (1) measurement fit, which aims to ensure measurement validity and reliability, and (2) structural fit, which aims to test hypotheses on structural models (Anderson & Gerbing, 1988). The evaluation of the outer model was carried out to measure the reliability and validity of the indicators in the research model. The first evaluation is convergent validity measurement, employing outer loading and average variance extracted (AVE). An acceptable criterion for convergent validity for outer loading is > = 0.708, while for AVE it is >= 0.50. However, in social science research, particularly on a newly developed scale, outer loading values in the range of 0.40–0.70 are still acceptable. They can be considered for deletion if removing indicators increases the composite reliability value and the average variance extracted (AVE) value. The measurement model also meets the internal consistency reliability criteria, as evidenced by the composite reliability and Cronbach alpha values, which are greater than 0.7, indicating consistency of understanding from one respondent to another for each measurement statement for each variable in the questionnaire (Hair et al., 2016). Table 2 illustrates values of the outer model, AVE, composite reliability, and Cronbach alpha for each indicator.

Table 2

Reliability and Validity of the Variables

|

Variable |

Indicator |

Convergent |

Internal consistency |

||

|

Factor |

AVE |

Cronbach’s |

Composite |

||

|

Referral (R) |

|||||

|

R1 |

I will purchase insurance products recommended by friends or family. |

0.871 |

0.522 |

0.703 |

0.809 |

|

R2 |

I will purchase insurance products from a trusted company. |

0.730 |

|||

|

R3 |

I feel worried when I purchase an insurance product that is not recommended by friends or family. |

0.513 |

|||

|

R4 |

Recommendations from friends or family will increase my confidence in purchasing insurance products. |

0.730 |

|||

|

Agent characteristics (AC) |

|||||

|

AC1 |

Agents have a broad range of general knowledge. |

0.778 |

0.521 |

0.812 |

0.866 |

|

AC2 |

Agents are knowledgeable about the insurance products they sell. |

0.751 |

|||

|

AC4 |

Agents are pleasant individuals. |

0.718 |

|||

|

AC5 |

Agents are always kind to their consumers. |

0.805 |

|||

|

AC6 |

The agent is a person I want to meet. |

0.702 |

|||

|

AC8 |

The agent and I share the same life values. |

0.548 |

|||

|

Plan value (PV) |

|||||

|

PV1 |

I feel that the monthly insurance premium price is quite cheap. |

0.823 |

0.758 |

0.840 |

0.904 |

|

PV2 |

I feel that having an insurance policy makes out-of-pocket medical payments relatively reasonable. |

0.885 |

|||

|

PV3 |

I feel that the expense that must be paid by the consumer when a claim occurs (deductible limit) is quite reasonable. |

0.903 |

|||

|

Influencer credibility (IC) |

|||||

|

IC1 |

Influencers are highly fascinating. |

0.754 |

0.624 |

0.939 |

0.948 |

|

IC2 |

Influencers are very stylish. |

0.734 |

|||

|

IC3 |

Influencers appear to be well-dressed. |

0.700 |

|||

|

IC5 |

Influencers appear to be truthful. |

0.775 |

|||

|

IC6 |

Influencers are worth trusting. |

0.855 |

|||

|

IC7 |

Influencers are trustworthy. |

0.869 |

|||

|

IC8 |

Influencers appear to be sincere. |

0.833 |

|||

|

IC9 |

Influencers are well-versed in the products they promote. |

0.823 |

|||

|

IC10 |

Influencers are capable of making product remarks. |

0.812 |

|||

|

IC11 |

Influencers are insurance product experts. |

0.756 |

|||

|

IC12 |

Influencers have sufficient knowledge to make claims about insurance products. |

0.759 |

|||

|

Consumer trust in the insurance company (CT) |

|||||

|

CT1 |

I trust that the insurance company supplies the accurate information. |

0.881 |

0.782 |

0.861 |

0.915 |

|

CT2 |

If mistakes were made, I trust that the insurance company will apologize and take appropriate action. |

0.878 |

|||

|

CT3 |

I trust that the insurance company follows its commitments and offers benefits in accordance with the initial arrangement. |

0.894 |

|||

|

Purchase intention (PI) |

|||||

|

PI1 |

I might select insurance brand X above other existing insurance brands. |

0.846 |

0.711 |

0.798 |

0.881 |

|

PI2 |

I intend to purchase insurance brand X in the near future. |

0.827 |

|||

|

PI3 |

I intend to purchase insurance brand X in the future. |

0.858 |

|||

Table 3

Fornell-Lacker Criteria (Discriminant Validity)

|

Variable |

R |

AC |

PV |

IC |

CT |

PI |

|

R |

0.723 |

|||||

|

AC |

0.511 |

0.722 |

||||

|

PV |

0.467 |

0.605 |

0.871 |

|||

|

IC |

0.526 |

0.706 |

0.565 |

0.790 |

||

|

CT |

0.530 |

0.662 |

0.541 |

0.653 |

0.884 |

|

|

PI |

0.457 |

0.612 |

0.680 |

0.612 |

0.521 |

0.843 |

Discriminant validity analysis has shown that the square root value of the AVE of each variable is greater than the root of the correlation with other variables. This indicates that the measurement indicators are unidimensional and do not measure other variables within the measurement model.

Table 4

VIF Values

|

Variable |

R |

AC |

PV |

IC |

CT |

PI |

|

R |

1.507 |

1.572 |

||||

|

AC |

2.350 |

2.551 |

||||

|

PV |

1.731 |

1.761 |

||||

|

IC |

2.247 |

2.418 |

||||

|

CT |

2.173 |

|||||

|

PI |

Table 4 shows that all Variance Inflation Factor (VIF) values are all below the cut-off value of 5, indicating no evidence of multicollinearity issues in the measurement of each variable. Therefore, we can proceed with the test for the structural fit of the PLS model.

Table 5

Coefficient of Determination (R2) and Stone Geiser’s Q2 Values

|

Dependent variable |

R2 |

Q2 |

|

CT |

0.540 |

0.506 |

|

PI |

0.554 |

0.532 |

Testing R2 and Q2 in Table 5 demonstrates the accuracy and predictive relevance of the model. The R2 value for the CT variable is 0.540, indicating that 54% of the variation in Consumer Trust (CT) is explained by the influence of referrals, agent characteristics, plan values, and influencer credibility, with the remaining 46% attributed to unexamined variables. Similarly, the R2 value for the PI variable is 0.554, indicating that 55.4% of the variation in Purchase Intention (PI) is explained by the same factors, with the remaining 44.6% attributed to other variables. According to Hair et al. (2016), these percentages classify as moderate influences. Additionally, the Q2 values for both dependent variables are higher than zero, suggesting that the CT and PI variables have relevant predictors. These predictors, including referrals, agent characteristics, plan values, and influencer credibility, can predict changes in Consumer Trust (CT) and Purchase Intention (PI).

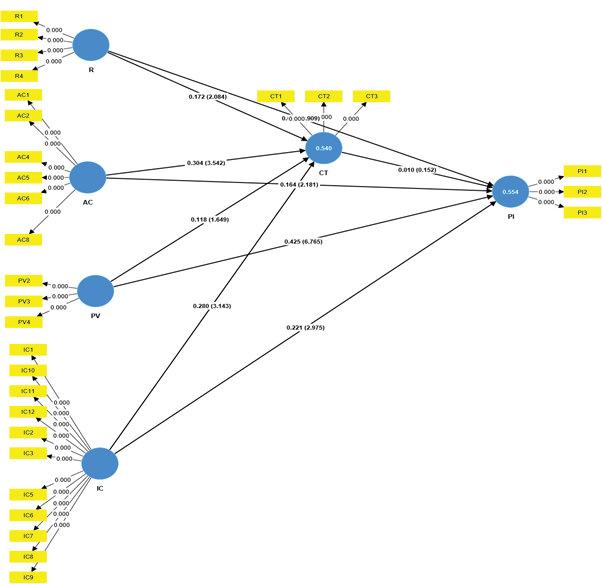

Figure 2 and Table 6 summarize the bootstrapping results used to test the hypotheses and determine the direct and indirect effects of the variables.

Figure 2

Bootstrapped PLS Model

Consumer trust (CT) and purchase intention (PI) are strongly and directly influenced by agent attributes (AC) and influencer credibility (IC). Plan value (PV) has a significant and direct effect on PI but does not predict CT. Conversely, referral (R) has a direct and significant effect on CT but does not predict PI. Additionally, consumer trust does not play a substantial mediating role in altering the relationship between PV, IC, R, and AC towards PI.

Table 6

Hypothesis Testing Results

|

Hypothesis |

Relationships |

ß |

t-value |

Result |

|

Direct effect |

||||

|

H1 |

R -> CT |

0.172 |

2.084* |

Accepted |

|

H2 |

R -> PI |

0.053 |

0.909 |

Rejected |

|

H3 |

AC -> CT |

0.304 |

3.542** |

Accepted |

|

H4 |

AC -> PI |

0.164 |

2.181* |

Accepted |

|

H5 |

PV -> CT |

0.118 |

1.649 |

Rejected |

|

H6 |

PV -> PI |

0.425 |

6.765** |

Accepted |

|

H7 |

IC -> CT |

0.280 |

3.143* |

Accepted |

|

H8 |

IC -> PI |

0.221 |

2.975* |

Accepted |

|

H10 |

CT -> PI |

0.010 |

0.152 |

Rejected |

|

Indirect effect |

||||

|

H9a |

R -> CT -> PI |

0.002 |

0.137 |

Rejected (no mediation) |

|

H9b |

AC -> CT -> PI |

0.003 |

0.145 |

Rejected (no mediation) |

|

H9c |

PV -> CT -> PI |

0.001 |

0.128 |

Rejected (no mediation) |

|

H9d |

IC -> CT -> PI |

0.003 |

0.144 |

Rejected (no mediation) |

|

Note. * = p < 0.05; **represents p < 0.01. |

||||

5. Discussion and Implications

5.1 Discussion

The present study provides evidence of the factors influencing insurance brand selection among Indonesians. First, this study discovered that referrals (recommendations from family, friends, or relatives) affect potential consumers’ assessments towards insurance brands, implicating their trust that the brand would behave in a way that benefits them. This is in line with the previous studies that state insurance is one of the products that has credence or quality that is difficult to measure and has a relatively high risk. As such, referral, as a personal communication channel, will have a significant influence on consumers to improve their trust (Abzari et al., 2014; Tanprajna & Ellyawati, 2020). In contrast to consumer trust, referrals have no substantial influence on purchase intention, indicating that recommendations from family, friends, or relatives do not directly raise prospective consumers’ intention or inclination to choose an insurance brand. This substantiates previous findings that referrals did not influence the intention to purchase service products (Chin et al. (2018).

Second, the present study also discovered that the characteristics of the insurance agent had a significant influence on consumer trust, indicating that agents are trust endorsers of the insurance brand who safeguard customers against any operational procedures that are not in their favor. Previous research also found that agent characteristics are directly and significantly related to consumer trust (Panda, 2013). Apart from its significant influence on consumer trust, agent characteristics also significantly affect purchase intention. This finding corroborates Yu and Tseng’s (2016) claim that this significant effect occurs because agents’ positive and pleasant characteristics will improve the quality of the relationship between agents and their consumers. The agent’s experience and knowledge will increase potential consumers’ trust because it minimizes the uncertainty consumers feel (Guenzi & Georges, 2010; Panda, 2013). In addition, the characteristics of agents who are nice and enjoyable will also make consumers feel pleased, and eventually trust will emerge (Chen et al., 2008).

Third, plan value has a significant direct influence on purchase intention but does not affect consumer trust. This suggests that the function of insurance price and quality directly affects the intention to purchase an insurance product, but it does not affect the potential customer’s trust in the advantages he would receive from the insurance. Price and quality are components attached to the product and determined unilaterally by the company. From the consumer or prospective consumer perspective, price and quality will provide benefits to the company so that they do not significantly influence prospective consumers’ trust that it will be beneficial to the consumers. This is distinct from the agent characteristics, which assign an emotional role to the potential consumer, although both plan values and agent characteristics are part of the company. In contrast to the level of trust, the price and the quality will influence the intention to buy because prospective consumers will undoubtedly compare their finances with the benefits and the quality they will get. This result is also in line with the research by Guan et al. (2020), which reveals that price is one of the factors that can drive the decision to purchase the insurance product itself. The perceptions of prospective consumers on prices in the service sector will encourage consumers to buy products (Mirza & Ali, 2017).

Fourth, in line with agent characteristics, influencer credibility also significantly influences consumer trust and purchase intention. This demonstrates that the perceptions of prospective consumers on the characteristics of influencers who collaborate may be trusted and relied upon so that it will affect the level of trust of prospective consumers and persuade prospective consumers to choose a particular insurance brand. This finding suggests that insurance companies may begin utilizing more influencers, especially for awareness purposes, whose credibility may form more positive consumer attitudes (Nafees et al., 2021) and trust with both the agents and the companies (Lin et al., 2021). Similarly, this finding provides additional evidence to the previous research (AlFarraj et al., 2021; Rebelo, 2017).

Fifth, consumer trust does not significantly affect purchase intention. This implies that even if the consumer believes that the insurance company will behave in a way that benefits the customer, it is not certain that the prospective consumer will choose to use the insurance. In fact, the intention to buy arises from the characteristics of agents who serve consumers, the prices, and the quality that matches the capabilities and expectations of the consumers. This is an intriguing conclusion since it contradicts numerous earlier research, including those by Gkouna et al. (2022); Khan and Siddiqui (2019), and Sanny et al. (2020), which claim that consumer trust has a significant influence on purchase intention, particularly in the insurance sector.

Last, while previous studies of Guenzi and Georges (2010) and Sulthana and Vasantha (2019) claimed that consumer trust mediates the relationship between referral and agent characteristics and purchase, the present study does not provide additional support. The findings of the present study are probably ‘nuanced’ by the context of the research and culture. Indonesians are mostly collectivists driven by social acceptance, which eventually motivates each individual to sacrifice the best decision for themselves to their surroundings and construct their views based on expert advice (Sudaryanto et al., 2021). Qualified insurance agents serve as the primary point of contact between the company and the customers, making them frequently rely on their expertise and personal goodwill, which in certain situations tend to depend on their guidance for decision-making (Giri, 2018). This is why agent characteristics significantly influence the intention to buy the insurance products rather than the trust in the insurance company itself. In a similar vein, when insurance brands partner with influencers or celebrities to promote their products, prospective [collectivist] consumers who idolize them will see them as experts and follow their advice, even if it means dismissing the best option. A similar viewpoint was also expressed by Nayeem (2012), who stated that consumers with a collectivist culture tend to be influenced by social influence in making decisions, including product purchasing decisions, especially for high-risk products.

5.2 Theoretical Implications

This study contributes to the growing body of knowledge regarding the effects of referrals, plan values, and agent characteristics on consumer trust and purchase intention of insurance products in Indonesia. These three factors are important considerations for prospective consumers when selecting insurance protection for themselves and their families. Furthermore, this study adds to previous research on the factors that influence prospective consumers’ trust and intention to purchase insurance products by including influencer credibility as one of the factors, even though the use of influencers to market insurance products and services is still uncommon in Indonesia. Previous research on the use of influencers in insurance product offerings has not been extensive, but this study demonstrates a significant linkage between influencer credibility and consumer trust and purchase intention.

5.3 Managerial Implications

This study provides empirical evidence that agents who meet directly with prospective consumers to introduce and advertise insurance products play a critical role in enhancing prospective consumers’ trust and purchase intention on insurance products. Companies are also expected to understand that the intention to purchase insurance products does not solely arise from the brand but from the quality of services provided by the agents, the value for the price, and the product quality. This means that insurance companies should pay attention to the quality and price of the products offered and provide regular training to agents on how to best deal with potential consumers face-to-face. Insurance companies can also explore more contemporary marketing techniques, such as collaborating with influencers and celebrities to become their brand ambassadors, thereby helping companies sell their insurance products. For instance, insurance companies can collaborate with healthcare influencers to ensure that insurance brands are well-represented.

6. Conclusion and Limitations

This research aims to investigate the relationship between the factors influencing consumer intentions to purchase insurance services. This study found that agent characteristics and influencer credibility directly affect consumer trust and purchase intention regarding an insurance brand. Meanwhile, referrals have a significant direct effect on consumer trust but not directly on purchase intention. Conversely, the plan value offered by insurance companies has a direct effect on purchase intention but no direct effect on consumer trust. An intriguing finding from this study is that consumer trust does not significantly mediate the effect of referrals, agent characteristics, plan values, and influencer credibility on purchase intention. This study validates previous research findings, which stated that apart from agent characteristics and plan values, influencer credibility also influences the intention to purchase insurance products, despite insurance products being high-credibility service products.

This research is not without limitations. First, the factors tested as predictors for increasing consumer trust and purchase intention are confined to several external factors. Therefore further studies can be undertaken to develop other external and internal factors as predictors, such as past performance and review quality variables. Taking into account the insignificant consumer trust variable as a mediating variable, which may be due to the influence of cultural orientation, future research can include this cultural orientation variable as an alternative mediating variable to measure the indirect effect of referrals, plan values, agent characteristics, and influencer credibility on purchase intention.

Additionally, the majority of this study’s participants were between the ages of 22–30 years old, which led to the findings that consumer trust cannot mediate the relationship between referrals, plan values, agent characteristics, and influencer credibility on purchase intention. Further research can validate the proposed research model by incorporating age groups as a moderating variable.

References

AAJI. (2022). Naik Signifikan, Penetrasi Asuransi Jiwa Tembus 8%. Retrieved from: https://aaji.or.id/file/uploads/content/file/1.%20Siaran%20Pers%20Semester%201%202022%20-%20rev.pdf

Abzari, M., Ghassemi, R. A., & Vosta, L. N. (2014). Analysing the Effect of Social Media on Brand Attitude and Purchase Intention: The Case of Iran Khodro Company. Procedia—Social and Behavioral Sciences, 143, 822–826.

Agyei, J., Sun, S., Abrokwah, E., Penney, E. K., & Ofori-Boafo, R. (2020). Influence of Trust on Customer Engagement: Empirical Evidence from the Insurance Industry in Ghana. SAGE Open, 10(1), 2158244019899104.

Ainiyah, S. M., Nelloh, L. A. M., & Sjahrifa, C. (2020). Life Insurance Customer Loyalty. Paper presented at the The International Conference on Business and Management Research (ICBMR 2020).

AlFarraj, O., Alalwan, A. A., Obeidat, Z. M., Baabdullah, A., Aldmour, R., & Al-Haddad, S. (2021). Examining the impact of influencers’ credibility dimensions: Attractiveness, trustworthiness and expertise on the purchase intention in the aesthetic dermatology industry. Review of International Business and Strategy. DOI:10.1108/RIBS-07-2020-0089

Amron, A., Usman, U., & Mursid, A. (2018). The role of electronic word of mouth, conventional media, and subjective norms on the intention to purchase Sharia insurance services. Journal of Financial Services Marketing, 23, 218–225.

Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411.

Arli, D., Bauer, C., & Palmatier, R. W. (2018). Relational selling: Past, present and future. Industrial Marketing Management, 69, 169–184.

Baicker, K., Mullainathan, S., & Schwartzstein, J. (2015). Behavioral Hazard in Health Insurance. The Quarterly Journal of Economics, 130(4), 1623–1667.

Borchers, N. S., & Enke, N. (2021). Managing strategic influencer communication: A systematic overview on emerging planning, organization, and controlling routines. Public Relations Review, 47(3), 102041.

Chang, J.-I., & Lee, C.-Y. (2020). The effect of service innovation on customer behavioral intention in the Taiwanese insurance sector: The role of word of mouth and corporate social responsibility. Journal of Asia Business Studies, 14(3), 341–360.

Chin, T. A., Lai, L., & Tat, H. (2018). Determinants of Brand Image and their Impacts on Purchase Intention of Grab. Journal of Arts and Social Sciences, 2(1), 26–36.

Delgado‐Ballester, E., & Munuera‐Alemán, J. L. (2001). Brand trust in the context of consumer loyalty. European Journal of Marketing, 35(11/12), 1238–1258. DOI:10.1108/EUM0000000006475

Dichter, E. (1966). How word-of-mouth advertising works. Harvard Business Review, 44(6), 147–166.

Dikiyanti, T., Rukmi, A., & Irawan, M. (2021). Sentiment analysis and topic modeling of BPJS Kesehatan based on twitter crawling data using Indonesian Sentiment Lexicon and Latent Dirichlet Allocation algorithm. Paper presented at the Journal of Physics: Conference Series.

Dion, P., Easterling, D., & Miller, S. J. (1995). What is really necessary in successful buyer/seller relationships? Industrial Marketing Management, 24(1), 1–9.

Djafarova, E., & Rushworth, C. (2017). Exploring the credibility of online celebrities’ Instagram profiles in influencing the purchase decisions of young female users. Computers in Human Behavior, 68, 1–7.

Ebrahim, R. S. (2020). The Role of Trust in Understanding the Impact of Social Media Marketing on Brand Equity and Brand Loyalty. Journal of Relationship Marketing, 19(4), 287–308.

Erdogan, B. Z. (1999). Celebrity Endorsement: A Literature Review. Journal of Marketing Management, 15(4), 291–314.

Flavian, C., Guinaliu, M., & Torres, E. (2005). The influence of corporate image on consumer trust: A comparative analysis in traditional versus internet banking. Internet Research, 15(4), 447–470.

Giri, M. (2018). A Behavioral Study of Life Insurance Purchase Decisions. [Doctoral dissertation, Indian Institute of Technology Kanpur]. Retrieved from https://www.iitk.ac.in/ime/devlina/data/Manohar%20Giri%20PhD%20Thesis%20_Final-4-10-19.pdf

Gkouna, O., Tsekouropoulos, G., Theocharis, D., Hoxha, G., & Gounas, A. (2022). The impact of family business brand trust and crisis management practices on customer purchase intention during Covid-19. Journal of Family Business Management (ahead-of-print).

Guan, L. P., Yusuf, D. H. M., & Ghani, M. R. A. (2020). Factors Influencing Customer Purchase Intention Towards Insurance Products. International Journal of Business and Management, 4(5), 70–79.

Guenzi, P., & Georges, L. (2010). Interpersonal trust in commercial relationships: Antecedents and consequences of customer trust in the salesperson. European Journal of Marketing.

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2016). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Sage publications.

Handel, B. R., & Kolstad, J. T. (2015). Health Insurance for “Humans”: Information Frictions, Plan Choice, and Consumer Welfare. American Economic Review, 105(8), 2449–2500.

Hovland, C. I., & Weiss, W. (1951). The Influence of Source Credibility on Communication Effectiveness. Public Opinion Quarterly, 15(4), 635–650.

Hsieh, J.-K., & Li, Y.-J. (2020). Will You Ever Trust the Review Website Again? The Importance of Source Credibility. International Journal of Electronic Commerce, 24(2), 255–275.

Iglesias, O., Markovic, S., Bagherzadeh, M., & Singh, J. J. (2020). Co-creation: A Key Link Between Corporate Social Responsibility, Customer Trust, and Customer Loyalty. Journal of Business Ethics, 163, 151–166.

Islam, T., Islam, R., Pitafi, A. H., Xiaobei, L., Rehmani, M., Irfan, M., & Mubarak, M. S. (2021). The Impact of Corporate Social Responsibility on Customer Loyalty: The Mediating Role of Corporate Reputation, Customer Satisfaction, and Trust. Sustainable Production and Consumption, 25, 123–135.

Jayaraman, K., Alesa, N., & Azeema, N. (2017). Factors influencing the purchase intention of health insurance policy-an empirical study in Malaysia. International Journal of Economic Research, 14(16), 1–13.

Jin, S. V., Muqaddam, A., & Ryu, E. (2019). Instafamous and social media influencer marketing. Marketing Intelligence & Planning, 37(5), 567–579.

Khan, N., & Siddiqui, D. A. (2019). Islamic Insurance (Takaful) and Factors Affecting its Purchase Intention in Karachi, Pakistan. SSRN Electronic Journal.

Kotler, P., & Keller, K. L. (2016). Marketing Management (15th ed.). New Jersey: Pearson Prentice Hall.

Kumar, I., Garg, R., & Rahman, Z. (2010). Influence of Retail Atmospherics on Customer Value in an Emerging Market Condition. Great Lakes Herald, 4(1), 1–13.

Leon, S., & Choi, H. (2020). Satisfaction and word-of-mouth moderated by choice: A service industry perspective. Journal of Consumer Marketing, 37(7), 869–881.

Lin, C. A., Crowe, J., Pierre, L., & Lee, Y. (2021). Effects of ParasocialIinteraction with an Instafamous Influencer on Brand Attitudes and Purchase Intentions. The Journal of Social Media in Society, 10(1), 55–78.

Lou, C., & Yuan, S. (2019). Influencer Marketing: How Message Value and Credibility Affect Consumer Trust of Branded Content on Social Media. Journal of Interactive Advertising, 19(1), 58–73.

Lyna, L., & Nany, M. (2023). Peran Celebrity Endorser Pada Keputusan Pembelian Produk Asuransi AIA Cabang Solo. Jurnal Ekonomi dan Bisnis, 26(1), 1–6.

Mansour, I. H. F., & Diab, D. E. D. (2016). The relationship between celebrities’ credibility and advertising effectiveness: The mediation role of religiosity. Journal of Islamic Marketing, 7(2), 148–166.

Mirza, B., & Ali, M. (2017). AN Assessment of Relationship Among Service Quality, Price Perception and Customer Satisfaction in the Formation of Consumer’s Purchase Intention. Kuwait Chapter of the Arabian Journal of Business and Management Review, 6(12), 10–21.

Munnukka, J., Uusitalo, O., & Toivonen, H. (2016). Credibility of a peer endorser and advertising effectiveness. Journal of Consumer Marketing, 33(3).

Nafees, L., Cook, C. M., Nikolov, A. N., & Stoddard, J. E. (2021). Can social media influencer (SMI) power influence consumer brand attitudes? The mediating role of perceived SMI credibility. Digital Business, 1(2), 100008.

Nayeem, T. (2012). Cultural Influences on Consumer Behaviour. International Journal of Business and Management, 7(21), 78.

Nismawati, I., Umaruzzaman, U., & Mahadewi, E. P. (2022). Implication of BPJS for Private Health Insurance Marketing and Business Competition in Indonesia. International Journal of Health and Pharmaceutical (IJHP), 2(3), 580–588.

Ohanian, R. (1990). Construction and Validation of a Scale to Measure Celebrity Endorsers’ Perceived Expertise, Trustworthiness, and Attractiveness. Journal of Advertising, 19(3), 39–52.

OJK. (2020). Pedoman iklan jasa keuangan. Jakarta: OJK Retrieved from https://ojk.go.id/id/berita-dan-kegiatan/info-terkini/Documents/Pages/-OJK-Menerbitkan-Pedoman-Iklan-Jasa-Keuangan-April-2020/Pedoman%20Iklan%20-%20April%202020.pdf

Panda, T. K. (2013). Effects of Service Quality and Salesperson Characteristics on Consumer Trust and Relationship Commitment: An Empirical Study on Insurance Buyers in India. Vision, 17(4), 285–292.

Panigrahi, S., Azizan, N. A., & Waris, M. (2018). Investigating the Empirical Relationship Between Service Quality, Trust, Satisfaction, and Intention of Customers Purchasing Life Insurance Products. Indian Journal of Marketing January, 48(1), 28.

Perkasa, A.-H. M. (2019, 8 July 2019). Bangun literasi keuangan, asuransi Astra gandeng influencer. Marketeers. Retrieved from https://www.marketeers.com/bangun-literasi-keuangan-asuransi-astra-gandeng-influencer/

Pezhman, R., Javadi, M. H. M., & Shahin, A. (2013). Analyzing the Influence of Ethical Sales Behavior on Customers Loyalty through Customer Satisfaction and Trust in Insurance Company. International Journal of Academic Research in Business and Social Sciences, 3(9), 754.

Rasheed, F. A., & Abadi, M. F. (2014). Impact of Service Quality, Trust and Perceived Value on Customer Loyalty in Malaysia Services Industries. Procedia—Social and Behavioral Sciences, 164, 298–304.

Rebelo, M. F. (2017). How Influencers’ Credibility on Instagram is Perceived by Consumers and its Impact on Purchase Intention[ Dissertation, Universidade Catolica Portuguesa].

Rice, T., Unruh, L. Y., Rosenau, P., Barnes, A. J., Saltman, R. B., & van Ginneken, E. (2014). Challenges facing the United States of America in implementing universal coverage. Bulletin of the World Health Organization, 92, 894–902.

Sanny, L., Arina, A., Maulidya, R., & Pertiwi, R. (2020). Purchase intention on Indonesia male’s skin care by social media marketing effect towards brand image and brand trust. Management Science Letters, 10(10), 2139–2146.

Sesar, V., Martinčević, I., & Boguszewicz-Kreft, M. (2022). Relationship between Advertising Disclosure, Influencer Credibility and Purchase Intention. Journal of Risk and Financial Management, 15(7), 276.

Sirisha, B., & Babu, M. K. (2014). Branding of Hospitals–through Tangible Factors by Selected Hospitals. Excel International Journal of Multidisciplinary Management Studies, 4(3), 227–237.

Sokolova, K., & Kefi, H. (2020). Instagram and YouTube bloggers promote it, why should I buy? How credibility and parasocial interaction influence purchase intentions. Journal of Retailing and Consumer Services, 53, 101742.

Sudaryanto, S., Hanim, A., Pansiri, J., & Umama, T. L. (2021). Impact of culture, brand image and price on buying decisions: Evidence from East Java, Indonesia. Innovative Marketing, 17(1), 130.

Sulthana, A. N., & Vasantha, S. (2019). Influence of Electronic Word of Mouth eWOM on Purchase Intention. International Journal of Scientific & Technology Research, 8(10), 1–5.

Tanprajna, R. F., & Ellyawati, J. (2020). Effect of E-Referral and E-Wom on Purchase Intention: An Empirical Study in Indonesia. Paper presented at the 11th International Conference on Modern Research in Management, Economic, and Accounting.

Thaichon, P., & Quach, T. N. (2015). The relationship between service quality, satisfaction, trust, value, commitment and loyalty of Internet service providers’ customers. Journal of Global Scholars of Marketing Science, 25(4), 295–313.

Van der Waldt, D., Van Loggerenberg, M., & Wehmeyer, L. (2009). Celebrity endorsements versus created spokespersons in advertising: A survey among students. South African Journal of Economic and Management Sciences, 12(1), 100–114.

Watts, S. A., & Zhang, W. (2008). Capitalizing on Content: Information Adoption in Two Online Communities. Journal of the Association for Information Systems, 9(2), 3.

Wijaya, V. S., & Wismantoro, Y. (2017). Pengaruh Kualitas Produk Dan Persepsi Harga Terhadap Kepuasan Nasabah Melalui Kepercayaan Nasabah Asuransi Jiwasraya Cabang Kudus. Jurnal Penelitian Ekonomi dan Bisnis, 2(2), 101–113.

Xiong Chen, Z., Shi, Y., & Dong, D. H. (2008). An empirical study of relationship quality in a service setting: A Chinese case. Marketing Intelligence & Planning, 26(1), 11–25.

Yu, T.-W., & Tseng, L.-M. (2016). The role of salespeople in developing life insurance customer loyalty. International Journal of Retail & Distribution Management, 44(1), 22–37.