Organizations and Markets in Emerging Economies ISSN 2029-4581 eISSN 2345-0037

2022, vol. 13, no. 1(25), pp. 183–208 DOI: https://doi.org/10.15388/omee.2022.13.76

Intention to use Peer-to-Peer (P2P) Lending: The Roles of Perceived Structural Assurance and Perceived Critical Mass

Hanif Adinugroho Widyanto (corresponding author)

Radboud University, the Netherlands

President University, Indonesia

https://orcid.org/0000-0001-7582-2090

hanif.widyanto@ru.nl

Jhanghiz Syahrivar

Corvinus University of Budapest, Hungary

President University, Indonesia>

https://orcid.org/0000-0002-4563-3413

jhanghiz@president.ac.id

Genoveva Genoveva

President University, Indonesia

https://orcid.org/0000-0003-1829-5452

genoveva@president.ac.id

Chairy Chairy

President University, Indonesia

https://orcid.org/0000-0002-5876-5677

chairy@president.ac.id

Abstract. Peer-to-Peer (P2P) lending platform has enormous potential to improve financial inclusion for people in emerging countries. In this regard, the present study examined the predictors of continuance intention to borrow from P2P lending, especially as a Multi-Sided Platform (MSP) that relied heavily on critical mass to succeed. This research was among the first that analyzed the behavioral intention of P2P lending from the borrower’s perspective by expanding on the technology acceptance model (TAM) with two fundamental latent constructs for MSPs, namely perceived structural assurance and perceived critical mass. This quantitative study used Partial Least Square Structural Equation Modelling (PLS-SEM). Online questionnaires were spread to P2P lending borrowers (n =174) from all over Indonesia to measure the latent constructs. The result revealed that all the exogenous constructs did not have direct relationships with continuance intention to borrow. However, perceived structural assurance and perceived ease of borrowing indirectly affected the endogenous construct through perceived usefulness as the mediating variable. This study also offers some managerial implications for the P2P lending industry.

Keywords: P2P lending; perceived critical mass; perceived structural assurance; continuance intention to borrow; TAM

Received: 10/10/2021. Accepted: 16/3/2022

Copyright © 2022 Hanif Adinugroho Widyanto, Jhanghiz Syahrivar, Genoveva Genoveva, Chairy Chairy. Published by Vilnius University Press. This is an Open Access article distributed under the terms of the Creative Commons Attribution Licence, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

FinTech, a portmanteau of financial technology, refers to implementing digital technologies to provide innovative financial services in a disruptive manner (Lee & Teo, 2015; Sangwan et al., 2019). In recent years, there have been quite a few subsets of FinTech, such as peer-to-peer (P2P) lending, crowdfunding, crowdsourcing, cryptocurrency, mobile payment, e-banking, among others (Au et al., 2020; Liu et al., 2020). Of these, one of the most rapidly expanding FinTech business models is P2P lending (Au et al., 2020; Yan et al., 2018), an online lending platform that matches between lenders and borrowers and manages the repayment duty of the latter (Davis & Murphy, 2016). P2P lending is considered a disruptive force in the financial industry that challenges conventional retail lending and the investment market (Ahern, 2018). Since the founding of the UK-based Zopa in 2005 and the US-based Lending Club in 2007, P2P lending has seen massive expansions (Davis & Murphy, 2016; KPMG Siddharta Advisory, 2018). P2P lending platforms have turned into one of the most prevalent crowdfunding FinTech business models in the UK, Europe, the US, and China and is expanding massively in Australia, Japan, South Korea, and India (Lynn et al., 2019).

As the world’s fourth-largest country by population and 16th largest economy, Indonesia is uniquely positioned to capture the full benefits of FinTech lending. According to PwC Indonesia (2019), the relatively young demographic segments offer an unmatched capacity to improve economic growth. In 2019, around 67.7% of the population was part of the working-age and will peak by 2031. Managed well, this could lead to improved buying power and higher outputs, potentially helping the country evade the ‘middle-income trap’. However, to fully realise the potential, access to finance is critical. Unfortunately, around 66% of the population are unbanked (Nugroho & Samudera, 2018), while 74% of Micro, Small, and Medium Enterprises (MSMEs) do not have access to credit (PwC Indonesia, 2019). In this regard, P2P lending could help expand the financial inclusion and is estimated to boost the country’s GDP by 2-3%, translating into an income increase of 10% for the base of pyramid segment (Asian Development Bank, 2017). This is partly due to the more flexible nature of P2P lending collateral requirements and credit risk assessment than that of the traditional banks (Gupta & Xia, 2018).

Specifically, to ensure the sustainability of P2P lending platforms (Au et al., 2020), due to their nature as multi-sided platforms (MSP), achieving critical mass is imperative (Li et al., 2018; Lynn et al., 2019). Unfortunately, scholarly articles on this topic are still nascent (Sangwan et al., 2019), especially in developing countries like Indonesia, where P2P lending has only gained a foothold in the past few years (Ichwan & Kasri, 2019). Moreover, the literature on the topic in emerging countries has been limited in explaining the Information Systems (IS) adoption of P2P lending, particularly from the borrower’s side of the MSP equation. Hence, the present research attempts to address the gap by identifying the underlying factors that could attract the continuance intention to borrow from P2P lending platforms in Indonesia, which is essential to ensure the platform’s sustainability in the long run, especially from the demand (borrower’s) side.

Firstly, to predict the behavioral intention to use a system, the present study adopts the technology acceptance model (TAM), an empirically well-validated model by Davis (1989) that utilizes perceived ease of use and perceived usefulness. The model has been used in various industries such as e-banking (Cheng et al., 2006; Shanmugam et al., 2014; Zhou et al., 2010), e-government services (Hamid et al., 2016; Lean et al., 2009; Moraes & Meirelles, 2017), mobile payment (Kim et al., 2010; Lee & Sung, 2018; Mun et al., 2017; Widyanto et al., 2020), e-commerce (Chien et al., 2012; Gefen et al., 2003; Kim, 2012; Pavlou, 2001), e-learning (Cigdem & Ozturk, 2016; Sánchez & Hueros, 2010; Shen et al., 2006; Teo et al., 2019), freemium games (Syahrivar et al., 2022), among others. Hence, since FinTech P2P lending in developing countries like Indonesia is a novel and emerging industry, and this study is one of its kind, understanding the TAM-related constructs is a critical first step to understand the IS user acceptance better.

Secondly, the present study incorporates perceived structural assurance to predict continuance intention to borrow from P2P lending. The researchers believe that structural assurance is a critical construct for the adoption of IS in this context since the precarious nature of P2P lending in Indonesia, as a result of countless misconducts by illegal P2P firms, prompts potential borrowers to seek protective mechanisms such as the rule of law, favorable contracts, and transaction processes (Chien et al., 2012; Disemadi et al., 2020; Hidajat, 2019). Because of their importance to practitioners, structural assurance has received considerable attention from IS researchers (Khan et al., 2021; Sarkar et al., 2020; Sha, 2009; Wang et al., 2015; Wingreen & Baglione, 2005). Furthermore, since P2P lending is an emerging FinTech solution, the necessity of instituting a proper structural assurance has not been widely acknowledged (Chen et al., 2015).

Finally, since P2P lending is an MSP, establishing critical mass is key to ensuring the platform’s sustainability and expanding value co-creation (Au et al., 2020). For a new FinTech platform to be accepted, it must first attract a threshold of users to be regarded as valuable enough to be adopted, at which point the numbers would see a dramatic increase (Mahler & Rogers, 1999; Premkumar et al., 2008). In the context of IS research, an earlier study has proven that perceived critical mass has the highest effect on the intention to use (Lou et al., 2000). Zuo and Wang (2012) also argued that IS researchers should incorporate perceived critical mass with TAM to better understand the behavioral intention of the platform users. This is in line with the suggestion by Verkijika and Neneh (2021), who argued that TAM features should be used in conjunction with other constructs to better understand users’ behavior.

Therefore, the present study aims to provide some empirical insights into the growing industry of P2P lending platforms in emerging economies like Indonesia by analyzing the antecedents of continuance intention to borrow to ensure long-term sustainability. Specifically, the researchers would like to focus on the borrower side of the MSP equation to develop a helpful guideline for P2P lending firms, policymakers, and other relevant stakeholders. The subsequent sections will introduce the theoretical framework, followed by research methods, analysis and discussion, and conclude with managerial implications and limitations.

2. Literature Review

2.1 Technology Acceptance Model (TAM)

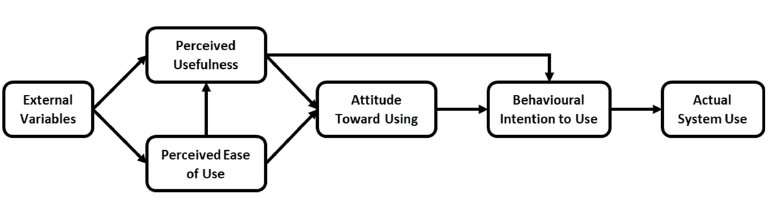

Technology Acceptance Model (TAM) was first developed and introduced by Davis et al. (1989) based on earlier theories such as expectancy-value and the theory of reasoned actions. TAM is rooted in the users’ intention to adopt technology in the context of IS (Kumar et al., 2018; Yuan et al., 2016). In its original form, two underlying latent constructs are used to predict technology adoption, namely, perceived ease of use (PEOU) and perceived usefulness (PU). PEOU refers to the extent to which users consider that particular technology would be free from efforts, while PU relates to how users perceive the benefits of using a particular technology. Additionally, PEOU positively influences PU, which mediates the effects of PEOU on behavioral intention to use (Davis, 1989). Earlier studies have also substantiated TAM’s ability to predict continuance intention to use (Gefen et al., 2003; Kim & Malhotra, 2005; Kumar et al., 2018; Wu & Chen, 2017).

Figure 1

Technology Acceptance Model (Davis et al., 1989)

2.2 Continuance Intention to Borrow

Continuance intention to borrow is adapted for the context of fintech P2P lending from the behavioral intention construct of the Theory of Acceptance Model (TAM) by Davis et al. (1989). One of the early studies on continuance intention was developed by Bhattacherjee (2001) through the Expectation Confirmation Model (ECM). Essentially, the concept of continuance intention refers to the likelihood that users would continue adopting a particular technology in the future (Bhattacherjee, 2001; Tarhini et al., 2016). However, it is worth noting that there is a clear distinction between continuance intention and adoption of technology (Franque, Oliveira, & Tam, 2021). Once users have decided to adopt a technology, they could make an informed decision whether to continue using the system or not in the long term, which is the basis for the continuance intention to use (Franque et al., 2021). Therefore, understanding continuance intention is vital to ensure retention of users (Nelloh et al., 2019) and help organizations improve their marketing strategies accordingly (Cheng et al., 2006). Specifically, in the context of fintech, earlier studies have also explored users’ continuance intention to use the innovative financial services (Kumar et al., 2018; Shiau et al., 2020; Yuan et al., 2016; Zhou et al., 2018).

2.3 Structural Assurance

The concept of structural assurance was first introduced by McKnight et al. (1998), which defined the construct as the conviction that institutions could achieve their goals when contingent factors such as contracts, safeguards, rules, legal recourse, and assurance have been put forth. In the context of online platforms (including fintech), McKnight et al. (2002) further explained that structural assurance could ensure that users of the platform have positive perceptions regarding the safety of the online environment, especially since it is full of uncertainties. This could be manifested through protective legal or technological arrangements that could ensure the safety of online transactions, which leads to trust among users (Gefen et al., 2003). In other words, structural assurance is an institution-based trust construct that could lead the users into having positive first impressions of the online platform (Yousafzai et al., 2005). Therefore, for a relatively new fintech platform like P2P lending, structural assurance is an important construct to explore, especially to ensure that users are interested in using the platform in the long run.

2.4 Critical Mass

Critical mass is another essential construct related to P2P lending as a Multi-Sided Platform (MSP). The concept of critical mass is an extension of the collective action theory. It suggests that a small number of interested and ingenious individuals can contribute toward a collective action that would likely grow exponentially, attract other people in the process, and bring the technology to its total capacity (Oliver et al., 1985). The more influential the individuals who adopt the technology are, the stronger the critical mass effects. In today’s context, Kate and Niels (2020) explained that critical mass could be understood as the minimum size of users required to generate a stable growth in an MSP. Evans and Schmalensee (2010) also explained that critical mass is the key to ensuring a platform’s sustainability, especially during its early stages, such as in the case of P2P lending.

3. Proposed Hypotheses

Perceived Structural Assurance (PSA) is the confidence of end-users regarding the effectiveness of an institution in ensuring a secure digital ecosystem by developing structural trust, which includes legal and technical provisions (Chandra et al., 2010; Sha, 2009), as well as rules, processes, contracts, guarantees, and trusted external authentication (Chien et al., 2012; Hsieh, 2015; Jones & Leonard, 2008; Yousafzai et al., 2005). In this regard, success is considered a factor of structural constraints such as agreements, deals, guidelines, and assurance (Kim, 2012). Structural assurance also entails that online channels have put in place the provision of legal and technological structures to ensure a safe and protected transaction (McKnight et al., 2002; Wang & Hu, 2009), which makes it exceptionally critical for online financial transactions, according to the findings of various studies in the past (Filotto et al., 2021; Gao et al., 2015; Kim & Prabhakar, 2004). Structural assurance can be manifested through an informative helpline, transparent policies, enforcement of privacy-related issues, and complaints management, which customers would find helpful (Hwang & Kim, 2007). A good structural assurance could also ultimately affect consumers’ behavioral intention to use online services (Choi et al., 2020; Gu et al., 2009; Huang et al., 2011). In fintech, structural assurance has also been found to directly and indirectly affect continuance intention to use fintech solutions (Ntaukira et al., 2021; Osakwe et al., 2021; Upadhyay & Jahanyan, 2016; Wang et al., 2019). Hence we propose the folowing hypotheses:

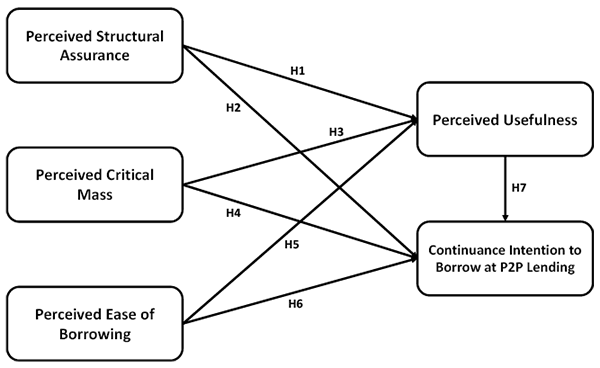

H1: Perceived structural assurance has a positive effect on perceived usefulness.

H2: Perceived structural assurance has a positive effect on the continuance intention to borrow from P2P lending platforms.

Critical mass could be established when users believe that most of their colleagues are using the system (Lou et al., 2000), which increases the likelihood of customer adoption (Wong et al., 2020). Critical mass is also widely acknowledged as the “tipping point” for a self-sustaining future of the system (He et al., 2021). As such, it could be used as a signal to induce collective action toward adopting new technology, the absence of which means fewer people would be willing to adopt the system (Lou et al., 2000). A critical mass of users who are actively involved in the system could even serve as a necessary condition for coordinated behavior (Markus, 1987). However, Van Slyke et al. (2007) argued that critical mass is difficult to measure despite its strategic importance. Hence, they proposed to examine the perception of the prospective users of the MSP regarding critical mass. This perception of critical mass is subjective and can be used to predict technology adoption (Lew et al., 2020), including in the context of fintech (Cabanillas et al., 2016; Lee & Kim, 2020; Mallat & Tuunainen, 2008; Moghavvemi et al., 2021). Critical mass is also posited to predict the technology acceptance behavior (TAM), meaning that the higher the critical mass, the more likely users will find them valuable and easy to use (Zuo & Wang, 2012). Therefore, the following hypotheses are formulated:

H3: Perceived critical mass has a positive effect on perceived usefulness.

H4: Perceived critical mass has a positive effect on the continuance intention to borrow from P2P lending platforms.

In the present study, the researchers adopted the construct, namely perceived ease of borrowing, based on a salient construct from the prominent Technology Acceptance Model (TAM), namely, perceived ease of use. In his widely acknowledged paper, Davis (1989) theorized that perceived ease of use is one of the essential predictors of system use, alongside perceived usefulness. The construct itself was derived from the self-efficacy theory (Bandura, 1982). Specifically, Davis argued that people would use an IS when they consider the system to impact the performance of their assigned tasks. In other words, it is the extent to which users believe that system adoption would be effortless to undertake and that they possess the technical aptitude to do so (Chien et al., 2012; Kim et al., 2010). In evaluating perceived ease of use, users should focus on their interface with the system instead of other external goals (Van der Heijden, 2004). In the original study and its many follow-up bodies of works, perceived ease of use is found to influence perceived usefulness, even more so in terms of effects than it does on behavioral intention (Ma & Liu, 2005). Earlier studies (Asnakew, 2020; Cheng et al., 2006; Kim et al., 2010; Yiu et al., 2007) have also found that in fintech, perceived ease of use has a positive effect on customers’ intention towards using fintech services. Therefore, the hypotheses are proposed:

H5: Perceived ease of borrowing has a positive effect on perceived usefulness.

H6: Perceived ease of borrowing has a positive effect on the continuance intention to borrow from P2P lending platforms.

Perceived usefulness is the extent to which users perceive that an IS solution could yield a positive outcome (Putritama, 2019) and possibly improve the performance of their ongoing tasks (Kim et al., 2010; Panagiotopoulos & Dimitrakopoulos, 2018). Originating from the TAM model by Davis (1989), perceived usefulness has been proven to be a solid antecedent of intention to use, with average path coefficients toward behavioral intention typically exceeding 60% (Venkatesh & Davis, 2000), and is even considered as the fundamental prerequisite in designing an IS (Kim, 2012). In the context of FinTech, perceived usefulness can be understood as the benefits received by users in the form of finances, access to funding, time-saving, convenience, among others (de Moraes & Meirelles, 2017). Consequently, perceived usefulness has been used to predict customer adoption in the field of FinTech (Kalinic et al., 2019; Kim et al., 2010; Putritama, 2019; Shanmugam et al., 2014). Thus, we propose the following hypothesis:

H7: Perceived usefulness has a positive effect on continuance intention to borrow from P2P lending platforms.

Figure 2

Proposed Conceptual Framework

4. Research Methodology

This quantitative research utilizes the Structural Equation Modelling with Partial Least Squares (PLS-SEM) technique to understand the antecedents of continuance intention to borrow from P2P lending platforms in Indonesia by analyzing the correlation between the latent constructs. The respondents in this study are people from all over Indonesia who identify as having a continuance intention to borrow from P2P lending platforms. In developing the questionnaire, the researchers conducted face validity to ensure that the measurements appear to be related to their relevant latent constructs (Taherdoost, 2018). The questionnaires were distributed online using Google Form to the study population between June and July 2021 by approaching the respondents directly through online P2P lending communities on Facebook and Instagram.

Table 1

Demographics of the Sample

|

Measure |

Item |

Sample Count |

(%) |

|

Gender |

Female |

112 |

64.4% |

|

Male |

61 |

35.1% |

|

|

Others |

1 |

0.6% |

|

|

Cohorts |

17-26 years old (Gen-Z) |

107 |

61.5% |

|

27-41 years old (Gen-Y) |

59 |

33.9% |

|

|

42-56 years old (Gen-X) |

8 |

4.6% |

|

|

Last Education |

Junior High School |

8 |

4.6% |

|

Senior High School |

91 |

52.3% |

|

|

Associate Degree |

21 |

12.1% |

|

|

Bachelor’s Degree |

52 |

29.9% |

|

|

Postgraduate Degree |

2 |

1.1% |

|

|

Provinces of Origin |

Central Java |

33 |

19.0% |

|

West Java |

22 |

12.6% |

|

|

DKI Jakarta |

17 |

9.8% |

|

|

Jambi |

15 |

8.6% |

|

|

Riau |

15 |

8.6% |

|

|

North Sulawesi |

9 |

5.2% |

|

|

Yogyakarta |

9 |

5.2% |

|

|

Banten |

8 |

4.6% |

|

|

Lampung |

7 |

4.0% |

|

|

East Java |

5 |

2.9% |

|

|

Others |

34 |

19.5% |

|

|

Current Occupation |

Employee |

70 |

40.2% |

|

Student |

48 |

27.6% |

|

|

Entrepreneur |

26 |

14.9% |

|

|

Freelancer |

12 |

6.9% |

|

|

Unemployed |

10 |

5.7% |

|

|

Civil Servant |

6 |

3.4% |

|

|

Stay-at-home Parent |

2 |

1.1% |

|

|

Monthly Expenses |

Less than IDR 1,150,000 |

52 |

29.9% |

|

IDR 1,150,001- IDR 3,900,000 |

88 |

50.6% |

|

|

IDR 3,900,001 - IDR 10,000,000 |

32 |

18.4% |

|

|

IDR 10,000,000 - IDR 20,000,000 |

2 |

1.1% |

The researchers also used the purposive sampling method since the population is unknown (Tongco, 2007), and the following inclusion criteria must be fulfilled (Acharya et al., 2013; Bernard, 2011): 1) They are familiar with legal P2P lending platforms that are registered or acknowledged by the Indonesian Financial Services Authority (“OJK”); 2) They have borrowed money from the platform in the past, and 3) They would like to borrow money from the platform again in the future. Initially, the researchers collected 388 participants, out of which only 174 were considered valid since they fulfilled all the three inclusion criteria. These respondents met the minimum size for the sample as put forth by Barclay et al. (1995) and Cohen (1992). The researchers then analyzed the data using PLS-SEM software to evaluate the structural equation modelling. In total, five latent variables were measured reflectively. As can be seen in the demographics of the sample in Table 1, the majority of the respondents are female (64.4%) from Generation Z (61.5%) who are living in the Java Island (54.02%), do not have higher education degrees (56.89%) and, on average, spend between IDR 1,150,001 (~USD 79.96) and IDR 3,900,000 (~USD 271.16) per month (50.6%).

5. Analysis and Discussion

5.1 Descriptive Analysis

To better understand the distribution of the data, Table 2 presents the essential attributes of the data in the form of descriptive statistics. The average values in this study ranged between 3.27 (Perceived Critical Mass) and 3.76 (Perceived Structural Assurance). This finding shows that respondents in the current research value structural assurance of the P2P lending platform the most and consider critical mass to be the least of their consideration. Except for critical mass, all the constructs have standard deviation (SD) values lower than 1, suggesting that the spread is not situated too far from the mean.

Table 2

Descriptive Analysis

|

Latent Constructs |

Min |

Max |

Mean |

SD |

|

Perceived Structural Assurance |

1 |

5 |

3.76 |

0.81 |

|

Perceived Critical Mass |

1 |

5 |

3.27 |

1.02 |

|

Perceived Ease of Borrowing |

1 |

5 |

3.65 |

0.86 |

|

Perceived Usefulness |

1 |

5 |

3.50 |

0.93 |

|

Continuance Intention to Borrow |

1 |

5 |

3.64 |

0.91 |

5.2 Measurement Model

To ensure that the model is valid and reliable, the researchers began the analysis by assessing the reliability and construct validity, consisting of convergent and discriminant validity (Taherdoost, 2018). The researchers analyzed the composite reliability (CR) and Cronbach’s alpha (CA) to assess the internal consistency reliability. As can be seen in Table 3, all the CR and CA values fall between 0.70 and 0.90, which are considered to be “satisfactory to good” (Hair et al., 2019). For convergent validity, the researchers evaluated the average variance extracted (AVE) values and found out that all of them have already fulfilled the minimum threshold of 0.50, suggesting that the construct could explain more than 50% of the items’ variance.

Table 3

Measurement Model

|

Latent Constructs |

AVE |

CA |

CR |

|

Perceived Structural Assurance |

0.62 |

0.80 |

0.87 |

|

Perceived Critical Mass |

0.71 |

0.90 |

0.92 |

|

Perceived Ease of Borrowing |

0.62 |

0.80 |

0.87 |

|

Perceived Usefulness |

0.61 |

0.87 |

0.90 |

|

Continuance Intention to Borrow |

0.68 |

0.84 |

0.90 |

Finally, since this study employs a reflective measurement model, indicator loadings are required for discriminant validity. The recommended loadings should be above 0.708, ensuring that the item reliability is satisfactory (Hair et al., 2019). In the present study, ITB4, PEB5, PSA1, PSA2, and PSA3 have lower-than-recommended loadings. Since the items in a reflective measurement model are interchangeable without changing the meaning of the latent construct (Benitez et al., 2020), the researchers decided to remove those items for subsequent analysis to improve model fit and construct validity, as can be observed in Table 4.

Table 4

Outer Loadings

|

|

ITB |

PCM |

PEB |

PSA |

PU |

|

ITB1 |

0.85 |

|

|

|

|

|

ITB2 |

0.75 |

|

|

|

|

|

ITB3 |

0.86 |

|

|

|

|

|

ITB5 |

0.84 |

|

|

|

|

|

PCM1 |

|

0.86 |

|

|

|

|

PCM2 |

|

0.87 |

|

|

|

|

PCM3 |

|

0.84 |

|

|

|

|

PCM4 |

|

0.84 |

|

|

|

|

PCM5 |

|

0.79 |

|

|

|

|

PEB1 |

|

|

0.79 |

|

|

|

PEB2 |

|

|

0.78 |

|

|

|

PEB3 |

|

|

0.84 |

|

|

|

PEB4 |

|

|

0.73 |

|

|

|

PSA4 |

|

|

|

0.73 |

|

|

PSA5 |

|

|

|

0.85 |

|

|

PSA6 |

|

|

|

0.76 |

|

|

PSA7 |

|

|

|

0.81 |

|

|

PU1 |

|

|

|

|

0.77 |

|

PU2 |

|

|

|

|

0.78 |

|

PU3 |

|

|

|

|

0.79 |

|

PU4 |

|

|

|

|

0.78 |

|

PU5 |

|

|

|

|

0.76 |

|

PU6 |

|

|

|

|

0.83 |

Note. ITB = Continuance Intention to Borrow; PCM = Perceived Critical Mass; PEB = Perceived Ease of Borrowing; PSA = Perceived Structural Assurance; PU = Perceived Usefulness

In keeping with Voorhees et al. (2016), the researchers also assessed the Heterotrait-Monotrait (HTMT) ratio, which is recommended as the new “standard” for discriminant validity testing. Table 5 shows that all values are below the suggested ratio cut-off of 0.85, which means no discriminant validity issue exists in the model.

Table 5

Heterotrait-Monotrait (HTMT) Ratio

|

|

ITB |

PCM |

PEB |

PSA |

PU |

|

ITB |

|

|

|

|

|

|

PCM |

0.24 |

|

|

|

|

|

PEB |

0.45 |

0.61 |

|

|

|

|

PSA |

0.58 |

0.33 |

0.52 |

|

|

|

PU |

0.78 |

0.28 |

0.49 |

0.64 |

|

5.3 Structural Model Analysis

The final part of the structural equation modelling assessment begins by assessing the R2 value to understand the total variance in the endogenous constructs because of the combined effects of the exogenous latent constructs. In the present study, Perceived Usefulness has an adjusted R2 of 32.1%, while Continuance Intention to Borrow from P2P Lending has an adjusted R2 value of 47.7%. According to Hair et al. (2017), an R2 value between 0.25 and 0.50 is considered “weak” but acceptable. Next, the researchers applied path analysis to determine if the data conclusively supported the proposed hypotheses.

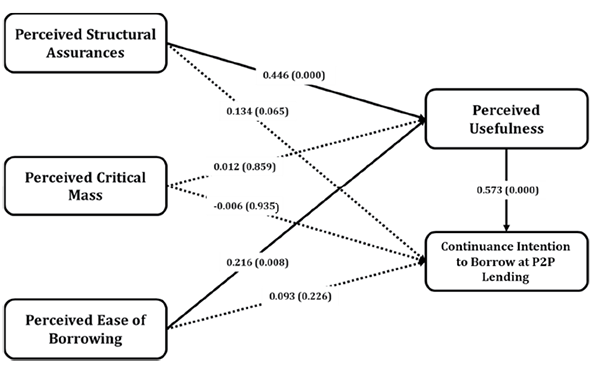

As can be observed in Table 6 and Figure 3, four out of seven hypotheses in the present study (i. e., H2, H3, H4, and H6) are not supported by the data, while the rest (i. e., H1, H5, and H7) are found to be significant.

Table 6

Structural Estimates

|

Hypothesis |

Path |

Estimate |

Mean |

SD |

t-value |

p-value |

Decision |

|

H1 |

PSA -> PU |

0.446 |

0.452 |

0.063 |

7.126 |

0.000 |

Supported |

|

H2 |

PSA -> ITB |

0.134 |

0.129 |

0.072 |

1.852 |

0.065 |

Not supported |

|

H3 |

PCM -> PU |

0.012 |

0.025 |

0.070 |

0.177 |

0.859 |

Not supported |

|

H4 |

PCM -> ITB |

-0.006 |

0.002 |

0.069 |

0.082 |

0.935 |

Not supported |

|

H5 |

PEB -> PU |

0.216 |

0.208 |

0.081 |

2.658 |

0.008 |

Supported |

|

H6 |

PEB -> ITB |

0.093 |

0.092 |

0.076 |

1.211 |

0.226 |

Not supported |

|

H7 |

PU -> ITB |

0.573 |

0.574 |

0.084 |

6.848 |

0.000 |

Supported |

Figure 3

Summary of the Relationships between the Latent Constructs

Finally, Table 7 reveals that the indirect relationship between Perceived Critical Mass and Continuance Intention to Borrow is the only one that is not supported by the data. On the other hand, Perceived Structural Assurance and Perceived Ease of Borrowing have indirect paths to explain the Continuance Intention to Borrow from P2P lending platforms.

Table 7

Total Indirect Effects

|

Path |

Estimate |

Mean |

SD |

t-value |

p-value |

Decision |

|

PSA -> ITB |

0.256 |

0.260 |

0.056 |

4.529 |

0.000 |

Supported |

|

PCM -> ITB |

0.007 |

0.014 |

0.040 |

0.177 |

0.860 |

Not supported |

|

PEB -> ITB |

0.124 |

0.120 |

0.052 |

2.396 |

0.017 |

Supported |

6. Discussion

6.1 Theoretical Contribution

The main objective of the present study aims to understand the antecedents of continuance intention to borrow from P2P lending platforms in Indonesia. The study could contribute to the body of literature by validating a valiant adoption model (i. e., TAM) in the context of P2P lending in a developing country and expanding it by incorporating two fundamental latent variables that have never been concurrently analyzed before in the context of Multi-Sided Platform (MSP) and FinTech, namely perceived structural assurance and perceived critical mass. The researchers believe that this is the first study that proposes the extension of TAM with the two exogenous latent variables to understand continuance intention better to borrow from a P2P lending platform.

This research revealed some interesting insights for the stakeholders of P2P lending and the emerging academic discourse on the topic. Firstly, perceived structural assurance is found to have a positive and significant relationship with perceived usefulness (t-value: 7.126; p-value: 0.000). The effect between the two hypothesized relationships is also relatively strong at 44.6%, which is the second-highest path coefficient in the present study. However, perceived structural assurance is not found to directly affect the continuance intention to borrow from P2P lending in a significant manner (t-value: 1.852; p-value: 0.065). Since this is the first study that assesses perceived structural assurance as an antecedent of perceived usefulness and continuance intention to borrow in the context of FinTech, the finding highlights the strategic importance of perceived usefulness as a mediating variable that could bridge between the exogenous and endogenous construct, especially since the direct route is not statistically significant. Table 7 also shows that perceived structural assurance has a total effect of 25.6% toward continuance intention to borrow.

The second important finding is the lack of urgency that the respondents of this study put on perceived critical mass. Although P2P lending is a Multi-Sided Platform (MSP) that relies heavily on the critical mass of users as a prerequisite to boost growth (Evans & Schmalensee, 2010; Ondrus et al., 2015), the findings show that in the case of P2P lending in Indonesia, the exogenous construct does not significantly influence either perceived usefulness (t-value: 0.177; p-value: 0.859) or continuance intention to borrow (t-value: 0.082, t-value: 0.935). This finding contradicts earlier studies on the topic that discovered a positive relationship between perceived critical mass and behavioral intention (Lou et al., 2000; Sledgianowski & Kulviwat, 2009). The results demonstrate that the perception of critical mass is not a factor that borrowers of P2P lending services in Indonesia consider the most, especially since borrowing money is a personal affair, and the overwhelming majority of them (84.5%) borrowed money to buy products or services (i. e., consumptive purposes), in line with the finding by Yunus (2019).

The present study also reveals that perceived ease of borrowing has a positive relationship with perceived usefulness (t-value: 2.658; p-value: 0.008) with a modest path coefficient of 21.6%. However, perceived ease of borrowing does not directly affect continuance intention to borrow from P2P lending (t-value: 1.211; p-value: 0.226), consistent with the earlier study by Susanti et al. (2016). This finding underlines the importance of perceived usefulness as a mediating variable. This suggests that establishing a mechanism that enables users of P2P lending to borrow money from the platform alone is not enough. They need to appreciate the platform’s usefulness before having an improved interest to borrow. Lastly, the path relationship between perceived usefulness and continuance intention to borrow from P2P lending (t-value: 6.848; p-value: 0.000) yields the highest effect (57.3%) among all the hypothesized relationships in the present study. Once again, the present study results demonstrate the strategic importance of perceived usefulness in developing the IS adoption of P2P lending: The more beneficial people consider the platform to be, the more likely they would be inclined to borrow money from it. In the context of FinTech, this finding is consistent with earlier studies (Gu et al., 2009; Ichwan & Kasri, 2019; Ozturk, 2016; Roca et al., 2009; Talwar et al., 2020).

6.2 Managerial Implications

Overall, as the first study examining the antecedents of continuance intention to borrow from P2P lending in an emerging country by expanding the Technology Acceptance Model (TAM) framework with the two crucial exogenous constructs of perceived structural assurance and perceived critical mass, the outcome of this research provides a host of insights for the development of the nascent FinTech platform especially from the borrower’s side. The validity and reliability of the proposed theoretical model and relationships between the paths in the present study were assessed using the Partial Least Squared Structural Equation Model (PLS-SEM) analysis.

Among the most notable findings of this research is the strategic importance of perceived usefulness as a mediating variable, bridging perceived structural assurance and perceived ease of borrowing with continuance intention to borrow from P2P lending as the endogenous variable. This is particularly notable since the direct paths between the exogenous and endogenous latent constructs in the present study are not significant, leaving the indirect routes through purceived usefulness as the only path to predict continuance intention to borrow. In addition, the path coefficient between perceived usefulness and continuance intention to borrow is the highest in the framework at 57.3%. The implication is clear: P2P lending firms should emphasize the many benefits and features that would entice borrowers to utilize their service. For instance, they can focus on how P2P lending services could reduce time and place barriers in performing financial transactions (Nuryakin et al., 2019), replace traditional banks to borrow money for the unbanked due to their more lenient requirements (Kohardinata et al., 2020), provide borrowers with the most competitive interest rate, loan tenor, as well as limit compared to other financing alternatives (Ghazali et al., 2019), process and approve the loan requests a lot faster than competitors (Pohan et al., 2020), among others.

Secondly, the present research also draws attention to perceived structural assurance as a crucial exogenous latent variable that could explain the continuance intention to borrow from P2P lending. Specifically, the exogenous construct could indirectly influence the IS adoption through perceived usefulness as the mediator since the direct path is not significant. In this regard, P2P lending firms should provide the structural assurance that many borrowers are concerned about, including the lack of consumer protection, privacy concerns regarding personal information (Abubakar & Handayani, 2018), the enactment of proper regulation of FinTech and P2P lending by the Financial Services Authority/OJK (Anugerah & Indriani, 2018) and comprehensive enforcement of said regulation to ensure that there are no misconducts attempted by P2P lending firms (Kohardinata et al., 2020), the sweeping eradication of illegal P2P lending players (Hidajat, 2019; Sitompul, 2019), and many more. Proper structural assurance could also ensure that borrowers are not caught in the vicious cycle of having to apply for loans with no end in sight (Yunus, 2019).

P2P lending firms should also pay attention to the perceived ease of borrowing as a crucial factor that could indirectly influence continuance intention to borrow from P2P lending. Potential borrowers typically favor borrowing money from P2P lending platforms due to their ease of use to apply for loans online through their mobile phones. In their study on the borrower’s sentiment of P2P lending in Indonesia, Pohan et al. (2020) discovered that users emphasize the speed of approval for their borrowing applications and the swift disbursement of the money more than other essential factors such as the security of the platform. Another study by Susanti et al. (2016) corroborated this finding by explaining that P2P lending borrowers preferred easy and speedy transaction processes. However, in doing so, the present study also provides a recommendation to P2P lending platforms that ease of borrowing itself is not enough to entice borrowers. It should go through the perceived usefulness route before indirectly affecting continuance intention to borrow, solidifying the fundamental role of usefulness in developing P2P lending IS adoption. Finally, the researchers also discovered the lack of importance being placed on perceived critical mass by the respondents of this study, which shows that they do not really care about the “same side effect” typically associated with an MSP as long as they could secure the “fast and easy” money to finance their consumptive behavior immediately.

6.3 Limitations and Future Research

As one of the first empirical studies investigating continuance intention to borrow from P2P lending by expanding TAM with two fundamental latent constructs for MSP in an emerging country, namely, perceived structural assurance and perceived critical mass, the current research is bound to have several limitations. To begin with, despite the researchers’ best efforts to gather the data, the total number of valid respondents who passed all the screening questions and other measures is only 174 people, down from the 388 responses initially collected. Hence, future studies could expand the sample to improve PLS the consistency of PLS-SEM estimates (Hair et al., 2017). Secondly, since the adjusted R2 of the endogenous latent variable (47.7%) is still below 50%, follow-up studies on the topic can incorporate other relevant variables to predict IS adoption of P2P lending platforms for borrowers, such as hedonic and utilitarian values (Van der Heijden, 2004), system quality and information quality (T. Zhou, 2013), financial literacy (KPMG Siddharta Advisory, 2018), religiosity (Ichwan & Kasri, 2019), among others. Furthermore, since structural assurance has been found to affect trust (Gefen et al., 2003; Huang et al., 2011; McCole et al., 2019; Yousafzai et al., 2005), which is an arguably important construct due to the online nature of P2P lending, future studies could also incorporate trust as a predicting construct in understanding continuance intention to borrow at the platform.

References

Abubakar, L., & Handayani, T. (2018). Financial Technology: Legal Challenges for Indonesia Financial Sector. IOP Conference Series: Earth and Environmental Science, 175(1), 0–5. https://doi.org/10.1088/1755-1315/175/1/012204

Acharya, A. S., Prakash, A., Saxena, P., & Nigam, A. (2013). Sampling: Why and How of it? Indian Journal of Medical Specialities, 4(2), 3–7. https://doi.org/10.7713/ijms.2013.0032

Ahern, D. M. (2018). Regulatory Arbitrage in a FinTech World: Devising an Optimal EU Regulatory Response to Crowdlending. SSRN Electronic Journal, February. https://doi.org/10.2139/ssrn.3163728

Anugerah, D. P., & Indriani, M. (2018). Data Protection in Financial Technology Services: Indonesian Legal Perspective. IOP Conference Series: Earth and Environmental Science, 175(1). https://doi.org/10.1088/1755-1315/175/1/012188

Asian Development Bank. (2017). Accelerating Financial Inclusion in South-East Asia with Digital Finance. https://doi.org/10.22617/RPT178622-2

Asnakew, Z. S. (2020). Customers’ Continuance Intention to Use Mobile Banking: Development and Testing of an Integrated Model. The Review of Socionetwork Strategies, 14(1), 123–146. https://doi.org/10.1007/s12626-020-00060-7

Au, C. H., Tan, B., & Sun, Y. (2020). Developing a P2P lending platform: Stages, strategies and platform configurations. Internet Research, 30(4), 1229–1249. https://doi.org/10.1108/INTR-03-2019-0099

Bandura, A. (1982). Self-Efficacy Mechanism in Human Agency. American Psychologist, 37(2), 122–147. https://doi.org/10.1037/0003-066X.37.2.122

Barclay, D., Thompson, R., & Higgins, C. (1995). The Partial Least Squares (PLS) Approach to Causal Modeling: Personal Computer Adoption and Use an Illustration. Technology Studies, 2(2), 285–309.

Benitez, J., Henseler, J., Castillo, A., & Schuberth, F. (2020). How to perform and report an impactful analysis using partial least squares: Guidelines for confirmatory and explanatory IS research. Information and Management, 57(2), 103168. https://doi.org/10.1016/j.im.2019.05.003

Bernard, H. R. (2011). Research Methods in Anthropology: Qualitative and Quantitative Approaches. AltaMira Press.

Bhattacherjee, A. (2001). Understanding information systems continuance: An expectation-confirmation model. MIS Quarterly, 25(3), 351–370. https://doi.org/10.2307/3250921

Cabanillas, F. L., Slade, E. L., & Dwivedi, Y. K. (2016). Time for a different perspective: A preliminary investigation of barriers to merchants’ adoption of mobile payments. AMCIS 2016: Surfing the IT Innovation Wave - 22nd Americas Conference on Information Systems, 2015, 1–8.

Chandra, S., Srivastava, S. C., Kim, W., & Theng, Y.-L. (2010). Evaluating the Role of Trust in Consumer Adoption of Mobile Payment Systems: An Empirical Analysis. Communications of the Association for Information Systems, 27(29), 561–588. http://aisel.aisnet.org/cais/vol27/iss1/29

Chen, D., Lou, H., & Lou, H. (2015). Toward an Understanding of Online Lending Intentions: Evidence from a Survey in China. Communications of the Association for Information Systems, 36. https://doi.org/10.17705/1CAIS.03617

Cheng, T. C. E., Lam, D. Y. C., & Yeung, A. C. L. (2006). Adoption of internet banking: An empirical study in Hong Kong. Decision Support Systems, 42(3), 1558–1572. https://doi.org/10.1016/j.dss.2006.01.002

Chien, S. H., Chen, Y. H., & Hsu, C. Y. (2012). Exploring the impact of trust and relational embeddedness in e-marketplaces: An empirical study in Taiwan. Industrial Marketing Management, 41(3), 460–468. https://doi.org/10.1016/j.indmarman.2011.05.001

Choi, H., Park, J., Kim, J., & Jung, Y. (2020). Consumer preferences of attributes of mobile payment services in South Korea. Telematics and Informatics, 51(February), 101397. https://doi.org/10.1016/j.tele.2020.101397

Cigdem, H., & Ozturk, M. (2016). Factors Affecting Students’ Behavioral Intention to Use LMS at a Turkish Post-Secondary Vocational School. International Review of Research in Open and Distance Learning, 17(3), 276–295. https://doi.org/10.19173/irrodl.v17i3.2253

Cohen, J. (1992). A Power Primer. Psychological Bulletin, 112(1), 155–159. http://www.bwgriffin.com/workshop/Sampling A Cohen tables.pdf

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly: Management Information Systems, 13(3), 319–339. https://doi.org/10.2307/249008

Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User Acceptance of Computer Technology: A Comparison of Two Theoretical Models. Management Science, 35(8), 982–1003. https://www.jstor.org/stable/2632151

Davis, K., & Murphy, J. (2016). Peer-to-Peer Lending: Structures, Risks and Regulation. The Finsia Journal of Applied Finance, 3, 3–37. https://search.informit.org/doi/10.3316/informit.419817919644101

de Moraes, G. H. S. M., & Meirelles, F. de S. (2017). User’s Perspective of Eletronic Government Adoption in Brazil. Journal of Technology Management and Innovation, 12(2), 1–10. https://doi.org/10.4067/s0718-27242017000200001

Disemadi, H. S., Yusro, M. A., & Balqis, W. G. (2020). The Problems of Consumer Protection in Fintech Peer To Peer Lending Business Activities in Indonesia. Sociological Jurisprudence Journal, 3(2), 91–97. https://doi.org/10.22225/scj.3.2.1798.91-97

Evans, D. S., & Schmalensee, R. (2010). Failure to Launch: Critical Mass in Platform Businesses. Review of Network Economics, 9(4). https://doi.org/10.2202/1446-9022.1256

Filotto, U., Caratelli, M., & Fornezza, F. (2021). Shaping the digital transformation of the retail banking industry. Empirical evidence from Italy. European Management Journal, 39(3), 366–375. https://doi.org/10.1016/j.emj.2020.08.004

Franque, F. B., Oliveira, T., & Tam, C. (2021). Understanding the factors of mobile payment continuance intention: Empirical test in an African context. Heliyon, 7(8), e07807. https://doi.org/10.1016/j.heliyon.2021.e07807

Franque, F. B., Oliveira, T., Tam, C., & Santini, F. de O. (2021). A meta-analysis of the quantitative studies in continuance intention to use an information system. Internet Research, 31(1), 123–158. https://doi.org/10.1108/INTR-03-2019-0103

Gao, L., Waechter, K. A., & Bai, X. (2015). Understanding consumers’ continuance intention towards mobile purchase: A theoretical framework and empirical study - A case of China. Computers in Human Behavior, 53, 249–262. https://doi.org/10.1016/j.chb.2015.07.014

Gefen, D., Karahanna, E., & Straub, D. W. (2003). Trust and TAM in Online Shopping: An Integrated Model. MIS Quarterly, 27(1), 51–90. https://doi.org/10.2307/30036519

Ghazali, R., Haryanto, J. O., Utomo, W. H., Santoso, A. S., Nugraha, R., & Asgha, B. (2019). Exploring the Drivers of Mobile Based Peer to Peer Lending Application Service Quality in Indonesia. ICSECC 2019 - International Conference on Sustainable Engineering and Creative Computing: New Idea, New Innovation, Proceedings, 343–348. https://doi.org/10.1109/ICSECC.2019.8907142

Gu, J. C., Lee, S. C., & Suh, Y. H. (2009). Determinants of behavioral intention to mobile banking. Expert Systems with Applications, 36(9), 11605–11616. https://doi.org/10.1016/j.eswa.2009.03.024

Gupta, A., & Xia, C. (2018). A Paradigm Shift in Banking: Unfolding Asia’s Fintech Adventures. In International Symposia in Economic Theory and Econometrics (Vol. 25, pp. 215-254). Emerald Publishing Ltd. https://doi.org/10.1108/S1571-038620180000025010

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2017). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). SAGE Publications.

Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. https://doi.org/10.1108/EBR-11-2018-0203

Hamid, A. A., Razak, F. Z. A., Bakar, A. A., & Abdullah, W. S. W. (2016). The Effects of Perceived Usefulness and Perceived Ease of Use on Continuance Intention to Use E-Government. Procedia Economics and Finance, 35(October 2015), 644–649. https://doi.org/10.1016/s2212-5671(16)00079-4

He, L., Sopjani, L., & Laurenti, R. (2021). User participation dilemmas in the circular economy: An empirical study of Scandinavia’s largest peer-to-peer product sharing platform. Sustainable Production and Consumption, 27, 975–985. https://doi.org/10.1016/j.spc.2021.02.027

Hidajat, T. (2019). Unethical practices peer-to-peer lending in Indonesia. Journal of Financial Crime, 27(1), 274–282. https://doi.org/10.1108/JFC-02-2019-0028

Hsieh, P. J. (2015). Physicians’ acceptance of electronic medical records exchange: An extension of the decomposed TPB model with institutional trust and perceived risk. International Journal of Medical Informatics, 84(1), 1–14. https://doi.org/10.1016/j.ijmedinf.2014.08.008

Huang, S. M., Shen, W. C., Yen, D. C., & Chou, L. Y. (2011). IT governance: Objectives and assurances in internet banking. Advances in Accounting, 27(2), 406–414. https://doi.org/10.1016/j.adiac.2011.08.001

Hwang, Y., & Kim, D. J. (2007). Customer self-service systems: The effects of perceived Web quality with service contents on enjoyment, anxiety, and e-trust. Decision Support Systems, 43(3), 746–760. https://doi.org/10.1016/j.dss.2006.12.008

Ichwan, I., & Kasri, R. (2019). Why Are Youth Intent on Investing Through Peer To Peer Lending? Evidence From Indonesia. Journal of Islamic Monetary Economics and Finance, 5(4), 741–762. https://doi.org/10.21098/jimf.v5i4.1157

Jones, K., & Leonard, L. N. K. (2008). Trust in consumer-to-consumer electronic commerce. Information and Management, 45(2), 88–95. https://doi.org/10.1016/j.im.2007.12.002

Kalinic, Z., Marinkovic, V., Molinillo, S., & Liébana-Cabanillas, F. (2019). A multi-analytical approach to peer-to-peer mobile payment acceptance prediction. Journal of Retailing and Consumer Services, 49(December 2018), 143–153. https://doi.org/10.1016/j.jretconser.2019.03.016

Kate, A. T., & Niels, G. (2020). Critical Mass for Two-sided Platforms and the Strength of the Externalities. SSRN Electronic Journal, 2010, 1–25. https://doi.org/10.2139/ssrn.3591811

Khan, S., Umer, R., Umer, S., & Naqvi, S. (2021). Antecedents of trust in using social media for E-government services: An empirical study in Pakistan. Technology in Society, 64, 101400. https://doi.org/10.1016/j.techsoc.2020.101400

Kim, C., Mirusmonov, M., & Lee, I. (2010). An Empirical Examination of Factors Influencing the Intention to Use Mobile Payment. Computers in Human Behavior, 26(3), 310–322. https://doi.org/10.1016/j.chb.2009.10.013

Kim, J. B. (2012). An Empirical Study on Consumer First Purchase Intention in Online Shopping: Integrating Initial Trust and TAM. Electronic Commerce Research, 12(2), 125–150. https://doi.org/10.1007/s10660-012-9089-5

Kim, K. K., & Prabhakar, B. (2004). Initial Trust and the Adoption of B2C e-Commerce. ACM SIGMIS Database: The DATABASE for Advances in Information Systems, 35(2), 50–64. https://doi.org/10.1145/1007965.1007970

Kim, S. S., & Malhotra, N. K. (2005). A Longitudinal Model of Continued IS Use: An Integrative View of Four Mechanisms Underlying Post-Adoption Phenomena. Management Science, 51(5), 741–755. https://doi.org/10.1287/mnsc.1040.0326

Kohardinata, C., Soewarno, N., & Tjahjadi, B. (2020). Indonesian Peer to Peer Lending (P2P) at Entrant’s Disruptive Trajectory. Business: Theory and Practice, 21(1), 104–114. https://doi.org/10.3846/btp.2020.11171

KPMG Siddharta Advisory. (2018). The Fintech Edge: Peer-to-Peer Lending (Issue November). https://assets.kpmg/content/dam/kpmg/id/pdf/2018/11/id-the-fintech-edge-p2p-lending.pdf

Kumar, A., Adlakaha, A., & Mukherjee, K. (2018). The Effect of Perceived Security and Grievance Redressal on Continuance Intention to Use M-Wallets in a Developing Country. International Journal of Bank Marketing, 36(7), 1170–1189. https://doi.org/10.1108/IJBM-04-2017-0077

Lean, O. K., Zailani, S., Ramayah, T., & Fernando, Y. (2009). Factors influencing intention to use e-government services among citizens in Malaysia. International Journal of Information Management, 29(6), 458–475. https://doi.org/10.1016/j.ijinfomgt.2009.03.012

Lee, D. K. C., & Teo, E. G. S. (2015). Emergence of Fintech and the Lasic Principles. SSRN Electronic Journal, April. https://doi.org/10.2139/ssrn.2668049

Lee, J.-S., & Sung, D.-K. (2018). Examining Factors Influencing the Intention to Use Mobile Payment: Focusing on Self-Construal. Journal of Digital Convergence, 16(4), 137–147. https://doi.org/10.14400/JDC.2018.16.4.137

Lee, J. M., & Kim, H. J. (2020). Determinants of adoption and continuance intentions toward Internet-only banks. International Journal of Bank Marketing, 38(4), 843–865. https://doi.org/10.1108/IJBM-07-2019-0269

Lew, S., Tan, G. W. H., Loh, X. M., Hew, J. J., & Ooi, K. B. (2020). The disruptive mobile wallet in the hospitality industry: An extended mobile technology acceptance model. Technology in Society, 63, 101430. https://doi.org/10.1016/j.techsoc.2020.101430

Li, Q., Chen, L., & Zeng, Y. (2018). The mechanism and effectiveness of credit scoring of P2P lending platform: Evidence from Renrendai.com. China Finance Review International, 8(3), 256–274. https://doi.org/10.1108/CFRI-06-2017-0156

Liu, J., Li, X., & Wang, S. (2020). What have we learnt from 10 years of fintech research? A scientometric analysis. Technological Forecasting and Social Change, 155(March), 120022. https://doi.org/10.1016/j.techfore.2020.120022

Lou, H., Luo, W., & Strong, D. (2000). Perceived critical mass effect on groupware acceptance. European Journal of Information Systems, 9(2), 91–103. https://doi.org/10.1057/palgrave.ejis.3000358

Lynn, T., Mooney, J. G., Rosati, P., & Cummins, M. (2019). Disrupting Finance: FinTech and Strategy in the 21st Century. Palgrave Macmillan.

Ma, Q., & Liu, L. (2005). The Role of Internet Self-efficacy in the Acceptance of Web-Based Electronic Medical Records. Journal of Organizational and End User Computing, 17(1), 38–57. https://doi.org/10.4018/joeuc.2005010103

Mahler, A., & Rogers, E. M. (1999). The diffusion of interactive communication innovations and the critical mass: The adoption of telecommunications services by German banks. Telecommunications Policy, 23(10–11), 719–740. https://doi.org/10.1016/S0308-5961(99)00052-X

Mallat, N., & Tuunainen, V. K. (2008). Exploring Merchant Adoption of Mobile Payment Systems: An Empirical Study. E-Service Journal, 6(2), 24. https://doi.org/10.2979/esj.2008.6.2.24

Markus, M. L. (1987). Toward a “Critical Mass” Theory of Interactive Media: Universal Access, Interdependence and Diffusion. Communication Research, 14(5), 491–511. https://doi.org/10.1177/009365087014005003

McCole, P., Ramsey, E., Kincaid, A., Fang, Y., & LI, H. (2019). The role of structural assurance on previous satisfaction, trust and continuance intention: The case of online betting. Information Technology and People, 32(4), 781–801. https://doi.org/10.1108/ITP-08-2017-0274

McKnight, D. H., Choudhury, V., & Kacmar, C. (2002). The impact of initial consumer trust on intentions to transact with a web site: A trust building model. Journal of Strategic Information Systems, 11(3–4), 297–323. https://doi.org/10.1016/S0963-8687(02)00020-3

McKnight, D. H., Cummings, L. L., & Chervany, N. L. (1998). Initial Trust Formation in New Organizational Relationships. The Academy of Management Review, 23(3), 473–490. https://doi.org/10.2307/259290

Moghavvemi, S., Mei, T. X., Phoong, S. W., & Phoong, S. Y. (2021). Drivers and barriers of mobile payment adoption: Malaysian merchants’ perspective. Journal of Retailing and Consumer Services, 59(March 2020), 102364. https://doi.org/10.1016/j.jretconser.2020.102364

Moraes, G. H. S. M., & Meirelles, F. S. (2017). User’s perspective of Eletronic Government adoption in Brazil. Journal of Technology Management and Innovation, 12(2), 1–10. https://doi.org/10.4067/S0718-27242017000200001

Mou, J., Shin, D. H., & Cohen, J. (2017). Understanding trust and perceived usefulness in the consumer acceptance of an e-service: a longitudinal investigation. Behaviour and Information Technology, 36(2), 125–139. https://doi.org/10.1080/0144929X.2016.1203024

Mun, Y. P., Khalid, H., & Nadarajah, D. (2017). Millennials’ Perception on Mobile Payment Services in Malaysia. Procedia Computer Science, 124, 397–404. https://doi.org/10.1016/j.procs.2017.12.170

Nelloh, L. A. M., Santoso, A. S., & Slamet, M. W. (2019). Will Users Keep Using Mobile Payment? It Depends on Trust and Cognitive Perspectives. Procedia Computer Science, 161, 1156–1164. https://doi.org/10.1016/j.procs.2019.11.228

Ntaukira, J., Maliwichi, P., & Khomba, J. K. (2021). Factors that Determine Continuous Intention to Use Mobile Payments in Malawi. Proceedings of the 1st Virtual Conference on Implications of Information and Digital Technologies for Development, 669–684. https://arxiv.org/abs/2108.09944

Nugroho, Y., & Samudera, I. (2018). All eyes on e-money: The race to reach 180M unbanked Indonesians. Google. https://www.thinkwithgoogle.com/intl/en-apac/tools-resources/research-studies/all-eyes-e-money-race-reach-180m-unbanked-indonesians/

Nuryakin, C., Aisha, L., & Massie, N. W. G. (2019). Financial Technology in Indonesia: A Fragmented Instrument for Financial Inclusion? In LPEM-FEB UI Working Paper 036 (May Issue).

Oliver, P., Marwell, G., & Teixeira, R. (1985). A Theory of the Critical Mass. I. Interdependence, Group Heterogeneity, and the Production of Collective Action. American Journal of Sociology, 91(3), 522–556. https://doi.org/10.1086/228313

Ondrus, J., Gannamaneni, A., & Lyytinen, K. (2015). The Impact of Openness on the Market Potential of Multi-sided Platforms: A Case Study of Mobile Payment Platforms. Journal of Information Technology, 30(3), 260–275. https://doi.org/10.1057/jit.2015.7

Osakwe, C. N., Okeke, T. C., & Kwarteng, M. A. (2021). Trust building in mobile money and its outcomes. European Business Review. https://doi.org/10.1108/EBR-09-2020-0221

Ozturk, A. B. (2016). Customer acceptance of cashless payment systems in the hospitality industry. International Journal of Contemporary Hospitality Management, 28(4), 801–817. https://doi.org/10.1108/IJCHM-02-2015-0073

Panagiotopoulos, I., & Dimitrakopoulos, G. (2018). An empirical investigation on consumers’ intentions towards autonomous driving. Transportation Research Part C: Emerging Technologies, 95(January), 773–784. https://doi.org/10.1016/j.trc.2018.08.013

Pavlou, P. A. (2001). Integrating Trust in Electronic Commerce with the Technology Acceptance Model: Model Development and Validation. Seventh Americas Conference on Information Systems, 816–822. https://aisel.aisnet.org/amcis2001/159/

Pohan, N. W. A., Budi, I., & Suryono, R. R. (2020). Borrower Sentiment on P2P Lending in Indonesia Based on Google Playstore Reviews. Sriwijaya International Conference on Information Technology and Its Applications, 172(Siconian 2019), 17–23. https://doi.org/10.2991/aisr.k.200424.003

Premkumar, G., Ramamurthy, K., & Liu, H. N. (2008). Internet messaging: An examination of the impact of attitudinal, normative, and control belief systems. Information and Management, 45(7), 451–457. https://doi.org/10.1016/j.im.2008.06.008

Putritama, A. (2019). The Mobile Payment Fintech Continuance Usage Intention in Indonesia. Jurnal Economia, 15(2), 243–258. https://doi.org/10.21831/economia.v15i2.26403

PwC Indonesia. (2019). Indonesia’s Fintech Lending: Driving Economic Growth Through Financial Inclusion. Executive Summary PwC Indonesia - Fintech Series. https://www.pwc.com/id/en/fintech/PwC_FintechLendingThoughtLeadership_ExecutiveSummary.pdf

Roca, J. C., García, J. J., & de la Vega, J. J. (2009). The importance of perceived trust, security and privacy in online trading systems. Information Management and Computer Security, 17(2), 96–113. https://doi.org/10.1108/09685220910963983

Sánchez, R. A., & Hueros, A. D. (2010). Motivational factors that influence the acceptance of Moodle using TAM. Computers in Human Behavior, 26(6), 1632–1640. https://doi.org/10.1016/j.chb.2010.06.011

Sangwan, V., Harshita, Prakash, P., & Singh, S. (2019). Financial technology: A review of extant literature. Studies in Economics and Finance, 37(1), 71–88. https://doi.org/10.1108/SEF-07-2019-0270

Sarkar, S., Chauhan, S., & Khare, A. (2020). A meta-analysis of antecedents and consequences of trust in mobile commerce. International Journal of Information Management, 50(March 2019), 286–301. https://doi.org/10.1016/j.ijinfomgt.2019.08.008

Sha, W. (2009). Types of structural assurance and their relationships with trusting intentions in business-to-consumer e-commerce. Electronic Markets, 19(1), 43–54. https://doi.org/10.1007/s12525-008-0001-z

Shanmugam, A., Savarimuthu, M. T., & Wen, T. C. (2014). Factors Affecting Malaysian Behavioral Intention to Use Mobile Banking with Mediating Effects of Attitude. Academic Research International, 5(2), 236–253.

Shen, D., Laffey, J., Lin, Y., & Huang, X. (2006). Social Influence for Perceived Usefulness and Ease-of-Use of Course Delivery Systems. Journal of Interactive Online Learning, 5(3), 270–282.

Shi, X., & Liao, Z. (2017). Online consumer review and group-buying participation: The mediating effects of consumer beliefs. Telematics and Informatics, 34(5), 605–617. https://doi.org/10.1016/j.tele.2016.12.001

Shiau, W. L., Yuan, Y., Pu, X., Ray, S., & Chen, C. C. (2020). Understanding fintech continuance: Perspectives from self-efficacy and ECT-IS theories. Industrial Management and Data Systems, 120(9), 1659–1689. https://doi.org/10.1108/IMDS-02-2020-0069

Sitompul, M. G. (2019). Urgensi Legalitas Financial Technology (Fintech): Peer To Peer (P2P) Lending Di Indonesia. Jurnal Yuridis Unaja, 1(2), 68–79. https://doi.org/10.35141/jyu.v1i2.428

Sledgianowski, D., & Kulviwat, S. (2009). Using Social Network Sites: The Effects of Playfulness, Critical Mass and Trust in a Hedonic Context. Journal of Computer Information Systems, 49(4), 74–83. https://doi.org/10.1080/08874417.2009.11645342

Susanti, R., Dalimunthe, Z., & Triono, R. A. (2016). What Factors Affect the Intention to Borrow Through Peer to Peer Lending in Indonesia ? Education Excellence and Innovation Management: A 2025 Vision to Sustain Economic Development during Global Challenges, 521–530.

Syahrivar, J., Chairy, C., Juwono, I. D., & Gyulavári, T. (2022). Pay to play in freemium mobile games: A compensatory mechanism. International Journal of Retail and Distribution Management, 50(1), 117–134. https://doi.org/10.1108/IJRDM-09-2020-0358

Taherdoost, H. (2018). Validity and Reliability of the Research Instrument; How to Test the Validation of a Questionnaire/Survey in a Research. SSRN Electronic Journal, 5(3), 28–36. https://doi.org/10.2139/ssrn.3205040

Talwar, S., Dhir, A., Khalil, A., Mohan, G., & Islam, A. K. M. N. (2020). Point of adoption and beyond. Initial trust and mobile-payment continuation intention. Journal of Retailing and Consumer Services, 55, 102086. https://doi.org/10.1016/j.jretconser.2020.102086

Tarhini, A., El-Masri, M., Ali, M., & Serrano, A. (2016). Extending the utaut model to understand the customers’ acceptance and use of internet banking in lebanon a structural equation modeling approach. Information Technology and People, 29(4), 830–849. https://doi.org/10.1108/ITP-02-2014-0034

Teo, T., Zhou, M., Fan, A. C. W., & Huang, F. (2019). Factors that influence university students’ intention to use Moodle: A study in Macau. Educational Technology Research and Development, 67(3), 749–766. https://doi.org/10.1007/s11423-019-09650-x

Tongco, M. D. C. (2007). Purposive Sampling as a Tool for Informant Selection. Ethnobotany Research and Applications, 5, 147–158. https://doi.org/10.17348/era.5.0.147-158

Upadhyay, P., & Jahanyan, S. (2016). Analyzing user perspective on the factors affecting use intention of mobile based transfer payment. Internet Research, 26(1), 38–56. https://doi.org/10.1108/IntR-05-2014-0143

Van der Heijden, H. (2004). User Acceptance of Hedonic Information Systems. MIS Quarterly, 28(4), 695–704. https://doi.org/10.2307/25148660

Van Slyke, C., Ilie, V., Lou, H., & Stafford, T. (2007). Perceived critical mass and the adoption of a communication technology. European Journal of Information Systems, 16(3), 270–283. https://doi.org/10.1057/palgrave.ejis.3000680

Venkatesh, V., & Davis, F. D. (2000). A Theoretical Extension of the Technology Acceptance Model: Four Longitudinal Field Studies. Management Science, 46(2), 186–204. https://doi.org/10.1287/mnsc.46.2.186.11926

Verkijika, S. F., & Neneh, B. N. (2021). Standing up for or against: A text-mining study on the recommendation of mobile payment apps. Journal of Retailing and Consumer Services, 63(August), 102743. https://doi.org/10.1016/j.jretconser.2021.102743

Voorhees, C. M., Brady, M. K., Calantone, R., & Ramirez, E. (2016). Discriminant validity testing in marketing: An analysis, causes for concern, and proposed remedies. Journal of the Academy of Marketing Science, 44(1), 119–134.

Wang, H., & Hu, Z. (2009). Online Trust between Inexperienced Consumers and Experienced Consumers: An Empirical Study. 2009 2nd International Conference on Future Information Technology and Management Engineering, 167–170. https://doi.org/10.1109/FITME.2009.47

Wang, P., Zheng, H., Chen, D., & Ding, L. (2015). Exploring the critical factors influencing online lending intentions. Financial Innovation, 1(1), 1–11. https://doi.org/10.1186/s40854-015-0010-9

Wang, Z., Guan, Z., Hou, F., Li, B., & Zhou, W. (2019). What determines customers’ continuance intention of FinTech? Evidence from YuEbao. Industrial Management and Data Systems, 119(8), 1625–1637. https://doi.org/10.1108/IMDS-01-2019-0011

Widyanto, H. A., Kusumawardani, K. A., & Septyawanda, A. (2020). Encouraging Behavioral Intention To Use Mobile Payment: An Extension of UTAUT2. Jurnal Muara Ilmu Ekonomi Dan Bisnis, 4(1), 87. https://doi.org/10.24912/jmieb.v4i1.7584

Wingreen, S., & Baglione, S. (2005). Untangling the Antecedents and Covariates of E‐Commerce Trust: Institutional Trust vs. Knowledge‐Based Trust. Electronic Markets, 15(3), 246–260. https://doi.org/10.1080/10196780500209010

Wong, L. W., Tan, G. W. H., Hew, J. J., Ooi, K. B., & Leong, L. Y. (2020). Mobile social media marketing: A new marketing channel among digital natives in higher education? Journal of Marketing for Higher Education, 0(0), 1–25. https://doi.org/10.1080/08841241.2020.1834486

Wu, B., & Chen, X. (2017). Continuance intention to use MOOCs: Integrating the technology acceptance model (TAM) and task technology fit (TTF) model. Computers in Human Behavior, 67, 221–232. https://doi.org/10.1016/j.chb.2016.10.028

Yan, Y., Lv, Z., & Hu, B. (2018). Building investor trust in the P2P lending platform with a focus on Chinese P2P lending platforms. Electronic Commerce Research, 18(2), 203–224. https://doi.org/10.1007/s10660-017-9255-x

Yiu, C. S., Grant, K., & Edgar, D. (2007). Factors affecting the adoption of Internet Banking in Hong Kong—implications for the banking sector. International Journal of Information Management, 27(5), 336–351. https://doi.org/10.1016/j.ijinfomgt.2007.03.002

Yousafzai, S. Y., Pallister, J. G., & Foxall, G. R. (2005). Strategies for building and communicating trust in electronic banking: A field experiment. Psychology and Marketing, 22(2), 181–201. https://doi.org/10.1002/mar.20054

Yuan, S., Liu, Y., Yao, R., & Liu, J. (2016). An investigation of users’ continuance intention towards mobile banking in China. Information Development, 32(1), 20–34. https://doi.org/10.1177/0266666914522140

Yunus, U. (2019). A Comparison Peer to Peer Lending Platforms in Singapore and Indonesia. Journal of Physics: Conference Series, 1235(1), 1–6. https://doi.org/10.1088/1742-6596/1235/1/012008

Zhou, T. (2013). An empirical examination of continuance intention of mobile payment services. Decision Support Systems, 54(2), 1085–1091. https://doi.org/10.1016/j.dss.2012.10.034

Zhou, T., Lu, Y., & Wang, B. (2010). Integrating TTF and UTAUT to explain mobile banking user adoption. Computers in Human Behavior, 26(4), 760–767. https://doi.org/10.1016/j.chb.2010.01.013

Zhou, W., Tsiga, Z., Li, B., Zheng, S., & Jiang, S. (2018). What influence users’ e-finance continuance intention? The moderating role of trust. Industrial Management and Data Systems, 118(8), 1647–1670. https://doi.org/10.1108/IMDS-12-2017-0602

Zuo, T., & Wang, M. (2012). A preliminary study of perceived critical mass effect on accepting internet products. Proceedings of 2012 International Conference on Information Management, Innovation Management and Industrial Engineering, ICIII 2012, 1, 292–296. https://doi.org/10.1109/ICIII.2012.6339659

Appendix

Table A1

Measurement scales

|

Latent Variables |

Code |

Source |

Adjusted Statements |

|

Perceived Structural Assurance |

PSA1 |

(Shi & Liao, 2017) |

Legal P2P lending platforms have a rigorous privacy and security policy. |

|

PSA2 |

Legal P2P lending platforms have implemented proper privacy and security measures. |

||

|

PSA3 |

I perceive that legal P2P lending platforms can lawfully protect customer rights. |

||

|

PSA4 |

I feel that legal P2P lending platforms have relatively low risks. |

||

|

PSA5 |

I feel that legal P2P lending platforms are free of security problem. |

||

|

PSA6 |

(Chandra et al., 2010) |

I believe that existing legal structures can sufficiently protect me from potential problems with legal P2P lending platforms. |

|

|

PSA7 |

I am confident that encryption and other technological safeguards make it safe for me to borrow money from legal P2P lending platforms. |

||

|

Perceived Critical Mass |

PCM1 |

(Van Slyke et al., 2007) |

A lot of people I communicate with borrow money from legal P2P lending platforms. |

|

PCM2 |

Many people I know want to continue borrowing money from legal P2P lending platforms in the future. |

||

|

PCM3 |

(Lew et al., 2020) |

A lot of my colleagues borrow money from legal P2P lending platforms. |

|

|

PCM4 |

(Wong et al., 2020) |

I predict that many of my friends will borrow money from legal P2P lending platforms in the future. |

|

|

PCM5 |

Many people in the groups that I am a part of borrow money from legal P2P lending platforms. |

||

|

Perceived Ease of Borrowing |

PEB1 |

(Chandra et al., 2010) |

Learning to use P2P lending application to borrow money would be easy for me. |

|

PEB2 |

In general, I believe borrowing money from P2P lending platform is an easy undertaking to do. |

||

|

PEB3 |

I would find it easy to become skillful at borrowing money from a P2P lending platform. |

||

|

PEB4 |

(Wong et al., 2020) |

I believe that I can borrow money from P2P lending platform on my own without having to ask for a help from an expert. |

|

|

PEB5 |

Borrowing money from legal P2P lending platforms does not require a lot of mental effort. |

||

|

Perceived Usefulness |

PU1 |

(Wong et al., 2020) |

Borrowing money from legal P2P lending platforms is useful to support my daily life. |

|

PU2 |

(Mou et al., 2017) |

Borrowing money from legal P2P lending platforms is beneficial to support my financial condition. |

|

|

PU3 |

Borrowing money from legal P2P lending platforms can enhance my effectiveness in managing my personal finances. |

||

|

PU4 |

(Putritama, 2019) |

Borrowing money from legal P2P lending platforms is better than borrowing from other traditional financial services. |

|

|

PU5 |

I believe borrowing money from legal P2P lending platforms has many positive benefits. |

||

|

PU6 |

(Roca et al., 2009) |

I would find borrowing money from legal P2P lending platforms to be useful in supporting my financial condition. |

|

|

Continuance Intention to Borrow |

ITB1 |

(Asnakew, 2020) |

If possible, I would keep on borrowing money from P2P lending platforms. |

|

ITB2 |

(Lew et al., 2020) |

I am likely to borrow money from P2P lending platforms in the near future. |

|

|

ITB3 |

Given the opportunity, I will borrow money from P2P lending platforms. |

||

|

ITB4 |

I will consider borrowing money from legal P2P lending platforms. |

||

|

ITB5 |

(Cheng et al., 2006) |

I intend to borrow money from legal P2P lending platforms to support my financial condition. |