Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2023, vol. 14, no. 1(27), pp. 194–213 DOI: https://doi.org/10.15388/omee.2023.14.88

COVID-19 Vaccination and Fear Indices Impacting the Price of Healthcare Stock Indices in Southeast Asia during

the Vaccination Rollout

Matthew Jeremiah

Finance Program, Accounting Department, School of Accounting, Bina Nusantara University, Indonesia

https://orcid.org/0000-0001-7315-1369

matthew.jeremiah@binus.ac.id

Andreas Setiadi

Finance Program, Accounting Department, School of Accounting, Bina Nusantara University, Indonesia

https://orcid.org/0000-0001-6026-2692

andreas.setiadi@binus.ac.id

Shinta Amalina Hazrati Havidz (corresponding author)

Finance Program, Accounting Department, School of Accounting, Bina Nusantara University, Indonesia

https://orcid.org/0000-0001-9837-7233

shinta.h@binus.edu

Abstract. This research aims to investigate the impact of COVID-19 vaccinations and fear indices on healthcare stock index prices in Southeast Asia during the vaccination rollout. The authors analyzed four Southeast Asian countries (i. e., Indonesia, Malaysia, Singapore, and Thailand) during the period of vaccination rollout by using daily weekday data from 1 March to 19 November 2021, with a total of 760 observations. The authors utilized Feasible Generalized Least Squares (FGLS) for the main methodology and incorporated Generalized Method of Moments (GMM) as the robustness check. The authors discovered three findings, including: (1) Increased number of people exploring news around vaccine doses created positive sentiments, while vaccine hesitancy revealed the opposite result; (2) Healthcare stock was found to be a defensive sector during the later period of the COVID-19 pandemic; (3) Many new investors arose during the pandemic, and it led to herding behavior thus, the investors’ decision-making was based on sentiment. It concludes that vaccine dose and hesitancy news can be utilized to manage investors’ portfolio investment in the healthcare sector. The government should disseminate more about the COVID-19 vaccination to citizens to prevent vaccine hesitancy. Investors could consider including healthcare stock in their portfolios to minimize risk during a pandemic. Citizens’ wise usage of social media and cooperation are needed to end the pandemic.

Keywords: COVID-19, COVID-19 fear, healthcare stock, sentiments, Southeast Asia, vaccines

Received: 17/5/2022. Accepted: 17/2/2023

Copyright © 2023 Matthew Jeremiah, Andreas Setiadi, Shinta Amalina Hazrati Havidz. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

The unexpected revelation of COVID-19 created an effect on the world’s economy (Pradhan et al., 2021, 2022; Sangwan et al., 2021; Tisdell, 2020; Tran et al., 2020) and hence declined the valuation of the stock market (Vo & Mazur, 2021). The ripple effect on the stock market caused an unexpected change in prices with an unprecedented level of risk (Zhang et al., 2020). According to the World Global Organization, global trade could decline by 32% due to the pandemic, affecting investor sentiments that cause stock market prices to change unprecedentedly (He et al., 2020). The COVID-19 impact varied across the industrial sector in the stock market, and finance researchers held a strong interest in this topic (Atems amp; Yimga, 2021; Höhler & Lansink, 2021; Mazur et al., 2020a; Sreenu & Pradhan, 2022). Evidence from the S&P 500 stocks showed that crude petroleum, real estate, and entertainment lost over 60% of their market value. However, the healthcare sector showed a positive trend among other sectors with a 20% monthly positive return (Mazur, 2021; Yacob & Abdullah, 2021).

Healthcare stocks remained one of the most resilient sectors in the crisis (He et al., 2020). The COVID-19 pandemic has been said to benefit the healthcare sector. The demand for medical devices, telehealth, face masks, and the awaited vaccines may have indicated that healthcare company would be more profitable during this outbreak, and it stimulated investor sentiments to invest in healthcare stocks, causing the sector to perform better (Höhler & Lansink, 2021; Nicola et al., 2020; Yacob & Abdullah, 2021). Evidence in the US healthcare industry shows the policy made by the government to postpone medical care for patients and focus on COVID-19 patients in 2020 (Bryan et al., 2021). It resulted in the US healthcare stocks performing a positive trend during the pandemic as the S&P 500 healthcare stock index price gained 16.1% in the following year (Levisohn, 2021). Encouragingly, the deficiencies exposed by COVID-19 prompted healthcare organizations around the world to invent new essential care for patients, increasing the healthcare investing trends. Strategies such as telemedicine have quickly taken hold of global healthcare facilities (Kaye et al., 2021).

Vaccination is one of the most crucial factors that boosted healthcare investing during the pandemic. The total number of vaccinated people brought less volatility to the stock market price (Rouatbi et al., 2021). The vaccine announcement raised Pfizer’s share prices by 15% in the first few hours (Campbell & Turner, 2020). The Google search engine, and specifically Google Trends, attracted public attention to grasp the news immediately. It is powerful for explaining and forecasting the finance and economics fields (Costola et al., 2021). The keyword ‘vaccine’ on Google Trends was determined to have a higher investment impact on healthcare stocks before the vaccination rollout (Lee, 2020). Media news related to vaccinations was found to impact healthcare stock prices and volume traded (Alifah & Yunita, 2021; Vierlboeck & Nilchiani, 2021).

As the vaccinations began, positive sentiments such as vaccine dose have been discussed to be effective to keep people immunized from the various evolutions of COVID-19 (Plante et al., 2021). Hence, we used ‘vaccine dose’ as the new keyword to provide a different perspective and stress on the dose, instead of merely the vaccine. Recent research by Havidz et al. (2022) constructed a vaccine confidence index against COVID-19 relying on the primary vaccination series (Dose 1 and Dose 2). The results revealed that the vaccine confidence index (VCI) pushed economic recovery and increased demand for the Bitcoin market. Meanwhile, it also created controversies that led to vaccine hesitancy discussion in the media. It caused serious problems due to the negative sentiment toward the vaccination program (Sekizawa et al., 2022).

Prior works did not explore the vaccination news (i. e., vaccine dose and hesitancy) and further findings on its impact on the healthcare stocks. Therefore, we addressed the research gap. Along with vaccination factors, COVID-19 fear indices (Global Fear, Panic, and Sentiment Indices) were also considered. Vaccination reduced the fear of COVID-19, thus changing peoples’ behavior and stock market reaction (Karayürek et al., 2021; Rouatbi et al., 2021).

We focused on the Southeast Asian Healthcare stock indices because it was the region most connected to the internet in 2021 (Neo, 2021). Southeast Asian countries spend their time (6 h 54 m) on the internet, exceeding the global average. This behavior allowed people to easily access the news related to the COVID-19 pandemic, especially news around COVID-19 vaccinations. Notably, it affected investors’ investment decision-making. The region also took care of health issues by spending 4% of its GDP on the healthcare sector during the pandemic (Medina, 2020). It ensures self-sustaining economic growth as the public health issue is well-guarded (Fauzi & Paiman, 2020). Therefore, it presents safe growth in Southeast Asia for stable development and boosts investment in the healthcare sector of the region.

Furthermore, Southeast Asia was one the most affected regions due to the COVID-19 outbreak, and therefore the stock markets quickly declined (Al-Qudah & Houcine, 2022). The stock markets of Southeast Asia experienced a significant liberalization in the 1980s (Ng, 2002) that contributed to the substantial growth of stock markets in the region (Wu, 2020). Therefore, it is important for investors to have a better understanding about stock markets in Southeast Asia to incorporate them in their investment portfolio and to reduce risk and increase return (Narayan et al., 2014), especially during economic downturns.

Based on the circumstances above, our research contributes several points: (1) It provides a new perspective by using ‘vaccine dose’ in Google Trends to stress its dose and incorporates vaccine hesitancy to explain doubts about the vaccine; (2) The sample focuses on Southeast Asian countries for several reasons: their citizens spend an above average time on the internet and have the healthcare stock indices, they were the most affected region due to COVID-19 and had a substantial growth of stock markets because of their liberalization.

This paper is put together as follows: a description of the underlying literature and hypotheses of this research are established in Section 2; the research data and methodology are explained in Section 3; the results and discussion are highlighted in Section 4; the conclusion and policy suggestions are illustrated in Section 5; lastly, recommendations for future research are presented in Section 6.

2. Literature Review

Theoretically, a financial crisis makes investors cautious, which leads them to be risk-averse and search for safe-haven assets to be included in their portfolios (Coudert & Gex, 2008). Public information and news of an event related to the crisis helps investors’ decision-making to minimize risk and maximize profit in their portfolios (Graham, 1999; Yu et al., 2014). The news created a sentiment which caused investors to overreact or underreact to decide their investment decision (Barberis et al., 1998). However, due to similarity of information obtained during financial crises, herding behavior occurs in the stock market (Bikhchandani ; Sharma, 2000). Under certain circumstances, a portfolio manager or independent investor mimics the investment decisions of other managers. It could be rational for them to mimic others’ decisions so they can maintain their reputation and maximize profit during a hard time like a financial crisis (Scharfstein & Stein, 1990). The theory above shows that investors will behave the same during the financial crisis caused by the COVID-19 pandemic. News and sentiments about COVID-19 vaccination and fear will affect healthcare investors’ decision-making. It will also cause herding behavior in the stock market due to the similarity of COVID-19 public information.

2.1 Healthcare Stock Indices Price (HCSI)

A pandemic causes an economic shock through rising unemployment affecting lower consumption (Lin & Meissner, 2020). COVID-19 and past infectious diseases have both been shown to negatively affect the stock market (Liu et al., 2020; Mittal & Sharma, 2021). In mitigating the spread of COVID-19, a series of lockdowns was enforced to place public health as a priority. A movement control order (MCO) in Malaysia was set up, while at the same time, a package of economic stimulus representing 17% of GDP was distributed to support it (Aziz et al., 2020). With COVID-19 rising in daily cases and lockdown enforcement, it pushed public fear and panic; hence the healthcare sectors were bound to benefit due to the high demand for medical products (He et al., 2020). The healthcare stock indices were found to have lower volatility, which caused a positive impact on stock prices. (Lee, 2020; Narayan et al., 2022; Yacob & Abdullah, 2021). A study in Indonesia during the announcement of the vaccine trial showed a significant increase in volume traded in healthcare stock indices (Alifah & Yunita, 2021). To have a more detailed overview of each relationship, we will discuss it further in the next subchapter.

2.2 Vaccination Indicators

2.2.1 Vaccine Dose Trend (VDT). Vaccine dose trend utilizes Google Trends frequency of search terms related to vaccine doses on a 0-100 scale. A study on the US stock market before the vaccination rollout utilized Google Trends big data search terms of ‘Vaccine’ as a COVID-19 sentiment measurement, and it showed a positive return for healthcare sectors (Lee, 2020). During the vaccination rollout, multiple vaccine doses had been observed to be effective in preventing severe COVID-19 and keeping people immunized from the various kinds of COVID-19 (Barda et al., 2021; Glatman-Freedman et al., 2021; Plante et al., 2021). A study estimated that a higher weekly GDP forecast would be obtained if a policy on vaccine doses was implemented (Oliu-Barton et al., 2022). Based on the studies above, we propose the hypothesis as follows:

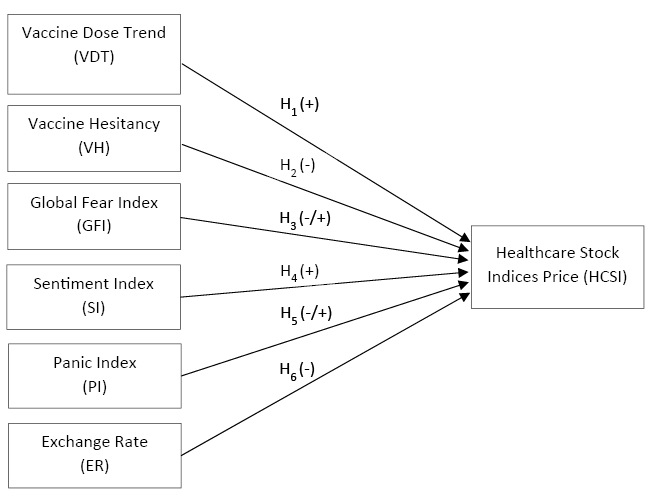

H1: Vaccine Dose Trend (VDT) positively affects the price of healthcare stock indices in Southeast Asia.

2.2.2 Vaccine Hesitancy (VH). Vaccine hesitancy is an act of refusal to get vaccinated (Sallam, 2021). It is measured on a scale between 0 and 100. Prior studies on COVID-19 vaccination concluded that healthcare workers were the priority group (Noh et al., 2021). Given the nature of the profession, the public would assume there would be no hesitancy in getting vaccinated. On the contrary, a study found that 22.51% of healthcare workers who were supposed to be advocating vaccination still hesitated about getting vaccinated due to COVID-19 vaccine safety and efficacy (Biswas et al., 2021). This led to unsuccessful public immunity, hence forcing the government to implement a strict lockdown policy, such as international flights being suspended along with non-essential public venues and businesses. It reduced mobility and consumption, consequently delaying economic recovery, which led to lower investment (Lin & Meissner, 2020; Roshchina et al., 2021). It made investment opportunities less attractive and reduced demand for investment in the stock market. Therefore, we propose the hypothesis as follows:

H2: Vaccine Hesitancy (VH) negatively affects the price of healthcare stock indices in Southeast Asia.

2.3 COVID-19 Fear Indices

2.3.1 Global Fear Index (GFI). Salisu and Akanni (2020) constructed a Global Fear Index (GFI) based on the COVID-19 reported cases index, deaths index, and the interval days. The GFI model is given a scale of 0 to 100, where the level of fear increases toward 100. Further, they found the impact of GFI on the stock market and revealed a negative correlation. Subramaniam and Chakraborty (2021) extended the Salisu and Akanni (2020) model and constructed their version using the index of Google search volume. Indeed, the results confirmed that GFI was negatively impacting the stock market. The Global Fear Index also caused volatility to rise and reacted sensitively toward IPO firms compared with existing firms thus negatively affecting stock prices (Li et al., 2021; Mazumder & Saha, 2021). However, the negative effect of the GFI on the stock market was found to be only significant during the initial days of COVID-19 and the second wave breakout (Rubbaniy et al., 2020). Prior research focused on the primary stock indices, while we focus on healthcare stock indices, which were found to be a defensive sector during the COVID-19 pandemic (He et al., 2020; Yacob & Abdullah, 2021). Therefore, there is a high possibility of investors investing in healthcare stocks because it benefits healthcare companies as they may achieve larger profitability. Practically, healthcare stocks have a similar function with the commodity sector during the pandemic in that the rise of COVID-19 fear increases commodity returns (Salisu et al., 2020). Based on the prior literature, we propose the hypothesis as follows:

H3: The Global Fear Index (GFI) negatively/positively affects the price of healthcare stock indices in Southeast Asia.

2.3.2 Sentiment Index (SI). Sentiment Index measures the level of sentiment that refers to COVID-19 across the media. It is valued from 0 (most negative) to 100 (most positive). The media plays a key role in transmitting information. It influences the market as it drives emotions and affects decision-making (Lazzini et al., 2022). During the initial days of COVID-19, the Sentiment Index was correlated with increasing volatility (Baig et al., 2021; Haroon & Rizvi, 2020). However, the volatility declined over time, indicating people were getting used to COVID-19. Thereafter, the values moved towards positive numbers eventually (Buigut & Kapar, 2021). The positive sentiment positively affected stock prices (Tan, 2021). Therefore, we propose the hypothesis as follows:

H4: The Sentiment Index (SI) positively affects the price of healthcare stock indices in Southeast Asia.

2.3.3 Panic Index (PI). Panic Index measures the level of news chatter that refers to panic and COVID-19. It is valued between 0 and 100; the higher value means more references to panic are found in the media. The Panic Index was found to be positively correlated with the world index volatility, and it negatively affected stock prices (Haroon & Rizvi, 2020; Wang et al., 2019). A study on media coverage using the Panic Index as its proxy found that it negatively affected stock prices (Haldar & Sethi, 2021). It was also found that the Panic Index increased the market risk premium as investors demanded to pay less for stock, hence negatively affecting stock prices (Aggarwal et al., 2021). In fact, when the Panic Index rose, it increased fear and pessimism; thus, the investors tended to take less risks by adjusting their investment portfolio to a defensive sector, namely healthcare stocks (He et al., 2020; Yacob & Abdullah, 2021). Based on the prior literature, we propose the hypothesis as follows:

H5: The Panic Index (PI) negatively/positively affects the price of healthcare stock indices in Southeast Asia.

2.4 Exchange Rate (ER)

Exchange rates are used as macroeconomic variables and act as the controlling variable. The exchange rate has a negative and insignificant correlation when the local currency is depreciated (Goh et al., 2021). Evidence from Indonesia, Malaysia, Singapore, Thailand, and several other Asian countries also showed a negative correlation with the stock market (Erdoğan et al., 2020; Mishra & Mishra, 2020; Syahri & Robiyanto, 2020). A study conducted on two Vietnam stock indices also exhibited negative effects on stock prices (Nguyen et al., 2020). Therefore, we propose the hypothesis as follows:

H6: Exchange Rate (ER) negatively affects the price of healthcare stock indices in Southeast Asia.

Figure 1

Conceptual Framework

3. Research Data and Methodology

3.1 Data and Sources

Focusing on the Southeast Asian countries which are categorized as the most internet-connected regions in 2021, we selected four countries that also have healthcare stock indices, namely Indonesia (IDX Health), Malaysia (KL Health), Singapore (SGX All Healthcare Index), and Thailand (SET Health). We covered the period during the vaccination rollout by using daily weekday data from 1 March 2021 to 19 November 2021, with a total of 760 observations. To have a balanced data observation, the starting date was based on Thailand as the latest country that began its vaccination rollout. We proposed seven indicators in this paper: one dependent variable (i. e., HCSI), five independent variables (i. e., VDT, VH, GFI, SI, and PI), and one control variable (i. e., ER). The variables used the data from each country, except for VH, which used the worldwide data. The descriptive statistics and data sources are shown in Table 1.

Table 1

Descriptive Statistic and Data Sources

|

Variable |

Mean |

Std. Dev. |

Min |

Max |

Obs |

Kurtosis |

Skewness |

|

HCSI |

3,005.00 |

1,503.83 |

1,238.40 |

5,904.44 |

760 |

2.12 |

0.69 |

|

Vaccination Indicators |

|||||||

|

VDT |

25.46 |

18.38 |

0.00 |

100.00 |

760 |

4.91 |

1.24 |

|

VH |

8.15 |

3.80 |

1.50 |

66.75 |

760 |

1.91 |

0.15 |

|

COVID-19 Fear Indices |

|||||||

|

GFI |

46.97 |

15.83 |

0.00 |

100.00 |

760 |

3.15 |

0.62 |

|

SI |

-12.18 |

15.03 |

-64.67 |

26.72 |

760 |

3.49 |

-0.61 |

|

PI |

4.08 |

5.31 |

0.22 |

43.65 |

760 |

16.21 |

3.26 |

|

Control Variable |

|||||||

|

ER |

3,595.92 |

6,210.96 |

1.32 |

14,600.00 |

760 |

2.33 |

1.15 |

|

JB-value |

116.4 |

||||||

|

Chi2 |

5.30E-26 |

||||||

Note. Data were obtained from investing.com for HCSI of Indonesia and Malaysia and the exchange rate; tradingview.com for HCSI of Thailand; SGX.com for HCSI of Singapore. VDT was collected from Google Trends. VH, SI, PI were obtained from ravenpack.com. GFI was collected from ourworldindata.org.

All variables unraveled positive means value, except SI, indicating that there is more negative news on average, which leads to negative sentiments due to COVID-19. The values of standard deviations imply that the observations have no big deviations from the mean values. Most of the variables showed positive value of skewness, except SI, which indicates positively skewed distribution. It implies a long tail towards the right compared with the normal distribution. Some variables (i. e., VDT, GFI, PI, and SI) are considered leptokurtic because the kurtosis value is above 3. It indicates a fat-tailed distribution and susceptibility because of COVID-19 pandemic situation as its extreme events. Meanwhile, the remaining variables (i. e., HCSI, VH, and ER) implied as platykurtic as the kurtosis value is below 3, which means a thin-tailed distribution, indicating fewer outliers’ distribution than does a normal distribution. The results are strengthened by the Jarque-Bera test that implies non-normality distribution. However, this is not an issue for large sample sizes (n is 100 or more). Normality assumption can be dropped by referring to the central limit theorem (Gujarati, 2004; DeFusco et al., 2015; Wooldridge, 2018).

3.2 Cross-Sectional Dependence Test

A cross-sectional dependence test helped the panel-data model in identifying cross-sectional dependence among cross-section units (De Hoyos & Sarafidis, 2006). A test of cross-sectional dependence on the model of large N panels has been considered in Pesaran (2004), Friedman (1937), and Frees (1995).

3.3 Unit Root Test

We examined the data stationarity using Fisher-Type Augmented Dicky Fuller (ADF) unit root tests because our data contains gaps (i. e., data for Saturday and Sunday are not available in the stock market). The Fisher-type test does not require a balanced datasheet and allows for gaps in the individual series (Choi, 2001; Nsiah & Fayissa, 2013). Therefore, the ADF unit root test is the most suitable compared with other unit root tests.

3.4 Feasible Generalized Least Squares (FGLS) Model

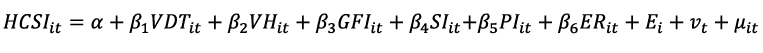

The next step was to investigate the relation between the explanatory variable and the explained variable. We found that our research model suffers from heteroskedasticity problems. The Breusch-Pagan/Cook-Weisberg test showed Prob > chi2 = 0.0000, indicating a heteroskedasticity problem (Breusch & Pagan, 1979). To solve the problem, we chose the FGLS model to explain our research results. The FGLS model was found to be more efficient than the OLS model in the presence of heteroskedasticity problems (Bai et al., 2020). The Breusch-Pagan/Cook-Weisberg test showed Prob > chi2 = 0.0000, indicating a heteroskedasticity problem (Breusch & Pagan, 1979). To solve the problem, we chose the FGLS model to explain our research results. The FGLS model is more efficient than the OLS model in the presence of heteroskedasticity problems (Bai et al., 2020). It could reduce potential bias when heteroskedasticity problems are detected by the Breusch-Pagan test (Lee et al., 2016). Furthermore, FGLS is more attractive than OLS when the sample size is large (Wooldridge, 2018). The model equation can be written as:

where i determines the cross-sectional data between four countries (Indonesia, Malaysia, Singapore, and Thailand); t indicates the 5-day daily data from our data collection period (1 March 2021 to 19 November 2021); α denotes the constant value; β in each independent variable is its coefficient; Ei represents individual specific error component in the model; νt denotes time specific error term of the model, and μit is the overall error term of the model. HCSI is the healthcare stock indices; VDT denotes vaccine dose trend; VH represents vaccine hesitancy; GFI is the Global Fear Index; SI denotes Sentiment Index; PI is the Panic Index; and ER represents the exchange rate.

3.5 Generalized Method of Moments (GMM) Model for Robustness Analysis

The difference GMM introduced by Arellano and Bond (1991) was implemented to test the robustness of our research results. We used the robust option in our diff-GMM model. Utilizing GMM as a robustness check was also done (Aiello; Cardamone, 2005; Havidz et al., 2021, 2022; Vo et al., 2022). The model relies on minimal assumptions and provides precise, consistent estimates even in panels with few time-series observations per individual model (Moral-Benito et al., 2019; Wooldridge, 2001). Bias from dynamic panel can also be avoided and overcome the concerns of crucial modelling (Abdeljawad et al., 2013).

4. Results and Discussion

4.1 Cross-Sectional Dependence Test Results

The results from Table 2 show that our model has sufficient evidence to reject the null hypothesis of cross-sectional independence. With this result, our model can proceed to the unit root test.

Table 2

Cross Sectional Dependence Test Result

|

Tests |

Pesaran |

Frees |

Friedman |

|

Pr |

0.00 |

0.00 |

0.00 |

|

H0= Cross Sectional Independece |

|||

4.2 Unit Root Test Results

The Fisher-type ADF provides four different unit root test results. We used the inverse normal Z statistic results as the method offers the best trade-off between size and power (Choi, 2001). Without and with trend components were applied to see if our model stationarity results were consistent when using different components. The results show that all variables have no stationary problem at level in both components. The unit root test result can be seen in Table 3.

Table 3

Fisher-Type ADF Test Results Without Trend and with Trend

|

Without trend |

Trend |

||

|

Variable |

Z Statistic (0) |

Variable |

Z Statistic (0) |

|

HCSI |

-1.8874** |

HCSI |

-1.7210** |

|

VDT |

-11.8930*** |

VDT |

-10.2441*** |

|

VH |

-7.7388*** |

VH |

-6.2229*** |

|

GFI |

-10.6305*** |

GFI |

-9.4802*** |

|

SI |

-5.5603*** |

SI |

-1.9561** |

|

PI |

-15.6188*** |

PI |

-15.0627*** |

|

ER |

-3.0062*** |

ER |

-8.1250*** |

Note. ***,**,* significant at 1%, 5%, and 10%, respectively.

4.3 FGLS and Diff-GMM Results

Table 4 shows the results of the FGLS and diff-GMM. The P-values of the FGLS results show that all the explanatory variables are significant at a 1% significance level except for vaccine hesitancy. Vaccine dose trend, global fear index, sentiment index, and panic index revealed positive effects, while vaccine hesitancy and exchange rate showed the opposite results. Therefore, the supported hypotheses are H1, H3, H4, H5, and H6, while H2 was not supported. Consistent directions were also documented from our diff-GMM results, in which all variables have the same direction with FGLS. Only sentiment index showed as insignificant on the diff-GMM results. Overall, our estimations proved to be robust over different regression models.

Table 4

FGLS and Diff-GMM Results

|

Dep Var |

HCSI |

|

|

Model |

FGLS |

Diff-GMM |

|

VDT |

9.322*** |

5.077*** |

|

(2.406) |

(1.899) |

|

|

VH |

-15.473 |

-5.385 |

|

(11.599) |

(13.052) |

|

|

GFI |

16.251*** |

10.112** |

|

(2.709) |

(4.065) |

|

|

SI |

8.562*** |

5.711 |

|

(2.850) |

(5.851) |

|

|

PI |

31.416*** |

14.185* |

|

(7.659) |

(7.990) |

|

|

ER |

-0.157*** |

-0.156*** |

|

(0.007) |

(0.051) |

|

|

Cons |

2,669.723*** |

3,016.784*** |

|

(157.967) |

(478.987) |

|

|

No of obs. |

760 |

760 |

|

No of Groups |

4 |

4 |

|

Wald Chi2 |

639.1 |

95.05 |

|

Prob > Chi2 |

0.000 |

0 |

|

AR(1) |

|

0.167 |

|

AR(2) |

|

0.921 |

Note. *** p<.01, ** p<.05, * p<.1; robust standard errors are in parentheses, and hence the Sargan test is not available after specifying the robust option; p-values of AR(1) and AR(2) were also disclosed, and it revealed no serial correlation on the first and second order.

4.4 Discussion

The commencement of the vaccination rollout by the government stimulated people in Southeast Asia to explore news about vaccine doses. Southeast Asia being the most internet-connected region, news around COVID-19 vaccination could easily be accessed by most Southeast Asian citizens. The news informed people about the effectiveness of vaccine doses to immunize people from being infected and which healthcare companies were involved with the vaccination program. It led people to anticipate the vaccination program and created positive sentiment among the healthcare companies. It attracted investors to invest in healthcare stocks and boosted the healthcare investment trend in Southeast Asia. In line with prior work which utilized a Google search engine using ‘vaccine’ as the keyword (Lee, 2020), the novelty of ‘vaccine dose’ as a new keyword also revealed a positive effect on the price of healthcare stock indices.

The rush of the COVID-19 vaccine development made people doubt its efficacy and effectiveness to immunize people (Khuroo et al., 2020). It led people to express their hesitance to be vaccinated through social media, linked with fake news and disinformation (Puri et al., 2020). The increase in vaccine hesitancy-related topics in the media made people disbelieve the government and healthcare industries, which caused an unsuccessful vaccination program. However, about 81% of Southeast Asian people still believe in the vaccines effectiveness to prevent COVID-19 infection despite a proliferation of fake news in the media (Rillera Marzo et al., 2022). This explains the insignificant effect of vaccine hesitancy toward the price of healthcare stock indices.

The pandemic created dependency on healthcare products. The policy created by the government required people to use face masks and diagnostic tests to prevent the spread. The increase in global fear index led to a high demand for COVID-19 recovery supplies such as oxygen tubes, medicine, and vitamins. It all benefited the healthcare companies’ profitability and made investors interested in including healthcare stocks in their portfolios to minimize risk during the pandemic panic. The rise of panic due to the fear of a COVID-19 stock market crash (Mazur et al., 2020a; Mazur et al., 2020b) directed investors to find a better option for their investment portfolio. Our results are in line with prior work, which suggested the healthcare sector remained a defensive sector during the pandemic (He et al., 2020; Yacob & Abdullah, 2021). Hence, healthcare stocks have a function similar to commodity sectors during the pandemic (Salisu et al., 2020).

Due to boredom during the lockdown period, the pandemic created countless new retail investors in the Southeast Asia stock market (Retail frenzy to drive stocks gains in South-east Asia: UBS, 2020). New inexperienced investors tended to perform herding behavior in the stock market (Bikhchandani & Sharma, 2000). Their emotions and investment decision-making were easily affected by news in the media. Along with Southeast Asian people’s high usage of the internet, it easily attracted new investors in Southeast Asia through information obtained from the internet. Positive COVID-19 sentiment such as vaccine doses caused new investors to be more optimistic to invest in healthcare stocks. It caused a high price change and a reversal in healthcare stocks. Due to high abnormal change, it triggered high volatility in the stock market. Our findings support prior research that utilized sentiment index as their explanatory variable (Baig et al., 2021; Haroon & Rizvi, 2020; Tan, 2021).

As most Southeast Asian healthcare firms were still heavily dependent on the import of medicine raw materials (Angelino et al., 2017), the strengthening of foreign exchange currencies affected the firms’ profitability margin, as the cost of imported materials increased. The decrease in the firms’ profitability margin was negatively reflected in the stock market. This finding was in accordance with prior studies (Erdoğan et al., 2020; Goh et al., 2021; Mishra & Mishra, 2020; Nguyen et al., 2020).

5. Conclusion and Policy Suggestions

Our research provided insight into the literature by exploring the impact of COVID-19 vaccinations and fear indices on healthcare stock indices. The variables we proposed relied on the news sentiment spread over the media. During the early days of the pandemic, Southeast Asian media was filled with negative sentiment about COVID-19, which caused a stock sell-off (Singh et al., 2020). On the other hand, news about vaccination was a common sight during the vaccination rollout. It provided a positive sentiment for the industry that boosted healthcare stock performance. This indicates that Southeast Asian investors’ decision-making heavily depends on news in the media along with their high usage of the internet.

Positive vaccination sentiment led investors to optimistically buy healthcare stocks; however, negative vaccination sentiment made them panic and sell healthcare stocks. This suggests that Southeast Asian healthcare investors have a biased opinion and herding behavior towards vaccination sentiment. We also emphasize that healthcare stock has the same characteristics and reactions as commodities to the COVID-19 fear indices (Salisu et al., 2020). Thus, it can be considered a safe-haven asset. It implies to investors that they should consider including healthcare stocks in their portfolios as a diversification to minimize risk when the COVID-19 pandemic worsens, or a similar pandemic occurs. In addition, vaccination news can be utilized to help investors manage their portfolio investment in the healthcare sector.

We go into detail on Southeast Asian governments and healthcare industries to encourage their cooperation in decreasing their dependency on imported materials and start looking for local alternative materials. It makes the region’s healthcare sector more resilient to an unexpected global economic crisis. We also pointed out that government participation in disseminating the COVID-19 vaccine was essential due to the lack of public knowledge. Ensuring quality and trusted information sources in this digital age was needed to build trust in the COVID-19 vaccine among the public. The government, healthcare, and media companies must collaborate to eradicate the widespread fake news that led to vaccine hesitancy and could cause another crisis. Besides government interventions, citizens’ wise usage of the internet to not transmit fake news and cooperation on vaccine mandate policies were key roles to end the pandemic.

6. Recommendation for Future Research

Based on our limitations in this study, we suggest several recommendations for future research: (1) adding another dependent variable as an extension from this study, such as other sub-sectors from the stock market and different asset classes; (2) utilizing other independent variables, such as economic policy uncertainty, Twitter economic uncertainty, and EMVID; (3) exploring the correlation by using a different time frame (i. e., another pandemic, war) to check whether the results are consistent, (4) extending the sample-base outside the Southeast Asia region to provide more understanding of the market responses globally during this phenomenon.

References

Abdeljawad, I., Nor, F. M., Ibrahim, I., & Abdul, R. (2013). Dynamic Capital Structure Trade-off Theory : Evidence from Malaysia. Proceedings of 3rd Global Accounting, Finance and Economics Conference 5-7 May, 9(6), 1–10.

Aggarwal, S., Nawn, S., & Dugar, A. (2021). What caused global stock market meltdown during the COVID pandemic–Lockdown stringency or investor panic? Finance Research Letters, 38, 101827. https://doi.org/10.1016/j.frl.2020.101827

Aiello, F., & Cardamone, P. (2005). R&D spillovers and productivity growth: Evidence from Italian manufacturing microdata. Applied Economics Letters, 12(10), 625–631. https://doi.org/10.1080/13504850500119112

Al-Qudah, A. A., & Houcine, A. (2022). Stock markets’ reaction to COVID-19: Evidence from the six WHO regions. Journal of Economic Studies, 49(2), 274–289.

Alifah, F. N., & Yunita, I. (2021). Capital Market Reaction to The Announcement of COVID-19 Vaccine Clinical Test by PT. Bio Farma Indonesia: Case Study of Pharmaceutical Sub-Sector Listed on The IDX 2020. International Journal of Advanced Research in Economics and Finance, 3(1), 2021.

Angelino, A., Khanh, D. T., Ha, N., & Pham, T. (2017). Pharmaceutical Industry in Vietnam: Sluggish Sector in a Growing Market. International Journal of Environmental Research and Public Health, 14(9), 976. https://doi.org/10.3390/IJERPH14090976

Arellano, M., & Bond, S. (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Review of Economic Studies, 58(2), 277–297. https://doi.org/10.2307/2297968

Atems, B., & Yimga, J. (2021). Quantifying the impact of the COVID-19 pandemic on US airline stock prices. Journal of Air Transport Management, 97(102141), 1–18.

Aziz, N. A., Othman, J., Lugova, H., & Suleiman, A. (2020). Malaysia’s approach in handling COVID-19 onslaught: Report on the Movement Control Order (MCO) and targeted screening to reduce community infection rate and impact on public health and economy. Journal of Infection and Public Health, 13(12), 1823–1829. https://doi.org/10.1016/j.jiph.2020.08.007

Bai, J., Choi, S. H., & Liao, Y. (2020). Feasible generalized least squares for panel data with cross-sectional and serial correlations. Empirical Economics, 60, 309–326. https://doi.org/10.1007/s00181-020-01977-2

Baig, A. S., Butt, H. A., Haroon, O., & Rizvi, S. A. R. (2020). Deaths, panic, lockdowns and US equity markets: The case of COVID-19 pandemic. Finance Research Letters, 38, 101701. https://doi.org/10.1016/j.frl.2020.101701

Barberis, N., Shleifer, A., & Vishny, R. (1998). A model of investor sentiment. Journal of Financial Economics, 49(3), 307–343. https://doi.org/10.1016/s0304-405x(98)00027-0

Barda, N., Dagan, N., Cohen, C., Hernán, M. A., Lipsitch, M., Kohane, I. S., Reis, B. Y., & Balicer, R. D. (2021). Effectiveness of a third dose of the BNT162b2 mRNA COVID-19 vaccine for preventing severe outcomes in Israel: An observational study. The Lancet, 398(10316), 2093–2100. https://doi.org/10.1016/S0140-6736(21)02249-2

Bikhchandani, S., & Sharma, S. (2000). Herd Behavior in Financial Markets. IMF Staff Papers, 47(3), 279–310.

Biswas, N., Mustapha, T., Khubchandani, J., & Price, J. H. (2021). The Nature and Extent of COVID-19 Vaccination Hesitancy in Healthcare Workers. Journal of Community Health, 46(6), 1244–1251. https://doi.org/10.1007/S10900-021-00984-3/TABLES/1

Breusch, T. S., & Pagan, A. R. (1979). A Simple Test for Heteroscedasticity and Random Coefficient Variation. Econometrica, 47(5), 1287–1294. https://doi.org/https://doi.org/10.2307/1911963

Bryan, A. F., Tsai, T. C. (2021). Health Insurance Profitability During the COVID-19 Pandemic. Annals of Surgery, 273(3), e88–e90. https://doi.org/10.1097/SLA.0000000000004696

Buigut, S., & Kapar, B. (2021). Covid-19 Cases, Media Attention and Social Mood. International Journal of Economics and Financial Issues, 11(4), 66–72. https://doi.org/10.32479/ijefi.11591

Campbell, G., & Turner, J. (2020, Nov 13). How has the news of a vaccine affected world stock markets? Economics Observatory. https://www.economicsobservatory.com/data-vaccine-and-stock-market

Choi, I. (2001). Unit root tests for panel data. Journal of International Money and Finance, 20(2), 249–272. https://doi.org/10.1016/S0261-5606(00)00048-6

Costola, M., Iacopini, M., & Santagiustina, C. R. M. A. (2021). Google search volumes and the financial markets during the COVID-19 outbreak. Finance Research Letters, 42, 101884. https://doi.org/10.1016/j.frl.2020.101884

Coudert, V., & Gex, M. (2008). Does risk aversion drive financial crises? Testing the predictive power of empirical indicators. Journal of Empirical Finance, 15(2), 167–184. https://doi.org/10.1016/J.JEMPFIN.2007.06.001

De Hoyos, R. E., & Sarafidis, V. (2006). Testing for Cross-Sectional Dependence in Panel-Data Models. The Stata Journal, 6(4), 482–496.

DeFusco, R. A., McLeavey, D. W., Pinto, J. E., & Runkle, D. E. (2015). Quantitative Investment Analysis (4th ed.). Wiley.

Erdoğan, S., Gedikli, A., & Çevik, E. İ. (2020). Volatility spillover effects between Islamic stock markets and exchange rates: Evidence from three emerging countries. Borsa Istanbul Review, 20(4), 322–333. https://doi.org/10.1016/J.BIR.2020.04.003

Fauzi, M. A., & Paiman, N. (2020). COVID-19 pandemic in Southeast Asia: Intervention and mitigation efforts. Asian Education and Development Studies, 10(2), 176–184. https://doi.org/10.1108/AEDS-04-2020-0064

Frees, E. W. (1995). Assessing cross-sectional correlation in panel data. Journal of Econometrics, 69(2), 393–414. https://doi.org/10.1016/0304-4076(94)01658-M

Friedman, M. (1937). The Use of Ranks to Avoid the Assumption of Normality Implicit in the Analysis of Variance. Journal of the American Statistical Association, 32(200), 675–701. https://doi.org/10.1080/01621459.1937.10503522

Glatman-Freedman, A., Hershkovitz, Y., Kaufman, Z., Dichtiar, R., Keinan-Boker, L., & Bromberg, M. (2021). Effectiveness of BNT162b2 vaccine in adolescents during outbreak of SARS-CoV-2 delta variant infection, Israel, 2021. Emerging Infectious Diseases 27(11), 2919–2922). https://doi.org/10.3201/eid2711.211886

Goh, T. S., Henry, H., & Albert, A. (2021). Determinants and Prediction of the Stock Market during COVID-19: Evidence from Indonesia. Journal of Asian Finance, Economics and Business, 8(1), 1–006. https://doi.org/10.13106/jafeb.2021.vol8.no1.001

Graham, J. R. (1999). Herding among Investment Newsletters: Theory and Evidence. Journal of Finance, 54(1), 237–268. https://doi.org/10.1111/0022-1082.00103

Gujarati, D. N. (2004). Basic Econometrics (4th ed.). The McGraw-Hill.

Haldar, A., & Sethi, N. (2021). The News Effect of COVID-19 on Global Financial Market Volatility. Buletin Ekonomi Moneter Dan Perbankan, 24, 33–58. https://doi.org/10.21098/BEMP.V24I0.1464

Haroon, O., & Rizvi, S. A. R. (2020). COVID-19: Media coverage and financial markets behavior—A sectoral inquiry. Journal of Behavioral and Experimental Finance, 27, 100343. https://doi.org/10.1016/j.jbef.2020.100343

Havidz, S. A. H., Karman, V. E., & Mambea, I. Y. (2021). Is Bitcoin Price Driven by Macro-financial Factors and Liquidity? A Global Consumer Survey Empirical Study. Organizations and Markets in Emerging Economies, 12(2), 399–414. https://doi.org/10.15388/omee.2021.12.62

Havidz, S. A. H., Tiffani, T., Calvilus,. I. C., & Angelita, Z. (2022). COVID-19 full vaccination and blockchain size: Empirical evidence from the cryptocurrency market. EuroMed Journal of Business. https://doi.org/10.1108/EMJB-12-2021-0200

He, P., Sun, Y., Zhang, Y., & Li, T. (2020). COVID–19’s Impact on Stock Prices Across Different Sectors—An Event Study Based on the Chinese Stock Market. Emerging Markets Finance and Trade, 56(10), 2198–2212. https://doi.org/10.1080/1540496X.2020.1785865

Höhler, J., & Lansink, A. O. (2021). Measuring the impact of COVID-19 on stock prices and profits in the food supply chain. Agribusiness, 37(1), 171–186. https://doi.org/10.1002/agr.21678

Karayürek, F., Çebi, A. T., Gülses, A., & Ayna, M. (2021). The Impact of Covid-19 Vaccination on Anxiety Levels of Turkish Dental Professionals and Their Attitude in Clinical Care: A Cross-Sectional Study. International Journal of Environmental Research and Public Health, 18(19), 10373. https://doi.org/10.3390/ijerph181910373

Kaye, A. D., Okeagu, C. N., Pham, A. D., Silva, R. A., Hurley, J. J., Arron, B. L., Sarfraz, N., Lee, H. N., Ghali, G. E., Gamble, J. W., Liu, H., Urman, R. D., & Cornett, E. M. (2021). Economic impact of COVID-19 pandemic on healthcare facilities and systems: International perspectives. Best Practice & Research Clinical Anaesthesiology, 35(3), 293–306. https://doi.org/10.1016/J.BPA.2020.11.009

Khuroo, M. S., Khuroo, M., Khuroo, M. S., Sofi, A. A., & Khuroo, N. S. (2020). COVID-19 Vaccines: A Race Against Time in the Middle of Death and Devastation! Journal of Clinical and Experimental Hepatology, 10(6), 610–621. https://doi.org/10.1016/j.jceh.2020.06.003

Lazzini, A., Lazzini, S., Balluchi, F., & Mazza, M. (2022). Emotions, moods and hyperreality: Social media and the stock market during the first phase of COVID-19 pandemic. Accounting, Auditing and Accountability Journal, 35(1), 199–215. https://doi.org/10.1108/AAAJ-08-2020-4786

Lee, H. S. (2020). Exploring the Initial Impact of COVID-19 Sentiment on US Stock Market Using Big Data. Sustainability, 12(16), 6648. https://doi.org/10.3390/su12166648

Lee, I. H., Paik, Y., & Uygur, U. (2016). Does Gender Matter in the Export Performance of International New Ventures? Mediation Effects of Firm-specific and Country-specific Advantages. Journal of International Management, 22(4), 365–379. https://doi.org/10.1016/J.INTMAN.2016.05.004

Levisohn, B. (2021). Covid Has Boosted the Healthcare Sector. This Stock Is a Prime Example. Barrons.

Li, W., Chien, F., Kamran, H. W., Aldeehani, T. M., Sadiq, M., Nguyen, V. C., & Taghizadeh-Hesary, F. (2021). The nexus between COVID-19 fear and stock market volatility. Economic Research-Ekonomska Istrazivanja , 0(0), 1–22. https://doi.org/10.1080/1331677X.2021.1914125

Lin, Z., & Meissner, C. M. (2020). Health Vs. Wealth? Public Health Policies and the Economy During Covid-19. Journal of Chemical Information and Modeling, 53(9), 1689–1699. https://doi.org/10.3386/w27099

Liu, H., Manzoor, A., Wang, C., Zhang, L., & Manzoor, Z. (2020). The COVID-19 Outbreak and Affected Countries Stock Markets Response. International Journal of Environmental Research and Public Health, 17(8), 1–19. https://doi.org/10.3390/ijerph17082800

Mazumder, S., & Saha, P. (2021). COVID-19: Fear of pandemic and short-term IPO performance. Finance Research Letters, 43, 101977. https://doi.org/10.1016/J.FRL.2021.101977

Mazur, M., Dang, M., & Vega, M. (2020a). COVID-19 and the March 2020 stock market crash. Evidence from S&P1500. Finance Research Letters,March, 101690. https://doi.org/10.1016/j.frl.2020.101690

Mazur, M., Dang, M., & Vo, T. T. A. (2020b). Dividend Policy and the COVID-19 Crisis. SSRN Electronic Journal, 108765. https://doi.org/10.2139/ssrn.3723790

Medina, A. F. (2020). Investing in ASEAN’s Healthcare Sector: New Opportunities After COVID-19. Asian Briefing September 17.

Mishra, P. K., & Mishra, S. K. (2020). Corona Pandemic and Stock Market Behaviour: Empirical Insights from Selected Asian Countries. Millennial Asia, 11(3), 341–365. https://doi.org/10.1177/0976399620952354

Mittal, S., & Sharma, D. (2021). Impact of COVID-19 on Stock Returns of the Indian Healthcare and Pharmaceutical Sector. Australasian Accounting, Business and Finance Journal, 15(1), 5–21. https://doi.org/10.14453/aabfj.v15i1.2

Moral-Benito, E., Allison, P., & Williams, R. (2019). Dynamic panel data modelling using maximum likelihood: An alternative to Arellano-Bond. Applied Economics, 51(20), 2221–2232. https://doi.org/10.1080/00036846.2018.1540854

Narayan, P. K., Gong, Q., & Ahmed, H. J. A. (2022). Is there a pattern in how COVID-19 has affected Australia’s stock returns? Applied Economics Letters, 29(3), 179–182. https://doi.org/10.1080/13504851.2020.1861190

Narayan, S., Sriananthakumar, S., & Islam, S. Z. (2014). Stock market integration of emerging Asian economies: Patterns and causes. Economic Modelling, 39, 19–31. https://doi.org/10.1016/j.econmod.2014.02.012

Neo, K. (2021). Southeast Asia: Digital Life Intensified. We are Social March 8.

Ng, T. H. (2002). Stock Market Linkages in South-East Asia. Asian Economic Journal, 16(4), 353–377. https://doi.org/10.1111/1467-8381.00157

Nguyen, T. N., Nguyen, D. T., & Nguyen, V. N. (2020). The Impacts of Oil Price and Exchange Rate on Vietnamese Stock Market. Journal of Asian Finance, Economics and Business, 7(8), 143–150. https://doi.org/10.13106/JAFEB.2020.VOL7.NO8.143

Nicola, M., Alsafi, Z., Sohrabi, C., Kerwan, A., Al-Jabir, A., Iosifidis, C., Agha, M., & Agha, R. (2020). The socio-economic implications of the coronavirus pandemic (COVID-19): A review. International Journal of Surgery, 78, 185–193. https://doi.org/10.1016/j.ijsu.2020.04.018

Noh, E. B., Nam, H. K., & Lee, H. (2021). Which Group Should be Vaccinated First?: A Systematic Review. Infection & Chemotherapy, 53(2), 261. https://doi.org/10.3947/IC.2021.0029

Nsiah, C., & Fayissa, B. (2013). Remittances and economic growth in Africa, Asia, and Latin American-Caribbean countries: A panel unit root and panel cointegration analysis. Journal of Economics and Finance, 37(3), 424–441. https://doi.org/10.1007/s12197-011-9195-6

Oliu-Barton, M., Pradelski, B. S., Woloszko, N., Guetta-Jeanrenaud, L., Aghion, P., Artus, P., Fontanet, A., Guntram, P. M., Wolff, B., Pradelski, B. S. R., Martin, P., & Wolff, G. B. (2022). The effect of COVID certificates on vaccine uptake, health outcomes, and the economy. Research Square. https://doi.org/10.21203/rs.3.rs-1242919/v2

Pesaran, M. H. (2004). General Diagnostic Tests for Cross Section Dependence in Panels. SSRN Electronic Journal. https://doi.org/10.2139/SSRN.572504

Plante, J. A., Mitchell, B. M., Plante, K. S., Debbink, K., Weaver, S. C., & Menachery, V. D. (2021). The variant gambit: COVID-19’s next move. Cell Host & Microbe, 29(4), 508–515. https://doi.org/10.1016/J.CHOM.2021.02.020

Pradhan, A. K., Rout, S., & Khan, I. A. (2021). Does market concentration affect wholesale electricity prices? An analysis of the Indian electricity sector in the COVID-19 pandemic context. Utilities Policy, 73(October), 101305. https://doi.org/10.1016/j.jup.2021.101305

Pradhan, A. K., Thomas, R., Rout, S., & Pradhan, A. K. (2022). Magnitude and Determinants of Mortalities Related to COVID-19: Evidence from 94 Countries Using Regression Techniques. Fudan Journal of the Humanities and Social Sciences, 15(4), 475–499. https://doi.org/10.1007/s40647-022-00352-y

Puri, N., Coomes, E. A., Haghbayan, H., & Gunaratne, K. (2020). Social media and vaccine hesitancy: New updates for the era of COVID-19 and globalized infectious diseases. Human Vaccines and Immunotherapeutics, 16(11), 2586–2593. https://doi.org/10.1080/21645515.2020.1780846

Retail frenzy to drive stocks gains in South-east Asia: UBS. (2020, September 18). The Business Times.

Rillera Marzo, R., Sami, W., Alam, M. Z., Acharya, S., Jermsittiparsert, K., Songwathana, K., Pham, N. T., Respati, T., Faller, E. M., Moralidad Baldonado, A., Aung, Y., Mukund Borkar, S., & Yasir Essar, M. (2022). Hesitancy in COVID-19 vaccine uptake and its associated factors among the general adult population: A cross-sectional study in six Southeast Asian countries. Tropical Medicine and Health, 50, 4. https://doi.org/10.1186/s41182-021-00393-1

Roshchina, Y., Roshchin, S., & Rozhkova, K. (2021). Determinants of COVID-19 Vaccine Hesitancy and Resistance in Russia. SSRN Electronic Journal. https://doi.org/10.2139/SSRN.3990897

Rouatbi, W., Demir, E., Kizys, R., & Zaremba, A. (2021). Immunizing markets against the pandemic: COVID-19 vaccinations and stock volatility around the world. International Review of Financial Analysis, 77(June), 101819. https://doi.org/10.1016/j.irfa.2021.101819

Rubbaniy, G., Khalid, A. A., Umar, M., & Mirza, N. (2020). European Stock Markets’ Response to COVID-19, Lockdowns, Government Response Stringency and Central Banks’ Interventions. SSRN Electronic Journal. https://doi.org/10.2139/SSRN.3758227

Salisu, A. A., & Akanni, L. O. (2020). Constructing a Global Fear Index for the COVID-19 Pandemic. Emerging Markets Finance and Trade, 56(10), 2310–2331. https://doi.org/10.1080/1540496X.2020.1785424

Salisu, A. A., Akanni, L., & Raheem, I. (2020). The COVID-19 global fear index and the predictability of commodity price returns. Journal of Behavioral and Experimental Finance, 27, 100383. https://doi.org/10.1016/j.jbef.2020.100383

Sallam, M. (2021). COVID-19 Vaccine Hesitancy Worldwide: A Concise Systematic Review of Vaccine Acceptance Rates. Vaccines, 9, 160. https://doi.org/10.3390/vaccines9020160

Sangwan, S., Nayak, N. C., Sangwan, V., & Pradhan, A. K. (2021). Covid-19 pandemic: Challenges and ways forward for the Indian microfinance institutions. Journal of Public Affairs, 21(4). https://doi.org/10.1002/pa.2667

Scharfstein, D. S., & Stein, J. C. (1990). Herd Behavior and Investment. The American Economic Review, 80(3), 465–479. https://doi.org/10.1257/aer.90.3.695

Sekizawa, Y., Hashimoto, S., Denda, K., Ochi, S., & So, M. (2022). Association between COVID-19 vaccine hesitancy and generalized trust, depression, generalized anxiety, and fear of COVID-19. BMC Public Health, 22(1), 1–17. https://doi.org/10.1186/s12889-021-12479-w

Singh, B., Dhall, R., Narang, S., & Rawat, S. (2020). The Outbreak of COVID-19 and Stock Market Responses: An Event Study and Panel Data Analysis for G-20 Countries. Global Business Review, 0(0). https://doi.org/10.1177/0972150920957274

Sreenu, N., & Pradhan, A. K. (2022). The effect of COVID-19 on Indian stock market volatility: can economic package control the uncertainty? Journal of Facilities Management, Ahead-of-print. https://doi.org/10.1108/JFM-12-2021-0162

Subramaniam, S., & Chakraborty, M. (2021). COVID-19 fear index: Does it matter for stock market returns? Review of Behavioral Finance, 13(1), 40–50. https://doi.org/10.1108/RBF-08-2020-0215

Syahri, A., & Robiyanto, R. (2020). The correlation of gold, exchange rate, and stock market on Covid-19 pandemic period. Jurnal Keuangan Dan Perbankan, 24(3), 350–362. https://doi.org/10.26905/jkdp.v24i3.4621

Tan, Ö. F. (2021). The Effect of Pandemic News on Stock Market Returns During the Covid-19 Crash: Evidence from International Markets. Connectist: Istanbul University Journal of Communication Sciences, 0(60), 217–240. https://doi.org/10.26650/connectist2021-884955

Tisdell, C. A. (2020). Economic, social and political issues raised by the COVID-19 pandemic. Economic Analysis and Policy, 68, 17–28. https://doi.org/10.1016/j.eap.2020.08.002

Tran, B. X., Nguyen, H. T., Le, H. T., Latkin, C. A., Pham, H. Q., Vu, L. G., Le, X. T. T., Nguyen, T. T., Pham, Q. T., Ta, N. T. K., Nguyen, Q. T., Ho, C. S. H., & Ho, R. C. M. (2020). Impact of COVID-19 on Economic Well-Being and Quality of Life of the Vietnamese During the National Social Distancing. Frontiers in Psychology, 11(September), 1–9. https://doi.org/10.3389/fpsyg.2020.565153

Vierlboeck, M., & Nilchiani, R. R. (2021). Effects of COVID-19 Vaccine Developments and Rollout on the Capital Market - A Case Study. https://doi.org/10.48550/arXiv.2105.12267

Vo, T. A., Mazur, M., & Thai, A. (2022). The impact of COVID-19 economic crisis on the speed of adjustment toward target leverage ratio: An international analysis. Finance Research Letters, 45(1),102157. https://doi.org/10.1016/j.frl.2021.102157

Vo, T. T. A., & Mazur, M. (2021). The effect of investor protection on firm riskiness and performance during the COVID-19 economic crisis. Applied Economics Letters, 00(00), 1–11. https://doi.org/10.1080/13504851.2021.2016581

Wang, Y., Zhang, H., Gao, W., Yang, C., & Yang, C. (2019). Spillover effects from news to travel and leisure stocks during the COVID-19 pandemic: Evidence from the time and frequency domains. Tourism Economics, 29(2),460–487. https://doi.org/10.1177/13548166211058497

Wooldridge, J. M. (2001). Applications of Generalized Method of Moments Estimation. Journal of Economic Perspectives, 15(4), 87–100. https://doi.org/10.1257/jep.15.4.87

Wooldridge, J. M. (2018). Introductory Econometrics — A Modern Approach (7th ed). Cengange.

Wu, F. (2020). Stock market integration in East and Southeast Asia: The role of global factors. International Review of Financial Analysis, 67, 101416. https://doi.org/10.1016/j.irfa.2019.101416

Yacob, N., & Abdullah, M. (2021). Healthcare Stocks. Defensive or Speculative ? Evidence From Developed and Emerging. International Journal of Accounting, Finance and Business (IJAFB), 6(35), 26–41.

Ding, X., Zhang, Y., Liu, T., & Duan, J (2014). Using Structured Events to Predict Stock Price Movement: An Empirical Investigation. Empirical Methods in Natural Language Processing, 5–8. https://doi.org/10.3115/v1/D14-1148

Zhang, D., Hu, M., & Ji, Q. (2020). Financial markets under the global pandemic of COVID-19. Finance Research Letters, 36, 101528. https://doi.org/10.1016/j.frl.2020.101528