(1)

(1)Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(3), pp. 57–69 DOI: https://doi.org/10.15388/Ekon.2024.103.3.4

Nazif Durmaz

Kean University, USA

Email: ndurmaz@kean.edu

ORCID: https://orcid.org/0000-0003-2835-6191

Abstract. Released by Policy Uncertainty, the economic policy uncertainty (EPU) index is built on newspaper reports that contribute to uncertain conditions. The present study examines the impact of the EPU index on stock price indices on a selected group of countries. Variations in stock price indices are explained in a similar fashion as in previous studies but this study employs a new dataset. To obtain the speeds of adjustment to long-run equilibrium and short-run elasticities in every country, the framework of error correction was applied. This paper concludes that increased uncertainty has unfavorable short-run effects in all countries in the dataset. The present study also reports negative relation in the long run between high uncertainty and stock prices in some countries.

Keywords: Policy uncertainty, Stock prices, ARDL

_________

Received: 03/05/2024. Revised: 24/06/2024. Accepted: 15/07/2024

Copyright © 2024 Nazif Durmaz. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Changes related to economic activities and policies always draw the attention of academia and businesses since the results may have significant impacts on the markets. Bernanke (1983) makes the point that negative effects on the overall economy can be due to reluctant spending and investment decisions of businesses, consumers, and investors. Bernanke also mentions that firms may delay future investment plans and hiring during high economic uncertainty, all of which can produce a contraction in the economy.

Many researchers and investors show deep interests about policy uncertainty following major events such as financial crisis, increased tensions between countries, and partisan disputes in nations. General expected reaction of stock market to bad news is fall in prices, and rise in prices to good news. One of the most remarkable undesirable effects was due to the recent global pandemic. Due to caused uncertainty, most indicators had reached their peak values and had a record negative impact on stock prices around world. But as usual, the markets get back to their normal levels and stock prices increase once the uncertainty is relieved. This unclear trading nature is also driven by some other factors. Pastor and Veronesi (2012) states that the reason why the market behaves negatively for a period is because when, for example, the US government cannot decide on a budget and worst outcome is expected by market participants.

Quantification of unclear factors into a one amount over time can help one evaluate its effect on stock prices. Baker, Bloom, and Davis (2016) build the EPU index that catches uncertainty from news outlets, policy, and other economic indicators. The authors systematically employ three different elements to collect factors and turn them into a new single index. They use 10 large newspapers’ coverage to constructed by policy-related economic uncertainty for their first component. The expiration of the federal tax code is investigated by their second component and finally the third one investigates economic forecasters’ disagreement that comes from Federal Reserve Bank of Philadelphia’s Survey.

Earlier studies employ the newly established policy uncertainty index and evaluate the effects on other macro values. Risk premia reaction and market returns by uncertainty index studies are done by Pastor and Veronesi (2012), Aye, Balcilar, Demirer, and Gupta (2018), and Das and Kumar (2018). Durmaz (2023) studies the effect of uncertainty index and its subindices on closed-end funds. Oil prices and uncertainty index relationships are explored by Bahmani-Oskooee et al. (2018), Istiak and Alam (2019) and Pham and Nguyen (2022). Bahmani-Oskooee et al. (2016) also look at the effect of policy uncertainty on the US money demand.

The purpose of this paper is to estimate long- and short-run effects of policy uncertainty on stock prices. For this, I use a new Economic Policy Uncertainty Index (EPU) developed by Baker, Bloom, and Davis (2016) on the frequency of newspaper reports, which represents changes in policy-related economic uncertainty. The analysis is based on time series data for monthly but different time periods for a total of 11 countries (10 of which are OECD members). These 11 countries are: Belgium (BEL), Colombia (COL), Croatia (HRV), Denmark (DNK), Greece (GRC), Ireland (IRL), Italy (ITA), Mexico (MEX), Spain (ESP), Sweden (SWE), and Singapore (SGP).

The present study employs the autoregressive distributed lag (ARDL) established in Pesaran, Shin, and Smith (2001). This ARDL bounds testing procedure is to overcome the spurious regression problem of stochastic trends’ presence that is usually seen in economic time series. Since most macro variables in a given model are combinations of I(0) and I(1), prestage unit root tests are unnecessary. This therefore makes this methodology advantageous over other approaches to cointegration.

Identifying stock price determinants is one of the important subjects of financial economics. Fama and French (1993) identifies five common risk factors in stock and bond returns of which three are stock market factors: overall market factors and factors related to company size and book-to-market value. A review article by Bahmani-Oskooee and Saha (2015) points out some of the main determinants of stock prices for most of the countries such as exchange rates, monetary aggregation, consumer price indices, domestic production, and interest rates, among others. The same study by Bahmani-Oskooee and Saha (2015) go over many studies in detail for the mentioned factors. Ma, Wang, and He (2022) find a relationship between increased stock volatility and high economic policy uncertainty. Tsai (2017) shows that Chinese EPU has the most impact on the global stock market. In a selected country study, Škrinjarić and Orlović (2020) report spillover effects between risk, return, and EPU in some of the countries.

Anari and Kolari (2001) use stock price and commodity price data from six industrial countries to demonstrate a positive, long-term Fisher effect for stock returns. Bahmani-Oskooee and Saha (2016) introduce nonlinearity into the adjustment process and demonstrate that the impact of exchange rate changes on stock prices is asymmetric and short-term. Degiannakis, Filis, and Arora (2018) estimate causal effects between oil and stock markets depend heavily on whether research is performed using aggregate stock market indices, sectorial indices, or firm-level data and whether stock markets operate in net oil-importing or net oil-exporting countries. Additionally, conclusions vary depending on whether studies use symmetric or asymmetric changes.

Another study by Bahmani-Oskooee and Saha (2019) investigates stock prices and uncertainty relationship in 13 countries. Caporale, Hunter, and Ali (2014) use data from the banking crisis, between 2007 and 2010, and examine the nature of the link between stock market prices and exchange rates in six advanced economies.

Granger, Huangb, and Yang (2000) apply recently developed unit root and cointegration models to determine the appropriate Granger relationship between stock prices and exchange rates and conclude that the exchange rates guide the stock price. Kutty (2010) examines the relationship between Mexican stock prices and exchange rates and confirms that there is a short-term but no long-term relationship between these two variables. Kollias, Mylonidis, and Paleologou (2012) study daily data to explore the link between stock prices and exchange rates for two European composite stock market indices. Jiang, El Khoury, Alshater, and Yoon (2024) examine the relationship between stock prices and exchange rates in the Australian context.

Lean, Narayan, and Smyth (2011) find that exchange rates and stock prices have primarily impacted each other in content, which is reflected in the short-term intertemporal linkages between these financial variables. Xie, Chen, and Wu (2020) claim that stock price may be used in estimation of exchange rates, however the opposite is not useful. Salisu and Vo (2021) show how stock prices behave with the exchange rates given the extreme fluctuations in interest rates. In their nonlinear approach, Nusair and Olson (2022) indicate differential long-term relationship between stock prices and exchange rates in G7 countries.

Tsagkanos and Siriopoulos (2013) report a normal relationship between stock prices and exchange rates, which is long-run in EU and short-run in USA, during the financial crisis between 2008 and 2012 in EU and USA. Tian, El Khoury, and Alshater (2023) study the spillover effects of exchange rates on the stock prices in emerging economies and conclude a nonlinear and negative relationship between these two. Chang, Chang, and Wang (2024) examine the relationship between stock prices and exchange rates in Taiwan and find a negative Granger causality.

Previous research shows that adverse effects of exchange rates happen to be more common in developing countries than developed countries (Durmaz 2015; Bahmani-Oskooee and Durmaz 2016). The purpose of this paper is to test the impact of economic policy uncertainty on stock prices in selected countries. Inclusion of countries depends on the availability of data collection on pertinent variables. Thus, Section 2 presents a model which includes the EPU index as one of the determinants of stock prices and discusses the applied methodology. Section 3 then presents the findings, and the summary is in Section 4. Lastly, Appendix A and B provide the data definitions and sources.

The present paper follows the works of Boonyanam (2014) and Moore and Wang (2014). Borrowing earlier studies is a straightforward way to evaluate policy uncertainty effects on stock prices. I also add a new variable as an additional determinant.

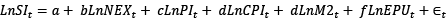

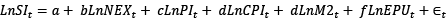

(1)

(1)

where SI represents the stock price indices, NEX is the nominal effective exchange rate, PI is the Industrial Production Index, which is a measure of output, CPI measures the price level which is the Consumer Price Index, next is M2, measure of nominal money supply, and lastly, I introduce EPU, measure of economic policy uncertainty index. Firms that are listed with certain stocks that are import or export focused could have a negative or positive sign for an estimate of coefficient b. Since a devaluation of the domestic currency will increase the exports of export-intensive firms, these firms should see their profits and stock prices increase as a result.

However, another expected result is that currency devaluation may increase the import costs and decrease the profits of import-reliant firms, which would decrease the stock prices of such firms. A positive sign is expected for an estimate of coefficient c because more economic activity would increase stock prices. Due to a lack of availability of monthly GDP data, the industrial productivity index is used. The coefficient of CPI, d, may also be positive or negative.

Arguments by Fama (1981) and Chen et al. (1986) point out that inflation is expected to result in high input prices with reduced profits which would decrease stock prices. But Anari and Kolari (2001) show that while stock prices and inflation are negatively correlated in the short run, this correlation could flip positive in the long run. The practice of an inflation hedge by holding stocks longer periods may yield a positive relationship between inflation and stock prices. Similarly, an estimate of e could be positive or negative as well. Since increases in the money supply causes inflation, Fama (1981) points out that it could negatively affect stock prices. On the other hand, lower interest rates after a money supply increase could lead to more investment opportunities and growth in the economy which result in increased stock prices.

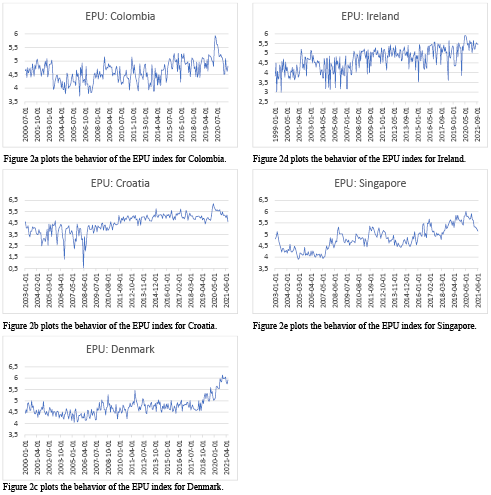

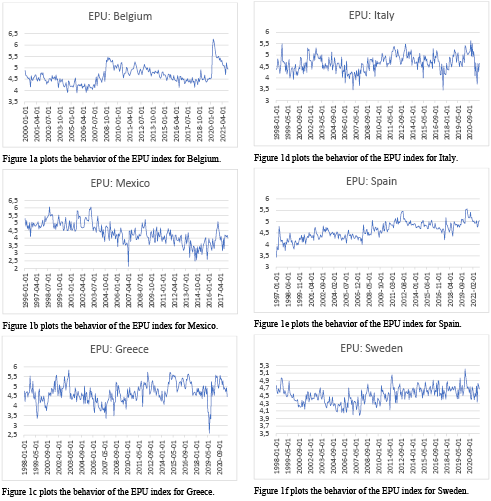

To conclude, an estimate of f is negative. An increase in uncertainty is expected to result in a negative reaction from investors that would decrease stock prices. Figure 1 plots the behavior of the EPU index over the period of the datasets of included countries.

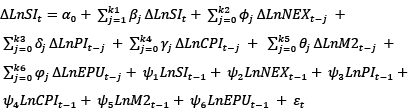

Long-run effects of used independent variables to explain stock price variations will be obtained by estimating equation (1) by an applied methodology. Using equation (1), I will construct an error-correction model to point out the differences in short-run and long-run effects. The present paper follows the previous studies and applies Pesaran et al.’s (2001) ARDL bounds test method by converting equation (1) into (2):

(2)

(2)

After estimating coefficients of first-differenced variables, their signs and magnitudes will determine short-run effects. In equation (2), the estimates ψ2, ψ3, ψ4, ψ5, and ψ6 measure the normalized value of long-run effects which is ψ1. In order to have sound estimated long-run effects, Pesaran et al. (2001) propose two different cointegration tests. The first cointegration test is an F-test that will specify the designed joint significance of lagged level variables. For the other test, a t-test will be applied to prove the importance of ψ1 in equation (2). The order of integration of variables is found by new critical values of nonstandard distributions of these two recommended tests. It is common in most empirical studies that one of the properties of most macro variables is a combination of I(0) and I(1). The present paper is also no different from those studies. Thus, I take advantage of employing this approach and skip pre-unit-root testing on the used variables. One more advantage this methodology also presents is the ability to estimate short-run and long-run effects in a single step.

This section discusses the error correction model (2) for the countries listed in Table 1 using the monthly data over the time period listed in the same table. The time period depends on the availability of the dataset from the sources provided in the Appendix. The present study imposes a maximum of ten lags and, to select an optimum model, it uses Akaike’s Information Criterion (AIC). The associated levels of significance provided in the table notes to recognize an estimate with an asterisk * if it is significant at a 10% level of significance, and ** if it is significant at a 5% level of significance. This paper separates reports into three parts per table by short-run estimates in Panel i, long-run estimates in Panel ii, and diagnostics in Panel iii.

I choose to include only five countries in Table 1 that have all the variables with at least one significant lagged coefficient. This implies that variables have short-run effects on stock prices. The present study’s focus is on the economic policy uncertainty measure (EPU), which has shown short-run effects on all five countries’ stock prices. It has the correct significant negative sign which suggests that economic uncertainty indeed negatively impacts stock prices in the short run in five cases. As expected, an increase in unclear economic policy indeed leads a fall in the stock markets of Belgium, Greece, Italy, Mexico, and Spain. These results are all in line with the previous literature findings (Tsai, 2017; Fortunato et al, 2020; Wang et al, 2020; Abid, 2020). Economic policy uncertainty is an important factor in explaining financial movements in developing countries such as Mexico, and in European countries as well. The next discussion inquires whether the short-run effects continue in the long run or not.

|

Belgium |

Greece |

Italy |

Mexico |

Spain |

|

|

Panel i: Short Run |

|||||

|

ΔlnEPUt |

-0.09 (0.02)** |

-0.10 (0.03)** |

-0.03 (0.01)** |

-0.02 (0.01)* |

-0.15 (0.02)** |

|

Lag 1 |

-0.06 (0.02)** |

0.01 (0.03) |

|||

|

Lag 2 |

-0.05 (0.02)** |

0.05 (0.02)** |

|||

|

Lag 3 |

-0.02 (0.02) |

||||

|

Lag 4 |

-0.01 (0.03) |

||||

|

Lag 5 |

0.01 (0.02) |

||||

|

Lag 6 |

-0.02 (0.01)* |

||||

|

Panel ii: Long Run |

|||||

|

Constant |

10.53 (3.71)** |

2.70 (30.0) |

14.11 (6.72)** |

-4.65 (22.14) |

0.13 (6.50) |

|

LnNEXt |

-3.04 (0.95)** |

7.15 (7.61) |

-0.62 (1.19) |

-1.01 (0.97) |

2.08 (2.14) |

|

LnPIt |

0.26 (0.58) |

0.82 (2.00) |

1.12 (0.84) |

-2.75 (3.82) |

0.34 (0.61) |

|

LnCPIt |

-10.30 (1.84)** |

-6.68 (3.43)* |

-3.51 (1.74)** |

-2.26 (2.07) |

1.78 (1.56) |

|

LnM2t |

4.50 (0.73)** |

0.34 (1.48) |

0.80 (0.57) |

1.92 (1.02)* |

-0.43 (0.53) |

|

LnEPUt |

-0.22 (0.07)** |

-1.03 (0.38)** |

-0.35 (0.16)** |

-0.32 (0.18)* |

-0.71 (0.25)** |

|

Panel iii: Diagnostics |

|||||

|

F test |

1.98 |

0.91 |

2.22 |

1.12 |

3.22 |

|

ecmt |

-0.12 (0.03)** |

-0.10 (0.03)** |

-0.11 (0.03)** |

-0.05 (0.02)** |

-0.09 (0.02)** |

|

LM |

9.02 |

8.14 |

6.76 |

11.53 |

8.26 |

|

RESET |

0.33 |

2.2 |

4.24 ** |

2.93 * |

1.05 |

|

R-Bar-Squared |

0.21 |

0.26 |

0.29 |

0.11 |

0.17 |

|

CS (CS2) |

S (S) |

S (US) |

S (S) |

US (US) |

S (US) |

a. Numbers inside the parentheses after coefficient estimates are standard errors. Symbols * and ** indicate significance levels at the 10% and 5% levels, respectively.

b. The upper bound critical value of the F-test for cointegration where there are four exogenous variables is 3.52 (4.01) at the 10% (5%) level of significance. These come from Pesaran et al. (2001, Table CI, Case III, p. 300

c. The critical value for significance of ECMt-1 is −3.66 (−3.99) at the 10% (5%) level when k = 4. These come from Pesaran et al. (2001, Table CII, Case III, p. 303)

d. LM is the Lagrange Multiplier statistic to test for autocorrelation. It is distributed as χ2 with 1 degree of freedom. The critical value is 3.84 (5%)

e. RESET is Ramsey’s test for misspecification. It is distributed as χ2 with one degree of freedom. The critical value is 3.84 (5%)

f. source: author’s own estimations.

Panel ii of Table 1 displays that economic policy uncertainty is found to be a statistically significant negative coefficient in the long run in all five countries. The effect does not appear to be temporary and is carried out in the long run. The findings of this paper are consistent with our expectation and past studies’ suggestions. Given the high Debt to GDP ratios of Greece, Italy, and Spain, this paper’s outcome is applicable. In addition, as Bloom (2014) points out that because emerging countries experience more uncertainty than others, this paper’s outcome is consistent.

Another variable included in the study, the nominal exchange rate, is statistically significant only in Belgium, which means it has a negative long-run effect on the stock prices. LnCPI has significant negative long-run effects in Belgium, Greece, and Italy. In these countries an increase in general prices is expected to have a long-run negative effect on stock prices. The LnM2 coefficient carries significant positive long-run effects in Belgium and Mexico. An increase in M2 will lead a long-run positive effect on Belgium and Mexico’s stock prices. The industrial production index, LnIPI, is the only variable that does not have any significant long-run effect in any of the five cases.

The present study moves to establish a cointegration in the following to have meaningful and applicable long-run effects. The reported F-test results are insignificant in all countries and thus fail to indicate cointegration. However, by using the normalized long-run estimates from Panel B and the long-run model introduced in equation (1), I produce the error term for an alternative test for cointegration. After designating this error term, ecm, I replace the linear combination of lagged level variables with  in equation (2). After imposing the same optimum number of lags, I gather from Panel i, it allows us to estimate the newly introduced measurement.

in equation (2). After imposing the same optimum number of lags, I gather from Panel i, it allows us to estimate the newly introduced measurement.

A supportive cointegration conclusion shall have a significant negative coefficient for the ecmt–1. One has to be careful at this level since the t-test here has a new distribution that is normally applied to evaluate the significance of these estimates. The ARDL approach suggests that included variables in a study may be a combination of I(0) and I(1). Pesaran et al. (2001, P. 303) offer a pre-calculated upper and a lower bound critical value for the necessary t-test. By checking that the provided values of all the countries in the study have significant negative coefficients, I conclude that the long-run effects are acceptable.

Finally, Panel iii reports key diagnostic statistics. Beginning with the Lagrange Multiplier (LM) statistic to test for autocorrelation, it reports a χ2 distribution with one degree of freedom. The present study tests for first order serial correlation and concludes that in all five cases it is insignificant, free of autocorrelation problem. To check for model misspecification, Panel iii reports Ramsey’s RESET statistics. RESET also follows a χ2 distribution with one degree of freedom. Only Italy and Mexico are found to be significant. The last tests, CUSUM and CUSUMSQ, are applied to the residuals of each model to verify the stability of both the short-run and long-run coefficient estimates. The last column of Panel iii indicates CS and CS2, where S indicates stable estimates and US indicates unstable ones. Except Mexico, all countries are stable by at least one test.

It is common to observe abrupt declines in the behavior of the stock market in any given economy when facing harsh times such as war, political turmoil, recessions, election period, and notably an uncertain situation. Fluctuations in the daily amount of good and bad news typically has an effect on stock prices.

The present paper addresses these unfavorable impacts of economic policy uncertainty on stock prices, and analyses whether they are temporary or long lasting on the stock prices of 11 countries. Further discussions all rely on the broad economic policy uncertainty indices collected from Policy Uncertainty Group, based on Baker et al.’s (2016) study. The Policy Uncertainty Group forms these economic policy uncertainty indices by heavily combing through the newspapers’ use of some crucial keywords in associated countries. Most of these newspaper-based words are policy-related macroeconomic variables. Finally, the Policy Uncertainty Group quantifies all these to build the economic policy uncertainty index.

This study concludes that economic policy uncertainty negatively affects stock prices in the short run in all 11 countries: Belgium, Colombia, Denmark, Greece, Ireland, Italy, Mexico, Spain, Sweden, Croatia, and Singapore. Economic policy uncertainty also negatively effects stock prices in the long run in Belgium, Greece, Italy, Mexico, Spain, and Singapore. This paper relies on an ARDL bounds testing approach by Pesaran et al. (2001) in order to form an error-correction model and cointegration, in order to evaluate short- and long-run effects. Additionally, employing economic policy uncertainty index into used models in the present paper helped improve predictability not in the short run but also in the long run and with better explanatory capacity.

This paper’s results present some significant policy implications that may be valuable for investors, researchers, and managers. Since the outcome suggests mostly temporary impacts, in the presence of uncertainty, long-term holding of stocks may be a sensible option rather than rushing to sell in the face of volatility. Some abrupt dips in the market may be interpreted as a potential buying opportunity.

Research Data Policy and Data Availability Statements: The data that support the findings of this study are available from the author, upon reasonable request.

Conflict of Interest Statement: The corresponding author states that there is no conflict of interest.

Funding: None.

Abid, A. (2020). Economic policy uncertainty and exchange rates in emerging markets: Short and long runs evidence. Finance Research Letters, 37, 101378. https://doi.org/10.1016/j.frl.2019.101378

Anari, A., & Kolari, J. (2001). Stock prices and inflation. Journal of Financial Research, 24(4), 587-602. https://doi.org/10.1111/j.1475-6803.2001.tb00832.x

Aye, G. C., Balcilar, M., Demirer, R., & Gupta, R. (2018). Firm-level political risk and asymmetric volatility. The Journal of Economic Asymmetries, 18. https://doi.org/10.1016/j.jeca.2018.e00110

Bahmani-Oskooee, M. & Durmaz, N. (2016). Exchange rate volatility and Turkish commodity trade with the rest of the world. Economic Change and Restructuring, 49, 1–21. https://doi.org/10.1007/s10644-015-9172-8

Bahmani-Oskooee, M., & Saha, S. (2015). On the relation between stock prices and exchange rates: a review article. Journal of Economic Studies 42(4), 707-732. https://doi.org/10.1108/JES-03-2015-0043

Bahmani-Oskooee, M., Saha, S. (2016). Do exchange rate changes have symmetric or asymmetric effects on stock prices? Global Finance Journal, 31, 57–72. https://doi.org/10.1016/J.GFJ.2016.06.005

Bahmani-Oskooee, M., & Saha, S. (2019). On the effects of policy uncertainty on stock prices. Journal of Economics and Finance, 43(4), 764-778. https://doi.org/10.1007/s12197-019-09471-x

Bahmani-Oskooee, M., Kones, A., & Kutan, A. (2016). Policy uncertainty and the demand for money in the United States. Applied Economics Quarterly, 62(1), 37-49. https://doi.org/10.3790/AEQ.62.1.37

Bahmani-Oskooee, M., Harvey, H., & Niroomand, F. (2018). On the impact of policy uncertainty on oil prices: an asymmetry analysis. International Journal of Financial Studies, 6(1), 12. https://doi.org/10.3390/ijfs6010012

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593-1636. https://doi.org/10.1093/qje/qjw024

Bernanke, B. (1983). Irreversibility, uncertainty and cyclical investment. Quarterly Journal of Economics, 98, 85–106. https://doi.org/10.2307/1885568

Bloom, N. (2014). Fluctuations in uncertainty. Journal of Economic Perspectives, 28(2), 153-176. https://doi.org/10.1257/jep.28.2.153

Boonyanam, N. (2014). Relationship of stock price and monetary variables of Asian small open emerging economy: Evidence from Thailand. International Journal of Financial Research, 5(1), 52. https://doi.org/10.5430/ijfr.v5n1p52

Caporale, G. M., Hunter, J., & Ali, F. M. (2014). On the linkages between stock prices and exchange rates: Evidence from the banking crisis of 2007–2010. International Review of Financial Analysis, 33, 87-103. https://doi.org/10.1016/j.irfa.2013.12.005

Chang, H. W., Chang, T., & Wang, M. C. (2024). Revisit the impact of exchange rate on stock market returns during the pandemic period. The North American Journal of Economics and Finance, 70, 102068. https://doi.org/10.1016/j.najef.2023.102068

Das, D., & Kumar, S. B. (2018). International economic policy uncertainty and stock prices revisited: Multiple and Partial wavelet approach. Economics Letters, 164, 100-108. https://doi.org/10.1016/j.econlet.2018.01.013

Degiannakis, S., Filis, G., & Arora, V. (2018). Oil prices and stock markets: A review of the theory and empirical evidence. The Energy Journal, 39(5), 85-130. https://doi.org/10.5547/01956574.39.5.sdeg

Durmaz, N. (2015). Industry level J-curve in Turkey. Journal of Economic Studies, 42: 689–706. https://doi.org/10.1108/JES-08-2013-0122

Durmaz, N. (2023) Closed-End Fund Discounts and Economic Policy Uncertainty, Journal of Risk and Financial Management 16-3, 1-29. https://doi.org/10.3390/jrfm16030200

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3-56. https://doi.org/10.1016/0304-405X(93)90023-5

Fortunato, G., Martins, N., & de Lamare Bastian-Pinto, C. (2020). Global Economic Factors and the Latin American Stock Markets. Latin American Business Review, 21(1), 61-91. https://doi.org/10.1080/10978526.2019.1665467

Granger, C. W., Huangb, B. N., & Yang, C. W. (2000). A bivariate causality between stock prices and exchange rates: evidence from recent Asian flu. The Quarterly Review of Economics and Finance, 40(3), 337-354. https://doi.org/10.1016/S1062-9769(00)00042-9

Istiak, K., & Alam, M. R. (2019). Oil prices, policy uncertainty and asymmetries in inflation expectations. Journal of Economic Studies, 46(2), 324-334. https://doi.org/10.1108/JES-02-2018-0074

Jiang, Z., El Khoury, R., Alshater, M. M., & Yoon, S. M. (2024). Impact of global macroeconomic factors on spillovers among Australian sector markets: Fresh findings from a wavelet‐based analysis. Australian Economic Papers, 63(1), 78-105. https://doi.org/10.1111/1467-8454.12299

Kollias, C., Mylonidis, N., & Paleologou, S. M. (2012). The nexus between exchange rates and stock markets: evidence from the euro-dollar rate and composite European stock indices using rolling analysis. Journal of Economics and Finance, 36(1), 136-147. https://doi.org/10.1007/s12197-010-9129-8

Kutty, G. (2010). The relationship between exchange rates and stock prices: the case of Mexico. North American Journal of Finance & Banking Research, 4(4). DOI: http://globip.com/contents/articles/northamerjournal-vol4-article1.pdf

Lean, H. H., Narayan, P., & Smyth, R. (2011). Exchange rate and stock price interaction in major Asian markets: Evidence for individual countries and panels allowing for structural breaks. The Singapore Economic Review, 56(02), 255-277. https://doi.org/10.1142/S0217590811004250

Ma, Y., Wang, Z., & He, F. (2022). How do economic policy uncertainties affect stock market volatility? Evidence from G7 countries. International Journal of Finance & Economics, 27(2), 2303-2325. https://doi.org/10.1002/ijfe.2274

Moore, T., & Wang, P. (2014). Dynamic linkage between real exchange rates and stock prices: Evidence from developed and emerging Asian markets. International Review of Economics & Finance, 29, 1-11. https://doi.org/10.1016/j.iref.2013.02.004

Nusair, S. A., & Olson, D. (2022). Dynamic relationship between exchange rates and stock prices for the G7 countries: A nonlinear ARDL approach. Journal of International Financial Markets, Institutions and Money, 78. https://doi.org/10.1016/j.intfin.2022.101541

Salisu, A. A., & Vo, X. V. (2021). The behavior of exchange rate and stock returns in high and low interest rate environments. International Review of Economics & Finance, 74, 138-149. https://doi.org/10.1016/j.iref.2021.02.008

Pastor, L., & Veronesi, P. (2012). Uncertainty about government policy and stock prices. The Journal of Finance, 67(4), 1219-1264. https://doi.org/10.1111/j.1540-6261.2012.01746.x

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289-326. https://doi.org/10.1002/jae.616

Pham, L., & Nguyen, C. P. (2022). How do stock, oil, and economic policy uncertainty influence the green bond market? Finance Research Letters, 45, 102128. https://doi.org/10.1016/j.frl.2021.102128

Škrinjarić, T., & Orlović, Z. (2020). Economic policy uncertainty and stock market spillovers: Case of selected CEE markets. Mathematics, 8(7), 1077. https://doi.org/10.3390/math8071077

Tian, M., El Khoury, R., & Alshater, M. M. (2023). The nonlinear and negative tail dependence and risk spillovers between foreign exchange and stock markets in emerging economies. Journal of International Financial Markets, Institutions and Money, 82, 101712. https://doi.org/10.1016/j.intfin.2022.101712

Tsagkanos, A., & Siriopoulos, C. (2013). A long-run relationship between stock price index and exchange rate: A structural nonparametric cointegrating regression approach. Journal of International Financial Markets, Institutions and Money, 25, 106-118. https://doi.org/10.1016/j.intfin.2013.01.008

Tsai, I. C. (2017). The source of global stock market risk: A viewpoint of economic policy uncertainty. Economic Modelling, 60, 122-131. https://doi.org/10.1016/j.econmod.2016.09.002

Wang, J., Lu, X., He, F., & Ma, F. (2020). Which popular predictor is more useful to forecast international stock markets during the coronavirus pandemic: VIX vs EPU? International Review of Financial Analysis, 72, 101596. https://doi.org/10.1016/j.irfa.2020.101596

Xie, Z., Chen, S. W., & Wu, A. C. (2020). The foreign exchange and stock market nexus: New international evidence. International Review of Economics & Finance, 67, 240-266. https://doi.org/10.1016/j.iref.2020.01.001

|

No |

alpha-3 code |

Countries |

Time Period in the study |

Stock Market Indices |

|

1 |

BEL |

Belgium |

January 2000 – November 2021 |

BEL 20 (^BFX) |

|

2 |

COL |

Colombia |

July 2000 – August 2021 |

FTSE Colombia (WICOL) |

|

3 |

HRV |

Croatia |

January 2003 – August 2021 |

CROBEX (CRBEX) |

|

4 |

DNK |

Denmark |

January 2000 – June 2021 |

Copenhagen 20 (^OMXC20) |

|

5 |

GRC |

Greece |

January 1998 – August 2021 |

FTSE/ATHEX Large Cap (ATF) |

|

6 |

IRL |

Ireland |

January 1999 – October 2021 |

ISEQ All Share (^ISEQ) |

|

7 |

ITA |

Italy |

January 1998 – November 2021 |

FTSE MIB (FTMIB) |

|

8 |

MEX |

Mexico |

January 1996 – February 2018 |

IPC MEXICO (^MXX) |

|

9 |

SGP |

Singapore |

January 2003 – June 2021 |

FTSE Straits Times Index |

|

10 |

ESP |

Spain |

January 1997 – November 2021 |

IBEX 35 (IBEX) |

|

11 |

SWE |

Sweden |

January 1998 – November 2021 |

OMX Stockholm 30 (OMXS30) |

Variable Definitions and Data Source

Monthly data over the covered periods listed in Appendix A.

Data come from the following sources:

a. Stock Prices Indices: Yahoo Finance

b. Economic Policy Uncertainty (http://www.policyuncertainty.com).

c. IFS, International Financial Statistics of the IMF.

d. OECD Statistical Database.

e. FRED – Federal Reserve Economics Data, St. Louis Fed.

f. Bank for International Settlements, (https://www.bis.org/statistics/eer.htm?m=2676)

Variables:

SI = Stock Price Index of the country, source a.

EPU = Policy Uncertainty Index, source b.

PI = Industrial Production Index of the country (measure of economic activity),

base year = 2010, source c.

CPI = Consumer Price Index of the country, base year = 2010, source c.

M2 = Nominal Money Supply. The data come from source c for all countries

NEX: Nominal Effective Exchange Rate, source f.