), asset prices (

), asset prices ( ), and external shocks (LEt).

), and external shocks (LEt).Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(3), pp. 22–39 DOI: https://doi.org/10.15388/Ekon.2024.103.3.2

Ahmed Kchikeche*

Mohammed V University of Rabat, Morocco

Orcid: https://orcid.org/0000-0003-1928-3381

Email: ahmed_kchikeche@um5.ac.ma

Driss Mafamane

Mohammed V University of Rabat, Morocco

Orcid : https://orcid.org/0009-0008-4796-9886

Email: d.mafamane@um5r.ac.ma

Abstract. We investigate external shocks and asset price’s impact on the slowdown of business and household credit in Morocco using disequilibrium models. The results show that banks’ fly to quality, driven by a simultaneous decline in interest margins and borrower creditworthiness, is a key factor behind the slowdown of credit supply. On the demand side, slower growth and saturated housing demand have contributed to reduced borrowing and repayment capacity of borrowers. Furthermore, external shocks are transmitted to credit supply through foreign deposits and households’ credit demand through remittances. Additionally, stocks and residential real estate asset prices are closely tied to credit demand. These findings suggest that addressing bank credit barriers could stimulate economic growth. To do so, policymakers may consider employing unconventional monetary policy tools to effectively manage the transmission channels of external shocks and asset prices to bank credit dynamics.

Keywords: Bank credit; Asset prices; External shocks; Disequilibrium model.

_________

* Correspondent author.

Received: 31/05/2024. Revised: 22/06/2024. Accepted: 07/07/2024

Copyright © 2024 Ahmed Kchikeche, Driss Mafamane. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Over the last decades, Morocco has experienced a substantial slowdown in economic growth (Sadok et al., 2022). This slowdown has coincided with an unprecedented decline in bank credit to the private sector.1 In developing countries, bank credit and economic growth are closely linked. Given the importance of bank credit as a source of financing in these countries (Kchikeche et al., 2024), investigating credit slowdowns has crucial policy implications, as determining their causes helps to choose the appropriate policy tools for intervention. For example, monetary policy is better equipped to deal with credit supply while fiscal policy is more appropriate for stimulating credit demand (Tamini & Petey, 2021).

The literature examining credit slowdowns often neglects the impact of some key factors on bank credit dynamics. For instance, while previous studies emphasized the impact of economic and financial crises on the real sector (Abere & Akinbobola, 2020; Rodríguez et al., 2023), studies on the transmission of external shocks to credit growth are scarce (Krishnamurthy & Muir, 2017; Mamonov et al., 2020; Silalahi et al., 2012). Furthermore, while several authors examined the impact of credit growth on asset prices (Gerdesmeier et al., 2010; Mora, 2008; Singh & Nadkarni, 2020), studies on the effect of asset prices on bank credit are lacking (Frommel & Karagyozova, 2008; Gupta et al., 2022; Pouvelle, 2012).

Examining the impact of these factors requires identifying their transmission channels to credit supply and demand. However, empirically distinguishing credit supply from demand is challenging since they can only be jointly observed at equilibrium (Stiglitz & Weiss, 1981). To deal with this identification problem, disequilibrium models developed by Maddala & Nelson (1974) are used to estimate supply and demand. Studies employing these models explain credit slowdowns, verify credit rationing, and investigate specific bank credit determinants (Barajas & Steiner, 2002; Herrera et al., 2013; Oulidi & Allain, 2009; Pazarbasioglu, 1997; Tamini & Petey, 2021). Thus, this class of models constitutes an appropriate tool to fill this gap in the literature.

Our study contributes to the existing literature by employing disequilibrium models to simultaneously identify the impact of external shocks and asset prices on the supply and demand for business and household credit. In addition to examining the traditional determinants of bank credit, our approach investigates the underlying causes of credit slowdowns by highlighting the transmission channels through which shocks to foreign capital inflows, liquidity, remittances, and changes in expected stock and residential property prices influence credit dynamics. To do so, the first section discusses the relevant literature, the second one describes our data and methodology, and the third one presents and discusses our results.

Examining credit slowdowns was conducted through various methods, from regression analysis (Bernanke et al., 1991), to survey-based studies (Ito & Pereira da Silva, 1999). These methods, however, fail to distinguish supply from demand (Tamini & Petey, 2021).

According to Stiglitz & Weiss (1981), credit markets are characterized by disequilibrium, as imperfections prevent interest rates from equating supply and demand. Thus, banks use nonprice terms to allocate credit supply at levels that can be below credit demand at the prevailing interest rate. Conversely, the endogenous money theory stipulates that banks are not constrained by the availability of funding and only face soft constraints related to profitability and prudential regulations (Ábel & Mérő, 2023).

Consequently, distinguishing supply from demand is necessary to properly identify the causes of credit slowdowns (Jiménez et al., 2012). While microeconomic loan-level data can help differentiate supply from demand factors, data on loan applications are often available, especially in developing countries.

Ghosh & Ghosh (2000) used aggregated data to distinguish credit supply from demand by imposing exclusionary restrictions on the demand function, identifying two exclusive supply variables: the bank’s ability and willingness to lend. The first variable relies on liquidity availability and regulatory capital compliance, while the second is influenced by banks’ risk perception and asset quality. Barajas & Steiner (2002) focused their analysis on credit to the private sector in various Latin American countries. Similarly, Herrera et al. (2013) studied the impact of international capital flows on bank credit dynamics, showing that contracting capital inflows exacerbated the post-2008 credit crunch. Also, Dumičić & Ljubaj (2018) disaggregate private sector credit into business and household credit, owing to the heterogeneity of these components. Recent applications of this class of models are Adair & Adaskou (2020), Ghosh et al. (2023) and Karmelavičius et al. (2022).

Negative exogenous shocks to the economy can reduce lending (Emre Akgündüz et al., 2021). Although promising, the examined literature often overlooks the impact of external shocks and asset prices on lending. Silalahi et al. (2012) suggest that foreign banks transmit financial crises to developing countries via credit crunches. According to Aiyar (2011), financial stress in foreign countries translates into credit crunches through cuts to foreign sources of funds. Finally, (Dinger & te Kaat, 2020; Mamonov et al., 2020) show that shocks to capital inflows strongly affect credit slowdowns, an impact transmitted through credit risk (Chen & Li, 2024; Dinger & te Kaat, 2020).

Similarly, few studies examined the impact of asset prices on bank credit. Frommel & Karagyozova (2008) argue that asset prices affect credit demand through a wealth effect, as higher asset prices stimulate aggregate and credit demand. (Kiyotaki & Moore, 1997) suggest that raising asset prices affects credit demand through borrowers’ net worth and collateral. Gupta et al. (2022) show that higher asset prices used as collateral improves credit growth. These studies presented some interesting empirical evidence. Frommel & Karagyozova (2008) show a time-varying relationship between asset prices and bank lending. Pouvelle (2012) illustrates that while stock prices have a robust effect on lending, property prices only affect credit growth in periods of financial stress. Gupta et al. (2022) show that higher real-estate collateral value improves business credit growth.

To our knowledge, while Oulidi & Allain (2009) explored the role that asset prices played in an earlier credit crunch (2000–2004), the recent credit slowdown in Morocco remains understudied. Overall, the literature provides two takeaways. First, the causes of credit slowdowns are country-specific. Second, the relative role of, and the channel by which, external shocks and asset prices affect credit needs a thorough examination. Our study aims to fill these gaps.

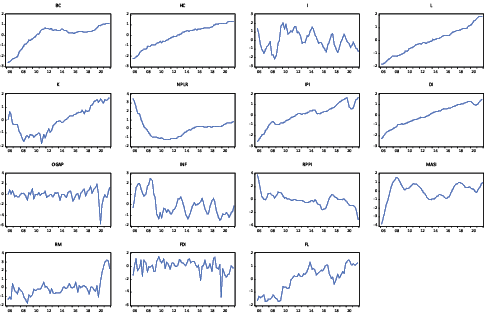

We estimate disequilibrium models for business and household credit during the period 2006–2021. The study period is justified by the unavailability of data on lending rates and property prices before 2006.

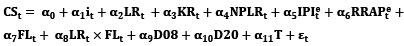

Credit supply is determined based on a bank asset portfolio management framework (Pazarbasioglu, 1997). Accordingly, supply is a function of the profitability of the lending activity (it), balance-sheet constraints (LRt, KRt), the bank’s evaluation of the quality of current and future borrowers ( ), asset prices (

), asset prices ( ), and external shocks (LEt).

), and external shocks (LEt).

The specifications of the supply functions of business and household credit are similar and are represented by equation (1) below.

(1)

(1)

where CSt denotes credit supply, it the real lending rate, Lt the liquid liabilities, KRt the capital ratio, NPLRt the nonperforming loans ratio, IPIte the expected industrial production, RRAPte the expected residential real estate prices index, FLt foreign liquidity, T a linear trend, and D08 and D20 are dummy variables indicating the impact of the 2008 and the COVID-19 crises, respectively.

We use a real lending rate as a measure of lending revenues (Ponomarenko, 2022), expecting it to be positively correlated with credit supply. However, information asymmetries and adverse selection can lead to credit rationing reducing supply (Beyhaghi et al., 2020).

Balance sheet characteristics indirectly measure banks’ ability to supply credit (Altavilla et al., 2021), as they constrain credit availability (Balke et al., 2021). Banks lend to creditworthy borrowers by creating the necessary funds, without the necessity for pre-existing deposits (Zolea, 2023). Nevertheless, liquid assets are needed for managing liquidity risk and meeting regulatory requirements. Thus, banks lend less in case of liquidity shortages (Thakor & Yu, 2023). We measure banks’ liquid liabilities as the logarithmic difference between deposits and reserves, expecting it to positively affect credit supply. Second, supply is affected by capital’s availability as prudential regulations require a capital buffer proportional to risk-weighted assets. Given that information asymmetries increase the cost of raising capital, undercapitalized banks can increase the capital ratio by either reducing supply or shifting it toward less risky borrowers (Fang et al., 2022). We measure bank capitalization using the logarithm of capital-to-credit ratio, expecting it to positively affect credit supply.

Risk management requires constant monitoring of the quality of potential borrowers using internal and external indicators. The NPL ratio usually indicates the quality of a bank’s loan portfolio and the bank’s risk perception (Naili & Lahrichi, 2022). Accordingly, we expect it to negatively affect supply (Tölö & Virén, 2021). Additionally, banks monitor economic conditions to form expectations about the quality of borrowers (Ma et al., 2021). We measure these expectations using the expected industrial production proxied by a 4-period distributed lag of the industrial production index, expecting it to positively affect supply.

Credit supply is closely linked to asset prices (Min et al., 2023). For instance, raising real estate asset prices positively affects the net worth of businesses and the book value of collateral (Gupta et al., 2022). Accordingly, we include the index of expected residential real estate asset prices, expecting it to positively affect credit supply.

External shocks are transmitted to credit supply by reducing foreign sources of funds (Aiyar, 2011). We account for external liquidity shocks by including the deposits of nonresident economic agents with Moroccan banks and the interaction term between this variable and liquid liabilities. We expect foreign liquidity to have a positive impact on credit supply, and this impact to be negatively moderated by liquidity availability.

The demand for credit is mainly determined by the cost of credit, borrowers’ expectations about the state of the economy, asset prices and external shocks. The specification of the demand function is different in the two versions of the model.

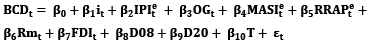

Business credit demand

(2)

(2)

where BCDt is business credit demand, it the real interest rate, IPIte the expected industrial production index, OGt the output gap, MASIte the expected Moroccan All Share Index, RRAPte the expected residential real estate price index, Rmt remittances, FDIt foreign direct investments, T a linear trend, and D08 and D20 are dummy variables indicating the impact of the 2008 and the COVID-19 crises, respectively

Business credit demand in equation (2) is driven by its cost and households’ expectations about the state of the economy. Therefore, we include the real lending rate as the main component of the price of credit (Ponomarenko, 2022), assuming it negatively affects business credit demand.

Furthermore, we use expected industrial production to represent firms’ expectations about future cash flows. Favorable economic conditions increase income and improve firms’ borrowing and repayment capacity (Lian & Ma, 2020). We expect this variable to positively affect business credit demand.

We also include the output gap following Ikhide (2003). This variable accounts for the increased demand for credit during periods of falling cashflows to maintain production levels, thus, we expect the sign of this variable to be negative.

We test the impact of external shocks on business credit demand through two transmission channels. First, foreign capital inflows increase working capital requirements and credit demand (Aiyar, 2011). Higher capital inflows stimulate credit growth and are generally associated with credit booms, particularly in countries with less flexible exchange rate regimes such as Morocco (Magud et al., 2014). Consequently, we expect FDI to positively affect demand. Second, remittances positively affect aggregate and business credit demand, so we expect the sign of this variable to be positive.

Furthermore, we examine the role of asset prices using two variables. First, expected residential real estate asset prices increase the value of residential real estate assets, improving the net worth of businesses and the value of their collateral (Frommel & Karagyozova, 2008; Gupta et al., 2022)

Second, the expected Moroccan All Shares Index represents borrowers’ expectations of economic conditions, as favorable conditions are associated with higher future income. However, higher stock prices indicate an increase in the net worth of firms and, consequently, their borrowing capacity (Pouvelle, 2012; Varadi, 2024). Finally, the index represents the opportunity cost of bank financing, as an improvement in this index can be interpreted as an improvement in the attractiveness of stock market financing. Thus, the sign of this variable is thus ambiguous.

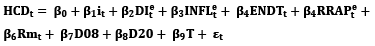

Household credit demand

Household credit demand is presented in equation (3) below.

(3)

(3)

where HCDt is household credit demand, it the real interest rate, DIte the expected disposable income, INFLte the expected inflation rate, ENDTt the indebtedness ratio, RRAPte the expected residential real estate price index, Rmt remittances, T a linear trend, and D08 and D20 are dummy variables indicating the impact of the 2008 and the COVID-19 crises, respectively

Household credit demand mainly depends on the cost of credit and the borrowing and repayment capacity of borrowers (Ponomarenko, 2022). Thus, we use the real lending rate as an indicator of the cost of credit and expect its sign to be negative.

Furthermore, we measure households’ borrowing capacity using expected disposable income. An anticipated rise in income incentivizes households to increase demand. Conversely, in the absence of precautionary balance, a reduction in expected income worsens the credit constraints of borrowers (Stiglitz & Guzman, 2021). Thus, this variable is expected to positively affect credit demand.

We include the expected inflation rate to measure uncertainty associated with the expected decline in purchasing power (Tamini & Petey, 2021), as uncertainty negatively affects credit demand (Ghosh & Ghosh, 2000). Furthermore, we also use the household indebtedness ratio, measured by dividing national disposable income by household credit. Since debt does not generate income for households, increasing indebtedness reduces their consumption and repayment capacity. Therefore, we expect the sign of this variable to be negative.

To measure the impact of asset prices on household credit demand, we use expected residential real estate asset prices representing housing demand and collateral value. Changes in residential real estate prices have both a wealth effect and a substitution effect; rising property prices reduce housing and credit demand. Furthermore, rising residential property prices may dissuade households from demanding housing credit and push them toward renting. However, real estate can serve as collateral for a loan application, so rising property prices improve the value of collateral and credit demand. The expected sign of this variable is ambiguous.

Finally, we measure the transmission of external exogenous shocks to household credit demand through remittances. This source of income can serve as a substitute for bank credit and negatively affects credit demand. Bjuggren et al. (2010) assert that remittances have a substitution effect on credit demand by offering an alternative to bank financing. The expected sign of this variable is negative.

Our data come from various national sources including Bank Al-Maghrib, High Commissary of Planning, Casablanca Stock Exchange, and the Exchange Office, as well as international data sources like the International Monetary Fund and the Bank for International Settlements.

Since we are mainly interested in long-run credit dynamics, some data transformations are necessary. First, we eliminate the effect of inflation on the levels of our variables by deflating all stock variables using the consumer price index. Second, to isolate the nonseasonal interactions between our variables, we seasonally adjust them using the X-13 seasonal adjustment procedure. In addition, our variables are in their log-linear form for the usual statistical reasons. Finally, all variables are standardized to avoid model instability (Guggisberg & Latshaw, 2020) and to facilitate comparing their relative impact. A table with the variable names, their calculation formulas, and expected signs, as well as a graphical representation of their evolution, are presented in Appendices 2 and 3. Finally, we note that variable handling was conducted using Excel and Eviews software while the estimations were conducted using the R script provided by Karapanagiotis (2024).

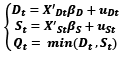

Our disequilibrium models consist of three equations:

(4)

(4)

where Dt is the demand for credit in t, St is the supply of credit in t, XDt and XSt are two vectors of independent variables of Dt and St, respectively, and uDt and uSt are i.i.d residuals. Furthermore, (6) is the short-side rule equation which, for each period t, associates the short side (the minimum of Dt and St) with Qt the quantity of observed credit.

Given this structure, the probability that an observation Qt is matched to the demand is given by

(5)

(5)

Since Qt can be assigned to the demand equation with probability πt and to the supply equation with probability 1 – πt, and given fD(Dt) and fS(Dt) the marginal density functions, and FD(Dt) and FS(Dt) the cumulative probability functions of demand and supply, respectively, the unconditional density of Qt is

(6)

(6)

Accordingly, L can be defined as the log-likelihood function:

(7)

(7)

Finally, by calculating the first and second derivatives of L, we can obtain the maximum likelihood estimates. A complete description of the practical implementation of the model can be found in (Karapanagiotis, 2024).

As with most macroeconomic stock series, observed credit likely has a unit root. In the presence of nonstationarity, inference on the significance of coefficients can only be made if observed credit forms a cointegrating vector with credit supply and demand, respectively (Ghosh & Ghosh, 2000). To check stationarity, we use the Dickey & Fuller (1979) unit root test. In addition, we test for cointegration using Johansen’s (1991, 1995) trace and the maximum eigenvalue statistics.

According to Ghosh & Ghosh (2000), inference based on disequilibrium models is only valid if there is a cointegrating relationship between observed credit and the estimated quantities of credit supply and demand. The unit root test results in Appendix 4 show that all endogenous variables are I(1). Furthermore, the cointegration test results in Appendix 5 show that there is a cointegrating relationship between observed credit and the estimated quantities of supply and demand in both models. Consequently, the interpretation of the regression coefficients is valid. The estimation results for the coefficients of the determinants of business and household credit are presented in Tables 1 and 2, respectively.

Table 1 shows that the real lending rate positively affects business credit supply. However, there is no evidence that real interest rates affect credit demand. These results show that business credit supply is elastic to variations in the lending rate, whereas credit demand is not.

|

Business credit demand |

Business credit supply |

||

|

Variable |

Coefficient |

Variable |

Coefficient |

|

C |

-2.704*** (0.085) |

C |

-0.719* (0.413) |

|

it |

-0.056 (0.050) |

it |

0.058*** (0.015) |

|

IPIte |

0.349*** (0.046) |

IPIte |

0.182 (0.225) |

|

MASIte |

-0.121*** (0.020) |

Lt |

0.084*** (0.030) |

|

OGt |

-0.021** (0.009) |

KRt |

-0.105** (0.050) |

|

RRAP ta |

0.199*** (0.052) |

NPLRt |

-0.381*** (0.028) |

|

Rmd |

0.040 (0.033) |

RRAP ta |

0.001 (0.012) |

|

IDEd |

-0.020 (0.032) |

LEt |

0.127*** (0.022) |

|

D08 |

-0.220** (0.111) |

Lt × LEt |

0.029 (0.037) |

|

D20 |

-6.500*** (0.072) |

D08 |

0.498*** (0.125) |

|

T |

0.173*** (0.004) |

D20 |

0.501*** (0.104) |

|

T |

0.011 (0.011) |

||

|

σt2 |

0.003*** (0.001) |

σt2 |

0.001*** (0.000) |

|

-2LL |

-231.504 |

||

Our results also show that balance sheet constraints significantly impact business credit supply. Liquidity positively affects business credit supply, demonstrating its importance for managing liquidity risk. However, the impact of bank equity is contrary to expectations. By examining the evolution of NPLs in Morocco during the study period, we can interpret this result by the possibility that faced with the deterioration in the quality of potential borrowers, Moroccan banks simultaneously increased their capital buffer and reduced business credit supply.

Furthermore, borrower quality is the main determinant of credit supply. Indeed, the NPL ratio is the largest significant coefficient in the business supply equation, showing its role in gauging credit risk. Conversely, the coefficient for expected industrial production is insignificant, showing that banks rely on their internal assessment of credit risk rather than macroeconomic indicators of economic conditions.

On the demand side, expected industrial production positively affects business credit demand. However, the output gap negatively impacts business credit demand indicating a precautionary component of it. While both effects seem contradictory, comparing the magnitude of the coefficient demonstrates the pro-cyclicality of business credit demand as the coefficient of the IPIe is bigger.

Our results show a significant impact of asset prices on business credit. First, property prices significantly impact credit demand. Thus, asset prices affect business credit demand by affecting net worth and collateral value, in support of Gupta’s et al. (2022) findings. Second, changes in stock market prices negatively affect business credit demand, showing that stock market prices affect credit demand via the substitutability of bank and stock market financing rather than by affecting net worth, as access to the Morrocan stock exchange is still limited to larger, more established firms (Kchikeche & Mafamane, 2024).

Finally, external shocks impact business credit as the dummy variables representing the 2008 financial crisis and the COVID-19 lockdown are significant in the supply and demand equations. Likewise, while external shocks have no impact on business credit demand, they are transmitted to business credit supply through foreign liquidity, as suggested by (Aiyar, 2011).

The estimates in Table 2 show that households and business credit supply respond differently to their determinants.

For instance, household credit supply is less sensitive to balance sheet constraints, more affected by their expectations of the economic conditions, and not affected by the bank’s balance sheet constraints. In addition, household credit supply is strongly affected by banks’ risk perception, as the coefficients of both the internal and external indicators of borrowers’ quality are significant. In contrast to business credit supply, banks rely more on their expectation about economic conditions to gauge the quality of potential borrowers. As for the impact of asset prices, our results show that expected property prices do not affect household credit supply. Finally, our estimates suggest that foreign liquidity positively affects household credit supply, an impact moderated by the level of domestic liquidity.

On the demand side, while household credit is inelastic to the lending rate, borrowing and repayment capacity are key determinants of credit demand. Furthermore, higher expected disposable income encourages household credit demand. Also, the indebtedness ratio positively affects households’ demand for credit. These results show that household credit demand is strongly pro-cyclical; borrowers who expect a rise in their disposable income and have established relationships with banks are more likely to apply for more loans. Our estimates also show that expected inflation does not affect household credit demand.

Property prices affect household demand through a substitution effect. Our results show that household credit is negatively affected by residential property prices. Rising property prices thus discourage housing and credit demand. Finally, remittances negatively affect household credit demand as they constitute an alternative form of financing.

|

Credit demand by households |

Credit supply to households |

||

|

Demand |

Coefficient |

Supply |

Coefficient |

|

C |

-0.473*** (0.043) |

C |

-0.103*** (0.012) |

|

it |

-0.031 (0.068) |

it |

0.032*** (0.009) |

|

DIte |

0.543*** (0.049) |

IPIte |

0.522*** (0.029) |

|

INFLte |

-0.118 (0.078) |

Lt |

0.018 (0.014) |

|

RRAP ta |

-0.126*** (0.039) |

KRt |

0.033 (0.027) |

|

ENDTt |

0.123*** (0.041) |

NPLRt |

-0.082*** (0.026) |

|

Rmt |

-0.154*** (0.037) |

RRAP ta |

0.000 (0.010) |

|

D08 |

-0.310** (0.144) |

LEt |

0.111*** (0.013) |

|

D20 |

0.625*** (0.000) |

LRt × LEt |

-0.177*** (0.014) |

|

T |

0.024*** (0.003) |

D08 |

-0.151*** (0.040) |

|

D20 |

-0.019 (0.032) |

||

|

T |

0.015*** (0.001) |

||

|

σd2 |

0.005*** (0.001) |

σt2 |

0.000*** (0.000) |

|

-2LL |

-233.3598 |

||

We investigate the impact of asset prices and external shocks on business and household credit between 2006 and 2021 using two disequilibrium models. Our results suggest that the decline in credit supply is attributed to the flight of banks to quality caused by the simultaneous deterioration in interest margins and the quality of borrowers. The declining quality of borrowers is caused by higher indebtedness, saturated housing demand, and slower economic growth. Our results also show that external shocks affect business and household credit supply through their impact on nonresident deposits with Moroccan banks. On the demand side, our results show that remittances harm households’ credit demand and that stocks and residential property prices impact the demand for business and household credit.

Our study is not without limitations. Despite disaggregating private-sector credit into firm and household credit, sectoral or bank-level data could provide more insights into bank credit dynamics in Morocco. Also, our quantitative focus neglects the potential impact of structural and institutional factors on credit dynamics in Morocco. For instance, a lack of financial innovation can explain credit slowdowns (Lee et al., 2020) by affecting credit risk (Khan et al., 2021) and SME lending (Hryckiewicz et al., 2023). Further investigation along these lines is needed.

Despite these limits, our study has important practical applications and policy recommendations. First, recent evidence by Kchikeche & Khallouk (2021) and Kchikeche & Mafamane (2024) reveals a causal impact of private-sector credit on GDP in the short and long run. Thus, the slowdown in credit to the private sector may explain the observed economic slowdown in Morocco since 2009. Public policy aiming to stimulate economic growth in Morocco and other developing countries should closely monitor barriers to private sector financing, as financial constraints could constitute bottlenecks to sustained growth in emerging markets. Policymakers could either investigate barriers to credit growth or support the development of other financing providers. Second, our results highlight the role of banks as transmitters of external shocks to the financial and real spheres of the Moroccan economy. As the Moroccan economy and financial system continue to liberalize and integrate with the global supply chain, public policy should consider the spillover effects of asset price fluctuations, foreign liquidity drops, and remittances slowdowns on the financial constraints of Moroccan firms and households to solidify the resilience of the Moroccan economy. Finally, we contribute to explaining the disconnect between the dynamics of interest rates and credit growth (Kchikeche et al., 2024).

Our results suggest that the failure of conventional interest-based monetary policy to stimulate credit growth in Morocco is due to the relatively weak elasticity of credit supply to changes in lending rates. Thus, stimulating credit, and consequently, economic growth may necessitate the development and use of unconventional monetary policy tools.

Ábel, I., & Mérő, K. (2023). Endogenous money, soft budget constraint and the banking regulation. Acta Oeconomica, 73(S1), 99–118. https://doi.org/10.1556/032.2023.00036

Abere, S. S., & Akinbobola, T. O. (2020). External Shocks, Institutional Quality, and Macroeconomic Performance in Nigeria. SAGE Open, 10(2). https://doi.org/10.1177/2158244020919518

Adair, P., & Adaskou, M. (2020). Credit Rationing and Mature French SMEs: A Disequilibrium Model. World Journal of Applied Economics, 6(1), 55–72. https://doi.org/10.22440/wjae.6.1.4

Aiyar, S. (2011). How did the crisis in international funding markets affect bank lending? Balance sheet evidence from the United Kingdom (Bank of England Working Paper No. 424). https://www.bankofengland.co.uk/working-paper/2011/how-did-the-crisis-in-international-funding-markets-affect-bank-lending

Altavilla, C., Boucinha, M., Holton, S., & Ongena, S. (2021). Credit Supply and Demand in Unconventional Times. Journal of Money, Credit and Banking, 53(8), 2071–2098. https://doi.org/10.1111/jmcb.12792

Balke, N. S., Zeng, Z., & Zhang, R. (2021). Identifying credit demand, financial intermediation, and supply of funds shocks: A structural VAR approach. North American Journal of Economics and Finance, 56. https://doi.org/10.1016/j.najef.2021.101375

Barajas, A., & Steiner, R. (2002). Why Don’t They Lend? Credit Stagnation in Latin America. IMF Economic Review, 49(1), 156–184. https://doi.org/https://doi.org/10.2307/3872475

Bernanke, B., Lown, C. S., & Friedman, B. M. (1991). The Credit Crunch. Brookings Papers on Economic Activity, 2, 205–247. https://www.brookings.edu/articles/the-credit-crunch/

Beyhaghi, M., Firoozi, F., Jalilvand, A., & Samarbakhsh, L. (2020). Components of credit rationing. Journal of Financial Stability, 50, 100762. https://doi.org/10.1016/j.jfs.2020.100762

Bjuggren, P.-O., Dzansi, J., & Shukur, G. (2010). Remittances and investment (CESIS Electronic Working Paper No. 216). https://static.sys.kth.se/itm/wp/cesis/cesiswp216.pdf

Chen, R., & Li, J. (2024). How Do Short-Term Cross-Border Capital Flows Affect Bank Risk-Taking? Evidence from China. Emerging Markets Finance and Trade, 60(5), 1064–1076. https://doi.org/10.1080/1540496X.2023.2267739

Dickey, D., & Fuller, W. (1979). Distribution of the Estimators for Autoregressive Time Series With a Unit Root. Journal of the American Statistical Association, 74(366), 427. https://doi.org/10.2307/2286348

Dinger, V., & te Kaat, D. M. (2020). Cross-border capital flows and bank risk-taking. Journal of Banking and Finance, 117. https://doi.org/10.1016/j.jbankfin.2020.105842

Dumičić, M., & Ljubaj, I. (2018). Delayed Credit Recovery in Croatia: Supply or Demand Driven? Journal of Central Banking Theory and Practice, 7(1), 121–144. https://doi.org/10.2478/jcbtp-2018-0006

Emre Akgündüz, Y., Cılasun, S. M., Dursun-de Neef, H. Ö., Hacıhasanoğlu, Y. S., & Yarba, İ. (2021). How do banks propagate economic shocks? (Central Bank of the Republic of Türkiye Working Paper No. 21/24). https://www.tcmb.gov.tr/wps/wcm/connect/EN/TCMB+EN/Main+Menu/Publications/Research/Working+Paperss/2021/21-24

Fang, X., Jutrsa, D., Peria, S. M., Presbitero, A. F., & Ratnovski, L. (2022). Bank capital requirements and lending in emerging markets: The role of bank characteristics and economic conditions. Journal of Banking and Finance, 135. https://doi.org/10.1016/j.jbankfin.2020.105806

Frommel, Michael., & Karagyozova, Kristina. (2008). Bank lending and asset prices: evidence from Bulgaria (Bulgarian National Bank Discussion Paper No. DP/65/2008). https://library.centralbankmalta.org/cgi-bin/koha/opac-detail.pl?biblionumber=3326

Gerdesmeier, D., Reimers, H., & Roffia, B. (2010). Asset Price Misalignments and the Role of Money and Credit. International Finance, 13(3), 377–407. https://doi.org/10.1111/j.1468-2362.2010.01272.x

Ghosh, S., & Ghosh, A. (2000). East Asia in the aftermath: Was there a crunch? (Deutsche Bank Research Note No. 5). https://hdl.handle.net/10419/40258

Ghosh, S., Herwadkar, S., Verma, R., & Gopalakrishnan, P. (2023). Disentangling demand and supply side determinants of post-GFC credit slowdown: an Indian perspective. Indian Economic Review, 58(S2), 399–421. https://doi.org/10.1007/s41775-023-00177-w

Giuliano, P., & Ruiz-Arranz, M. (2009). Remittances, financial development, and growth. Journal of Development Economics, 90(1), 144–152. https://doi.org/10.1016/j.jdeveco.2008.10.005

Guggisberg, M., & Latshaw, N. (2020). Disequilibrium: Model for markets in disequilibrium. https://cran.r-project.org/package=Disequilibrium

Gupta, A., Sapriza, H., & Yankov, V. (2022). The Collateral Channel and Bank Credit. (Board of Governors of the Federal Reserve System Finance and Economics Discussion Series No. 2022-024). https://doi.org/10.17016/FEDS.2022.024

Herrera, S., Hurlin, C., & Zaki, C. (2013). Why don’t banks lend to Egypt’s private sector? Economic Modelling, 33(June), 347–356. https://doi.org/10.1016/j.econmod.2013.04.003

Hryckiewicz, A., Korosteleva, J. A., Kozłowski, Ł., Rzepka, M., & Ruomeng, W. (2023). Bank Technological Innovation and SME Lending: Do We Experience a Transformation in a Bank-SME Relationship? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4390485

Ikhide, S. (2003). Was There a Credit Crunch in Namibia Between 1996–2000? Journal of Applied Economics, 6(2), 269–290. https://doi.org/10.1080/15140326.2003.12040595

Ito, T., & Pereira da Silva, L. (1999). The Credit Crunch in Thailand during the 1997-98 crisis : Theoretical and operational issues the JEXIM survey. Exim Review, 19(2), 1–40. https://www.researchgate.net/publication/236861255_The_Credit_Crunch_in_Thailand_during_the_1997-98_crisis_Theoretical_and_operational_issues_the_JEXIM_survey

Jiménez, G., Ongena, S., Peydró, J.-L., & Saurina, J. (2012). Credit Supply and Monetary Policy: Identifying the Bank Balance-Sheet Channel with Loan Applications. American Economic Review, 102(5), 2301–2326. https://doi.org/10.1257/aer.102.5.2301

Johansen, S. (1991). Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models. Econometrica, 53(9), 1689–1699. https://doi.org/10.2307/2938278

Johansen, S. (1995). A Statistical Analysis of Cointegration for I(2) Variables. Econometric Theory, 11(1), 25–59. https://doi.org/10.1017/S0266466600009026

Karapanagiotis, P. (2024). The R Package markets: Estimation Methods for Markets in Equilibrium and Disequilibrium. Journal of Statistical Software, 108(2). https://doi.org/10.18637/jss.v108.i02

Karmelavičius, J., Mikaliūnaitė-Jouvanceau, I., & Petrokaitė, A. (2022). Housing and credit misalignments in a two-market disequilibrium framework. (Bank of Lithuania Occasional Paper No. 42). https://www.lb.lt/uploads/publications/docs/36380_ac93efa620cef0f0a5e72207fca18012.pdf.

Kchikeche, A., El fakir, R., & Mafamane, D. (2024). Can Conventional Monetary Policy Stimulate Bank Credit? Evidence from a Developing Country. Statistika: Statistics and Economy Journal, 104(2). https://doi.org/10.54694/stat.2023.54

Kchikeche, A., & Khallouk, O. (2021). On the nexus between economic growth and bank-based financial development: evidence from Morocco. Middle East Development Journal, 13(2), 1–20. https://doi.org/10.1080/17938120.2021.1930830

Kchikeche, A., & Mafamane, D. (2024). Examining the Interactions of Economic Growth and Bank Credit to the Private Sector in Morocco: A Causality Analysis. Journal of Economic Cooperation and Development, 45(3). https://www.sesric.org/publications-jecd-articles.php?jec_id=133

Khan, A. B., Fareed, M., Salameh, A. A., & Hussain, H. (2021). Financial Innovation, Sustainable Economic Growth, and Credit Risk: A Case of the ASEAN Banking Sector. Frontiers in Environmental Science, 9. https://doi.org/10.3389/fenvs.2021.729922

Kiyotaki, N., & Moore, J. (1997). Credit Cycles. Journal of Political Economy, 105(2), 211–248. https://doi.org/https://doi.org/10.1086/262072

Krishnamurthy, A., & Muir, T. (2017). How Credit Cycles Across A Financial Crisis (NBER Working Paper No. 23850). http://www.nber.org/papers/w23850

Lee, C.-C., Wang, C.-W., & Ho, S.-J. (2020). Financial innovation and bank growth: The role of institutional environments. The North American Journal of Economics and Finance, 53, 101195. https://doi.org/10.1016/j.najef.2020.101195

Lian, C., & Ma, Y. (2020). Anatomy of Corporate Borrowing Constraints. The Quarterly Journal of Economics, 136(1), 229–291. https://doi.org/10.1093/qje/qjaa030

Ma, Yueran, Teodora Paligorova, and José-Luis Peydro (2021). Expectations and Bank Lending. Working Paper. https://memento.epfl.ch/public/upload/files/MaPaper.pdf

Maddala, G. S., & Nelson, F. D. (1974). Maximum Likelihood Methods for Models of Markets in Disequilibrium. Econometrica, 42(6), 1013. https://doi.org/10.2307/1914215

Magud, N. E., Reinhart, C. M., & Vesperoni, E. R. (2014). Capital Inflows, Exchange Rate Flexibility and Credit Booms. Review of Development Economics, 18(3), 415–430. https://doi.org/10.1111/rode.12093

Mamonov, M., Pankova, V., Akhmetov, R., & Pestova, A. (2020). Financial Shocks and Credit Cycles. Russian Journal of Money and Finance, 79(4), 45–74. https://doi.org/10.31477/rjmf.202004.45

Min, F., Wen, F., Xu, J., & Wu, N. (2023). Credit supply, house prices, and financial stability. International Journal of Finance & Economics, 28(2), 2088–2108. https://doi.org/10.1002/ijfe.2527

Modigliani, F., & Jaffee, D. M. (1969). A Theory and Test of Credit Rationing. The American Economic Review, 59(5), 850–872. https://www.jstor.org/stable/1810681

Mora, N. (2008). The Effect of Bank Credit on Asset Prices: Evidence from the Japanese Real Estate. Journal of Money, Credit and Banking, 40(1), 57–87. https://doi.org/10.1111/j.1538-4616.2008.00104.x

Naili, M., & Lahrichi, Y. (2022). Banks’ credit risk, systematic determinants and specific factors: recent evidence from emerging markets. Heliyon, 8(2), e08960. https://doi.org/10.1016/j.heliyon.2022.e08960

Oulidi, N., & Allain, L. (2009). Credit Market in Morocco: A Disequilibrium Approach. (IMF Working Paper No. WP/09/53). https://doi.org/10.5089/9781451872019.001

Pazarbasioglu, C. (1997). A Credit Crunch? Finland in the Aftermath of the Banking Crisis. Staff Papers - International Monetary Fund, 44(3), 315. https://doi.org/10.2307/3867562

Ponomarenko, A. (2022). Money creation and banks’ interest rate setting. Journal of Financial Economic Policy, 14(2), 141–151. https://doi.org/10.1108/JFEP-10-2020-0214

Pouvelle, C. (2012). Bank credit, asset prices and financial stability: Evidence from French banks (IMF Working Paper No. WP/12/103). http://www.imf.org/external/pubs/cat/longres.aspx?sk=25874

Rodríguez, G., Vassallo, R., & Castillo B., P. (2023). Effects of external shocks on macroeconomic fluctuations in Pacific Alliance countries. Economic Modelling, 124. https://doi.org/10.1016/j.econmod.2023.106302

Sadok, H., Elfakir, R., & Hakik, I. (2022). Optimal inflation threshold and economic growth in Morocco: an empirical analysis. Journal of Economic Cooperation and Development, 43(4), 103–130. https://jecd.sesric.org/pdf.php?file=ART22081601-2.pdf

Silalahi, T., Wibowo, W. A., & Nurlian, L. (2012). Impact Of Global Financial Shock To International Bank Lending In Indonesia. Buletin Ekonomi Moneter Dan Perbankan, 15(2), 75–110. https://doi.org/10.21098/bemp.v15i2.423

Singh, B., & Nadkarni, A. R. (2020). Role of credit and monetary policy in determining asset prices: Evidence from emerging market economies. The North American Journal of Economics and Finance, 51, 100874. https://doi.org/10.1016/j.najef.2018.11.003

Stiglitz, J., & Guzman, M. (2021). The pandemic economic crisis, precautionary behavior, and mobility constraints: an application of the dynamic disequilibrium model with randomness. Industrial and Corporate Change, 30(2), 467-497. https://doi.org/10.1093/icc/dtab012

Stiglitz, J., & Weiss, A. (1981). Credit Rationing in Markets with Imperfect Information. The American Economic Review, 75(4). https://www.jstor.org/stable/1802787

Tamini, A., & Petey, J. (2021). Hoarding of reserves in the banking industry: Explaining the African paradox. Quarterly Review of Economics and Finance, 81, 214–225. https://doi.org/10.1016/j.qref.2021.06.002

Thakor, A., & Yu, E. (2023). Funding Liquidity Creation by Banks (Federal Reserve Bank of Philadelphia Working Paper No. WP 23-02). https://doi.org/ 10.21799/frbp.wp.2023.02

Tölö, E., & Virén, M. (2021). How much do non-performing loans hinder loan growth in Europe? European Economic Review, 136, 103773. https://doi.org/10.1016/j.euroecorev.2021.103773

Varadi, A. (2024). Identifying the transmission channels of credit supply shocks to household debt: Price and non-price effects. European Economic Review, 166, 104747. https://doi.org/10.1016/j.euroecorev.2024.104747

Zhao, Y., & Xu, Z. (2021). The Impact of Cross-Border Capital Flows on the Chinese Banking System. SAGE Open, 11(2), 215824402110214. https://doi.org/10.1177/21582440211021410

Zolea, R. (2023). A Functional Analysis of the Role of Deposits in the Traditional Banking Industry. Review of Political Economy, 35(4). https://doi.org/10.1080/09538259.2023.2233870

|

Variable |

Formula |

Expected Sign |

|

it |

Nominal interest rate – smoothed inflation rate |

(+) on supply / |

|

Lt |

Log(deposits – reserves) |

(+) |

|

KRt |

Equity/Loans |

(+) |

|

NPLRt |

Nonperforming loans/Total loans |

(-) |

|

IPI te |

4-period distributed lag of the industrial production index |

(+) |

|

RRAP te |

4-period distributed lag of the residential real estate asset prices index |

Ambiguous |

|

FLt |

Log(deposits of nonresident economic agents with Moroccan banks) |

(+) |

|

MASI te |

the expected Moroccan All Shares Index |

Ambiguous |

|

INFL te |

4-period distributed lag of the inflation rate |

(-) |

|

OGt |

Real GDP/Potential GDP – 1 |

(-) |

|

DI te |

4-period distributed lag of the log(real disposable income) |

(+) |

|

ENDTt |

Disposable income/Household credit |

(-) |

|

Rmt |

Log(Remittances)/ Log(GDP) |

(-) |

|

FDIt |

Log(Foreign direct investment)/Log(GDP) |

(+) |

|

Variables |

ADF statistic |

Decision |

|

|

BC |

Level |

-2.542 |

I(1) |

|

1st difference |

-2.005** |

||

|

BCS |

Level |

-3.036 |

I(1) |

|

1st difference |

-6.802*** |

||

|

BCD |

Level |

-1.693 |

I(1) |

|

1st difference |

-7.832*** |

||

|

HC |

Level |

-3.479 |

I(1) |

|

1st difference |

-9.586*** |

||

|

BCS |

Level |

-2.232 |

I(1) |

|

1st difference |

-7.102*** |

||

|

BCD |

Level |

-1.006 |

I(1) |

|

1st difference |

-8.441*** |

||

|

Model 1 |

Cointegration test using the trace statistic |

||||

|

H0 |

Eigenvalue |

Trace |

Critical value at 5% |

Decision |

|

|

r = 0 |

0.306 |

25.959 |

15.495 |

Reject |

|

|

r ≤ 1 |

0.051 |

3.271 |

3.841 |

Do not reject |

|

|

Cointegration test using the maximum eigenvalue statistic |

|||||

|

H0 |

Eigenvalue |

Max eigenvalue |

Critical value at 5% |

Decision |

|

|

r = 0 |

0.306 |

22.689 |

14.264 |

Reject |

|

|

r ≤ 1 |

0.051 |

3.271 |

3.841 |

Do not reject |

|

|

Model 2 |

Cointegration test using the trace statistic |

||||

|

H0 |

Eigenvalue |

Trace |

Critical value at 5% |

Decision |

|

|

r = 0 |

0.253 |

18.729 |

15.495 |

Reject |

|

|

r ≤ 1 |

0.015 |

0.954 |

3.841 |

Do not reject |

|

|

Cointegration test using the maximum eigenvalue statistic |

|||||

|

H0 |

Eigenvalue |

Max eigenvalue |

Critical value at 5% |

Decision |

|

|

r = 0 |

0.253 |

17.775 |

14.264 |

Reject |

|

|

r ≤ 1 |

0.015 |

0.954 |

3.8414 |

Do not reject |

|

1 As Appendix 1 shows, the average quarterly growth of real business and household credit in Morocco has slowed down significantly during the last decade.