Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(3), pp. 70–90 DOI: https://doi.org/10.15388/Ekon.2024.103.3.5

Novel Analysis on the Impact of FinTech Developments for Monetary Policy: The Case of Türkiye

Ömer Faruk Kömürcüoğlu*

Independent Researcher, Türkiye

ORCID: https://orcid.org/0000-0002-8399-5597

Email: ofkomurcuoglu@outlook.com

Haydar Akyazi

Karadeniz Technical University, Türkiye

ORCID: https://orcid.org/0000-0002-9700-4512

Email: akyazi@ktu.edu.tr

Abstract. One of the most noteworthy benefits that new technological opportunities bring to economies is Financial technologies (FinTech), which makes it easier for financial services to be cheap, fast, and accessible, especially by creating more digital payment services. This high rate of digitalization in payment services changes the liquidity preferences of economic agents daily and may affect the demand for central bank money. However, the prerequisite for the central bank to carry out monetary policy and be effective is accurately predicting the demand for its own money. Therefore, the developments in FinTech, in the last decade, are among the most attention-grabbing issues for demand in money, as well as being in the leading position for central banks, which followed intimately. In this context, the aim of this study is to reveal the impacts of developments in FinTech on monetary policy for Türkiye’s real money demand. For this purpose, in order to represent the developments in financial technologies, The FinTech index, which is formed for the first time in the relevant economy using the PCA method over the period 2012:Q1–2021:Q4, is included in the model where national income, interest rate, exchange rate, and inflation are explanatory variables. Results from the ARDL approach show that FinTech developments and demand for money are co-integrated, and also an increase in FinTech reduces money demand both in the short and long-run. The causality analysis handled with the Toda-Yamamoto approach has revealed the existence of a bidirectional causality relationship between FinTech and money demand. Accordingly, Fintech developments in Türkiye have a huge potential to shape economic agents’ liquidity preferences. To maintain the effectiveness of monetary policy, the policymakers in the central bank should closely follow FinTech developments and supervise and regulate activities that will create an alternative to its currency.

Keywords: Financial Technology, FinTech, Monetary Policy, ARDL, Türkiye

________

* Correspondent author.

Received: 22/05/2024. Revised: 25/07/2024. Accepted: 31/08/2024

Copyright © 2024 Ömer Faruk Kömürcüoğlu, Haydar Akyazi. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

1. Introduction

Historically, central banking and monetary policies have encountered many significant developments and crises, such as the Great Depression of 1929, the 2008 Global Financial Crisis (GFC), technological developments, globalisation, the COVID-19 pandemic, and climate change. These developments have paved the way for substantial changes in the institutional structure of central banks as well as in their set of objectives and instruments over time. Central banks, which once served as public banks, now have an autonomous institutional structure. In this context, central banking and monetary policies are in a continuous process of change and transformation.

One of the main factors that makes this change and transformation continuous is undoubtedly technological development. The concept of FinTech, one of the most prominent and debated topics in recent years, has become an important topic, especially after the 2008 GFC. FinTech, which refers to technology-intensive products and services in financial services, has led to significant developments in payment services that will change the spending habits of economic agents. These developments are being monitored for central banks, which are responsible for the smooth and efficient operation of payment systems.

For central banks to fulfill their essential functions in monetary policy, they need to be able to affect the amount of money and credit, in other words, to keep the liquidity in the market at the desired level. Therefore, central banks monitor the monetary aggregates (M1, M2, and M3) that they can control. What is meant by controllability is that it is a quantity that the central bank can influence (increase or decrease) with its monetary policy. For example, central banks, which monopolize printing money, monitor the “monetary base” as a monetary aggregate. The monetary base simply consists of money in circulation and net open market transactions (OMOs). However, printing money and money in circulation are different concepts. While money printing refers to the production of money, changing the money in circulation means performing banking transactions that will affect the emission volume. The cash demand of individuals and banks shapes the level of liquidity in the market. In today’s central banking, the emission volume is not directly determined, and monetary policy is not conducted accordingly. Monetary policy is carried out to determine the cost of money rather than the amount of money. In other words, central banks conduct monetary policy by lending to demanding banks at the short-term interest rate they set. When the demand for money (liquidity demand) increases in the market, banks meet this demand by borrowing at the policy rate set by the central bank. Therefore, the main determinant of emission volume is the cash demand of economic agents. The cash demand of economic agents is determined by factors such as seasonal effects, salary payment days, holidays, and inflation. In addition, the use of credit cards, mobile, and internet banking, almost all kinds of FinTech developments, and the spread of alternative payment instruments affect the cash demand of economic agents (Özatay, 2015: 39-40; CBRT, 2019: 65-67).

Lagarde (2018: 5) suggests that the evolution of FinTech will complicate monetary policy implementation, prompting the need for revisions in central banking practices. She draws comparisons between physical and virtual currencies, highlighting the convenience and security of electronic transactions as factors driving preference for virtual currencies over traditional forms like the dollar. Lagarde proposes that virtual currencies could be issued based on a stable basket of currencies transparently and reliably, managed by AI-driven algorithms adhering to predefined rules to manage macroeconomic conditions effectively. While she predicts potential transformations in currencies and monetary policy, Lagarde (2018: 8) concludes that she does not foresee monetary policy being entirely conducted by artificial intelligence and machines, emphasizing the necessity of human accountability in central banking due to the risks involved. Despite this, the significance of the risks identified by Lagarde and their implications for monetary policy remains pertinent.

At this point, the question “How will FinTech developments affect the effectiveness of monetary policy conducted by central banks?” has become an agenda. Besides the limited number of studies in the literature, the impact of FinTech developments on monetary policy has not been analysed for Türkiye. Although there are studies analysing developments in financial services in terms of concepts such as financial innovation, financial development, and financial inclusion, these concepts are not fully evaluated as FinTech. In addition, FinTech developments are mostly analysed through their effects on the banking sector and enterprises, while macroeconomic effects are not sufficiently taken into account. In light of these evaluations, the aim of this study is to “analyse the short and long-run effects of FinTech developments on monetary policy through real money demand in the economy of Türkiye”. In this study, a new index is created to better represent the multidimensional nature of FinTech developments. The index is constructed using the PCA method with seven different variables that are considered to reflect the elements of today’s FinTech ecosystem effectively. The FinTech index differs greatly from literature in terms of the richness of its content, elements, and arguments. The variables used in the index calculation represent the aspects of payment services, which have the largest proportion in FinTech segments. The scope of the study analysis consists of FinTech developments in Türkiye during the period 2012:Q1-2021:Q4. Within this scope, FinTech developments have been represented in the post-GFC period, in which they gained momentum and popularity. This is because today’s FinTech developments and definitions cover the last 10-15 years, while the creation of data sets on these developments in Türkiye started in 2012. Accordingly, based on theoretical foundations, the elements of the FinTech ecosystem in the FinTech 3.0 period (present) are represented. Therefore, this study, which approaches FinTech developments from a different perspective from the literature, has the potential to provide important implications for monetary policymakers. This study intends to significantly contribute to the expanding body of literature by taking into account all of these viewpoints and providing the following motivations: firstly, while the current analysis is one of the newest efforts to empirically examine the relationship of FinTech developments with demand for money, specifically for the sample case of Türkiye, it also aims to boost the nascent literature. Secondly, besides the data set of national income, interest rate, exchange rate, and inflation continually referred to for the money demand in the literature, regrettably, limited papers investigating the role of Fintech with this data set are available in the literature. Therefore, a new FinTech index created through many variables for Türkiye, a combination of new technological opportunities in financial services, is considered in the current analysis together with the variables mentioned in the previous contribution. The PCA method, which is frequently preferred in the literature, was largely used in creating the index. Finally, the possible relationships between the FinTech and money demand are scrutinized from both the short and long-term perspectives using the ARDL approach for the first time for the Turkish economy.

While looking at the relationship between FinTech and monetary policy, this paper is intended to flesh out the empirical evidence, focusing on the Türkiye. The study is organized under the remaining six primary headings, severally: an overview of FinTech, literature review, methodology, and data, results of empirical analysis, discussion, and lastly, the conclusion part.

2. An Overview of FinTech Concept and Historical Development of FinTech

The historical background of the FinTech concept can be traced back to the 19th century. There are even studies suggesting that the abacus is a FinTech development due to its use in financial calculations (Saraswati et al., 2022: 110; Jayasuriya and Sims, 2023: 24). Although there is no consensus in the literature yet, the classification proposed by Arner et al. (2017) is important in terms of reflecting the historical development of FinTech (Table 1).

Table 1. FinTech Periods in Historical Process

|

Date

|

1866-1967

|

1968-2008

|

2009-

|

|

Period

|

FinTech 1.0

|

FinTech 2.0

|

FinTech 3.0/3.5

|

|

Geographical Area

|

Developed Countries

|

Global

|

Developed and Developing Countries

|

|

Main Factor

|

Infrastructure

|

Banks

|

Start-ups

|

|

Trigger

|

Globalisation

|

Technology

|

GFC and Market Reforms

|

Source: Arner et al. (2017: 4)

During the FinTech 1.0 era, finance’s development paralleled trade, with joint-stock companies, insurance, and banking playing crucial roles in the European financial revolution of the 18th century. The late 19th century saw the establishment of cross-border financial connections facilitated by technological innovations like the telegraph, railways, and steamships. The transatlantic cable laying in 1866 marked the beginning of the FinTech 1.0 period, enhancing communication between Europe and America. This was followed by rapid technological advancements post-World War II, including the launch of the global telex network, signaling the transition from analog to digital (Arner et al., 2016: 8; Arner et al., 2017: 4-5; Mohamed and Ali, 2019: 17).

In 1967, the introduction of calculators and ATMs marked the beginning of the FinTech 2.0 era, expanding the intersection of finance and technology. This period witnessed the implementation of numerous payment systems and technological innovations alongside financial crises. Key developments include the establishment of the Clearing House Interbank Payments System and the Society of Worldwide Interbank Financial Telecommunications in the USA in 1970 and 1973, respectively. However, the Herstatt Bank crisis in 1974 underscored the risks associated with increased international financial connections. This crisis prompted the establishment of the Basel Committee on Banking Supervision and the implementation of international legal agreements. The stock market crash of 1987, known as “Black Monday”, further highlighted the interconnectedness of global markets facilitated by technology. The widespread adoption of the Internet and electronic banking in the 1990s paved the way for the FinTech 3.0 era, characterized by the digitalization of traditional finance (Arner et al., 2016: 11-12; Arner et al., 2017: 6; Mohamed and Ali, 2019: 19-20; Al-Zaqeba et al., 2022: 1406).

The 2008 GFC significantly impacted banks’ profitability and competitiveness, with increased regulatory compliance costs restricting credit availability. This led to layoffs in the banking sector, forcing professionals to seek new opportunities. The timing and impact of the GFC accelerated the development of FinTech, particularly start-ups offering innovative, fast, easy, and reliable services amidst technological advancements (e.g., Apple, Bitcoin, Mobile Payments). This period marked the emergence of FinTech 3.0, where rapidly growing technology companies transitioned from being “too small to be ignored” to “too big to fail” (Arner et al., 2016: 15; Arner et al., 2017: 6-7; Mohamed and Ali, 2019: 22).

The term FinTech was first used in 1972 by Abraham Bettinger, vice president of Manufacturers Hanover Trust Company, a US bank. Bettinger referred to FinTech as an acronym for financial technology, combining bank expertise with modern management science techniques and computers. This initial definition closely resembles today’s understanding of FinTech. Despite this early usage, the term was not widely encountered in literature for a significant period afterward. It resurfaced in 1993 with Citicorp’s project, the “Financial Services Technology Consortium”, aimed at fostering collaboration with technology companies. However, it’s likely that Citicorp was unaware of its prior use of the term, indicating a historical recurrence of the concept (Schueffel, 2016: 36).

Although the concept of FinTech has a long historical background, it can be said that it gained popularity in the post-GFC period. FinTech, which combines financial services and the use of technology, refers to the provision of financial services in a more flexible and cheaper way by utilising the opportunities of technology (Dorfleitner et al., 2017: 5).

In the light of the literature reviews, it is possible to define FinTech as follows: It is the general name of the sector led by technology-intensive new generation finance companies - FinTech - which aim to provide all kinds of financial services to individuals and/or institutions faster, more efficiently and cheaper, and which produce solutions by making the most of the possibilities of technology for this purpose.

3. Literature Review

Equilibrium in the money market is defined by the condition where money demand (MD) equals money supply (MS). In the presence of a stable money demand function, central banks can achieve equilibrium by appropriately determining the corresponding level of money supply. For central banks, having comprehensive information on money demand—the amount of money economic agents wish to hold—and the velocity of money—the average frequency at which a unit of money changes hands—is crucial for the effective formulation and implementation of monetary policy. The factors influencing money demand and the velocity of money are inherently interconnected, as they mutually influence each other. The stability of these factors is a major point of contention between the Classical and Keynesian schools of economic thought. These schools lack consensus on which variables affect the velocity of money and the direction and magnitude of these effects (Altunöz, 2022: 250). This ongoing debate underscores the complexity of accurately predicting monetary dynamics and the challenges faced in designing robust monetary policies.

The Quantity Theory of Money (QTM), developed by Fisher (1911), posits that the demand for money is a function of income. The theory is encapsulated in the equation V = (P*Y) / M, where V denotes the velocity of money, Y denotes national income, P denotes prices, and M denotes the money supply. According to this framework, both the velocity of money and national income are assumed to be constant. Consequently, changes in the money supply are reflected proportionally in price levels. Contrarily, Keynes (1936) challenges this Classical perspective with his Liquidity Preference Theory (LTT). Keynes posits that real money demand is formulated as  , where

, where  represents real money demand, Y is national income, and i is the interest rate. When considering the velocity of money, this equation transforms to

represents real money demand, Y is national income, and i is the interest rate. When considering the velocity of money, this equation transforms to  . Keynes argues that the velocity of money is not constant; instead, it is influenced by variations in national income and interest rates. This distinction underscores a fundamental divergence between Classical and Keynesian economic thought regarding the determinants and stability of the velocity of money. This fundamental theoretical distinction, which influences the economic policy-making process and approach, emphasizes the need for central banks to be able to forecast money demand effectively in order to improve monetary policy maneuverability (Goldfeld, 1973). In their study, Gurley and Shaw (1955) showed that money substitutes, which are the result of financial innovations, change the sensitivity of money holding to the interest rate. In this case, the relationship between monetary aggregates and price stability weakens. Namely, it is argued in the literature that FinTech developments may affect the demand of economic agents for central bank money, create instability, and complicate the monetary policymaking process. Modern payment methods, virtual money innovations and many other developments encourage society to become cashless.

. Keynes argues that the velocity of money is not constant; instead, it is influenced by variations in national income and interest rates. This distinction underscores a fundamental divergence between Classical and Keynesian economic thought regarding the determinants and stability of the velocity of money. This fundamental theoretical distinction, which influences the economic policy-making process and approach, emphasizes the need for central banks to be able to forecast money demand effectively in order to improve monetary policy maneuverability (Goldfeld, 1973). In their study, Gurley and Shaw (1955) showed that money substitutes, which are the result of financial innovations, change the sensitivity of money holding to the interest rate. In this case, the relationship between monetary aggregates and price stability weakens. Namely, it is argued in the literature that FinTech developments may affect the demand of economic agents for central bank money, create instability, and complicate the monetary policymaking process. Modern payment methods, virtual money innovations and many other developments encourage society to become cashless.

Given the current state of FinTech developments, despite their importance, their potential effects on monetary policy have not been sufficiently addressed in both empirical and theoretical literature. However, empirical analyses conducted with variables that can be considered as FinTech developments may be beneficial in enhancing understanding of the FinTech-Monetary Policy relationship.

Studies examining the effects of FinTech developments on monetary policy in the context of technological innovations have been investigated by considering the variables that can be characterized as FinTech Variables (FV). Accordingly, the number of ATMs has been the most commonly used variable to represent FinTech developments (Rinaldi, 2001; Fischer, 2007; Columba, 2009; Snellman and Viren, 2009; Tehranchian et al., 2012; Lenka and Bairwa, 2016; Mlambo and Msosa, 2020; Mumtaz and Smith, 2020; Ugwuanyi et al., 2020).

Credit, debit, and ATM cards are other frequently used variables (Attanasio et al., 2002; Rinaldi, 2001; Snellman et al., 2001; Tehranchian et al., 2012; Wasiaturrahma et al., 2019).

On the other hand, the number of POS devices (Columba, 2009; Mumtaz and Smith, 2020; Ugwuanyi et al., 2020); online and digital payment transactions (Mumtaz and Smith, 2020; Ugwuanyi et al., 2020; Jiang et al., 2022); e-money usage and adoption (Fujiki and Tanaka, 2009; Wasiaturrahma et al, 2019; Saraswati et al., 2020); the number of banks (Lenka and Bairwa, 2016); mobile phone subscription (Mlambo and Msosa, 2020); crypto assets (Mumtaz and Smith, 2020); FinTech adaptation (Hasan et al., 2024) variables used as FinTech developments.

Among the analysed studies, it is observed that inferences about the effectiveness of monetary policy are mostly based on money demand. An increase in the FinTech variable(s) decreases the demand for money (Rinaldi, 2001; Snellman et al., 2001; Columba, 2009; Fujiki and Tanaka, 2009; Snellman and Viren, 2009; Wasiaturrahma et al, 2019; Mlambo and Msosa, 2020) as well as studies that conclude that it increases the demand for money (Ziberfarb, 1989; Tehranchian et al., 2012; Wasiaturrahma et al., 2019; Ugwuanyi et al., 2020).

Limited studies sharing findings that an increase in FinTech variables leads to an increase in money demand suggest a possible rationale for this, suggesting that individuals primarily use ATMs for cash withdrawals and do not utilize other financial services. On the other hand, studies indicating that FinTech developments increase sensitivity to interest rates (Attanasio et al., 2002), enhance financial development (Fischer, 2007), and reduce inflation (Lenka and Bairwa, 2016; Saraswati et al., 2020) have contributed to the literature by providing different perspectives on the effectiveness of monetary policy. Furthermore, the impact of FinTech developments on the monetary transmission mechanism (MTM) has been examined (Mumtaz and Smith, 2020; Hasan et al., 2024), and these developments have been found to reduce the effectiveness of the MTM.

When the literature is examined, it is seen that the studies have increased especially in recent years. However, the number of studies directly addressing the relationship between FinTech and monetary policy is quite limited. In studies using time series and panel data analysis, no study specific to Türkiye has been found. Additionally, the variables used in the studies are similar. However, no general consensus has been reached regarding the findings obtained.

4. Model, Data Set and Methodology

4.1. Model

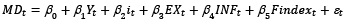

The aim of this study is to reveal both the short and long-run effects of developments in the field of FinTech on monetary policy through real money demand in Türkiye. The literature review reveals that monetary policy effectiveness is mostly represented by money demand. It is observed that income, interest rate, and inflation variables are used as the main variables in a standard money demand equation in theoretical and empirical studies. On the other hand, in empirical studies for Türkiye, the exchange rate is also considered to be an important factor affecting the demand for money (Sevüktekin and Nargeleçekenler, 2007; Bayram and Uca, 2019). In addition, the index representing FinTech developments within the scope of the study is included in the model as another variable.

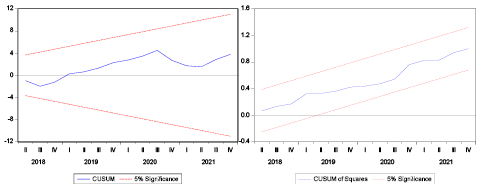

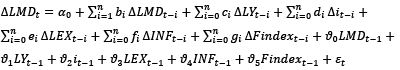

The model used in the analysis is as in Equation 1:

(1)

(1)

Here, MD represents money demand, Y represents national income, i represents interest rate, EX represents exchange rate, INF represents inflation rate, and finally, Findex represents the constructed FinTech index.

4.2. Data Set

The acceleration of FinTech developments after the GFC and the emergence of observable data only during this period determined the analysis period 2012:Q1-2021:Q4. In the index constructed by Principal Component Analysis (PCA), seven different variables are used. The explanatory information of the variables used in the index is given in Table 2.

Table 2. Variables Used in the Index

|

Variables

|

Description

|

Database

|

|

Number of ATMs

|

Total Number of ATMs

|

Interbank Card Centre (BKM)

|

|

Number of POS Devices

|

Total Number of POS and Cash Register devices

|

|

Total Number of Cards

|

Total Number of Credit, Debit and Prepaid Cards

|

|

Number of Contactless Cards

|

Number of Contactless Cards in Total Cards

|

|

Contactless Card Usage

|

Number of Transactions of Contactless Cards in Domestic and Cross-Border Shopping

|

|

Internet Banking

|

Number of Customers Registered in Internet Banking

|

Banks Association of Türkiye

(TBB)

|

|

Mobile Banking

|

Number of Customers Registered in Mobile Banking

|

Explanatory information for other variables is provided in Table 3. To make the dependent variable, money demand, real, the M2 money supply is divided by the Consumer Price Index (CPI), obtained from the TURKSTAT database.

Table 3. Variables Used in the Analysis

|

Variables

|

Description (Units of Measurement)

|

Database

|

|

MD

|

M2 Money Supply (Thousand TRY-Level)

|

Central Bank of the Republic of Türkiye

(CBRT-EVDS)

|

|

Y

|

GDP Chain Linked Volume (Thousand TRY-Level)

|

|

i

|

TRY Deposits with Maturity up to 1 Month (Total TRY Deposit-Flow Data %)

|

|

EX

|

The Effective Exchange Rate of the US Dollar (US Dollar (Banknote Buying)-Level Exchange Rates)

|

|

INF

|

Inflation Rate (Consumer Price Index (2003=100)-Yearly Percentage Change)

|

Before starting the analysis, the data are subjected to a seasonality test. Accordingly, the national income data, which is found to contain seasonal effects, is seasonally adjusted using the Census X-12 method. In addition, natural logarithmic transformations of money demand, national income, and exchange rate variables are performed. However, since the Findex index contains negative values, and inflation and interest data are rates (%), they are not subjected to natural logarithmic transformation. In this respect, the model is semi-logarithmic. In the following part of the analysis, the letter L is added to the abbreviations to represent that the logarithms of the variables are taken.

4.3. Methodology

PCA is a method of orthogonal transformation characterized by its ability to effectively capture the variance present in a dataset through a reduced set of principal components. This approach entails computing the covariance matrix of the dataset and subsequently determining its eigenvalues and eigenvectors. Following this, a subset of eigenvectors corresponding to the highest eigenvalues is selected to construct the transformation matrix, thereby facilitating dimensionality reduction of the dataset (Tsouli, 2022: 46-47).

The PCA-constructed index must be statistically significant and consistent, indicated by the high variance of the first component. The first component explains 76% of the total variance, and the first two components together explain 94%. The Kaiser-Meyer-Olkin consistency test score is 72%, and Bartlett’s Test of Sphericity confirms the index’s validity with a p-value of 0.000. Therefore, the FinTech index is deemed usable in the model.

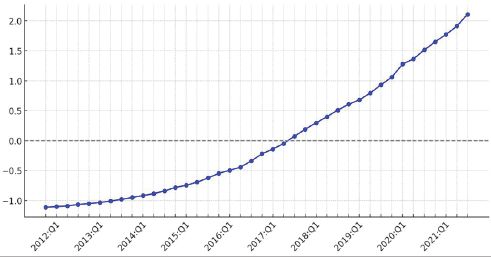

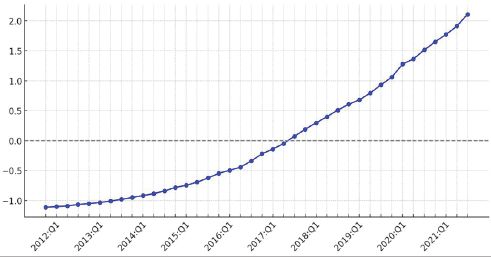

The index values obtained by PCA are shown in Graph 1. As can be seen, the change in the index over time follows a course that reflects the process of technological developments. Periods with negative index values (roughly until mid-2017) indicate that FinTech developments are below the long-run average.

Graph 1. Time graph of Findex

The common feature of many cointegration techniques is that time series are integrated to the same degree. However, Pesaran, Shin, and Smith (PSS) (2001) proposed the ARDL model, which provides robust results when the time series analysed for cointegration relationship are I(0) or I(1) or both (Çelik and Doğan, 2024: 48; Kripfganz and Schneider, 2023: 989; Mert and Çağlar, 2019: 279).

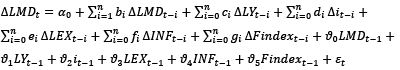

Equation 2 shows the basic model used in the analysis for the ARDL bounds test.

(2)

(2)

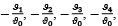

∆ denotes the first difference operator, and ε denotes the error term. While bi, ci, di, ei, fi, and gi parameters represent short-run dynamic coefficients, the parameters  and

and  denotes the long-run coefficients respectively for LYt–1, it–1, LEXt–1, INFt–1, and Findext–1.

denotes the long-run coefficients respectively for LYt–1, it–1, LEXt–1, INFt–1, and Findext–1.

While ARDL, which can be applied to series integrated to different degrees, provides long and short-run coefficient results, it does not provide information about the direction of the causality relationship between variables. Toda and Yamamoto causality test is preferred for the causality analysis of series integrated to different degrees. Unlike the Granger causality test, which requires the series to be stationary, the Toda and Yamamoto causality test can be applied. Moreover, like the ARDL bounds test, the Toda and Yamamoto causality test gives better results in relatively small samples as in this study (40) (Pata and Aydın, 2020; Nazlıoglu et. al, 2019; Wegari et. al, 2023: 5).

Toda and Yamamoto (1995) stated that VAR analysis can be performed by using the level values of these variables even if the relevant variables contain unit root when constructing an econometric model and the Wald test can be used here. The Toda-Yamamoto causality test suggests the construction of a VAR model of order (k+dmax). Here, k is the lag length at which stability conditions are met, and dmax is the maximum degree of integration of the series in the model (Mert and Çağlar, 2019: 344-345).

5. Empirical Analysis

The results of the Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) unit root tests are presented in Table 4.

Table 4. ADF and PP Unit Root Test Results

|

Variables

|

ADF

|

PP

|

|

Constant

|

Constant-Trend

|

Constant

|

Constant-Trend

|

|

LMD

|

0.533

|

-1.687

|

1.184

|

-1.687

|

|

LY

|

-0.703

|

-3.991**

|

-0.839

|

-3.959**

|

|

i

|

-2.607

|

-3.867**

|

-1.820

|

-2.620

|

|

LEX

|

1.386

|

-2.466

|

4.110

|

-1.972

|

|

INF

|

-0.627

|

-2.340

|

-0.286

|

-1.862

|

|

Findex

|

10.068

|

-0.411

|

8.762

|

-0.355

|

|

ΔLMD

|

-6.523***

|

-6.528***

|

-6.528***

|

-6.589***

|

|

ΔLY

|

-9.775***

|

-9.639***

|

-10.894***

|

-10.744***

|

|

Δi

|

-5.391***

|

-5.279***

|

-3.702***

|

-3.646**

|

|

ΔLEX

|

-5.529***

|

-5.885***

|

-5.307***

|

-6.832***

|

|

ΔINF

|

-3.525**

|

-3.727**

|

-3.525**

|

-3.727**

|

|

ΔFindex

|

-0.950

|

-6.650***

|

-1.392

|

-6.760***

|

Note: *** and ** denote 1% and 5% significance level, respectively.

According to unit root test results, LMD, LEX, and Findex are stationary at 1% significance level, and INF is stationary at the first difference at 5% significance level, and LY is stationary at 5% significance level. The interest rate i is stationary at 5% significance level according to ADF unit root results and at the first difference at 1% significance level according to PP unit root results. I(0) series are stationary at level, with mean, variance, and autocovariance remaining constant over time; I(1) series are non-stationary at level but become stationary when first differences are taken. Therefore, these variables may contain a long-term trend or structural change, which suggests that the series may have persistent effects against shocks and should be carefully evaluated in economic analyses. During the unit root process, it is observed that the degree of integration of any series is not greater than I(1). Hence, the analysis can continue with the ARDL Bound Test process.

The series must first be cointegrated for the coefficient interpretations regarding the long-run equilibrium to be valid. Otherwise, even if the results are statistically significant, the relationship will be spurious/nonsensical/degenerate (Mert and Çağlar, 2019: 294). Therefore, F and t bounds test results for long-run forecasts and t bounds test results for the error correction model should be analysed.

Table 5. Bound Tests Results

|

Model: k=5

|

|

|

Test Statistics

|

Critical Values

|

I(0)

|

I(1)

|

|

|

F-statistic

26.747

|

%5

|

2.962

|

4.338

|

Long Run Estimation Model

|

|

%1

|

4.045

|

5.898

|

|

t-statistic

-5.729

|

%5

|

-2.860

|

-4.190

|

|

%1

|

-3.430

|

-4.790

|

|

t-statistic

-14.628

|

%5

|

-2.860

|

-4.190

|

Error Correction Model

|

|

%1

|

-3.430

|

-4.790

|

The F-statistic (26.747>5.898) and t-statistic (5.729>4.79) in the bounds test for the long run estimation and the t-statistic (14.628>4.79) in the bounds test for the error correction model are found to be greater than the upper table critical values (I(1)) at 1% significance level. Accordingly, it is concluded that the series are cointegrated, the cointegration relationship is valid, and the error correction model works.

The maximum lag length of the ARDL model is determined as (3, 2, 4, 0, 3, 3) according to AIC. The long-run estimation results of the variables are presented in Table 6.

Table 6. Long Run Estimation Results

|

Dependent Variable: LMD

|

|

Independent Variables

|

Coefficient

|

Standard Er.

|

t-statistic

|

Probability

|

|

LY

|

0.732

|

0.137

|

5.358

|

0.000

|

|

i

|

-0.053

|

0.011

|

-4.755

|

0.000

|

|

LEX

|

0.795

|

0.099

|

8.051

|

0.000

|

|

INF

|

0.019

|

0.009

|

2.157

|

0.048

|

|

Findex

|

-0.103

|

0.039

|

-2.647

|

0.008

|

The long-run coefficients show that the inflation rate is significant at the 5% level, while national income, interest rate, exchange rate, and Findex are significant at the 1% level. Changes in national income, exchange rate, and inflation rate positively affect money demand, whereas changes in interest rate and Findex negatively affect it. Specifically, 1% increase in national income raises money demand by 0.73%, 1% increase in exchange rate raises money demand by 0.79%, and 1 unit increase in inflation raises money demand by 0.01%. On the other hand, 1 unit increase in interest rate decreases money demand by 0.05%, and 1 unit increase in Findex decreases money demand by 0.10%.

After the long-run estimation, the error correction model, which is the short-run estimation, is estimated.

Table 7. Error Correction Model Estimation Results

|

Variables

|

Coefficient

|

Standard Er.

|

t-statistic

|

Probability

|

|

LYt

|

-0.676

|

0.113

|

-5.983

|

0.000

|

|

∆it

|

0.007

|

0.003

|

2.333

|

0.020

|

|

∆INFt

|

-0.017

|

0.003

|

-5.667

|

0.000

|

|

∆Findext

|

-1.991

|

0.155

|

-12.845

|

0.000

|

|

ECTt-1

|

-0.886

|

0.061

|

-14.628

|

0.000

|

Accordingly, the error correction coefficient is calculated as ECTt-1= -0.886. According to these results, any deviation from equilibrium in the short-run during the period under consideration is corrected after 1/0.886=1.13 quarters (roughly at the beginning of the second quarter) and reaches the long-run equilibrium. The short-run coefficients of the error correction model of the variables indicate that the exchange rate has no effect on the demand for money. On the other hand, at the 5% significance level, 1 unit increase in interest rates raises money demand by 0.007%. Other explanatory variables have 1% significance level. While 1% increase in national income decreases money demand by 0.68%, 1 unit increase in inflation rate and Findex decrease money demand by 0.02% and 1.99%, respectively.

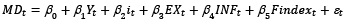

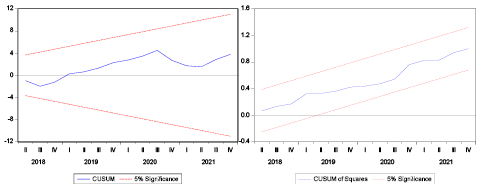

Tests are conducted to show that the estimated model is stable and consistent. No instability and/or inconsistency is observed in the estimated model. The results are presented in the table of diagnostic tests (Table 8) and Cusum-Cusumq graphs (Graphs 2).

Table 8. Diagnostic Test Results

|

Tests

|

Test Statistic

|

|

Serial Correlation Test

|

2.486 (0.122)

|

|

Heteroscedasticity Test

|

0.610 (0.850)

|

|

Specification Error Test

|

1.593 (0.134)

|

|

Normality Test

|

2.378 (0.305)

|

Note: Parentheses indicate probability values.

Graph 2. CUSUM and CUSUMQ

As seen in Table 8, there is no serial correlation problem, heteroscedasticity, specification error, and the residuals of the model are normally distributed. Finally, Cusum and Cusumq graphs should be analysed to test the parameter stability.

Since the parameter estimates (straight blue lines) are within the confidence limits (red lines) in both graphs, the parameter estimates fulfil the stability condition.

Toda-Yamamoto causality analysis is applied to determine the existence and direction of causality relationships between variables. The results are presented in Table 9.

Table 9. Toda-Yamamoto Causality Results

|

H0 Hypothesis

|

Chi-square

|

k+dmax

|

Probability

|

Decision

|

|

Findex ↛ LMD

|

34.157

|

4

|

0.000***

|

Reject

|

|

LY ↛ LMD

|

8.472

|

0.037**

|

|

i ↛ LMD

|

25.318

|

0.000***

|

|

LEX ↛ LMD

|

30.930

|

0.000***

|

|

INF ↛ LMD

|

19.722

|

0.000***

|

|

LMD ↛ Findex

|

10.769

|

0.013**

|

|

LY ↛ Findex

|

55.694

|

0.000***

|

|

i ↛ Findex

|

8.963

|

0.030**

|

|

LEX ↛ Findex

|

14.827

|

0.002***

|

|

INF ↛ Findex

|

16.945

|

0.001***

|

Note: *** and ** denote 1% and 5% significance level, respectively.

According to Table 9, a bidirectional causality relationship was found between FinTech and money demand. Other variables, such as LY, is significant at the 5% level, while i, LEX, and INF are significant at the 1% level as the causes of LMD. Furthermore, it is found that LMD and i are significant at the 5% level, and LY, LEX, and INF are significant at the 1% level as the causes of Findex.

6. Discussion

It is important to correctly determine the functional structure of money demand for an effective monetary policy. Accurately estimating economic agents’ demand for central bank money under changing conditions will pave the way for an effective monetary policy. In this context, the findings of the analysis conducted to understand better the interaction of FinTech developments in Türkiye with monetary policy can be presented as follows:

• In the long-run, an increase in GDP and inflation increases the demand for money. On the other hand, an increase in the interest rate decreases the demand for money. These results are in line with the theoretical literature.

• In the long-run, an increase in the exchange rate increases the demand for money. This result can be explained within the framework of the wealth effect. Economic agents in Türkiye, who consider foreign exchange as a safe asset, demand money to buy foreign exchange with the expectation that exchange rates will increase (Sevüktekin and Nargeleçekenler, 2007; Bayır, 2020).

• In the long-run, an increase in the FinTech developments reduces the demand for money. In this context, FinTech, which creates alternatives in payment services with its rapidly changing and developing structures, reduces the demand of economic agents for central bank money. With the FinTech developments, the number of factors affecting the money demand function has increased, and the innovations in payment services have destabilised individuals’ liquidity preferences. Developments and innovations in the field of FinTech have reached such dimensions that they constitute a substitute for central bank money (Bayır, 2020: 63-64; Bechara et al., 2021: 3-4).

• In the short run, it can be stated that the exchange rate has no effect on money demand; in other words, exchange rate movements are not taken into account. FinTech developments and inflation have a dampening effect on money demand in the short run as well as in the long run. FinTech developments, which provide consistent results in both the short and long run, can be considered an indicator of the high sensitivity of economic agents in Türkiye to developments in payment services. As they quickly adapt to new payment methods, they reduce the amount of Turkish lira they want to hold in both the short and long run. Higher national income might initially lead economic agents to substitute money holdings with other assets that offer higher returns. This may be driven by the opportunity cost of holding non-interest-bearing money compared to interest-bearing assets like bonds or stocks. On the other hand, high interest rates may have created uncertainty and pushed economic agents to hold more cash (Parveen et. al, 2020).

The results of the Toda-Yamamoto causality analysis are presented as follows:

• In the short term, there exists a bidirectional causality relationship between FinTech developments and money demand, with a statistically significant relationship at the 1% level from FinTech developments to money demand and at the 5% level from money demand to FinTech developments. Although the relationship is bidirectional, it is more robust from FinTech developments to money demand than vice versa. This more robust causality from FinTech developments to money demand can be attributed to the fact that FinTech developments are primarily concentrated in the payment services segment, becoming a significant alternative for economic agents. Consequently, the statistically robust causality relationship between FinTech developments and money demand in Türkiye aligns with theoretical expectations. Conversely, the weaker, yet still statistically significant, causality from money demand to FinTech developments may be due to the sensitivity of economic agents to factors affecting their liquidity preferences, thereby encouraging progress in the FinTech sector.

• Among other explanatory variables, GDP, interest rate, exchange rate, and inflation are found to be the cause of money demand at 5%, 1%, and 1% significance levels, respectively. When a cointegration relationship is detected, at least a unidirectional causality relationship is expected between the variables. In line with both this expectation and theoretical expectations, the explanatory variables included in the model are the causes of money demand in the short run.

• The causality relationship is also found between all variables and FinTech developments. The increase in GDP may have been reflected in payment services and other FinTech sectors. On the other hand, GDP increases may have caused traditional payment methods and instruments to be insufficient in the Turkish economy and encouraged FinTech developments. A possible explanation for inflation being the cause of FinTech developments is that inflationary processes depreciate the national currency and encourage the search for alternative instruments/methods. Thus, economic agents who do not want to transact with national currency turn to crypto-assets, new financial service platforms, and alternative payment instruments, which pave the way for FinTech developments. The stability of interest rate and exchange rate variables is desirable in an economy. In this context, interest rate and exchange rate movements affect the cost of holding the Turkish lira, its reliability, and its function as a transaction instrument. This encourages the FinTech ecosystem in Türkiye to operate more actively, develop alternative payment instruments, and make financial services easy and accessible. Within the scope of the Toda-Yamamoto causality test, it can be stated that the changes in GDP, exchange rate, and inflation in Türkiye are the causes of FinTech developments to a greater extent than other variables.

The results of the empirical analysis reveal that FinTech developments are a phenomenon that central banks cannot ignore when determining monetary policy. FinTech developments will influence monetary policy through their impact on money demand. Payment services, a particularly prominent segment of FinTech, are central to this dynamic. Advancements in this area have the potential to affect the central bank’s room for manoeuvre directly. The interplay between finance and technology has intensified markedly in recent years. Notably, Bill Gates remarked in 1994 that “banking is important, not banks” likening banks to “dinosaurs”. This analogy suggests that traditional banks may face growing challenges if they do not adapt to contemporary trends. For instance, Apple offers AppleCard users a deposit interest rate of 4.17%, eleven times higher than the U.S. average deposit interest rate of 0.37%. This development underscores the potential trajectory of the financial sector’s evolution.

FinTech developments have the potential to impact central banks both directly and indirectly. This influence has become more pronounced in the current FinTech 3.0 era. Consequently, central banks may need to accelerate their adaptation to the digital age. In a 2018 speech, Christine Lagarde questioned whether the Governor of the Bank of England in 2040 might be an artificial intelligence-based machine. She asserted that this question should still be answered in the negative for the sake of responsibility and accountability. Nonetheless, it can be argued that the prevailing trends favor FinTech developments.

In addition, FinTech platforms often operate under different regulatory frameworks than traditional banks, which can affect their responses to monetary policy. The competition between FinTech and traditional banks can also influence how credit is extended under varying monetary conditions. In some cases, businesses may turn to FinTech platforms when traditional bank credit becomes constrained due to tightening monetary policy. According to Cornelli et al. (2024), loans extended by FinTech exhibit a lower sensitivity to monetary policy shocks than traditional bank loans. It is argued that this lower sensitivity stems from FinTech’s adoption of a business model based on data rather than physical collateral. As a result, FinTech lending is less affected by asset price fluctuations caused by monetary policy changes.

The role of FinTech in monetary policy transmission is complex and may vary. Fintech can potentially weaken the monetary policy transmission by easing credit constraints and increasing the share of financially unconstrained firms. On the other hand, Hasan et al. (2024) argue that regions with higher FinTech adoption show weaker responses to monetary policy shocks, suggesting that FinTech adoption may reduce the effectiveness of monetary policy.

7. Conclusions

Technological innovations in financial services, which may create a source of instability in money demand, can be summarized by the concept of FinTech. FinTech, which can respond quickly and effectively to the needs of the new generation by using technologies such as software, artificial intelligence, machine learning, cloud computing, big data, etc., has made remarkable progress, especially in the payment services segment. Considering these developments affecting the liquidity preference of economic agents, how monetary policy will be affected by this has become an important question. This study seeks the answer to this question in Türkiye specifically.

In order to investigate relationships between FinTech developments and money demand, the ARDL Bounds Test approach is followed, and quarterly data for Türkiye for the period 2012:Q1-2021:Q4 is used. As a result, it is observed that national income, interest rate, exchange rate, inflation, and FinTech developments move together with money demand in the long-run; in other words, they are cointegrated. Accordingly, the evolution of FinTech developments in Türkiye reduces the demand of economic agents for central bank money over the period analyzed. This research distinguishes itself by not only highlighting the disruptive potential of FinTech but also by proposing novel frameworks for central banks to adapt their policy tools in response to these technological changes.

Based on the findings of the study, it is possible to make some recommendations to policymakers and actors of the FinTech ecosystem. It will be possible to prevent FinTech from being considered as a problem for the monetary system by introducing laws governing FinTech developments and the sector, determining the conditions of competition with the traditional banking system, and preferring inclusive and encouraging practices instead of restrictive or prohibitive practices. In this sense, steps to make Türkiye a center of attraction for FinTech should be encouraged. For this purpose, it may be beneficial to establish a legal infrastructure and to implement the Sandbox system, which is widely applied in the UK. Another critical aspect is digital financial literacy. Digital financial literacy, which means individuals having the skills and knowledge to make the right financial decisions with digital devices, can be included in the CBRT’s financial literacy activities and training. Thus, FinTech products and services can be adopted by a wider audience. On the other hand, many central banks around the world are working on their own digital currencies (Agur et al., 2022; Li et al., 2022). It would be beneficial to establish collaborations to benefit from FinTech’s technological capacities and know-how. If all these developments are evaluated as a whole and necessary steps are taken by public authorities, FinTech developments may have positive effects on the monetary system and especially on the monetary policy of central banks.

References

Agur, I., et al. (2022). Designing central bank digital currencies. Journal of Monetary Economics, Vol.125, p.62-79. https://doi.org/10.1016/j.jmoneco.2021.05.002

Altunöz, U. (2022). Türkiye’de Paranın Dolanım Hızı ve Para Talebi İstikrarlı Mı? Para Talebinin Belirleyicileri İle Ampirik Analiz. Hacettepe Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, Vol.40, No.2, p.249-271. DOI: 10.17065/huniibf.939095

Al-Zaqeba, M. A. A. et al. (2022), Intelligent Matching: Supply Chain Management and Financial Accounting Technology, Uncertain Supply Chain Management, Vol.10, p.1405-1412. Doi: 10.5267/j.uscm.2022.6.016

Arner, D. W. et al. (2016), The Evolution of FinTech: A New Post-Crisis Paradigm?, University of Hong Kong Faculty of Law, Vol.047, p.1-44. http://dx.doi.org/10.2139/ssrn.2676553

Arner, D. W. et al. (2017), FinTech and RegTech in a Nutshell, and the Future in a Sandbox, CFA Institute Research Foundation Briefs, Vol.3, No.4, p.1-20. Doi: 10.2139/ssrn.3088303

Attanasio, O. P. et al. (2002), The Demand for Money, Financial Innovation, and the Welfare Cost of Inflation: An Analysis with Households’ Data, Journal of Political Economy, Vol.110, No.2, p. 317-351. Doi: 10.1086/338743

Bayır, M. (2020), An Empirical Analysis On Determinants And Stability Of Money Demand In Turkey, Int. Journal of Management Economics and Business, Vol.16, No.1, p.62-74. http://dx.doi.org/10.17130/ijmeb.700856

Bayram, O. & Uca, H. F. (2019), Determination Of Money Demand Function In Turkey, Dumlupınar University Journal Of Social Sciences, Vol.59, p.1-12.

Bechara, M. M., et. al. (2021). The Impact of Fintech on Central Bank Governance: Key Legal Issues. International Monetary Fund.

Bernoth, K., et. al. (2017). Monetary policy implications of financial innovation: In-depth analysis (No. 120). DIW Berlin: Politikberatung kompakt.

Bettinger, A. L. (1972), FINTECH: A Series of 40 Time Shared Models Used at Manufacturers Hanover Trust Company, Interfaces, Vol.2, No.4, p.62-63.

CBRT (2019), 100 Soruda Merkez Bankacılığı, 2nd Edition, CBRT Publications, Ankara.

Carbó-Valverde, S., Cuadros-Solas, P.J. & Rodríguez-Fernández, F. (2021). FinTech and Banking: An Evolving Relationship. In: King, T., Stentella Lopes, F.S., Srivastav, A., Williams, J. (eds) Disruptive Technology in Banking and Finance. Palgrave Studies in Financial Services Technology. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-81835-7_6

Columba, F. (2009), Narrow money and transaction technology: New disaggregated evidence, Journal of Economics and Business, Vol.61, p.312-325. https://doi.org/10.1016/j.jeconbus.2009.01.001

Cornelli, G., De Fiore, F., Gambacorta, L., & Manea, C. (2024). Fintech vs bank credit: How do they react to monetary policy?. Economics Letters, 234, 111475. https://doi.org/10.1016/j.econlet.2023.111475

Çelik, B. S., & Doğan, B. Ö. (2024). Does Uncertainty in Climate Policy Affect Economic growth? Empirical Evidence from the US. Ekonomika, Vol.103, No.1, p.44-55. Doi:10.15388/Ekon.2024.103.1.3

Dorfleitner, G. et al. (2017), Fintech in Germany, Springer International Publishing, Cham. https://doi.org/10.1007/978-3-319-54666-7

Elia, G., Stefanelli, V. & Ferilli, G.B. (2023), Investigating the role of Fintech in the banking industry: what do we know?, European Journal of Innovation Management, Vol. 26 No. 5, p. 1365-1393. https://doi.org/10.1108/EJIM-12-2021-0608

Elgharib, W. A. (2024), Financial inclusion, financial development and financial stability in MENA, Review of Accounting and Finance, https://doi.org/10.1108/RAF-05-2023-0146

Fischer, A. M. (2007), Measuring income elasticity for Swiss money demand: What do the cantons say about financial innovation?, European Economic Review, Vol.51, p.1641-1660. https://doi.org/10.1016/j.euroecorev.2006.12.002

Fisher, I. (1911), The purchasing power of money. New York: Macmillian.

FSB (2017), Financial Stability Implications from FinTech, https://www.fsb.org/2017/06/financial-stability-implications-from-fintech/.

Fujiki, H. & Tanaka, M (2009). Demand for Currency, New Technology and the Adoption of Electronic Money: Evidence Using Individual Household Data, IMES Discussion Paper Series 09-E-27, Institute for Monetary and Economic Studies, Bank of Japan.

Goldfeld, S. (1973). The demand for money revisited. Brooking Papers on Economic Activity, Vol.4, No.3, p.577-646.

Gurley, J. G. & Shaw, E. S. (1955). Financial aspects of economic development. The American Economic Review, Vol.45, No.4, p.515-538.

Hasan, I., Kwak, B., & Li, X. (2024). Financial technologies and the effectiveness of monetary policy transmission. European Economic Review, 161, 104650. https://doi.org/10.1016/j.euroecorev.2023.104650

Jayasuriya, D. D., & Sims, A. (2023), From the abacus to enterprise resource planning: is blockchain the next big accounting tool?, Accounting, Auditing & Accountability Journal, Vol.36, No.1, p.24-62. https://doi.org/10.1108/AAAJ-08-2020-4718

Jiang, S. et al. (2022), Will digital financial development affect the effectiveness of monetary policy in emerging market countries?, Economic Research, Vol.35, No.1, p.3437-3472. https://doi.org/10.1080/1331677X.2021.1997619

Keynes, J. M. (1936), The general theory of employment, interest, and money. London and New York: Macmillan. https://doi.org/10.1093/acprof:osobl/9780199777693.001.0001

Kripfganz, S., & Schneider, D.C. (2023), Estimating autoregressive distributed lag and equilibrium correction models. The Stata Journal, Vol.23, No.4, p.983–1019. https://doi.org/0.1177/1536867X231212434

Lagarde, C. (2018), Central Banking and Fintech: A Brave New World, Innovations: Technology, Governance, Globalization, Vol.12, No.1-2, p.4-8.

Lenka, S. K., & Bairwa, A. K. (2016), Does financial inclusion affect monetary policy in SAARC countries?, Cogent Economics & Finance, Vol.4, No.1, p.1-8. https://doi.org/10.1080/23322039.2015.1127011

Li, Z., et al. (2022). How does the fintech sector react to signals from central bank digital currencies?. Finance Research Letters, Vol.50, 103308. https://doi.org/10.1016/j.frl.2022.103308

Mert, M., & Çağlar, A. E. (2019), Eviews ve Gauss Uygulamalı Zaman Serileri Analizi, 1th ed., Detay Yayıncılık, Ankara.

Mlambo, C., & Msosa, S. K. (2020), The effect of financial technology on money demand: evidence from selected African states, International Journal of Economics and Business Administration, Vol.3, No.1, p.366-373. Doi: 10.35808/ijeba/430

Mohamed, H., & Ali, H. (2019), Blockchain, Fintech, and Islamic Finance, Walter de Gruyter, Berlin. https://doi.org/10.1515/9781547400966

Mumtaz, M. Z., & Smith, Z. A. (2020), Empirical examination of the role of fintech in monetary policy, Pacific Economic Review, Vol.25, No.5, p.620-640. Doi: 10.1111/1468-0106.12319

Nazlioglu S., Gormus A. & Soytas U. (2019), Oil prices and monetary policy in emerging markets: structural shifts in causal linkages. Emerg Mark Financ Trade, Vol.55, No.1, p.105–117. https://doi.org/10.1080/1540496X.2018.1434072

Nguyen, L., Tran, S. & Ho, T. (2022), Fintech credit, bank regulations and bank performance: a cross-country analysis, Asia-Pacific Journal of Business Administration, Vol. 14 No. 4, pp. 445-466. https://doi.org/10.1108/APJBA-05-2021-0196

Ozili, P. K. (2020). Financial inclusion research around the world: A review. Forum for Social Economics, Vol.50, No.4, p.457–479. https://doi.org/10.1080/07360932.2020.1715238

Özatay, F. (2015), Parasal İktisat: Kuram ve Politika, 4th Edition, Efil Publishing, Ankara.

Parveen, S., e Ali, M. S., & Adeem, M. A. (2020). The Determinants of Demand for Money: Empirical Evidence from Some Selected Developing Countries. Journal of Contemporary Macroeconomic Issues, Vol.1, No.2, p.20-34.

Pata, U.K. & Aydin, M. (2020). Testing the EKC hypothesis for the top six hydropower energy-consuming countries: evidence from Fourier Bootstrap ARDL procedure. J Clean Prod 264:121699. https://doi.org/10.1016/j.jclepro.2020.121699

Peseran, M. H. et al. (2001), Bounds testing approaches to the analysis of level relationships, Journal of Appl Econometrics, Vol.16, p.289-326. https://doi.org/10.1002/jae.616

Rinaldi, L. (2001), Payment Cards and Money Demand in Belgium, Center for Economic Studies Discussions Paper Series, https://ideas.repec.org/p/kul/kulwps/ces0116.html

Saraswati, B. D. et al. (2020), The Effect of Financial Inclusion and Financial Technology on Effectiveness of the Indonesian Monetary Policy, Business: Theory and Practice, Vol.21, No.1, p.230-243. https://doi.org/10.3846/btp.2020.10396

Schueffel, P. (2016), Taming the Beast: A Scientific Definition of Fintech, Journal of Innovation Management, Vol.4, No.4, p.32-54. https://doi.org/10.24840/2183-0606_004.004_0004

Sevüktekin, M.; Nargeleçekenler, M. (2007), The Roles of Financial Factors on the Real Money Demand: Turkey Case, Balıkesir University The Journal of Social Sciences Institute, Vol.10, No.18, p.45-61.

Snellman, J. S. et al. (2001), Substitution of Noncash Payment Instruments for Cash in Europe, Journal of Financial Services Research, Vol.19, No.2/3, p.131-145. https://doi.org/10.1023/A:1011151219545

Snellman, H.; Viren, M. (2009), ATM networks and cash usage, Applied Financial Economics, Vol.19, p.841-851. https://doi.org/10.1080/09603100701675548

Tang, Y. M., Chau, K. Y., Hong, L., Ip, Y. K., & Yan, W. (2021). Financial innovation in digital payment with WeChat towards electronic business success. Journal of Theoretical and Applied Electronic Commerce Research, Vol.16, No.5, p.1844-1861. https://doi.org/10.3390/jtaer16050103

Tang, M., Hu, Y., Corbet, S., Hou, Y. G., & Oxley, L. (2024). Fintech, bank diversification and liquidity: Evidence from China. Research in International Business and Finance, 67, 102082. https://doi.org/10.1016/j.ribaf.2023.102082

Tehranchian, A. M. et al. (2012), The Impact of Modern Technology on Demand for Money in Iran, Iranian Economic Review, Vol.16, No.32, p.133-148. Doi: 10.22059/IER.2012.32742

Toda, H. Y.; Y., Taku (1995), Statistical inference in vector autoregressions with possibly integrated processes, Journal of econometrics, Vol.66, No.1-2, p.225-250. https://doi.org/10.1016/0304-4076(94)01616-8

Tsouli, D. (2022). Financial inclusion, poverty, and income inequality: Evidence from European Countries. Ekonomika, Vol.101, No.1, p.37-61. Doi:10.15388/Ekon.2022.101.1.3

Ugwuanyi, G. O. et al. (2020), Investigating the Impact of Digital Finance on Money Supply in Nigeria, Nigerian Journal of Banking and Finance, Vol.12, No.1, p.47-55.

Walker, T., Nikbakht, E., Kooli, M. (2023). Fintech and Banking: An Overview. In: Walker, T., Nikbakht, E., Kooli, M. (eds) The Fintech Disruption. Palgrave Studies in Financial Services Technology. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-031-23069-1_1

Wasiaturrahma et al. (2019), Non cash payment and demand for real money in Indonesia, Journal of Economics, Business, and Accountancy Ventura, Vol.22, No.1, p.1-8. https://doi.org/10.14414/jebav.v22i1.1575

Wegari, H. L., Whakeshum, S. T. & Mulatu, N. T. (2023) Human capital and its impact on Ethiopian economic growth: ARDL approach to co-integration, Cogent Economics & Finance, Vol.11, 2186046, DOI: 10.1080/23322039.2023.2186046as usual, the markets get back to their normal levels and stock prices increase once the uncertainty is relieved. This unclear trading nature is also driven by some other factors.

, where

, where  represents real money demand, Y is national income, and i is the interest rate. When considering the velocity of money, this equation transforms to

represents real money demand, Y is national income, and i is the interest rate. When considering the velocity of money, this equation transforms to  . Keynes argues that the velocity of money is not constant; instead, it is influenced by variations in national income and interest rates. This distinction underscores a fundamental divergence between Classical and Keynesian economic thought regarding the determinants and stability of the velocity of money. This fundamental theoretical distinction, which influences the economic policy-making process and approach, emphasizes the need for central banks to be able to forecast money demand effectively in order to improve monetary policy maneuverability (Goldfeld, 1973). In their study, Gurley and Shaw (1955) showed that money substitutes, which are the result of financial innovations, change the sensitivity of money holding to the interest rate. In this case, the relationship between monetary aggregates and price stability weakens. Namely, it is argued in the literature that FinTech developments may affect the demand of economic agents for central bank money, create instability, and complicate the monetary policymaking process. Modern payment methods, virtual money innovations and many other developments encourage society to become cashless.

. Keynes argues that the velocity of money is not constant; instead, it is influenced by variations in national income and interest rates. This distinction underscores a fundamental divergence between Classical and Keynesian economic thought regarding the determinants and stability of the velocity of money. This fundamental theoretical distinction, which influences the economic policy-making process and approach, emphasizes the need for central banks to be able to forecast money demand effectively in order to improve monetary policy maneuverability (Goldfeld, 1973). In their study, Gurley and Shaw (1955) showed that money substitutes, which are the result of financial innovations, change the sensitivity of money holding to the interest rate. In this case, the relationship between monetary aggregates and price stability weakens. Namely, it is argued in the literature that FinTech developments may affect the demand of economic agents for central bank money, create instability, and complicate the monetary policymaking process. Modern payment methods, virtual money innovations and many other developments encourage society to become cashless. (1)

(1)

(2)

(2)