Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2024, vol. 15, no. 1(30), pp. 127–145 DOI: https://doi.org/10.15388/omee.2024.15.7

Voluntary Disclosures and their Drivers: A Study of MD&A Reports in India

Himani Singla (corresponding author)

Indira Gandhi University, Meerpur, Rewari, India

himani.comm.rs@igu.ac.in

Vijay Singh

Indira Gandhi University, Meerpur, Rewari, India

vijay.commerce@igu.ac.in

Abstract. The aim of this study is to examine the impact of corporate characteristics on voluntary disclosures of management discussion and analysis (MD&A) reports in India. Using a formal tone, the data was extracted from the annual reports of the top 100 listed firms available on the CMIE Prowess database for seven years (2016–2022). After excluding 23 companies from the financial and insurance sector, a panel regression method with the assistance of Gretl software was employed to investigate the relationship between the Management Discussion and Analysis Disclosure Index (MDADI) for voluntary aspects and various corporate attributes, with a total of 490 firm years of balanced observations. In India, firms follow the mandatory compliance of the MD&A reports, but voluntary disclosures are somehow those which are not much emphasized but are a good indication of firm performance and their accountability towards their stakeholders (Mayew et al., 2015). Our empirical findings reveal that profitability as a proxy to firm performance has a significant positive relationship with MD&A voluntary disclosures. Further, an insignificant association between VDS (Voluntary Disclosure Score) and the board size, presence of independent directors and firm size was found. This indicates that firm performance plays a significant role in adding more voluntary disclosures in MD&A reports. The possible reason for this could be the use of “Management Impression Strategy” in the MD&A reports, which means managers disclose more only when the firm has earned more and use impressive language to attract stakeholders. The outcomes of this research offer valuable insights for regulators, policymakers, and listed companies in India, aiding in the enhancement of MD&A reporting quality. Additionally, this study provides a roadmap for future research on MD&A reporting quality and corporate attributes in other emerging countries that have similar regulatory frameworks. This paper makes a timely and pertinent contribution to the scholarly discourse by shedding light on the relationship between MD&A disclosures and firm attributes. Its findings provide valuable insights for both academia and industry.

Keywords: management discussion and analysis, voluntary disclosures, corporate characteristics, MD&A reporting quality, emerging countries

Received: 19/10/2023. Accepted: 4/4/2024

Copyright © 2024 Himani Singla, Vijay Singh. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Corporate reports play a critical role in conveying essential information for business survival and decision-making. These reports adhere to good accounting practices, legal compliance, and effective management and wealth distribution (Meenakshi & Manoj, 2010). With businesses operating in an interconnected external environment, the need for reporting has increased to share corporate information with stakeholders. Among the various types of reports provided by companies, management discussion and analysis (MD&A) reports are essential in maintaining stakeholders’ trust in the business, and in many countries, this section has become mandatory for companies to provide a variety of disclosures related to different dimensions of the concerned companies.

The MD&A section of annual reports aims to provide significant corporate information from the perspective of managers (SEC, 2003). As managers have a close association with the firm, they possess valuable insights into its current position and plans, making their information more reliable. Given the occurrence of frauds and scams at national and international levels, regulatory bodies are increasingly focusing on the role of MD&A disclosures in safeguarding stakeholders’ interests. MD&A is regarded as a pivotal document signed by company managers, providing crucial insights into a company’s liquidity position, capital resources, and operations (Caserio et al., 2019; Singh & Singla, 2021).

The government mandates MD&A disclosures, making them accessible to the public and facilitating the understanding of critical information for predicting a company’s future results. Consequently, MD&A has become the most read and crucial component of the annual report, offering crucial insights about the company (Lawrence, 1998; Li, 2010). Financial analysts in developed nations rely on MD&A reports when assessing a company’s performance. Therefore, continuous reforms are incorporated into MD&A reports to ensure the disclosure of all material information, both financial and non-financial, from a management perspective (Bryan, 1997; Courtis, 1998; Cole & Jones, 2005; Cole, 2012).

The same idea has been adopted by India to bring more transparency in the corporate disclosures and safeguard the interest of the stakeholders. India is one of the leading economies in the world continuously growing on the path of becoming a developed nation. As MD&A is considered a firm’s overall disclosure package (Clarkson et al., 1999), it becomes vital to study this report. In this study, the authors have attempted to determine the factors which are motivating the companies to provide more information in their MD&A reports. In India, the Companies Act of 2013 mandates that firms include MD&A disclosures in their annual reports, making the term “MD&A” popular in recent years (Meenakshi & Manoj, 2010; Companies Act, 2013; SEBI, 2015). Although there is no standard framework for presenting information in MD&A reports, SEBI has guided nine mandatory principles that should be disclosed in MD&A reports. These include a SWOT analysis of the business, key risks and risk mitigation, outlook for the business, performance breakdown, key financial ratios, operational performance parameters, employment status, industry structure, and internal adequacy of control systems.

Previous research has examined different corporate reports such as corporate social responsibility reports, sustainability reports, corporate governance reports, and integrated reports in India, investigating their association with firm attributes (Laskar & Maji, 2016; Aggarwal & Singh, 2019; Saha & Kabra, 2022). With regard to corporate reports, previous studies found that the information provided by the managers was part of “management impression strategy”, in which managers used positive language in such a way that it always attracts the investors of the companies (Caserio et al., 2019). Studies on mandatory disclosures of the MD&A reports found that listed firms follow the compliance related to the MD&A disclosures in India, therefore, more emphasis on MD&A reports is required by the regulatory bodies (Singh & Singla, 2022; Singla & Singh, 2023). Other studies, which checked the readability of the MD&A reports in India, found that the reports are difficult to read and can be understood by graduates only (Singh et al., 2022). But to the best of the authors’ knowledge, nominal studies so far addressing the voluntary disclosures of the MD&A reports are fewer, and absent in the case of India. Therefore, this study contributes to the existing research on MD&A voluntary disclosures in developing economies, particularly in the context of India, where research on MD&A reports is limited. Understanding the voluntary aspects of MD&A is crucial, as it holds significant importance in developing countries. This study adds to the body of knowledge on MD&A reporting in India. Further, voluntary disclosures represent the true spirit of transparency and reliability of companies’ commitments (Mayew et al., 2015). Hence, the quantity and quality of voluntary information reflect the level of intention of the company regarding meeting the basic objectives of reporting in this VUCA (Volatility, Uncertainty, Complexity, and Ambiguity) world.

The MD&A indexes have been framed in the context of developed economies so far. However, there is a huge variation in MD&A regulations as compared to developed nations. As a result, a new MD&A disclosure index (MDADI) needs to be developed to ascertain the quality of the MD&A index in the context of developing economies. The empirical findings of this study indicate a positive and significant relationship between MD&A Disclosure Index (MDADI) and corporate attributes such as profitability and firm performance. However, the study finds insignificant associations between MDADI and board size, independent directors, firm age, and firm size. These results provide insights for policymakers and regulators to shape MD&A practices in the Indian scenario.

This research has been divided into five parts. Section 2 presents the review of the literature derived from the previous research and Section 3 consists of the research design methodology, data gathering, and model building. Section 4 discusses the results and findings of the study. The discussion and conclusions, as well as the implications, restrictions, and potential future applications of the current study are explained in the final section.

2. Literature Review

2.1 Theoretical Background and Hypotheses Development

2.1.1 Theoretical Background. Several theories have been cited by previous literature related to corporate reporting disclosures. The stakeholder theory and signaling theory are major theories that have been used in this study as the objectives of this study are closely related to these two theories. The stakeholder theory explains the actions of the company’s executives to fulfill the informational demands of the stakeholders (Erin & Adegboye, 2022; Mishra et al., 2022; Soriya & Rastogi, 2022). This theory focuses on the two-way relationship between the stakeholders and the company’s executives. Stakeholders provide financial assistance to the companies when their demands are fulfilled by the company. Thus, MD&A reports help stakeholders get all kinds of material information including both financial and non-financial information (Barron & Kile, 1999; Clarkson et al., 1999; Hufner, 2007; Singla & Singh, 2023). This two-way healthy relationship between stakeholders and the company’s executives helps build the reputation of the company and stimulates them to create value (Li, 2008; Sun, 2010).

On the other hand, signaling theory helps to remove the problem of information asymmetry between the stakeholders of the company and the head of the company. This theory is important because the asymmetry of information in the stock market creates a problem and causes a competitive disadvantage for one firm over another (Verrecchia, 1990). Therefore, signaling theory communicates mandatory or voluntary information to the public to cure the problem of information asymmetry. MD&A reports provide both mandatory and voluntary disclosures and disclose all the relevant information to the stakeholders (Barron & Kile, 1999; Brown & Tucker, 2011). Therefore, such MD&A disclosures give a competitive advantage to the firm to raise low-cost capital and smooth operating activities, resulting in more profits.

2.1.2 The Quality of the MD&A. MD&A disclosures indeed provide information that is relevant and material for the decision-making of the stakeholders (Singh & Singla, 2023). However, investors for a long time, based on their experience, demand more forward-looking information. Therefore, managers should focus on forecast-related information rather than historical data and information in the MD&A. Also, non-financial aspects must be disclosed more, along with the financial disclosures. (Pava & Epstein, 1993; Brown & Tucker, 2011; Sutton et al., 2012).

However, regulators are constantly working to raise the standard of MD&A reports in response to various accounting frauds and scams. Therefore, some studies have developed an MD&A index to measure the quality of the MD&A reports (Botosan, 1997; Barron & Kile, 1999; Hufner, 2007). However, these MD&A indexes are framed in the context of developed economies. Meanwhile, there is a huge variation in MD&A regulations as compared to developed nations. As a result, a new MD&A disclosure index (MDADI) needs to be developed to ascertain the quality of the MD&A index in the context of developing economies. A manual content analysis technique is applied to measure the quality of the MD&A disclosures in the quantitative form (Botosan, 1997; Laskar & Maji, 2016; Aggarwal & Singh, 2019; Saha & Kabra, 2022; Soriya & Rastogi, 2022). Such index tool will be used to ascertain the voluntary disclosure score, which is further used to establish the relationship with the firm characteristics.

2.2 Hypotheses Development

2.2.1 MD&A reports and firm performance: MD&A reports are emphasized by the regulators more as they provide all kind of financial and non-financial information in one place (Botosan, 1997; Cole & Jones, 2005). Moreover, MD&A is a set of disclosures that protects the interests of the shareholders. It also helps to ascertain the objectives of the firm and the way to achieve those goals (Clarkson et al., 1999; Hufner, 2007). Along with it, the evaluation of the past objectives can be done based on MD&A, and plans can be ascertained. Therefore, it improves the relationship between the managers and the stakeholders and thus helps increase the firm profitability (Bryan, 1997; Brown & Tucker, 2011b; Cole & Jones, 2014; Jayasree & Shette, 2020). However, in certain studies, a negative relationship is found because managers use an impression management strategy to attract potential investors and avoid any questions from the existing shareholders (Richards et al., 2011; Moreno & Casasola, 2016; Caserio et al., 2019; Hamza, 2022). Due to such conflicting results, it is important to check this relationship with more empirical evidence. Therefore, the proposed hypothesis is as follows:

H1: There is a positive relationship between MD&A disclosures and firm performance.

2.2.2 The size of the board and MD&A disclosures: As per the integration of agency theory and resource dependence theory, the total number of directors on the board is important to influence the firm performance (Nicolo et al., 2022; Shafeeq Nimr Al-Maliki et al., 2023). Hence, proper coordination and communication should be maintained by the adequate board size. Srinivasan et al. (2014) favor a larger number of directors on the board. The operations of corporations are complex and need a large board size to resolve those activities. It also allows better control and better decision-making (Erin & Adegboye, 2022; Hichri, 2022). However, some studies favor a small board size as a small board is more effective in controlling the activities of the managers and quick decision-making. Also, the small board size does not cause as much conflict as compared to the big one (Eliza et al., 2022; Nicolo et al., 2022). The association between board size and business performance is ambiguous and contradictory based on prior studies. As a result, further empirical research is still needed to fully understand this relationship. In the case of MD&A reporting, we anticipate a favorable correlation between board size and company performance. As a result, the following is the hypothesis on the effect of board size on MD&A disclosures.

H2: The size of the board and MD&A disclosure have a positive association.

2.2.3 Board independence and MD&A disclosure: The inclusion of independent directors on the board aligns with the principles of agency theory and resource dependence theory (Nicolo et al., 2022; Shafeeq Nimr Al-Maliki et al., 2023). Numerous studies have demonstrated a positive correlation between the presence of independent directors and corporate performance. The rationale behind this association lies in the expertise and control abilities of external directors. Independent directors are typically considered skilled individuals capable of effectively monitoring managerial actions. Moreover, it is commonly observed that director remuneration is linked to corporate performance. This incentive structure encourages enhanced monitoring of managers, thereby reducing agency costs. The appointment of independent directors serves as a mechanism to mitigate agency conflicts, as their objective viewpoint and independent judgment contribute to effective corporate governance and ultimately lead to improved company performance (Erin & Adegboye, 2022; Nicolo et al., 2022; Pillai & Seetha, 2022). However, a few studies have established a negative relationship between independent directors and firm performance as independent directors are merely for fulfilling the norms and they do not actively participate in board meetings (Queiri et al., 2021; Abdullah, 2022; Hichri, 2022). Therefore, we expect a positive role of the independent directors in the case of MD&A disclosures. The proposed hypothesis suggests:

H3: There is a positive relationship between board independence and MD&A disclosures.

2.2.4 Control Variables. To account for potential influences on both financial performance and MD&A practices, we incorporated controls for firm size (market capitalization) and leverage (debt–equity ratio) in the analysis. Prior research by Bryan (1997) and Liu et al. (2019) argued that these corporate characteristics can impact these variables. It is anticipated that larger firms may benefit from economies of scale, leading to better performance (Shawtari et al., 2016). In this study, the natural logarithm of market capitalization is utilized as a proxy for company size. Additionally, leverage can affect corporate performance, as higher levels of debt require closer monitoring by creditors to ensure sound managerial practices within the companies. As a result, managers provide less information about their leverage position if they have more debt in the firm. Therefore, in line with previous studies (Laskar & Maji, 2016; Liu et al., 2017; Oware, 2021; Muhammad & Migliori, 2022; Usman et al., 2022) the following hypotheses have been set forth:

H4: The association between firm size and MD&A disclosures is significantly positive.

H5: There is a significant negative relationship between leverage and MD&A disclosures.

3. Research Methodology

3.1 Selection of Sample

A sample of the companies comprised of Nifty 100 index (Top 100 companies) was initially taken for this study as it represents 77% of the total market capitalization of the National Stock Exchange (NSE). Moreover, it was found that good disclosure practices are generally provided by the large-sized corporations because of better availability of resources (Saha & Kabra, 2022); therefore, this selection is expected to serve the aim of the study in a better way.

Firms belonging to the financial service sector were not included in the final sample as different reporting norms are appropriate to them (Banking Regulation Act, 1949). Also, to ensure comparability, this study considered those firms that provide annual reports with a year-end date of 31st March. Therefore, the final sample consists of 490 observations, covering 70 companies.

Table 1 describes the bifurcation of the firms included in the sample according to their respective industries. The number of Consumer Goods firms (20%) is the highest followed by Pharmaceutical (14%), Automobiles (13%), Oil and Gas (11%), and Metals (10%). The remaining (32%) firms belong to other industries. This research covered a seven years’ period from 2015–2016 to 2021–2022 because major reforms in MD&A reporting in India were put in place after the introduction of Companies Act, 2013, and Listing and Obligation Disclosure Requirements (LODR, 2015) (Companies Act, 2013; SEBI, 2015). The data for the study were gathered from the Prowess Centre for Monitoring Indian Economy (CMIE) database, which is widely used by researchers for Indian companies (Soriya & Rastogi, 2021; Srinivisan, 2017).

3.2 Construction of MD&A Disclosure Index (MDADI)

To assess the quality of voluntary disclosure in MD&A reports as a dependent variable, a manual content analysis approach was employed. This method involves categorizing written text into various classes or groups, as described by Holder-Webb (2007). Consequently, an MD&A disclosure index was developed by the researcher to evaluate and quantify the voluntary disclosures made by Indian-listed companies. To include all the voluntary aspects of MD&A in the Indian context, the list of the MD&A disclosures was checked against the regulations set by the regulators. Accordingly, nine mandatory items are covered under the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015. Except for those nine points of information, other information is gathered as voluntary disclosures. We identified 30 items which can be included in the voluntary disclosures index on the basis of previous study and thorough reading of the MD&A reports (Ahn & Lee, 2004). Additionally, assistance was taken from two practicing Chartered Accountants and two Chartered Financial Analysts for their views to verify the items carried in MDADI as they have good knowledge of the disclosure regulations of India. To ensure its credibility, we selected these items from previous studies associated with financial reporting (Cole, 1990; Botosan, 1997; Holder-Webb, 2007).

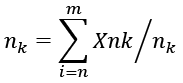

For empirical analysis, the items in the MDADI were scored. So, we also used this scoring method on the patterns of previous studies. Many studies have followed the unweighted scoring method, which includes the presence or absence of a specific item in the documents to avoid partiality and subjectivity in such measurement (Holder-Webb, 2007; Jain & Lawrence, 2016; Aggarwal & Singh, 2019), therefore, unweighted scoring was preferred for the same. As a result, a total of 30 items were identified. Each item under voluntary disclosures in the MD&A reports was assigned a score of “0” for non-disclosure and “1” for disclosure. The overall disclosure score for MD&A performance is computed by employing the following equation:

where nk is the maximum expected score for each category of voluntary disclosures, k is the company, and n is the item. The total time taken from developing of the disclosure index and the voluntary disclosure score, almost five months, was taken in this process.

3.3 Reliability

Comparing the consistency of the evaluators (inter-raters) is one way to examine this reliability test. For this procedure, the content of ten reports, each collected from a different company, was categorized by two different raters according to the Index. Both raters had master’s degrees in accounting and finance and had undergone training for using the Index in practice. Cohen’s Kappa statistic calculates the probability of agreement between two raters on any given item and is used to verify the validity of inter-rater reliability. Cohen’s Kappa value for the percentage agreement between these two coders is .80, significant at p = 0.00, indicating that, ignoring chance agreement, the raters significantly agreed around 80% of the time. Also, the percent agreement between both the raters comes out to be 0.82, which also shows 80% of the acceptance between the raters. “If there is likely to be much guessing among the raters, it may make sense to use the kappa value, but if raters are well trained and little guessing is likely to exist, the researcher may safely rely on percent agreement to determine inter-rater reliability” (McHugh, 2012). Thus, in this index, the reliability statistics are obtained as .80, which draws the inference that a good index has more reliable results.

3.4 Measurement of Independent Variables

For this study, to ascertain the independent variables, the firms’ attributes, mostly based on past studies were considered and shown in Table 2. To analyze the Disclosure Index of a corporate report, the impact of major firms’ characteristics is assessed, and these attributes mainly include firm operating performance and the board characteristics of the company.

Table 1

Composition of the Industry in the Sample

|

Industry |

Number of Firms |

% of firms |

|

Automobile |

9 |

13% |

|

Cement & Cement Products |

3 |

4% |

|

Chemicals |

1 |

1% |

|

Construction |

2 |

3% |

|

Consumer Goods |

14 |

20% |

|

Consumer Services |

2 |

3% |

|

Fertilizers & Pesticides |

1 |

1% |

|

Healthcare Services |

1 |

1% |

|

Information Technology |

5 |

7% |

|

Metals |

7 |

10% |

|

Oil & Gas |

8 |

11% |

|

Pharma |

10 |

14% |

|

Power |

3 |

4% |

|

Services |

2 |

3% |

|

Telecom |

2 |

3% |

|

Total |

70 |

100% |

Source: National Stock Exchange, April 2022.

BSIZ is measured as the total number of directors on the board, and BIND is calculated as the percentage of independent directors on the board as adopted by Bhasin (2010), and Saha and Kabra (2022).

Other firm pertaining attributes are the financial attributes which consist of earnings per share (EPS), firm size (MCAP), leverage (LEV) (Ahn & Lee, 2004; Al-Kalbani, 2008; Meenakshi & Manoj, 2010; Amel-zadeh, 2016; Marchetti, 2018).

Table 2

Description of the Variables

|

Variables |

Meaning |

Calculation of the variables |

Source |

References |

|

VDS |

Voluntary disclosure score |

Actual score/ Total score |

Annual reports |

(Botosan, 1997; Holder-Webb, 2007) |

|

EPS |

Earnings per share |

Natural Logarithm of (Total earning/Outstanding shares) |

CMIE Prowess |

(Erin & Adegboye, 2022; Saha & Kabra, 2022) |

|

BSIZ |

Board size |

Total number of directors on the board |

CMIE Prowess |

(Boshnak, 2022) |

|

BIND |

Independent directors on the board |

Percentage of independent directors represented on the board |

CMIE Prowess |

(Hichri, 2022) |

|

MCAP |

Firm size |

NLOG (Market Capitalization) |

CMIE Prowess |

(Soriya & Rastogi, 2022) |

|

LEV |

Leverage |

Total market debt divided by total shareholders’ equity |

CMIE Prowess |

(Hichri, 2022; Soriya & Rastogi, 2022) |

3.5 Model Development

After identifying the independent factors, seven years of the company’s data were pooled along with MD&A disclosures. As the same individual units are studied over some time, it is called panel data. Hence, the meaning of panel data is the combination of cross-section and time dimensions. Ordinary Least Square (OLS) regression is applied to each explanatory variable, i.e., EPS, BSIZ, BIND, LEV, MCAP, and MD&A disclosure scores.

The regression model was constructed by including one dependent variable and all independent variables. The equation below serves as the foundation for estimating the regression model:

VDSit = β0++β1EPSit + β2BSIZit + β3BINDit + β4it + β5LEVit + εit

where β0 is constant, β1-5 are coefficients, and the subscript “i” denotes firms while “t” denotes time.

4. Results

4.1 Descriptive Statistics

Table 3 presents the descriptive statistics for the variables examined in this research. The mean score for VDS (Voluntary Disclosure Score based on the Management Discussion and Analysis Disclosure Index) is 39%, with a range of 0.14 to 0.68, indicating a wide variation in MD&A disclosures among the sampled firms. This suggests that companies with higher MD&A disclosures do not necessarily disclose all the items specified in the MD&A reporting, highlighting a poor level of MD&A integration among India’s companies.

Table 3

Descriptive Statistics of the Variables

|

|

EPS |

BSZ |

BIND |

VDS |

MCAP |

LEV |

|

Mean |

4.87 |

6.71 |

0.41 |

0.39 |

10.87 |

0.59 |

|

Median |

4.67 |

7.00 |

0.50 |

0.39 |

10.91 |

0.23 |

|

Maximum |

8.70 |

19.00 |

1.00 |

0.68 |

14.13 |

23.87 |

|

Minimum |

0.00 |

1.00 |

0.00 |

0.14 |

4.40 |

0.00 |

|

Standard Deviation |

0.63 |

3.52 |

0.23 |

0.11 |

1.15 |

1.33 |

The average EPS (earnings per share) value is 4.87, with a range of 0% to 8.70%, which shows that some firms earn from zero up to 9% earnings in a year. The average size of the board comprises seven members, having at least one independent director. Furthermore, the average leverage value is 0.59%, with a maximum value of 23.87% and no debt as the minimum value. This suggests that the sampled firms are primarily financed through equity capital.

4.2 Correlation

Multicollinearity exists when the independent variables are related to each other. Hence, it is important to measure the correlation between the independent factors and dependent factors in any regression to get unbiased results.

Table 4

Correlation Matrix

|

Correlation |

EPS |

LEV |

MCAP |

BSIZ |

BIND |

VDS |

VIF |

|

EPS |

1 ---- |

1.21 |

|||||

|

LEV |

-0.134 0.056* |

1 ---- |

1.12 |

||||

|

MCAP |

-0.053 0.274 |

-0.032 .0504 |

1 ---- |

1.64 |

|||

|

BSIZ |

0.146 0.002* |

0.045 0.353 |

0.158 0.001* |

1 ---- |

1.42 |

||

|

BIND |

0.142 0.003* |

-0.062 0.198 |

-0.005 0.905 |

0.449 0.000* |

1 ---- |

1.44 |

|

|

VDS |

0.015 0.756 |

-0.045 0.311 |

0.188 0.000* |

0.019 0.691 |

0.071 0.151 |

1 --- |

- |

Table 4 shows Pearson’s correlation matrix for all the model variables. The VDS is positively correlated with the MCAP (0.188), EPS (0.015), BSZE (0.019), and negatively correlated with the LEV (-0.45) and BIND (-0.089). MCAP is the most significant independent variable affecting voluntary MD&A disclosures. Such correlation coefficients are supported by the existing literature (Soriya & Rastogi, 2021; Hichri, 2022; Saha & Kabra, 2022). Further, among all the independent variables, the highest correlation is 0.449, indicating that no issue of multicollinearity is present in the data. The multicollinearity in this study is also checked with the help of the Variation Inflation Factor (VIF) test. This test provides advanced results as it measures the multicollinearity in a set of multiple regression variables. The rule for analyzing and interpreting the VIF is that if the VIF score is 1, it means not correlated, and 5, it means there is some correlation, however acceptable. If VIF>5, it means there is a high correlation and it should not be accepted. Each independent variable has a centered VIF lying between 1 and 2, which means that there is not much correlation among the independent variables and thus the case of multicollinearity does not exist. Hence, this assumption is also fulfilled, and the required models can be applied appropriately.

4.3 Regression Analysis

First of all, the Panel OLS Model is applied to check the relationship between voluntary disclosures with firm characteristics. Panel OLS is estimated because it is the simple OLS method that considers all the cross-sectional units to be homoscedastic. To identify whether the individual units have a heterogeneity effect in the data or not, the Pesaran CD test was conducted as presented in Table 5.

4.3.1 Cross-Sectional Dependence. Cross-sectional dependence is checked to ascertain the dependence in all the units of the same cross-section. If there is dependence, it means there are some unobserved effects which impact all the units in the same or different way. The Pesaran CD test is applied to check the cross-sectional data.

Table 5

Pesaran CD Test

|

Breusch-Pagan Lagrange |

Chi-square |

Probability |

Null Hypothesis: There is no |

|

VDS |

535.72 |

0.04 |

Rejection of Null |

Note. * represents significance at a 5% level.

The null of the Pesaran CD test shows no cross-sectional dependence in the dataset. Our dataset also supports it as p<0.05, which means there is cross sectional dependence in the dataset and some unobserved heterogeneity factor is lying between them. Therefore, in this case, the data does not have pool ability, hence, a fixed effects model or random effects model will be appropriate.

4.3.2 Fixed Effects and Random Effects Models. In Table 6, the fixed effects and random effects models are applied to test which model is best to control that unobserved heterogeneity effect. A fixed effects model controls the unobserved heterogeneity by allowing each cross-sectional unit to have its intercept, while the random effect allows each unit to behave randomly instead of fixing it to control the unobserved heterogeneity (Oware, 2021).

Table 6

Fixed and Random Effects Models

|

Variable |

Fixed |

Random |

||

|

Coefficient |

Prob. |

Coefficient |

Prob. |

|

|

EPS |

0.04 |

0.000** |

0.035 |

0.000** |

|

BSIZ |

0.0044 |

0.7749 |

-0.0007 |

.5509 |

|

BIND |

0.02 |

0.3142 |

0.018 |

0.35 |

|

MCAP |

0.0002 |

0.9595 |

0.0017 |

0.6986 |

|

LEV |

-0.0002 |

0.9060 |

-0.003 |

0.8714 |

|

_cons |

0.2266 |

0.0144* |

0.1256 |

0.044* |

|

R-squared |

0.8298 |

0.227 |

||

|

Prob (F-statistic) |

0.000* |

0.000* |

||

Note. * and ** denote the significance level of the correlation at 5 and 10%, respectively. Computed using Gretl software.

Now, the Hausman test is applied to find out the best-fitted model between the fixed effects model and the random effects model. The application of the Hausman test supported the fixed effects model, with p=0.000, which is less than 5% of the significance level. Therefore, the fixed effects model is suitable for our dataset. The value of R2 (.8298) and the largely significant value of F-statistics [24.98 (p=0.00)] favor the goodness of fit for the model.

The only positive and significant variable among all the independent variables is EPS (proxy to profitability), which affects the voluntary disclosure score of the MD&A reports in India. The rest of the independent factors do not significantly explain the voluntary disclosure level of the MD&A section of the annual reports. This suggests that management tends to disclose more information voluntarily when the company is experiencing higher earnings and profitability. It indicates that profitable firms possess a greater level of confidence in providing MD&A disclosures effectively. However, the constant value is significant with high coefficient values, indicating there are other variables which impact the voluntary disclosures apart from the firm characteristics.

Additionally, this could be attributed to the fact that the variance in voluntary disclosure and the selection of a reporting system relies on the utility of the financial information generated by the system. To reduce the cost of capital, the management may provide only a transparent set of accounting information that follows the standards and procedures of the regulators and listing stock exchange that can attract more investors and financial analysts. These results are consistent with the results of previous studies on the role of profitability in the disclosures (Ahn & Lee, 2004; Al-Kalbani, 2008; Srinivasan et al., 2014; Jain & Lawrence, 2016; Islam, 2018; Jayasree & Shette, 2020; Saha & Kabra, 2022).

4.3.3 Panel Regression: Assumption Testing. As the panel data set has both the dimensions of cross-sectional and time series, it is important to test all the assumptions related to the errors of the panel data regression model. Following are the assumptions that are tested for the error terms.

4.3.3.1 Normality of error term. The error term should be normally distributed for having a good-fitted model. We have applied the Jarque-Bera test for the normality of the error term, having a p-value of 0.92 > 0.05, indicating that the error terms are normally distributed (Hichri, 2022).

4.3.3.2 The mean of the error term is zero. The second assumption for the panel data regression is that the mean of the error term should be zero. In our case, the mean value is 1.0983e-016 ~ 0. It means that our selected fixed effects model fulfills the assumption that the mean of the error term is zero.

4.3.3.3 No serial correlation. The serial correlation term is also popularly known as autocorrelation. Autocorrelation is the relation of an error term with its lag value. The Durbin-Watson test is used very widely for measuring autocorrelation, which is a hypothetical test. The null hypothesis of this test is that there is no autocorrelation in the variables. Table 7 presents the results of the Durbin-Watson test.

Table 7

The Durbin-Watson test

|

Durbin-Watson Test |

Coefficient |

Probability |

Null Hypothesis: There is |

|

MDADI |

1.688 |

0.7896 |

Acceptance of Null |

Table 8

Expected and Obtained Results in MD&A Disclosures

|

Dimensions |

Hypothesis |

Expected effect |

Actual Result |

|

EPS |

H1 |

Positive |

Significant |

|

BSIZ |

H2 |

Positive |

Insignificant |

|

BIND |

H3 |

Positive |

Insignificant |

|

MCAP |

H4 |

Positive |

Insignificant |

|

LEV |

H5 |

Negative |

Insignificant |

Note. This table provides an overview of the comparison between the anticipated relationships and the actual relationships observed between corporate performance and MD&A disclosure.

The results accept the null hypothesis as p>0.05, which means there is no serial correlation in the variables and supports our selection of the fixed effects model.

All the assumptions tested clearly support the model and make the model more robust. Hence, in this study, the fixed effects model is appropriate.

5. Conclusion

MD&A reporting serves as a platform for management to express their perspectives on the firm’s future outlook, long-term vision, missions, achievements, and business survival in a dynamic environment. In India, the Securities and Exchange Board of India (SEBI) made it mandatory for all listed companies to disclose MD&A in their annual reports in 2015. The implementation of new policies and practices creates an opportunity to examine the impact of these changes on decision-making processes. Since the voluntary part of the disclosure package nowadays constitutes a significant part, and serves as an indication of good performance of a firm (Mayew et al., 2015), this research aims to investigate how firm attributes influence the extent of voluntary disclosures in MD&A reports.

The study’s hypothesis-driven analysis reveals that profitability is the factor that significantly affects the level of voluntary disclosures in MD&A reports. Although the firm size and board composition show an association with MD&A disclosures, their relationship is not statistically significant. Notably, the board of directors plays a crucial role in non-financial reports like MD&A, as it represents the managers’ viewpoints. However, in this study, the relationship between independent directors on the board and voluntary disclosures is found to be insignificant; these findings suggest that managers are primarily motivated by firm profitability when making voluntary disclosures, compared to other factors. The possible explanation behind this result would be the utilization of impression management strategies by managers, which means managers disclose more only when the firm has earned more and use impressive language to attract stakeholders and enjoy the company’s positive reputation (Caserio et al., 2019; Hamza, 2022).

The findings also have implications for policymakers and practitioners to check on the information given by the companies in their reports. The study highlights that voluntary disclosure in the MD&A reports is majorly influenced by the profitability of the firm, which shows the biasness of the managers toward information disclosure. Therefore, the regulators and policy makers should check on such practices and emphasize the standard framework for the MD&A reports in India. We also recommend that company managers provide MD&A reports in a clear and defined manner and use them as a competitive advantage. This study is confined to India only. Further research can be extended by establishing a comparison of voluntary disclosure practices followed by a developed and a developing nation.

References

Abdullah, S. N. (2022). Earnings Management in Small Listed Firms in Malaysia Using Quantile Regression. International Journal of Business and Society, 23(1), 326–341. doi: 10.33736/ijbs.4615.2022

Aggarwal, P, & Singh, A. K. (2019). CSR and sustainability reporting practices in India: An in-depth content analysis of top-listed companies. Social Responsibility Journal, 15(8), 1033–1053. doi: 10.1108/SRJ-03-2018-0078

Ahn, T., & Lee, J. (2004). Determinants of Voluntary Disclosures in Management Disclosure and Analysis (MD & A): Korean Evidence. Semantic Scholar.

Al-Kalbani, M. (2008). The Quality of Annual Corporate Reports in an Emerging Economy: The Case of Oman.

Amel-Zadeh, A. (2016). The Information Content of 10-K Narratives: Comparing MD & A and Footnotes Disclosures. Available at SSRN https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2807546

Barron, O. E., & Kile, C. O. (1999). MD&A Quality as Measured by the SEC and Analysts’ Earnings Forecasts. Contemporary Accounting Research, 16(1), 75–109.

Bhasin, M. L. (2010). Corporate Governance Disclosure Practices: The Portrait of a Developing Country. International Journal of Business and Management, 5(4), 150–167. doi: 10.5539/ijbm.v5n4p150

Boshnak, H. A. (2022). Determinants of corporate social and environmental voluntary disclosure in Saudi listed firms. Journal of Financial Reporting and Accounting, 20(3), 667–692. doi: 10.1108/JFRA-05-2020-0129

Botosan, C. A. (1997). Disclosure Level and the Cost of Equity Capital Disclosure Level and the Cost of Equity Capital. The Accounting Review, 72(3), 323–349.

Brown, S. V., & Tucker, J. W. (2011). Large-Sample Evidence on Firms’ Year-Over-Year MD&A Modifications. Journal of Accounting Research, 49(2), 309–346. doi: 10.1111/j.1475-679X.2010.00396.x

Bryan, S. H. (1997). Incremental Information Content of Required Disclosures Contained in Management Discussion and Analysis. Accounting Review, 72(2), 285–301.

Caserio, C., Trucco, S., & Panaro, D. (2019). Management discussion and analysis: A tone analysis on US financial listed companies. Management Decision, 58(3), 510–525. doi: 10.1108/MD-10-2018-1155

Clarkson, P. M., Kao, J. L., & Richardson, G. D. (1999). Evidence That Management Discussion and Analysis (MD&A) is a Part of a Firm’s Overall Disclosure Package. Contemporary Accounting Research, 16(1), 111–134. doi: 10.1111/j.1911-3846.1999.tb00576.x

Cole, C. (1990). MD&A Trends in Standard & Poor’s Top 100 Companies. Journal of Corporate Accounting and Finance, winter(90/91), 127–136.

Cole, C. J. (2012). International Best Practices for MD&A: An Update. The Journal of Corporate Accounting & Finance, (September/October), 37–47. doi: 10.1002/jcaf

Cole, C. J., & Jones, C. L. (2005). Management Discussion and Analysis: A Review and Implications for Future Research. Journal of Accounting Literature, 24, 135–174.

Cole, C. J., & Jones, C. L. (2014). The Quality of Management Forecasts of Capital Expenditures and Store Openings in MD&A. Journal of Accounting, Auditing & Finance, 30(2), 1–23. doi: 10.1177/0148558X14544502

Companies Act. (2013). Referencer on Board’ s Report.

Courtis, J. K. (1998). Differential Patterns of Textual Characteristics and Company Performance in the Chairman’s Statement. Accounting, Auditing & Accountability Journal, 11(4), 459–472.DOI:10.1108/09513570610679100

Eliza, A., Fali Rifan, D., & Fajar Ramdani, R. (2022). Does SAK Online Enhance The Quality of Financial Reporting? The Indonesian Journal of Accounting Research, 25(03), 299–318. doi: 10.33312/ijar.615

Erin, O., & Adegboye, A. (2022). Do corporate attributes impact integrated reporting quality? An empirical evidence. Journal of Financial Reporting and Accounting, 20(3/4), 416–445. doi: 10.1108/JFRA-04-2020-0117

Hamza, S. (2022). CSR or social impression management ? Tone management in CSR reports. Journal of Financial Reporting and Accounting, 20(3), 599–617. doi: 10.1108/JFRA-04-2020-0115

Hichri, A. (2022). Corporate governance and integrated reporting: Evidence of French companies. Journal of Financial Reporting and Accounting, 20(3), 472–492. doi: 10.1108/JFRA-09-2020-0261

Holder-Webb, L. L. (2007). The Question Of Disclosure: Providing A Tool For Evaluating Managements’ Discussion And Analysis. Advances in Accounting Behavioral Research, 10, 183–223.

Hufner, B. (2007). The SEC’s MD&A: Does it Meet the Informational Demands of Investors? – A Conceptual Evaluation. Schmalenbach Business Review (SBR), 59(1), 58–84.

Islam, M. S. (2018). Corporate Governance and Readability of Annual Reports. In A. Farazmand (Ed.), Global Encyclopedia of Public Administration, Public Policy, and Governance (pp. 1–6). doi: 10.1007/978-3-319-31816-5_3342-2

Jain, R., & Lawrence, H. W. (2016). CSR and sustainability reporting practices of top companies in India. Corporate Communications: An International Journal, 21(1), 35–55. DOI:10.1108/CCIJ-09-2014-0061

Jayasree, M., & Shette, R. (2020). Readability of Annual Reports and Operating Performance of Indian Banking Companies. IIM Kozhikode Society & Management Review, 10(1), 1–11. doi: 10.1177/2277975220941946

Laskar, N., & Maji, S. G. (2016). Corporate sustainability reporting practices in India: Myth or reality? Social Responsibility Journal, 12(4), 625–641. doi: 10.1108/SRJ-05-2015-0065

Lawrence, R. (1998). Make the MD&A More Readable. The CPA Journal, 68(1), 10.

Li, F. (2008). Annual report readability, current earnings, and earnings persistence. Journal of Accounting and Economics, 45(2–3), 221–247. doi: 10.1016/j.jacceco.2008.02.003

Li, F. (2010). The Information Content of Forward-Looking Statements in Corporate Filings—A Naıve Bayesian Machine Learning Approach. Journal of Accounting Research, 48(5), 1049–1102. doi: 10.1111/j.1475-679X.2010.00382.x

Liu, N., Liu, C., Guo, Q., Da, B., Guan, L., & Chen, H. (2019). Corporate Social Responsibility and Financial Performance: A Quantile Regression Approach. Sustainability (Switzerland), 11(13), pp. 1–22. doi: 10.3390/su11133717

Liu, S. B., Hsueh, S. J., & Wu, T. P. (2017). Shareholdings of Board Members and Corporate Performance: A Panel Quantile Regression Analysis. Global Economic Review, 46(3), 271–298. doi: 10.1080/1226508X.2017.1312477

Marchetti, A. (2018). The Management Discussion and Analysis in China (848726). [Master’s Thesis, Ca’ Foscari University of Venice].

Mayew, W. J., Sethuraman, M., & Venkatachalam, M. (2015). MD&A Disclosure and the Firm’s Ability to Continue as a Going Concern. The Accounting Review, 90(4), 1621–1651. doi: 10.2308/accr-50983

McHugh, M. L. (2012). Interrater reliability: The kappa statistic. Biochemica Medica, 22(3), 276–282. Available at: https://hrcak.srce.hr/89395

Meenakshi, S. A., & Manoj, J. (2010). MD & A Reporting - A Reality Check. IMS Manthan, 5(1), 119–124.

Mishra, N., Nurullah, M., & Sarea, A. (2022). An empirical study on company’s perception of integrated reporting in India. Journal of Financial Reporting and Accounting, 20(3), 493–515. doi: 10.1108/JFRA-03-2020-0081

Moreno, A., & Casasola, A. (2016). A Readability Evolution of Narratives in Annual Reports: A Longitudinal Study of Two Spanish Companies. Journal of Business and Technical Communication, 30(2), 202–235. doi: 10.1177/1050651915620233

Muhammad, H.. & Migliori, S. (2022). Effects of board gender diversity and sustainability committees on environmental performance: A quantile regression approach. Journal of Management and Organization, 29(6), 1051–1076. doi: 10.1017/jmo.2022.8

Nicolo, G., Zampone, G., Sannino, G., & De Iorio, S. (2022). Sustainable corporate governance and non-financial disclosure in Europe: Does the gender diversity matter ? Journal of Applied Accounting Research, 23(1), 227–249. doi: 10.1108/JAAR-04-2021-0100

Oware, K. M., & Mallikarjunappa, T. (2021). Corporate social responsibility and debt financing of listed firms: A quantile regression approach. Journal of Financial Reporting and Accounting, 19(4), 615–639. doi: 10.1108/JFRA-07-2020-0202

Pava, M. L., & Epstein, M. J. (1993). How Good is MD&A as an Investment Tool?. Journal of Accountancy, 175(3), 51–53.

Pillai, Y., & Seetha, K. (2022). Determinants of Integrated Reporting Quality of Financial Firms. The Indonesian Journal of Accounting Research, 25(2), 281–308. doi: 10.33312/ijar.611

Queiri, A., Madbouly, A., Reyad, S., & Dwaikat, N. (2021). Corporate governance, ownership structure and firms’ financial performance: Insights from Muscat securities market (MSM30). Journal of Financial Reporting and Accounting, 19(4), 640–655. doi: 10.1108/JFRA-05-2020-0130

Richards, G., Fisher, R., &Van Staden, C. (2011). Readability and Thematic Manipulation in Corporate Communications: A Multi-Disclosure Investigation. p. 40. Available at: https://ir.canterbury.ac.nz/handle/10092/11069

Saha, R., & Kabra, K. C. (2022). Corporate governance and voluntary disclosure: Evidence from India. Journal of Financial Reporting and Accounting, 20(1), 127–160. doi: 10.1108/JFRA-03-2020-0079

SEBI. (2015). Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015.

SEC. (2003). General Principles Regarding Disclosure of Management’s Discussion and Analysis of Financial Condition and Results of Operations Report of the Technical Committee of the International Organization of Securities Commissions February 2003, International Organization.

Shafeeq Nimr Al-Maliki, H., Salehi, M., & Kardan, B. (2023). The relationship between board characteristics and social responsibility with firm innovation. European Journal of Management and Business Economics, 32(1), 113–129. doi: 10.1108/EJMBE-04-2020-0094

Shawtari, F. A., Salem, M. A., Hussain, H. I., Alaeddin, O., Shawtari, F. A., Salem, M. A., Hussain, H. I., Alaeddin, O., & Thabit, O. B.(2016). Corporate governance characteristics and valuation: Inferences from quantile regression. Journal of Economics, Finance and Administrative Science, 21(41), 81–88. doi: 10.1016/j.jefas.2016.06.004

Singh, V., & Singla, H. (2021). Assessment of MD&A Readability using Flesch readability formula: A Study of Indian Companies. PIMT Journal of Research, 13(3), 29–33.

Singh, V., & Singla, H. (2022). Quality, readability, and narrative aspects of MD&A reports: Literature review and future research potential. Asian Journal of Research in Banking and Finance, 12(8), 1–13. doi: 10.5958/2249-7323.2022.00045.1

Singh, V., & Singla, H. (2023). MD & A Disclosure Practices in Indian Pharmaceutical Industry. International Reserach Journal of Economics and Management Studies, 2(2), 375–378. doi: 10.56472/25835238/IRJEMS-V2I2P140

Singh, V., Singla, H., & Aggarwal, S. (2022). Exploring the Readability Level of Indian Companies’ Management Discussion and Analysis Reports. Internation Journal of Food and Nutritional Sciences (IJFNS), 11(11), 3158–3165.

Singla, H., & Singh, V. (2023). Disclosure Practices of Management Discussion and Analysis: A Study on the Indian Corporate Sector. The Indonesian Journal of Accounting Research, 26(2), 183–208. doi: 10.33312/ijar.667

Soriya, S., & Rastogi, P. (2022). The impact of integrated reporting on financial performance in India: A panel data analysis. Journal of Applied Accounting Research, 24(1), 199-216. doi: 10.1108/JAAR-10-2021-0271

Srinivasan, P., Srinivasan, R., Marques, A. (2014). Narrative Analysis of Annual Reports: A Study of Communication Efficiency (IIM Bangalore Research Paper No. 486).

Sun, Y. (2010). Do MD & A Disclosures Help Users Interpret Disproportionate Inventory Increases?. The Accounting Review, 85(4), 1411–1440. doi: 10.2308/accr.2010.85.4.1411

Sutton, S. G., Bedard, J. C., & Phillips, J. R. (2012). Enhancing and Structuring the MD&A to Aid Investors when Using Interactive Data. Journal of Information System, 26(2), 167–188. doi: 10.2308/isys-50256

Usman, M., Nwachukwu, J., & Ezeani, E. (2022). The impact of board characteristics on the extent of earnings management: Conditional evidence from quantile regressions. International Journal of Accounting and Information Management, 30(5), 600–616. doi: 10.1108/IJAIM-05-2022-0112

Verrecchia, R. E. (1990). Information quality and discretionary disclosure. Journal of Accounting and Economics, 12(4), 365–380. doi: 10.1016/0165-4101(90)90021-U