Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2024, vol. 15, no. 1(30), pp. 27–50 DOI: https://doi.org/10.15388/omee.2024.15.2

COVID-19 Effect on Accelerating Technology and Innovation in Businesses

Husam Arman (corresponding author)

Kuwait Institute for Scientific Research, Kuwait

harman@kisr.edu.kw

https://orcid.org/0000-0002-3546-1718

Shaikha Al-Fulaij

Kuwait Institute for Scientific Research, Kuwait

sfulaij@kisr.edu.kw

Sulayman Al-Qudsi

Kuwait Institute for Scientific Research, Kuwait

squdsi@kisr.edu.kw

Ahmad Alawadhi

Kuwait Institute for Scientific Research, Kuwait

aawadhi@kisr.edu.kw

Mohammad Al Ali

Kuwait Institute for Scientific Research, Kuwait

maali@kisr.edu.kw

Abstract. This paper assesses empirically the COVID-19 effect on businesses and the potential dynamic changes regarding post-COVID-19 automation and technology penetration using various logistic regression models. A field survey was used to collect the necessary data for testing various hypotheses. This study demonstrates the severity of the pandemic on businesses and how it has changed their perspectives on technology as a critical aspect of survival and future success. The results showed that capital-intensive firms are more resilient to the crisis. In addition, the firms that were affected severely in terms of employment due to the pandemic believe that technology will significantly impact hiring, investment, and value added. This paper investigates a unique phenomenon represented by COVID-19, its impact on businesses in a resource-rich context and their responsiveness concerning technology deployment and automation.

Keywords: innovation, COVID-19, automation, technology, productivity

Received: 4/6/2023. Accepted: 23/1/2024

Copyright © 2024 Husam Arman, Shaikha Al-Fulaij, Sulayman Al-Qudsi, Ahmad Alawadhi, Mohammad Al Ali. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

The COVID-19 pandemic created a public health crisis and triggered a significant economic crisis, immediately disrupting production and consumption. Thus, the COVID-19 pandemic delivered a double whammy to economic activity. The pandemic led to a reduction in labor supply (which leads to a drop in output) due to restrictions on people’s movements and the loss of labor due to COVID-19 deaths, quarantine, and hospital admissions laborers. Containment measures such as total or partial lockdowns exacerbate the loss of labor. On the other hand, consumers lost their income due to containment measures and workers’ layoffs. However, some sectors, such as tourism, leisure centers, entertainment, restaurants, and transportation, were affected more than others.

Many firms opted for technology as a life-saver to carry on their business activities to minimize disruption to their operations. This surge in the use of digital technologies enabled people and organizations worldwide to adjust to new ways of work and life (Brem et al., 2021; Cruz-Cárdenas et al., 2021; Pandey & Pal, 2020). Cloud computing, Internet-of-Things (IoT), Artificial Intelligence (AI), and automation are key examples of what organizations adopt as part of their transformational journey. For instance, the Intelligent Internet of Things which applies IoT jointly with Artificial Intelligence has emerged as a key factor in the pandemic’s wake, especially in the health sector (López-Vargas et al., 2021).

A vast flow of literature documents the accumulated enormity and dragging effects of the COVID-19 pandemic shock and its widespread impact on global businesses (Apedo-Amah et al., 2020; Bloom et al., 2021). Locally, in the case of Kuwait, the pandemic has provoked serious health, social, and economic disruptions, including strict social distancing, curfews, and travel restrictions that culminated in a serious recession where GDP contracted by around 9%, and its protracted severity lasted longer than any of the historical recessions that Kuwait had experienced before (Al-Qudsi et al., 2021). In the private sector, the pandemic hit Kuwait’s business and labor market hard and displaced many foreign workers, estimated at 200,000 by 2021. Kuwaiti businesses rushed to automation as a substitute for physical labor in the workplace to safeguard their businesses during curfews and strict social distancing. They deployed remote working, training, and learning in schools and universities.

According to Mishna et al. (2021) and Singh et al. (2020), ICT adoption appeared as a business strategy for micro, small and medium-sized enterprises (MSMEs) during the COVID-19 pandemic. Several studies reported that firms benefited from ICT adoption during the crisis (Guo et al., 2020; Shiralkar et al., 2021; Wendt et al., 2021). More specifically, Kumar et al. (2023) aimed to investigate the impact of ICT adoption factors on MSMEs. A total of 393 responses from Indian small and medium-sized enterprises (SMEs) were collected; 48.6% of respondents believed that COVID-19 accelerated the process of digitization, and 70% indicated increased use of ICT due to the COVID-19 conditions. Also, about 64% indicated that their digitization expenses had increased due to COVID-19. Also, Wicaksono and Simangunsong (2022) argue that the COVID-19 epidemic appears to have accelerated digital technology adoption in Indonesia as digital technologies helped MSMEs handle the COVID-19 shock better. Their preliminary analysis suggests that utilization of the internet and being part of the supply chains were critical determinants for lessening the impact of COVID-19.

Zutshi et al. (2021) examined how SMEs can deal with the COVID-19 crisis through a review of 34 articles. They suggest that new technological advancements can enhance SMEs’ ability to survive in the context of the COVID-19 pandemic.

Several studies have suggested that Industry 4.0 adoption enabled manufacturers to deal with the effects of the COVID-19 pandemic (Akpan et al., 2021; Hopkins, 2021; Spieske & Birkel, 2021). More specifically, Bianco et al. (2023) studied whether Industry 4.0 implementation improved companies’ resilience, performance and stability during the COVID-19 shock. They utilized structural equation modeling to analyze data collected from 207 manufacturing companies in Brazil from October to December 2020. Their findings suggest that operational responses based on Industry 4.0 helped manufacturers to sustain their performance during the COVID-19 crisis, which supports the development of resilience characteristics for a company (flexibility, reliability, robustness, and responsiveness). Their study suggests that manufacturers’ resilience characteristics helped ease the effects of the COVID-19 crisis.

As discussed above, the literature entertained the idea that COVID-19 has contributed to accelerating technology deployment and digitization in particular (Kutnjak, 2021). For instance, Egana-delSol et al. (2021) examined how COVID-19 catalyzed the automation process. This paper contributes to this direction of work and tests specific hypotheses regarding the potential of automation due to COVID-19 based on the perspectives of the businesses in Kuwait. Unlike previous studies, this paper links the severity of the impact of COVID-19 with influencing the business perspective of the outlook of AI, productivity, and creativity, which are key future capabilities for any firm.

Limited published studies have investigated the possible link between COVID-19 and automation, especially in a resource-rich economy context. This study addresses a contemporary issue explored in recent literature concerning the correlation between COVID-19 and the adoption of technology and automation. The literature review has highlighted a consensus on the significant impact of COVID-19 on businesses. However, its role in expediting technology deployment, including AI, is still unclear, and there is a scarcity of empirical studies addressing this aspect.

2. Background

2.1 The Impact of COVID-19 on Business Performance

Numerous scholars have investigated the effect of the COVID-19 pandemic on the overall macroeconomic performance of an economy and business. Apedo-Amah et al. (2020) investigated the short-term effects of the pandemic on over 100,00 businesses across 51 developing countries. The authors concluded that the shock of the pandemic had had a severe and persistent negative impact on sales across various sectors. The findings indicate that over 90% of the open firms show an 84% reduction in sales and employment. Similar negative impacts of SMEs on liquidity, business activity, and closure are demonstrated in the literature (Barrero et al., 2020; Bartik et al., 2020). Bloom et al. (2021) used survey data of around 2,500 US small businesses to gauge the bearing of COVID-19 on businesses. They found that sales plummeted steeply in the second quarter of 2020 by an average of 29%. They forecast that these impacts seem to be persistent up to the middle of 2021. Their analysis uncovers heterogeneity in the impact of COVID-19 on different types of firms and owners. Firms with little or no internet presence experienced a decline of over 40% in sales compared to less than 10% for online firms. Alessa et al. (2021) surveyed 445 male and female entrepreneurs in Riyadh, Saudi Arabia, using a simple random sample over four months. They found that the pandemic negatively impacted business productivity and profits, forcing many businesses to physically close permanently in Saudi Arabia.

2.2 COVID-19 as a Catalyst for Digitization and Automation

The lockdowns and the health restrictions of the pandemic forced businesses even in developing countries to shift from conventional sales to digital sales. Patma et al. (2020) studied the adoption of internet and e-business technology on the performance of SMEs during the pandemic by applying structural equation modelling-based variance partial least square on 123 SMEs in Indonesia. The findings obtained in this study showed a positive impact of adopting e-business technology to boost profits and sales. Effiom and Edet (2020) have assessed Nigeria’s adoption of financial technologies. The study applied an autoregressive distributed lag methodology to investigate the effect of automated financial clearing on business performance. The results indicate that automated financial clearing can positively impact firms’ productivity and performance.

The COVID-19 pandemic seems to have catalyzed digitization. New technologies have replaced the mode of operations in almost every industry and have changed consumer behavior. Craven et al. (2020) indicate a substantial surge in e-commerce, a change in brand preferences and a decline in non-essential expenditure. According to Puttaiah et al. (2020), there has been an extreme increase of business and videoconferencing apps, and 58% of US consumers indicated that they have been spending more money online since the start of the COVID-19 pandemic.

2.3 Technology Penetration Impact on Businesses due to COVID-19

COVID-19 came out of the blue and allegedly accelerated the new era of integrated technologies (Industry 4.0), which include robotics, artificial intelligence, 3D printing, and the Internet of things (Martinelli et al., 2021). Apart from its technological impact, it is expected to affect job opportunities in the future (WEF, 2016).

During the pandemic, the pressure due to the supply shortages of critical medical equipment forced countries to reconsider the global value chain of these products and others in the future. Localized supply sources and Industry 4.0 technologies such as big data are key examples of effective strategies to overcome the challenges posed by COVID-19 (Belhadi et al., 2021). Such a shift could change the global manufacturing game and increase polarization within and across countries, especially if these new technologies reduce the importance of low-wage labor (Hallward-Driemeier & Nayyar, 2017).

A recent econometric study on Industry 4.0 showed that back-shoring is linked with high technology industries (Dachs & Adnan, 2019). Hence, the R&D-intensive firms are the ones that are keen to bring back operations that can be performed effectively utilizing Industry 4.0 capabilities.

The initial indication is that COVID-19 will most likely induce technological change and advance automation (Lund et al., 2021). This will increase productivity and wages in some occupations and negatively affect other workforce groups (Warman & Chernoff, 2020). The negatively affected jobs are the ones that are usually identified as jobs at risk in the near future. These include jobs such as mortgage brokers, paralegals, accountants, and some back-office staff, according to a McKinsey study (Manyika et al., 2017), which suggests that by 2030, from 75 million to 375 million workers will need to switch occupational categories, but this varies across countries.

COVID-19 brought a new dimension to the equation where jobs in work areas with higher levels of physical proximity are likely to see a greater transformation after the pandemic (Lund et al., 2021). However, the automation story in the United States and the past hype did not meet the expectation. According to Acemoglu and Restrepo (2020), adding one additional robot per 1,000 workers reduced the national employment-to-population ratio by about 0.2 per cent from 1990 to 2007.

2.4 AI, Productivity, and Creativity

Productivity gains encourage accelerating technology deployment further, and COVID-19 is another new incentive. However, only those developing, investing, and working in Industry 4.0 technologies will benefit by accumulating capital and increasing their income significantly, increasing the wage gap and income inequality (Prettner & Strulik, 2020).

Apart from the specific impact of COVID-19 due to the added incentives to automate to protect workers’ health and mitigate risks to their operations, recessions proved to result in an economic transformation. Pieces of evidence from the US and Canada, for instance, showed that the main routine job losses have occurred over the last three recessions and that these jobs do not return (Blit, 2020). However, the COVID-specific incentives are going to affect sectors differently. For example, in the retail sector, there has been a significant impact on the retail real estate business in general (Nanda et al., 2021), and hence the jobs associated with high street stores.

AI has been an essential part of Industry 4.0, and COVID-19 has increased its importance due to its broad applications, including healthcare, such as Digital healthcare wearables, which were used heavily during the pandemic (Brem et al., 2021). The development of modern AI is related to the recent advancement in computing technologies and machine learning processes (Martinelli et al., 2021). Such development is essential since the technology is becoming surprisingly capable in domains that are only for humans and not just to substitute for routine manual and cognitive tasks (Autor et al., 2003). Pedota and Piscitello (2022) argue that new dynamics of complementarity are also likely to emerge and rise in importance. The complementarity, according to Pedota and Piscitello, represents a relationship between two entities that enhance the value of each other as part of creative tasks that are a subset of non-routine cognitive tasks. Therefore, the demand for creativity for businesses is not just offered by humans but also the machine-made competencies (Kirstetter et al., 2013). Amabile (2020) anticipates that AI might eventually yield creative breakthroughs with a high impact on businesses and society. Therefore, researching empirically the AI outlook is necessary, and this study contributes to this effort.

3. Theoretical Framework and Hypotheses

As discussed in the Background Section, COVID-19 and similar events affected the economy, spurred automation, and increased technology adoption in general (Belhadi et al., 2021; Brem et al., 2021; Lund et al., 2021). The review of previous studies demonstrated a consensus on the negative impact of COVID-19 on the performance of enterprises (Apedo-Amah et al., 2020; Barrero et al., 2020; Bartik et al., 2020). However, unlike most reviewed studies, our study tested such phenomena using three dimensions: the effect on sales, liquidity and employment. In a few studies that have investigated the potential of COVID-19 to accelerate technology deployment in general, the emphasis was mainly on how COVID-19 “pushed” digital transformation into specific industries (Kutnjak, 2021). This paper examined those firms severely affected by COVID-19 and measured the expected response and outlook of technology deployment. This part fills the gap in the literature by focusing on the impact of COVID-19 on accelerating technology adoption using micro-level data that distinguishes between the views of those affected by the pandemic and their prospective reaction. For instance, the paper links the impact of COVID-19 on businesses with future demand for critical emerging technologies such as AI.

The two central research questions of this paper are as follows:

Question 1: How did COVID-19 impact on business performance in Kuwait?

In the first question, the performance was measured in terms of sales, liquidity, and employment. The corresponding hypothesis to this question was developed as follows:

Hypothesis 1: The impact of COVID-19 (measured by sales, liquidity, and employment) differs based on firm age, sector, labor/capital intensity.

Question 2: What is the anticipated impact on technology deployment?.

Three sub-questions were derived from the second central research question, each relating to different aspects of the future impact of COVID-19 on technology deployment. Corresponding hypotheses were developed from the three sub-questions. These three sub-questions and hypotheses are explained below.

Sub-Question 2.1: What is the potential of automation due to COVID-19?

This research question tries to determine whether automation was a temporary solution during the pandemic or whether it will extend beyond to achieve other objectives, such as productivity improvement.

Hypothesis 2.1: The severity of the impact of COVID-19 influenced the firms’ views of the speed of automation anticipation.

Sub-Question 2.2: How will technology deployment affect employment (in Kuwait and elsewhere), investment, and value added?

This research question addresses the view of the business on the role of technology penetration in changing employment, investment and value added, and whether COVID-19 played a role or not.

Hypothesis 2.2: The severity of the impact of COVID-19 influenced the firms’ views of future employment, investment, and value added due to technology penetration.

Sub-Question 2.3: What is the impact of COVID-19 on the demand for AI, productivity, and creativity?

AI has been on the rise recently, along with creativity and productivity. This research question takes care of this recent trend and checks if COVID-19 has enhanced this perspective.

Hypothesis 2.3: The severity of the impact of COVID-19 influenced the firms’ views of the demand for AI, productivity, and creativity.

4. Methodology

The paper utilizes survey data to determine the COVID-19 impact on Kuwait’s businesses and how the pandemic affected technology deployment. The data was analyzed statistically using STATA software to test a set of hypotheses mentioned in the Theoretical Framework and Hypotheses Section.

4.1 The Dataset

The field survey of a sample comprising 262 CEOs (business leaders) was polled between September and December 2020. The sample broadly represents Kuwait’s overall business leaders in terms of size of business companies, paid-up capital and broad industrial and sector classifications. The response rate was 66% (262 firms out of 397 targeted firms). Due to the COVID-19 partial lockdown and restrictions, different data gathering approaches were utilized, although the objective was to conduct face-to-face interviews. The additional approaches included telephone interviews and an online questionnaire while maintaining the same contents of topics discussed in the interview questions. The interviews were conducted with CEOs or senior managers.

The survey collected information on the impact of COVID-19 on the Kuwaiti economy and its ramifications on their companies in terms of specific indicators such as sales, liquidity, and employment. Also, the survey sought to glean information from Kuwait’s CEOs regarding the anticipated role of technology in their operations, employment of Kuwaiti and non-Kuwaiti workers, investment and value added.

4.2 The Specifications of the Models

Several logistic models were derived to test the hypotheses identified in the Theoretical Framework Section (Wooldridge, 2006). The first group of these models were designed to measure the impact of COVID-19 on sales, liquidity, and employment using binary logistic regression models, as was the case for the second group, which were designed to measure automation potential and its relationship with the COVID-19 impact.

The logit model was as follows:

Pr(Yi = 1 ∨ Xj ) = F(B0 + B1X1 + ⋯ + BiXj)

where

Yi is the dependent variables representing the impact of COVID-19 in the first group of models and automation in the second group as described in Table 1;

Xj is the independent variables representing indicators such as firm age in the first group of models and the same for indicators in the second group, but including the impact of COVID-19 as described in Table 1;

B1to Bi are coefficients to be estimated.

The third group focused on measuring the relationship between the severity of COVID-19 and its impact on future employment, investment, and value added. In contrast, the fourth measured the demand for AI, productivity and creativity post COVID-19 utilizing the ordered logistic regression. Since the latter group models have an ordinal dependent variable, ordered logistic regression was used (Fullerton, 2009).

Table 1 lists the variables defined in the models. The first group of variables measures the impact of COVID-19. The second group of variables measures different dimensions related to technology and automation, and the third describes the basic firms’ demography.

Table 1

List of Variables Used in the Models

|

Variable name |

Description |

|

Impact of COVID-19 |

|

|

Impactsevs |

Dichotomous variable equal to 1 for firms with sales decreased more than 40% due to COVID-19, and 0 if sales decreased less than 40%; |

|

Impactsevl |

Dichotomous variable equal to 1 for firms with liquidity decreased more than 40% due to COVID-19, and 0 if sales decreased less than 40%; |

|

Impactseve |

Dichotomous variable equal to 1 for firms with employment decreased more than 40% due to COVID-19, and 0 if sales decreased less than 40%; |

|

Technology and Automation |

|

|

Autop |

Dichotomous variable equal to 1 for firms expecting 40% or more reliance on automation in 2024, and 0 for less than 40%; |

|

Techk |

Categorical variable represents the impact of technology penetration on hiring Kuwaiti, equal to 1 if it increases, 2 if there is no change, and 3 if it decreases. |

|

Technk |

Categorical variable represents the impact of technology penetration on hiring non-Kuwaiti, equal to1 if it increases, 2 if there is no change, and 3 if it decreases. |

|

Techi |

Categorical variable represents the impact of technology penetration on investment volume, equal to 1 if it increases, 2 if there is no change, and 3 if it decreases. |

|

Techv |

Categorical variable represents the impact of technology penetration on value added; 1=increase, 2=no change, and 3=decrease; |

|

Demai |

Categorical variable represents demand for AI in the future; 1=very high, 2= high, 3=medium, 4=low, and 5=very low. |

|

Demprod |

Categorical variable represents demand for productivity in the future; 1=very high, 2=high, 3=medium, 4=low, and 5=very low. |

|

Demcreat |

Categorical variable represents demand for creativity in the future; 1=very high, 2=high, 3=medium, 4=low, and 5=very low. |

|

Firm and sectors indicators |

|

|

Firmage |

Continuous variable representing the age of the firm in years; |

|

Sector |

A set of dummy variables: 1 indicates the sector a firm belongs to (manufacturing, construction, trade, non-finance, and finance ) and 0 otherwise. |

|

Lintens |

Dichotomous variable: 1 stands for firms which are labor intensive, and 0 if they are not. |

|

Cintens |

Dichotomous variable: 1 stands for firms which are capital intensive, and 0 if they are not. |

To avoid any selectivity bias, the authors ran parallel regression models utilizing Heckman selection models (Heckman, 1979) using a probit link function (Agresti, 2015), and the results of the models were very similar to the original regression models which are presented in this paper. This has given the authors of this paper further confidence in the robustness of the models in addition to the standard test reported in the Analysis and Results Section.

5. Analysis and Results

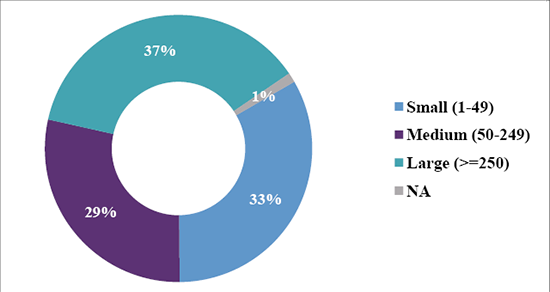

The CEO sample was mainly from the private sector (84%), while 10% were in the government sector and 6% were in the public-private sector. Nearly 29% of responding CEOs represent medium-sized companies that employ 50–249 workers. 37% of total CEOs represent CEOs of large companies employing more than 250 workers, while those in charge of small companies constitute 33% (Figure 1).

Figure 1

Company Size by Number of Total Workers

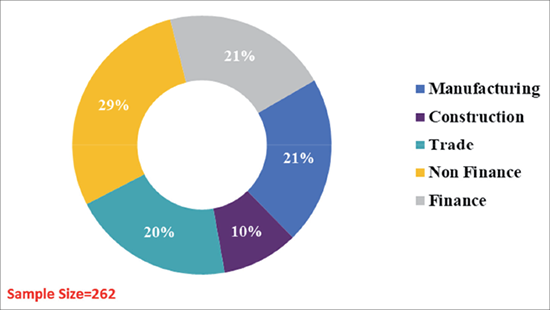

The survey covered all the major sectors, as shown in Figure 2. The results show that 29% of the surveyed firms are from the non-finance sector (business services), followed by the manufacturing sector and the finance sector, both at 21%, while trade activities constitute 20%, and the remaining 10% are in the construction sector (Al-Fulaij & Al-Qudsi, 2021).

Figure 2

TED CEO Survey: Company Size by Economic Sector

5.1 The Impact of COVID-19

About 72% of Kuwaiti CEOs believe that the 2020 coronavirus cum oil price collapse has severely impacted the Kuwaiti economy. This is comparable to findings of a recent international survey by the World Economic Forum (WEF), which showed that nearly 70% of business leaders expected a long-drawn-out recession worldwide resulting from the pandemic outbreak, which has shocked and wrecked livelihoods (Franco et al., 2020).

The great majority of Kuwaiti CEOs indicate that since coronavirus first hit their companies, its impact on their companies’ sales volumes has been harsh, with 88% indicating a negative sales impact. This is similar to previous SMEs surveys in Kuwait (the majority of our surveyed firms are SMEs), which were published at the beginning of the pandemic and showed that COVID-19 has severely impacted Kuwait SMEs and forced many firms to suspend or shut down their operation, particularly non-financial sectors (Al-Rowaih et al., 2020; Bensirri, 2020). A similar impact on businesses has been reported across geographies and sectors at the global level, and SMEs were the most affected sector (Apedo-Amah et al., 2020).

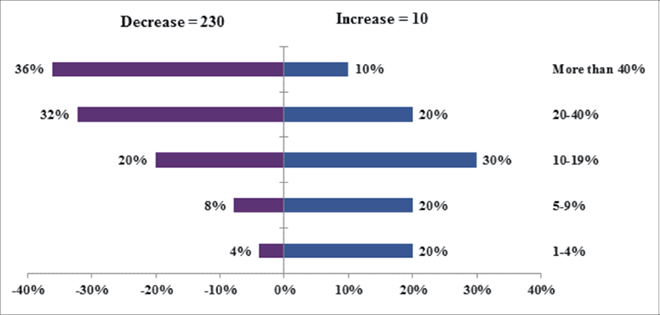

The negative impact of sales reduction was considered substantial, greater than 40% reduction in sales by 36%, while only 10% of the CEOs indicated the increase in sales was greater than 40% (Figure 3). However, a small minority of Kuwait’s business leaders, 4%, indicated that coronavirus positively impacted their company sales. Moreover, the magnitude of the indicated increase in company sales was relatively small, 20% indicating a sales gain in the range of 20% to 40%.

Figure 3

The Impact of COVID-19 on a Company’s Sales

In terms of the impact of coronavirus on company liquidity, the majority of Kuwaiti CEOs, 82%, indicated that their company liquidity declined. Only 3% stated that company liquidity increased, 12% indicated no change, and 3% had no response. Nearly 36% of CEOs asserted that the negative impact on liquidity exceeded 40%.

In terms of employment, 68% of total responses indicated that the 2020 coronavirus recession had a negative impact on employment size, with 64% of them rating the extent of the diminished employment demand to be over 20%. This was a direct and short-term effect on employment. Still, the long-term and permanent COVID-related layoffs could be devastating as they were estimated to be 42%, according to Barrero et al. (2020).

The results of the logistics regression models to measure COVID-19 impact on sales, liquidity and employment show that most of the factors considered were not statistically significant in predicting the impact except capital-intensive firms in the case of impact on sales (p < .01) and liquidity (p < .1). The sign of the coefficient confirms that capital-intensive firms are more resilient. In a similar crisis situation, an empirical study showed that access to capital was one of the key factors that enabled firms in Sweden to survive difficult times, including the 1990–93 and 2007–09 crises (Pal et al., 2014). Another specific econometric study on COVID-19 in the UK found a significant relationship between resilience and entrepreneurs’ management and financial capabilities (Greene et al., 2020).

Table 2

The COVID-19 Impact in Terms of Sales, Liquidity and Employment

|

|

(1) |

(2) |

(3) |

|

VARIABLES |

impactsevs |

impactsevl |

impactseve |

|

lintens |

-0.274 |

-0.227 |

0.0316 |

|

(0.396) |

(0.374) |

(0.389) |

|

|

cintens |

-0.986*** |

-0.591* |

-0.384 |

|

(0.367) |

(0.345) |

(0.363) |

|

|

2.sectorid |

1.237* |

0.555 |

0.566 |

|

(0.745) |

(0.627) |

(0.608) |

|

|

3.sectorid |

0.0537 |

0.124 |

-0.823 |

|

(0.529) |

(0.510) |

(0.553) |

|

|

4.sectorid |

0.868 |

0.686 |

0.402 |

|

(0.528) |

(0.495) |

(0.481) |

|

|

5.sectorid |

-0.252 |

-0.0221 |

-0.791 |

|

(0.506) |

(0.491) |

(0.525) |

|

|

firmage |

0.00171 |

-0.00496 |

-0.00572 |

|

(0.0101) |

(0.00942) |

(0.00970) |

|

|

Constant |

0.892* |

0.628 |

-0.0861 |

|

(0.517) |

(0.490) |

(0.495) |

|

|

AIC |

220.7434 |

239.5567 |

228.1919 |

|

BIC |

245.9233 |

264.7367 |

253.3719 |

|

Pesudo R -Square |

0.0797 |

0.0383 |

0.0564 |

|

Prob > chi2 |

0.0133 |

0.2601 |

0.0804 |

|

Observations |

172 |

172 |

172 |

Note. Standard errors in parentheses. ***represents p<0.01, ** p<0.05, * p<0.1.

It is worth mentioning that we have dropped the firm size in these models due to the high correlation with labor-intensive variables (0.88). In terms of sectors, only the construction sector was significant (p < .1) concerning the impact on sales only (the sales of 80% of the sampled firms in construction sectors declined by at least 20%). Therefore, it seems that since we have aggregated all sectors to five sectors, the difference was not apparent. The three models were tested using receiver operating characteristic (ROC) curves which measure the model’s ability to discriminate between observations. The value was close to 0.7 for all of them, which is considered acceptable (Mandrekar, 2010). For the goodness of fit (GOF), the Hosmer-Lemeshow test was used, and the p-value for all the models indicated that there is no significant difference between observed and predicted values (Zhang, 2016).

5.2 The Potential of Automation and Technology Penetration Post COVID-19

The response of the Kuwaiti CEOs to the question “How much do you think your company will rely on automation in future dates by January 2024?” showed that the future is going to look very different since 43% expect that more than 40% of their operation will be automated. Only 6% of CEOs think they will not use automation, and 6% think they will use it less than 5%. Interestingly, this is not specific to Kuwait; in their survey of Canadian citizens in 2020 and 2021, Loewen and Lee-Whiting (2021) found that the majority of the respondents think that the adoption of AI and automation will not stop when the pandemic ends.

Although the descriptive analysis showed that COVID-19 had changed the mindset of CEOs in terms of investing in automation, interestingly, this view was not significantly different between those affected more severely during the pandemic (Table 3). The only significant relationship was with the labor-intensive firms (p < .1), which showed that those firms are more keen and aware of the need for automation, and this pandemic proved this point for now and in the future. Although the ROC curves were not as good as the previous models (about 0.6), the Hosmer-Lemeshow GOF test was acceptable except for Model 4. Our results are consistent with the findings in the literature. Beland et al. (2020) found that in the United States, COVID-19 has increased the unemployment rate for less-educated workers. Micco (2019) found that total employment in occupations at risk (primarily manual labor) declined at an annual rate of 1.5% compared to riskless occupations in the United States during the period 2004–2016. The literature suggests that this may be more profound for less developed countries that rely on labor (labor-intensive sectors). For instance, Arntz et al. (2016) found that the fraction of jobs at high risk of automation among member countries of OECD was 9%, compared to Egaña-delSol and Joyce (2020) estimates of 11–42% for developing economies.

Table 3

The Relationship Between COVID-19 and Automation

|

|

(4) |

(5) |

(6) |

|

VARIABLES |

autop |

autop |

autop |

|

lintens |

0.631* |

0.617* |

0.615* |

|

(0.369) |

(0.369) |

(0.370) |

|

|

cintens |

-0.0597 |

-0.113 |

-0.0423 |

|

(0.355) |

(0.352) |

(0.350) |

|

|

firmage |

-0.000231 |

-0.000530 |

0.000107 |

|

(0.00915) |

(0.00919) |

(0.00916) |

|

|

Impactsevs |

0.0354 |

||

|

(0.348) |

|||

|

Impactsevl |

-0.343 |

||

|

(0.332) |

|||

|

impactseve |

0.363 |

||

|

(0.334) |

|||

|

Constant |

-0.843** |

-0.584 |

-0.967*** |

|

(0.398) |

(0.378) |

(0.338) |

|

|

AIC |

229.133 |

228.0767 |

227.9686 |

|

BIC |

244.8705 |

243.8142 |

243.7061 |

|

Pesudo R -Square |

0.0150 |

0.0198 |

0.0202 |

|

Prob > chi2 |

0.5026 |

0.3550 |

0.3420 |

|

Observations |

172 |

172 |

172 |

Note. Standard errors in parentheses. *** represents p<0.01, ** p<0.05, * p<0.1.15.

In response to the likely impact of technology penetration on investment in the post-coronavirus era, a sizeable majority (62%) of CEOs indicate that company investment will decline. This is consistent with the survey conducted on 500 firms in 10 emerging markets, which showed that COVID-19 encouraged firms to reduce investment (Beck et al., 2020).

In the inferential analysis, the severity of the impact of COVID-19 influenced the firms’ view about the impact of technology penetration on hiring, investment and value added. Still, it varied among the firms affected by COVID-19 in terms of sales, liquidity and employment. The severity measured by employment can predict the technology penetration impact on hiring non-Kuwaiti with significance (p < .05) and less significance with hiring Kuwaitis (p < .1). This shows how the pandemic has influenced those affected severely in terms of employment of the future impact of technology, not just regarding hiring but also investment and value added, and both are highly significant (p < .01), as shown in Table 4. The severity in terms of liquidity was the only significant predictor of the value added. It is worth mentioning that all the models were tested using the customized GOF Hosmer-Lemeshow (HL), Pulkstenis-Robinson (PR), and Lipsitz test (Fagerland & Hosmer, 2017).

Table 4

The Relationship Between COVID-19 and Technology Penetration

|

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

|

|

VARIABLES |

techk |

techk |

techk |

technk |

technk |

technk |

techi |

techi |

techi |

techv |

techv |

techv |

|

lintens |

0.0658 |

0.0778 |

0.0576 |

0.395 |

0.394 |

0.357 |

-0.789** |

-0.783** |

-0.852** |

-0.212 |

-0.190 |

-0.218 |

|

(0.350) |

(0.350) |

(0.350) |

(0.363) |

(0.362) |

(0.366) |

(0.356) |

(0.355) |

(0.366) |

(0.350) |

(0.351) |

(0.357) |

|

|

cintens |

0.0159 |

0.0248 |

-0.0136 |

0.448 |

0.374 |

0.405 |

-0.327 |

-0.351 |

-0.349 |

-0.125 |

-0.0934 |

-0.196 |

|

(0.342) |

(0.338) |

(0.335) |

(0.350) |

(0.344) |

(0.345) |

(0.342) |

(0.338) |

(0.342) |

(0.342) |

(0.340) |

(0.338) |

|

|

firmage |

0.00169 |

0.00256 |

0.00250 |

-0.00467 |

-0.00449 |

-0.00341 |

0.00939 |

0.0102 |

0.00995 |

-0.00131 |

-0.000452 |

-0.00107 |

|

(0.00864) |

(0.00868) |

(0.00870) |

(0.00860) |

(0.00859) |

(0.00874) |

(0.00906) |

(0.00904) |

(0.00929) |

(0.00844) |

(0.00852) |

(0.00858) |

|

|

Impactsevs |

0.266 |

0.429 |

0.504 |

0.488 |

||||||||

|

(0.340) |

(0.337) |

(0.343) |

(0.334) |

|||||||||

|

Impactsevl |

0.495 |

0.167 |

0.486 |

0.898*** |

||||||||

|

(0.324) |

(0.318) |

(0.325) |

(0.323) |

|||||||||

|

impactseve |

0.581* |

0.811** |

1.326*** |

1.145*** |

||||||||

|

(0.327) |

(0.334) |

(0.365) |

(0.360) |

|||||||||

|

AIC |

322.6166 |

320.8781 |

320.0404 |

317.1782 |

318.517 |

312.6457 |

308.7544 |

308.6775 |

296.3101 |

323.2069 |

317.5061 |

314.3012 |

|

BIC |

341.03 |

339.2915 |

338.4538 |

335.8139 |

337.1527 |

331.2814 |

327.28 |

327.2031 |

314.8357 |

341.6954 |

335.9945 |

332.7897 |

|

Pesudo R -Square |

0.0024 |

0.0079 |

0.0106 |

0.0157 |

0.0113 |

0.0303 |

0.0338 |

0.0340 |

0.0743 |

0.0115 |

0.0296 |

0.0398 |

|

Prob > chi2 |

0.9471 |

0.6497 |

0.5074 |

0.3023 |

0.4751 |

0.0521 |

0.0345 |

0.0334 |

0.0001 |

0.4580 |

0.0533 |

0.0138 |

|

Observations |

159 |

159 |

159 |

165 |

165 |

165 |

162 |

162 |

162 |

161 |

161 |

161 |

|

Note. Standard errors in parentheses. *** represents p<0.01, ** p<0.05, * p<0.1. |

||||||||||||

5.3 The Future Demand for AI, Productivity, and Creativity

According to our results from the logistic regression models, the impact of COVID-19 cannot explain the demand for AI, productivity and creativity. None of the impact measures showed a significant predictor. However, a firm’s age was significant (p < .05) in predicting the demand for AI, and capital-intensive firms are also significant (p < .05), but in predicting the demand for productivity and creativity. According to the Global AI Adoption Index 2021 of IBM, 43% of interviewed firms think that the COVID-19 pandemic has accelerated their rollout of AI, and larger firms were 31% more likely than smaller ones to report that their company had accelerated their AI deployment programs as a result of COVID-19 (IBM, 2021).

The literature indicates that mixed effects differ considerably across economic sectors and countries (Dümcke, 2021; Florida & Seman, 2020; Travkina & Sacco, 2020). The Information Technologies (IT) sector is experiencing positive effects (Kim et al., 2020), while libraries, museums, and arts and entertainment industries have experienced negative effects (Agostino et al., 2020; Machovec, 2020). According to Belitski et al. (2021), the IT industry has expanded due to increased demand for IT and software (e.g., online digital platforms). Additionally, the IT industry has aided the complementarity effect within other industries, buttressing firms’ resilience and performance. For instance, sales and delivery, education, and meeting migrated to online operations (Soni, 2020).

In our survey, more than 85% of firms that are more than 20 years old indicated that demand for AI is medium and above. So although there is a consensus on the AI trends and potential impact, it seems its economic impact and value for productivity are less conclusive (Damioli et al., 2021).

Table 5

Ordered Logistic Regression (COVID-19 Impact on Demand for AI, Productivity and Creativity)

|

|

(19) |

(20) |

(21) |

(22) |

(23) |

(24) |

(25) |

(26) |

(27) |

|

VARIABLES |

demai |

demai |

demai |

demprod |

demprod |

demprod |

demcreat |

demcreat |

demcreat |

|

lintens |

-0.421 |

-0.440 |

-0.447 |

0.154 |

0.161 |

0.188 |

-0.527 |

-0.522 |

-0.501 |

|

(0.335) |

(0.334) |

(0.333) |

(0.348) |

(0.349) |

(0.349) |

(0.354) |

(0.351) |

(0.352) |

|

|

cintens |

-0.127 |

-0.168 |

-0.200 |

-0.666** |

-0.673** |

-0.610* |

-0.771** |

-0.778** |

-0.750** |

|

(0.317) |

(0.315) |

(0.314) |

(0.332) |

(0.331) |

(0.324) |

(0.331) |

(0.328) |

(0.327) |

|

|

firmage |

0.0177** |

0.0177** |

0.0174** |

0.00356 |

0.00229 |

0.00312 |

0.0127 |

0.0123 |

0.0124 |

|

(0.00822) |

(0.00823) |

(0.00822) |

(0.00869) |

(0.00869) |

(0.00870) |

(0.00931) |

(0.00927) |

(0.00929) |

|

|

Impactsevs |

0.361 |

-0.341 |

-0.174 |

||||||

|

(0.313) |

(0.323) |

(0.311) |

|||||||

|

Impactsevl |

0.116 |

-0.413 |

-0.430 |

||||||

|

(0.295) |

(0.311) |

(0.302) |

|||||||

|

impactseve |

-0.321 |

-0.319 |

-0.162 |

||||||

|

(0.302) |

(0.308) |

(0.304) |

|||||||

|

AIC |

475.2119 |

476.3984 |

475.4158 |

441.7191 |

441.0597 |

441.746 |

463.9115 |

462.186 |

463.9397 |

|

BIC |

499.5593 |

500.7458 |

499.7632 |

466.1179 |

465.4586 |

466.1449 |

487.9966 |

486.2711 |

488.0248 |

|

Pesudo R -Square |

0.0146 |

0.0120 |

0.0142 |

0.0104 |

0.0120 |

0.0104 |

0.0221 |

0.0259 |

0.0221 |

|

Prob > chi2 |

0.1469 |

0.2300 |

0.1589 |

0.3440 |

0.2725 |

0.3472 |

0.0382 |

0.0184 |

0.0387 |

|

Obser. |

155 |

155 |

155 |

156 |

156 |

156 |

150 |

150 |

150 |

Note. Standard errors in parentheses.*** represents p<0.01, ** p<0.05, * p<0.1.

6. Discussion

The effect of COVID-19 was contagious, and developing countries exhibited economic vulnerability during the COVID-19 crisis due to the disruptions in global value chains, reducing GDP up to 5.4% for countries in sub-Saharan Africa, Asia and Latin America (Pahl et al., 2021). The anticipated long-term effect regarding the supply chain was that firms in developed countries started to amend future strategies and accelerate investment in technologies to lessen dependence on developing countries (Hallward-Driemeier & Nayyar, 2017). The Reshoring Initiative in the United States is an example of increasing investments in Industry 4.0 technologies to reduce dependence on China in manufacturing (Sauter & Stebbins, 2016). 3D printing is one of the key enabling technologies for countries with a strong manufacturing base in the past to revive the manufacturing sector and create new jobs in advanced manufacturing niches. It can also be an excellent opportunity for developing countries to leapfrog technological developments and indigenize their manufacturing industry, especially those with the financial resources for such ambitious goals as Kuwait.

For Kuwait, although the direct negative impact measured by the financial aspect (e.g., sales and liquidity) was the primary concern, this paper argues that the long-term effect is the one that needs attention. This includes job creation and improving the human capital of Kuwait, which is the cornerstone of Kuwait’s 2035 Vision and its future socio-economic development path.

Large firms in Kuwait seem more innovative, significant economic contributors, and more resilient to crises (Arman et al., 2022). The results of this study showed that these firms, the capital-intensive ones in particular, were better equipped to face all the types of negative impacts of COVID-19.

Business leaders are usually aware of the importance of future trends and the rapid pace of technological developments. Still, the firms are habitually lacking when it comes to actions and implementation. In this study, most of the CEOs of Kuwaiti firms believe and anticipate the high role of automation to be embedded in their operations, and the possibility of replacing labor is high, yet very few initiates are taking place on their shop floor for different reasons. Firms had a similar view of the future of automation regardless of the recent impact of COVID-19, except those firms with a large number of employment (labeled in this study as labor-intensive firms). This could mean that even those firms who were poorly affected by COVID-19 have witnessed the pandemic wave on businesses, which has changed their thinking and increased the future automation outlook.

The analysis and the insights from the study highlight the difference in the impact of technology penetration on the two types of employment in the unique context of Kuwait and GCC at large. It seems businesses believe that national employees will be safeguarded even with high technology penetration in Kuwait. This could be attributed to the businesses’ view of the expected role of government to protect these jobs, or the skill level is within the category that is immune to technology change impact. However, the adverse reactions to investment and value added due to technology penetration are expected to bounce back, but the time and shape remain uncertain.

Although CEOs think highly of AI and are willing to invest in improving their human capital through training, it seems COVID-19 did not spur high demand for AI in businesses in Kuwait, according to our survey results. Only well-established firms that have been in business for a long time (more than 20 years) predict the future accurately compared to the fresh eyes of the new firms.

7. Conclusions

This paper made a significant contribution by addressing the recently explored issue of how COVID-19 has influenced companies, either by prompting them or at times, necessitating them to invest in technology and automation. This investment is aimed at adapting to future disruptions while enhancing business performance. Our analysis revealed that the majority of the surveyed companies, even those minimally impacted by COVID-19, share the belief that technology and automation will become increasingly prevalent in the future. However, limitations of the study dictate cautious interpretation of the results since the data was collected in the middle of the crisis. Hence, there is a need for replication studies to test if such a trend is persisting and if there have been any structural changes post the crisis.

The demand for productivity and creativity is part of the future plans of businesses in Kuwait, and capital-intensive ones seem to be leading the way toward building productive human capital in Kuwait. The results regarding the impact of technology on employment are unique in GCC, including Kuwait as a case, due to Kuwait’s labor structure dichotomy of national and foreign labor. Hence, the treatment of such phenomena needs to be unique. The reliance on low-skilled labor seems to slow the adoption of new technologies in production and operations. Although there is awareness of the new technologies and their future such as that of AI, Kuwait businesses are still reluctant to invest and pursue such technological developments. The lack of skilled labor and the ability to attract talents is also a factor.

A few managerial implications can be derived from this study. These include advancing the firms’ understanding of the anticipated role of technology and automation in the future for their business and how they can take advantage of such transformation. Firms in Kuwait should accelerate their investment in Industry 4.0 technologies such as AI and 3D printing to improve their resilience to crises. These technologies can enhance efficiency and reduce dependence on labor, making firms more adaptable to sudden disruptions such as the COVID-19 crisis, which has highlighted the vulnerability of developing countries, including Kuwait, in global supply chains. Hence, Kuwaiti firms should consider diversifying their supply chains and reducing dependence on a single source, especially for critical inputs. This can mitigate the risk of future disruptions. An important practical implication is the need to invest in skill development and creating employment opportunities to contribute to job creation and enhance human capital. Given their resilience, large firms can play a crucial role in this. Finally, in the wake of COVID-19, firms should focus on building resilience regarding supply chains and technology adoption and financial stability, liquidity management, and crisis preparedness, such as introducing business contingency management systems.

Despite rigorous inferential analysis and empirical findings of this study, some limitations must be acknowledged. First, the empirical part only included Kuwait, and it would be ideal for matching the GCC analysis with cross-country surveys. Second, a more extensive survey sample could have increased the coverage of sub-sectors. Thirdly, the study relied only on quantitative analysis; a complementary qualitative data approach could have highlighted additional business insights.

This paper has opened the door for future studies. A qualitative study can be conducted to dig deeper into how businesses consider risks and are able to develop strategies to be ready for other future disturbances; for instance, whether COVID-19 encouraged firms to adopt business continuity management systems. Since this survey did not include start-ups, it will be interesting to see their views on this topic in future studies focusing on high-tech firms. Moreover, a dedicated study on AI potential and challenges in Kuwait is recommended for future studies to examine Kuwait’s potential to catch up with the wave of development and not be left behind.

Acknowledgement

The authors wish to extend their sincere thanks to the Kuwait Foundation for Advancement of Sciences (KFAS) for their partial financial support of this study related to Project TE062C—Research Grant (PN20-171C-07)- (CORONA PROP-92).

References

Acemoglu, D. & Restrepo, P. (2020). Robots and Jobs: Evidence from US Labor Markets. Journal of Political Economy, 128(6), 2188–2244.

Agostino, D., Arnaboldi, M. & Lampis, A. (2020). Italian state museums during the COVID-19 crisis: From onsite closure to online openness. Museum Management and Curatorship, 35(4), 362–372.

Agresti, A. (2015) Foundations of Linear and Generalized Linear Models. John Wiley & Sons.

Akpan, I. J., Soopramanien, D., & Kwak, D. (2021). Cutting-edge technologies for small business and innovation in the era of COVID-19 global health pandemic. Journal of Small Business & Entrepreneurship, 33(6), 607–617.

Alessa, A. A., Alotaibie, T. M., Elmoez, Z., & Alhamad, H. E. (2021). Impact of COVID-19 on Entrepreneurship and Consumer Behaviour: A Case Study in Saudi Arabia. The Journal of Asian Finance, Economics and Business, 8(5), 201–210.

Al-Fulaij, S., & Al-Qudsi, S. (2021). Kuwaiti Economy Under Corona and Beyond: Insights from TED’s Survey of Kuwaiti Business Leaders. (KISR Technical Report 16851). Kuwait: Kuwait Institute for Scientific Research.

Al-Qudsi, S., Gelan, A., Al-Awadhi, A., Ramadhan, M., Arman, H., Alenezi, M. Al-Othman, A., Al-Fulaij, S, Behbehani, W., Al-Musallam, M., Alali, M., Al-Musallam, N., Awadh, W, Naseeb, A, Bu-Hamad, M, Al-Khayat, A., Aljaber, A., Hajjieh, A. (2021). The 2020 Coronavirus Outbreak and Global Growth and Trade Collapse: Impact on Kuwait’s overall Economy and Society, its Sectors and Business Firms and Vital Fiscal Recovery Plan. TE062C. Kuwait: Kuwait Institute for Scientific Research.

Al-Rowaih, A., Al-Fozan, B., Al-Joan, A., & Alloghani, A. (2020). Special Study on COVID-19 Impact on SMEs in Kuwait. Kuwait.

Amabile, T. M. (2020), Creativity, Artificial Intelligence, and a World of Surprises. Academy of Management Discoveries, 6(3), 351–354.

Apedo-Amah, M. C., Avdiu, B., Cirera,. X, Cruz, M., Davies, E., Grover, A., Iacovone, L., Kilinc, U., Medvedev, D., Maduko, F. O., Poupakis, S., Torres, J., Tran, T. T.(2020). Unmasking the Impact of COVID-19 on Businesses. (Policy Research Working Paper 9434). The World Bank.

Arman, H., Iammarino,. S., Ibarra-Olivo, J. E., & Lee, N. (2022). Systems of innovation, diversification, and the R&D trap: A case study of Kuwait. Science and Public Policy, 49(2), 179–190.

Arntz, M., Gregory, T., & Zierahn, U. (2016). The Risk of Automation for Jobs in OECD Countries: A Comparative Analysis. (OECD Social, Employment and Migration Working Papers).

Autor, D. H., Levy, F., & Murnane, R. J. (2003). The Skill Content of Recent Technological Change: An Empirical Exploration. The Quarterly Journal of Economics, 118(4), 1279–1333.

Barrero, J. M., Bloom, N., & Davis, S. J. (2020). Covid-19 is Also a Reallocation Shock. (NBER Working Paper 27137). National Bureau of Economic Research.

Bartik, A. W., Bertrand, M., Cullen, Z. B., Glaeser, E. L., Luca, M., & Stanton, C. T. (2020). How are Small Businesses Adjusting to Covid-19? Early Evidence from a Survey. (NBER Working paper 26989). National Bureau of Economic Research.

Beck, T., Flynn, B., & Homanen, M. (2020). Covid-19 in emerging markets: Firm survey evidence. CEPR.

Beland, L., Brodeur, A., & Wright, T. (2020). The short-term economic consequences of Covid-19: Exposure to disease, remote work and government response. PLOS ONE, 18(3), e0270341.

Belhadi, A., Kamble, S., Jabbour, C. J. C., Gunasekaran, A., Ndubisi, N. O., & Venkatesh, M. (2021). Manufacturing and service supply chain resilience to the COVID-19 outbreak: Lessons learned from the automobile and airline industries. Technological Forecasting and Social Change, 163, 120447.

Belitski, M., Kalyuzhnova, Y., & Khlystova, O. (2022). The Impact of the COVID-19 Pandemic on the Creative Industries: A Literature Review and Future Research Agenda. Journal of Business Research, 139,1192–1210.

Bensirri Public Relations. (2020). COVID-19 Kuwait Business Impact Survey. Kuwait.

Bianco, D., Bueno, A., Godinho Filho M, Latan, H., Ganga, G. M. D., Frank, A. G. Jabbour, C. (2023). The role of Industry 4.0 in developing resilience for manufacturing companies during COVID-19. International Journal of Production Economics, 256(2), 108728.

Blit, J. (2020). Automation and Rreallocation: Will COVID-19 Usher in the Future of Work? Canadian Public Policy, 46(S2), S192–S202.

Bloom, N., Fletcher, R. S., & Yeh, E. (2021). The Impact of COVID-19 on US Firms. (NBER Working paper 28314). National Bureau of Economic Research.

Brem, A., Viardot, E., & Nylund, P. A. (2021). Implications of the coronavirus (COVID-19) outbreak for innovation: Which technologies will improve our lives? Technological Forecasting and Social Change, 163, 120451.

Craven, M., Liu, L., Mysore, M., & Wilson, M. (2020). COVID‐19: Implications for Business.McKinsey and Company Website.

Cruz-Cárdenas, J., Zabelina, E., Guadalupe-Lanas, J., Palacio-Fierro, A., & Ramos-Galarza, C. (2021). COVID-19, consumer behavior, technology, and society: A literature review and bibliometric analysis. Technological Forecasting and Social Change, 173, 121179.

Dachs, B., & Adnan, S. (2019). Industry 4.0 and the Changing Topography of Global Value Chains. (UNIDO Working Paper 10/2019). United Nations Industrial Development Organization.

Damioli, G., Van Roy, V., & Vertesy, D. (2021). The impact of artificial intelligence on labor productivity. Eurasian Business Review, 11(1), 1–25.

Dümcke, C. (2021). Five months under COVID-19 in the cultural sector: A German perspective. Cultural Trends, 30(1), 19–27.

Effiom, L., & Edet, S. E. (2020). Financial innovation and the performance of small and medium scale enterprises in Nigeria. Journal of Small Business & Entrepreneurship, 34(2), 141–174.

Egana-delSol, P., & Joyce, C. (2020). The Future of Work in Developing Economies. MIT Sloan Management Review, 61(2), 1–3.

Egana-delSol, P., Cruz, G., & Micco, A. (2021). COVID-19’s Impact on the Labor Market Shaped by Automation: Evidence from Chile. Available at SSRN 3761822.

Fagerland, M. W., & Hosmer, D. W. (2017). How to test for goodness of fit in ordinal logistic regression models. The Stata Journal, 17(3), 668–686.

Florida, R., & Seman, M. (2020). Lost Art: Measuring COVID-19’s devastating impact on America’s creative economy. Brookings.

Franco, E. G., Lukacs, R., Müller, M. S., Shetler-Jones, P., & Zahidi, S. (2020). COVID-19 Risks Outlook: A Preliminary Mapping and its Implications. Davos: World Economic Forum.

Fullerton, A. S. (2009). A Conceptual Framework for Ordered Logistic Regression Models. Sociological Methods & Research, 38(2), 306–347.

Greene, F. J., Rosiello, A., Golra, O., & Vidmar, M. (2020). Analysing Resilience in High Growth Firms at the Onset of COVID-19 Crisis. Clinical Psychology.

Guo, H., Yang, Z., Huang, R., & Guo, A. (2020). The digitalization and public crisis responses of small and medium enterprises: Implications from a COVID-19 survey. Frontiers of Business Research in China, 14, 1–25.

Hallward-Driemeier, M., & Nayyar, G. (2017). Trouble in the Making?: The Future of Manufacturing-Led Development. World Bank Publications.

Heckman, J. J. (1979). Sample Selection Bias as a Specification Error. Econometrica: Journal of the Econometric Society, 47(1), 153–161.

Hopkins, J. L. (2021). An investigation into emerging industry 4.0 technologies as drivers of supply chain innovation in Australia. Computers in Industry, 125, 103323.

IBM. (2021). Global AI Adoption Index 2021. IBM Watson.

Kim, S., Parboteeah, K. P., & Cullen, J. B. (2020). The COVID-19 Crisis Management in the Republic of Korea. In Anonymous International Case Studies in the Management of Disasters (pp. 231-249). Emerald Publishing Limited.

Kumar, V., Verma, P., Mittal, A., Tuesta Panduro, J. A., Singh, S., Paliwal, M., Sharma, N. (2023) Adoption of ICTs as an emergent business strategy during and following COVID-19 crisis: Evidence from Indian MSMEs. Benchmarking: An International Journal, 30(6), 1850–1883.

Kutnjak, A. (2021). Covid-19 accelerates digital transformation in industries: Challenges, issues, barriers and problems in transformation. IEEE Access, 9, 79373–79388.

Loewen, P., & Lee-Whiting, B. (2021). Automation, AI and COVID-19. Public Policy Forum, Ottawa, Ontario.

López-Vargas, A., Ledezma, A., Bott, J., & Sanchis, A. (2021). IoT for Global Development to Achieve the United Nations Sustainable Development Goals: The New Scenario After the COVID-19 Pandemic. IEEE Access, 9, 124711–124726.

Lund, S., Madgavkar, A., Manyika, J., Smit, S., Ellingrud, K., & Robinson, O. (2021). The Future of Work After COVID-19. New York: McKinsey Global Institute.

Machovec, G. (2020). Pandemic impacts on library consortia and their sustainability. Journal of Library Administration, 60(5), 543–549.

Mandrekar, J. N. (2010). Receiver Operating Characteristic Curve in Diagnostic Test Assessment. Journal of Thoracic Oncology, 5(9), 1315–1316.

Manyika, J., Lund, S., Chui, M., Bughin, J., Woetzel, J., Batra, P., Ko, R., Sanghvi, S. (2017) Jobs Lost, Jobs Gained: Workforce Transitions in a Time of Automation. New York: McKinsey Global Institute.

Martinelli, A., Mina, A., & Moggi, M. (2021). The enabling technologies of industry 4.0: examining the seeds of the fourth industrial revolution. Industrial and Corporate Change, 30(1), 161–188.

Micco, A. (2019). Automation, Labor Markets, and Trade. (Working paper 486). Universidad de Chile, Departamento de Economía.

Mishna, F., Milne, E., Bogo, M., & Pereira, L. F. (2021). Responding to COVID-19: New Trends in Social Workers’ Use of Information and Communication Technology. Clinical Social Work Journal, 49, 484–494.

Nanda, A., Xu, Y., & Zhang, F. (2021). How would the COVID-19 pandemic reshape retail real estate and high streets through acceleration of E-commerce and digitalization? Journal of Urban Management, 10(2), 110–124.

Pahl, S., Brandi, C., Schwab, J., & Stender, F. (2021). Cling together, swing together: The contagious effects of COVID‐19 on developing countries through global value chains. (The World Economy Discussion Papers).

Pal. R., Torstensson, H., & Mattila, H. (2014). Antecedents of organizational resilience in economic crises—an empirical study of Swedish textile and clothing SMEs. International Journal of Production Economics, 147, 410–428.

Pandey, N., & Pal, A. (2020). Impact of digital surge during Covid-19 pandemic: A viewpoint on research and practice. International Journal of Information Management, 55, 102171.

Patma, T. S., Wardana, L. W., Wibow, A., & Narmaditya, B. S. (2020). The Shifting of Business Activities during the COVID-19 Pandemic: Does Social Media Marketing Matter? The Journal of Asian Finance, Economics, and Business, 7(12), 283–292.

Pedota, M., & Piscitello, L. (2022). A new perspective on technology‐driven creativity enhancement in the Fourth Industrial Revolution. Creativity and Innovation Management, 31(1), 109–122.

Prettner, K., & Strulik, H. (2020). Innovation, automation, and inequality: Policy challenges in the race against the machine. Journal of Monetary Economics, 116, 249–265.

Puttaiah, M., Raverkar, A. K., & Avramakis, E. (2020). All change: How COVID-19 is transforming consumer behaviour. Swiss Re Institute.

Sauter, M. B., & Stebbins, S. (2016, Apr 23). Manufacturers bringing the most jobs back to America. US Official News.

Shiralkar, K., Bongale, A., Kumar, S., Kotecha, K., & Prakash, C. (2021). Assessment of the benefits of information and communication technologies (ICT) adoption on downstream supply chain performance of the retail industry. Logistics, 5(4), 80.

Singh, P. K., Nandi, S., Ghafoor, K. Z., Ghosh, U., & Rawat, D. B. (2020). Preventing COVID-19 spread using information and communication technology. IEEE Consumer Electronics Magazine, 10(4), 18–27.

Soni, V. D. (2020). Information technologies: Shaping the World under the pandemic COVID-19. Journal of Engineering Sciences, 11(6).

Spieske, A., & Birkel, H. (2021). Improving supply chain resilience through industry 4.0: A systematic literature review under the impressions of the COVID-19 pandemic. Computers & Industrial Engineering, 158, 107452.

Travkina, E., & Sacco, P. L. (2020). Culture shock: COVID-19 and the cultural and creative sectors. (OECD Policy Responses to Coronavirus (COVID-19).

Warman, C., & Chernoff, A. W. (2020). COVID-19 and Implications for Automation. Cambridge, Mass: National Bureau of Economic Research.

WEF. (2016). The Future of Jobs: Employment, Skills and Workforce Strategy for the Fourth Industrial Revolution. Geneva: World Economic Forum.

Wendt, C., Adam, M., Benlian, A.,& Kraus, S. (2021). Let’s connect to keep the distance: How SMEs leverage information and communication technologies to address the COVID-19 crisis. Information Systems Frontiers, 24, 1061-1079.

Wicaksono, T. Y., & Simangunsong, A. (2022). Digital Technology Adoption and Indonesia’s MSMEs during the COVID-19 Pandemic. Economic Research Institute for ASEAN and East Asia.

Wooldridge, J. M. (2006). Introductory Econometrics: A Modern Approach. New York: Thomson.

Zhang, Z. (2016). Model building strategy for logistic regression: purposeful selection. Annals of Translational Medicine, 4(6).

Zutshi, A., Mendy, J., Sharma, G. D., Thomas, A., & Sarker, T. (2021). From challenges to creativity: Enhancing SMEs’ resilience in the context of COVID-19. Sustainability, 13(12), 6542.