Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(2), pp. 45–65 DOI: https://doi.org/10.15388/Ekon.2024.104.2.3

Ahmed Yusuf Sarihan

Bandırma Onyedi Eylül University, Turkey

Email: asarihan@bandirma.edu.tr

ORCID: https://orcid.org/0000-0001-7119-9852

Abstract. Türkiye has possessed significant agricultural opportunities throughout its history. Although the effective utilization of these opportunities is a subject of debate today, the country still plays a significant role in the global trade of some agricultural products. When discussions about Türkiye’s exports are examined, a common complaint is the external dependency of the export industry. However, there are also debates about the diminishing agricultural advantages that have been present since the past. When these discussions are brought together, the trade of certain processed agricultural products, whose raw materials are agricultural products, also becomes a noteworthy research topic due to a similar import dependency. In this study, an analysis was conducted using time series and the ARDL model to investigate whether there is a relationship between Türkiye’s pasta export quantity, as one of the leading pasta exporter’s globally, and the prices of wheat imports from Ukraine, Russia, and Bulgaria. Also robustness checks enhanced the analyzes by employing FMOLS and DOLS methods. The research findings indicate variations in the impact of wheat prices from country to country on the quantity of pasta exported by Türkiye. Recommendations regarding the importance of wheat production in Türkiye are also provided as a result of the research.

Keywords: Export-Import Analyzes, ARDL, FMOLS, DOLS

________

Received: 22/03/2024. Revised: 13/04/2024. Accepted: 29/04/2024

Copyright © 2024 Ahmed Yusuf Sarihan Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

The climate crisis and the sustainability agenda have led to increased discussions on agricultural production and consumption. While high-tech products dominate the lion’s share of trade in the current global economic system, the inherent necessity of food in human life is making the importance of food more pronounced with each passing day during global crises. Events such as the COVID-19 pandemic (Hatipoğlu, 2021), the Russia-Ukraine war (Yenginar, 2022), and the ongoing Israel-Palestine conflict underscore the significance of food supply. Particularly in Türkiye, the sunflower oil crisis and food price inflation during the pandemic highlight some agricultural issues that the country needs to carefully address (Gündüz, 2021). From the past to the present, Türkiye has faced challenges in maintaining its title as an agricultural paradise (Aksoylu & Karaalp-Orhan, 2022). Factors such as rapidly increasing population, global migrations, inefficient use of agricultural land, and a decrease in irrigation areas for various reasons undermine Türkiye’s claim of self-sufficiency in agriculture. In addition to these, more of the factors can be seen such as agricultural subsidies and rural-urban migration (Sugozu et al., 2017; Tasci et al., 2023). With these issues unfortunately claiming to be an agricultural heaven is losing its validity in today’s context. The presence of products like chickpeas, beans, and lentils originating from the Americas, such as Mexico and Canada, on the shelves of markets indicates that Turkish cities, which were once associated with the production of these products, are now falling short in terms of production (TMO, 2021). Especially lentil import is kind of new for Türkiye (Gulumser, 2016). Apart from these examples, Türkiye occupies a distinctive position in terms of bread consumption compared to other countries around the world (Dolekoglu et. al., 2014). Bread and various dough products hold a significant place within the basic dietary habits of the Turkish population (Koca and Yazici, 2014). In fact, bread is considered a sacred blessing in Türkiye. Turkish women, even without the necessity of local bakeries or industrial bread production facilities, create different types of bread when they have access to flour. The majority of the Turkish population consumes bread or dough products in every meal of the day. This situation also highlights the demand for the fundamental raw material, wheat. The source of wheat is of great importance for Türkiye at this point. The table below shows the countries from which Türkiye imported the most wheat in 2022 (ITC, 2024a).

|

Exporter Country |

Value Imported |

Share of Türkiye’s Imports % |

|

Russia |

2,395,449 |

71,4 |

|

Ukraine |

719,333 |

21,4 |

|

Brazil |

52,825 |

1,6 |

|

Mexico |

34,957 |

1 |

|

Bulgaria |

32,794 |

1 |

|

Kazakhstan |

26,987 |

0,8 |

|

Moldova |

23,780 |

0,7 |

|

Argentina |

22,520 |

0,7 |

|

Syria |

15,009 |

0,4 |

|

Latvia |

14,982 |

0,4 |

These countries account for more than 99% of Türkiye’s wheat imports. Additionally sectors in Türkiye that relies on wheat for sustenance is not limited to bread or pastry alone. Türkiye is one of the leading exporters of pasta worldwide. The ease with which pasta can be prepared for consumption has made it a universally beloved food, elevating it to the status of a significant product globally. It is worth emphasizing that, in terms of potential markets, this important product knows no bounds. The table below shows the countries that exported the most pasta in 2022 (ITC, 2024b).

|

Exporter Country |

Value Exported |

Share of World’s Imports % |

|

Italy |

4,169,527 |

28,7 |

|

China |

1,195,235 |

8,2 |

|

South Korea |

978,361 |

6,7 |

|

Türkiye |

964,539 |

6,6 |

|

Thailand |

663,258 |

4,6 |

|

Viet Nam |

464,706 |

3,2 |

|

USA |

438,995 |

3 |

|

Belgium |

412,920 |

2,8 |

|

Germany |

401,256 |

2,8 |

|

Netherlands |

363,691 |

2,5 |

Table 2 shows that Türkiye ranks fourth among the world’s top pasta exporting countries. However, viewing the pasta trade as a completely profitable and effortless venture would be an erroneous approach. This is because pasta, being a low-value-added product, can be produced and exported by many countries as can be seen from the Table 2 above. Though finding new export markets for many products may be challenging, products like pasta can easily enter any market based on customer preferences.

The crucial issue here is whether one country possesses the factors to produce pasta efficiently. Heckscher (1919) and Ohlin’s (1933) Factor Endowment Theory suggest that a country has a comparative advantage in exports based on its superiority in the production factors it possesses. When we look at the example of Türkiye, which has been considered throughout this study, it is expected that Türkiye indeed has a historical advantage in agricultural products. Türkiye, with its productive plains, is known as an important center for wheat. However, in contemporary times, Türkiye, despite its historical advantage in wheat production, is not self-sufficient and resorts to importing wheat from abroad. In other words, Türkiye purchases production factors, such as wheat, from other countries to use them in different stages of the production process. Examining Türkiye’s imports, it can be observed that the majority of wheat is purchased from Ukraine, Russia, and Bulgaria (see Table 1). This deviation from self-sufficiency in wheat production aligns with the central premise of the Factor Endowment Theory, indicating that countries may engage in international trade to acquire the necessary production factors they lack domestically.

In this study, as the variables expected to influence Türkiye’s pasta exports are not limited to imported raw material prices alone, there is a need for a theory to explain the relationship between exchange rates and exports. The Marshall-Lerner Condition, which suggests that increases in exchange rates will boost countries’ exports (Bahmani et al., 2013), offers a second theoretical foundation for this study. In fact, the origin of this theory is based on Robinson’s (1937) work, and it has been strengthened by criticism from Hirschman (1949), drawing attention to issues such as price elasticity. However, fundamentally, as mentioned above, it is possible to conclude that increases in exchange rates will lead to higher exports. Additionally, according to the price effect approach, it can be argued that increases in exchange rates will encourage exporters to increase sales to earn more income, thus achieving an increase in the country’s exports at the macro level (Zamani et al., 2013).

As seen in this study, the Factor Endowment Theory, an important international trade theory and Marshall-Lerner Condition will form the foundation of the research. Before delving into the methodology section, similar studies conducted globally will also be addressed.

Firstly, it is important to note that any product traded in the world is referred to as a commodity. In this context, studies related to factors influencing commodity exports will be examined. Through these studies, variables affecting the export quantity of a commodity will be revealed. Subsequently, research on pasta trade worldwide, especially in countries like Italy, and factors influencing pasta trade will be discussed. In the next stage, studies on the relationship between pasta and wheat in Türkiye will be examined. Last stage of literature review will host the studies about exchange rate and export relationship. This approach aims to provide a better understanding of why such a study is needed before moving on to the methodology section.

Nikonenko et al. (2020) state that the volatility in raw material prices affects the exports of commodity-exporting countries in world trade. Similarly, there are empirical studies that examine different countries for different commodities (McGregor, 2017; Jawaid and Waheed, 2011; Schmitt-Grohe and Uribe, 2018). In these studies, relationships between increases in commodity prices and the variability of global markets and economic growth are observed. In his research emphasizing the importance of commodity supply for different commodities, Tiess (2010) has stated that price increases can affect competition in various ways. In another study, Wlodarczyk (2018) has expressed that price volatility in commodity markets significantly affects the real economy. Niemi (2018) has stated that exports may vary depending on the price. Also, Khalifa (2016) has revealed that raw material prices are determinant for exports. The assumption that this highly probable change could be reflected in Türkiye’s pasta exports through the change in raw material, namely wheat prices, is crucial for this study. Golikova et. al., (2020) have conducted research at a crucial point that will contribute significantly to this study. According to their study, price fluctuations in agricultural raw materials affect the planning of agricultural production. The existing research in the literature that examines the relationship between raw material prices and commodity exports strengthens the starting point and theoretical foundation of the study. Subsequent studies, however, focus specifically on pasta, which is the central focal point of this research.

Turning into international studies on the commercial structure of pasta, it is possible to encounter examinations from different perspectives. In their research highlighting modern pasta production in the context of sustainability, Recchia et al. (2019) emphasized that companies engaged in global pasta exports using imported wheat are strong in this sector. It has been particularly noted that Mexico and Canada hold significant positions in wheat exports. In Italy, on the other hand, wheat is mainly supplied by local wheat suppliers, and wheat from France, the United States, and Australia are integrated into pasta production (Andrade-Sanchez, 2014; Samson et al., 2016). Mukhametzyanov et al. (2021), in their study on the production and export potential of grains and their subgroups, including wheat and other agricultural products that serve as raw materials for many products, including pasta, have indicated that these play a significant economic role. Therefore, the export of these products is also emphasized to have strategic importance. The strategic importance of the wheat used in pasta production aside, its quality is another noteworthy aspect. Bruneel et al. (2010) underscored the paramount importance of the quality of wheat utilized in pasta production, asserting that the nutritional characteristics of pasta vary depending on the type of wheat employed. Correspondingly, Hare (2017) emphasized the correlation between the quality of the wheat used and the resulting pasta quality. Menesatti and Bucarelli (2007), in their study, accentuated that achieving high quality in the pasta sector entails elevated costs. They elucidated that consumers with a strong inclination to pay value for pasta crafted through traditional production methods for its superior quality are willing to invest in such premium pasta without hesitation. In addition, Simeone et al. (2015) highlighted in their study on the Italian pasta sector that pasta prices play a crucial role in shaping competitive strategies. In a parallel vein, Cacchiarelli and Sorrentino (2018) identified the effectiveness of regulations imposed by market regulators in pasta markets. They specifically noted that regulations on wheat have a substantial impact on the pasta supply chain. Quality and market conditions also play a significant role in pasta trade and the supply chain. All these studies indicate that there are various areas providing research opportunities regarding the relationship between the wheat used and the produced pasta.

When it comes to research conducted in Türkiye, especially those related to the pasta trade, they have been included in this study. Keskin and Demirbaş (2011) emphasized the potential of the pasta sector in Türkiye during the relevant period in a study highlighting the potential of processed agricultural products in the country. In another study, Özaydın and Karakayacı (2023) examined the structure of the flour and bakery products industry in the food industry, underlining the necessity of imported wheat for pasta exports. Çetin (2020) emphasized the dependence on imports for exports in his study, which investigated agricultural production through foreign trade data. In a study examining the foreign trade structure of wheat and wheat products in Türkiye, Duru et al. (2019) identified that wheat was imported through the inward processing regime and exported as wheat-based products. Turhan (2018), in a study analyzing the competitiveness of the pasta sector, determined that Türkiye has developed competitive capabilities in the global pasta markets. In addition to these studies, some research highlights the presence of pasta production facilities in Türkiye equipped with leading technologies (Varlık, 2021). Furthermore, it is mentioned that certain cities in Türkiye could make significant contributions to wheat production, which is essential for pasta manufacturing (Acibuca, 2021).

As observed up to this point in the study, Türkiye stands out as a significant hub for pasta production. Moreover, it has the capability to produce the wheat necessary for pasta manufacturing; however, for various reasons, the wheat produced is not sufficient to meet the required quantity for export. Çığ et al. (2022) explained this situation by stating that Turkey produces enough wheat for its own consumption but imports wheat for pasta exports by taking advantage of the inward processing regime. Despite the inherent potential for Türkiye to be a pasta exporter based on the Factor Endowment Theory, scientific studies emphasizing the necessity of importing wheat have contributed to the formulation of hypotheses in this research. As indicated in the data and methods section of the study, there are ideas suggesting that the prices determined by the countries from which Türkiye imports the most wheat could be related to Türkiye’s pasta export quantity.

Nevertheless, an entire model should not be built solely on the structure of imported raw materials. Therefore, it would be appropriate to include not only the purchase of imported raw materials but also the foreign currencies obtained in exchange for exports in the research. In other words, the exchange rate variable is also a crucial factor affecting exports, particularly for developing countries such as Türkiye. Various outcomes can be observed in studies investigating the influence of the exchange rate on trade. While some studies argue that exchange rate volatility reduces foreign trade (Baak et al., 2007; Cheung & Sengupta, 2013), other studies have found that exchange rate volatility does not affect exports (Lee & Masih, 2018). Of course, there are also studies observing that exchange rate volatility increases exports (Kasman & Kasman, 2005; Kılıç and Yıldırım, 2015). Similar studies exist regarding the impact of exchange rates on Türkiye’s exports. Aktaş (2012) stated that the exchange rate does not affect exports, Nazlıoğlu (2013) found that changes in the exchange rate have different effects on sectors’ exports, Uysal and Doğru (2013) indicated that exports decrease as the exchange rate increases, and Karakaş and Erdal (2017) mentioned that agricultural product exports increase as the exchange rate rises. Considering these studies, the model determined for the research in the next section is appropriate in terms of theory and literature.

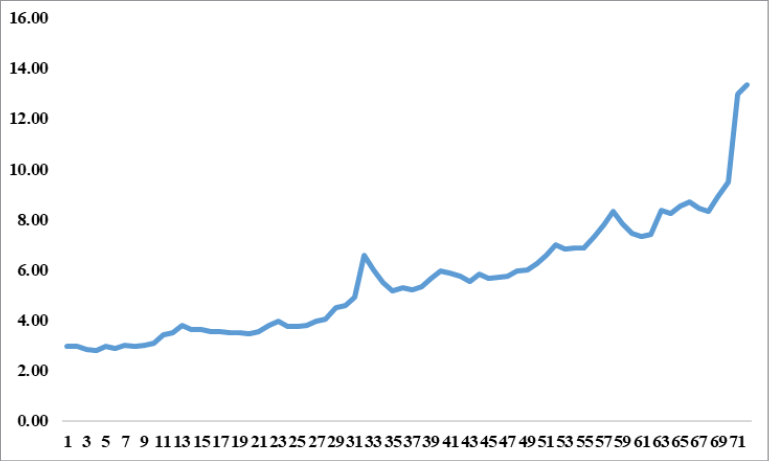

Econometric model of the study explains Türkiye’s pasta exports using variables such as Russia’s wheat export price, Ukraine’s wheat export price, Bulgaria’s wheat export price, and the exchange rate. Türkiye’s pasta exports represent the quantity of pasta exported from the country. The prices of countries represent the average wheat selling prices in their exports to the world. The exchange rate shows the Central Bank of the Republic of Türkiye’s USD/TRY rate. This exchange rate is included in the model due to the relationship between the exchange rate and exports as per classical economic thought. Graphs for these variables are presented in following figures. As the figures for the variables are at significantly different levels, the graphs are presented individually, as depicted in Figures below.

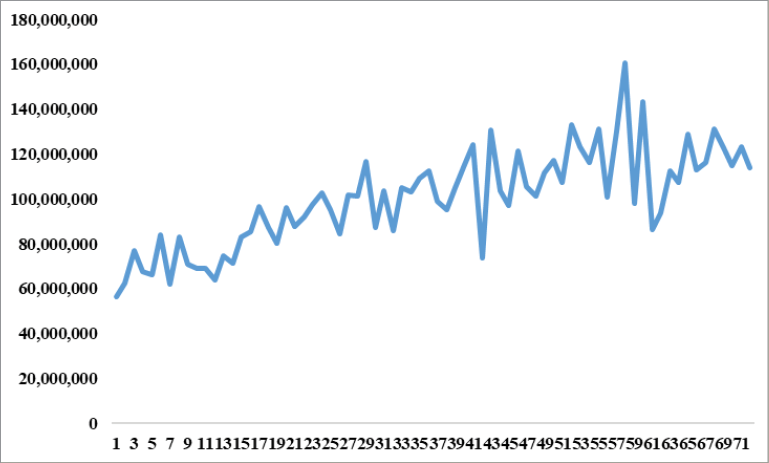

Turkey’s pasta exports reached 114 million kilograms by the end of 2021, up from 60 million kilograms at the beginning of 2016. At one point, it was also observed that it reached levels of 160 million kilograms.

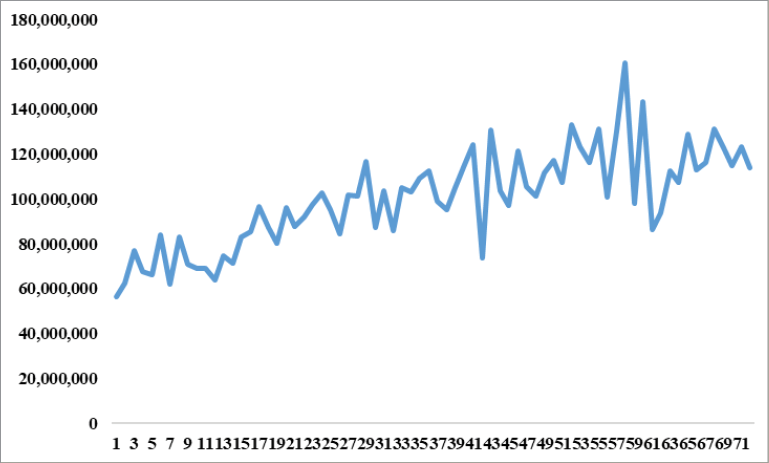

The changes in the prices per kilogram of wheat, the primary raw material for pasta production, applied by Russia, Ukraine, and Bulgaria, which are among the countries Turkey imports the most from, can be seen in Figure 2. According to this, while Ukraine offers the lowest prices and Russia offers the highest, the three prices are quite close to each other. Nevertheless, it is understood that wheat prices have almost doubled over the years.

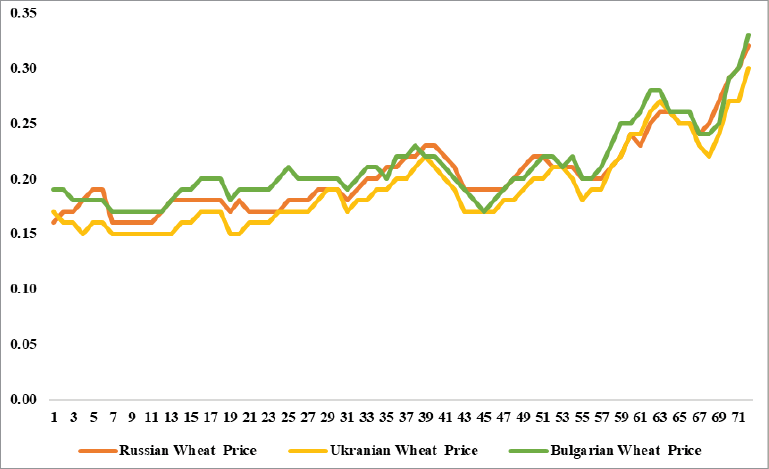

Finally, the changes in the exchange rate of the Turkish Lira against the US Dollar over the years are presented in Figure 3. Accordingly, the exchange rate has tripled from the beginning of 2016 to the end of 2021.

With these information, analyses were conducted using monthly data covering January 2016 to December 2021. The analysis period was determined based on the availability of data for all variables. Definitions of the variables and their sources are summarized in Table 3. All variables in the analysis were used in logarithmic form.

|

Variable |

Description* |

Period (Monthly) |

Source |

|

lnexp |

Export quantity of Turkish pasta (ton) |

2016(1) - 2021(12) |

International Trade Center |

|

lnuwp |

Average price of Ukranian wheat (USD) |

2016(1) - 2021(12) |

International Trade Center |

|

lnrwp |

Average price of Russian wheat (USD) |

2016(1) - 2021(12) |

International Trade Center |

|

lnbwp |

Average price of Bulgarian wheat (USD) |

2016(1) - 2021(12) |

International Trade Center |

|

lnexc |

Exchange rate (USD/TL) |

2016(1) - 2021(12) |

Central Bank of Turkish Republic |

In this study, conducted within the context of variables affecting the export of a specific sector, a model has been established. The model incorporates the above data and variables, taking into account the theoretical framework and support from the literature, as well as the consideration of raw material needs and costs. Constraints related to other variables that could not be included in the model are explained in the limitations section of the research.

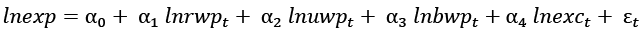

The empirical method chosen for this study is the ARDL boundary test approach proposed by Pesaran, Shin, and Smith (2001). This approach eliminates the necessity of having cointegration of the same order in standard cointegration tests and inefficiency in multivariate models (Pesaran, et. al., 2001). Furthermore, the boundary test approach ensures statistically efficient predictions, particularly in estimations conducted with small or limited samples (Altıntaş, 2013). In this study, the following model has been formulated to determine the potential impact of imported raw material prices on Türkiye’s pasta export quantity.

(1)

(1)

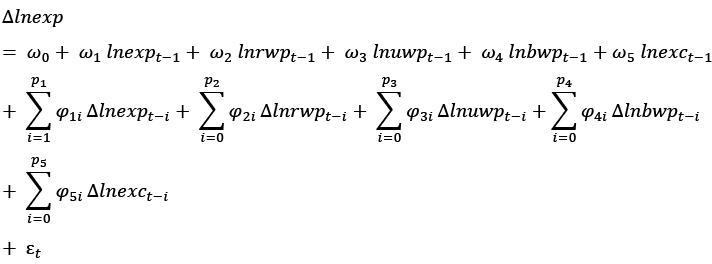

Here, α0 represents the constant term, ε denotes the random error term, and t represents the time period ranging from t=1,2,...,72. The first step of the ARDL procedure involves applying a boundary test; upon favorable results from this test, the estimation of long- and short-term coefficients can be conducted. To implement the boundary test, an unrestricted error correction model (UECM) is initially estimated using the least squares technique. Accordingly, adapting Model (1) to the UECM is feasible as follows:

(2)

(2)

Here, ω0 represents the constant term, εt denotes the random error term, Δ signifies the first difference operator, and pi represents the lag length of the respective variable. At this stage, utilizing Model (2), a null hypothesis stating the absence of a long-term cointegration relationship among the variables, expressed as “H0: ω1 = ω2 = ... = ω5 = 0”, is tested against an alternative hypothesis, articulated as “Ha: ω1 ≠ ω2 ≠ ... ≠ ω5 ≠ 0”, using the Wald or F-statistic [FIII(lnexp/lnrwp,lnuwp,lnbwp,lnexc,)] (Pesaran et al., 2001). Accordingly, the test statistic value is compared with the table boundary values provided in Pesaran et al. (2001). When making this comparison, if the stationarity degrees of the variables are I(0) or I(1), the table’s lower or upper boundary value is used, respectively. If the t-statistic is smaller than the lower boundary value, it is concluded that there is no cointegration relationship. Conversely, if the calculated statistic exceeds the upper boundary value, it is determined that there is cointegration. If the computed statistic falls between the upper and lower boundaries, no inference can be drawn regarding cointegration. If all variables have a stationarity degree of I(0), the table’s lower boundary value is used. If all variables have a stationarity degree of I(1), the table’s upper boundary value is utilized. In both cases, if the calculated t-statistic exceeds the table value, it is concluded that there is a cointegration relationship (Bayir and Kutlu, 2019).

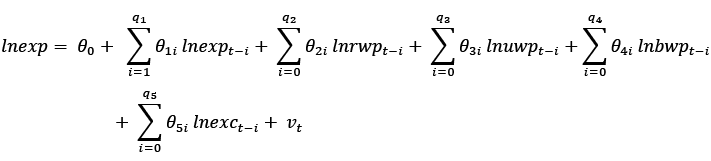

In determining the optimal lag length for each variable in the UECM, a total of (p + 1)k regression models are estimated using an information criterion such as Akaike or Schwarz, where p represents the chosen maximum lag length and k indicates the number of explanatory variables in the model (Ciftci and Yildiz, 2015). As emphasized by Pesaran et al. (2001), the presence of autocorrelation issues should be absent in the UECM for the validity of the boundary test. Additionally, for adequacy, the selected model is expected to pass diagnostic tests for changing variance, modeling error, and non-normal distribution aspects. If the boundary test confirms the presence of a long-term relationship between the variables, the analysis proceeds to the second stage. In this stage, using the Ordinary Least Squares OLS technique once again, a general ARDL model is estimated, where the dependent variable is regressed on its own lags and lags of explanatory variables (Pesaran and Shin, 1998). It is argued that combining the OLS technique in the ARDL method yields good results in calculating long- and short-term dynamics in models with 30-80 observations (Sulaiman & Abdul-Rahim, 2018); therefore, these methods have been employed. Within this scope, the general ARDL (q1, q2,q3,q4,q5) model, formulated based on Model (1), is presented below:

(3)

(3)

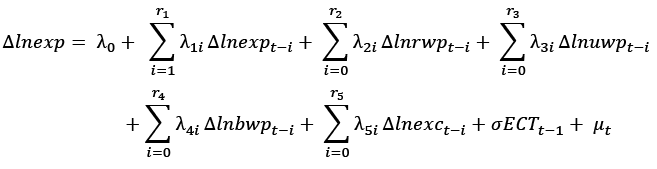

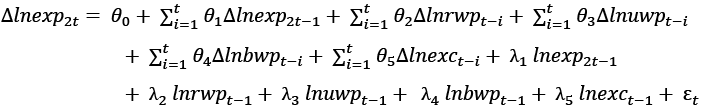

In Equation (3), θ0 represents the constant term, νt denotes the random error term, and qi signifies the lag length of the respective variable. According to the Granger Representation Theorem, when there is a cointegration relationship between two or more time series, there will also be a valid Error Correction Model (ECM) that reflects this relationship and the short-term dynamics (Engle and Granger, 1987). Therefore in the third and final stage of the ARDL procedure, leveraging the general ARDL model, an Error Correction Model (ECM) is constructed to link the long-term relationship with short-term dynamics, and this model is estimated using the OLS technique. Within this context, the ECM formulated based on Model (1) and consequently Model (3) can be formally expressed as follows:

(4)

(4)

In Equation (4), λ0 denotes the constant term, μt represents the random error term, Δ signifies the first difference operator, and ri represents the lag length of the respective variable (which, according to the lag lengths in Model (3), is qi - 1. Here, differenced lagged terms indicate short-term dynamics, while the term ECTt−1 represents the lagged error term derived from the long-term (cointegration) equation. The last term, referred to as the error correction term, reflects the rate at which variables converge to their equilibrium values after a shock occurs in the short term. For the correction of short-term imbalances and the system’s ability to converge to a long-term equilibrium, the coefficient of the error correction term (σ) should be statistically significant and negative (Ciftci and Yildiz, 2015).

In this section, firstly Augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) unit root tests were conducted to determine the integration levels of the variables. The results of the ADF and PP unit root analyses in Table 4 indicate that the lnexp variable is stationary at the level, while the other variables are stationary at their first differences.

|

Variables |

ADF Test Statistics |

PP Test Statistics |

Result |

||

|

Level Values |

1st Dif. Values |

Level Values |

1st Dif. Values |

||

|

lnexp |

-1.907 |

-11.839 |

-4.448 |

-25.761 |

I(1) |

|

lnrwp |

0.252 |

-7.176 |

-0.082 |

-7.125 |

I(1) |

|

lnuwp |

0.123 |

-7.128 |

-0.025 |

-7.176 |

I(1) |

|

lnbwp |

1.194 |

-5.751 |

0.154 |

-6.833 |

I(1) |

|

lnexc |

0.753 |

-7.469 |

0.992 |

-7.427 |

I(1) |

When evaluating the results in Table 4, it is observed that the conditions required for the use of the ARDL procedure are met. The results of the boundary test conducted as the first stage of the ARDL procedure are presented in Table 5. The calculated F-statistic for the joint significance of the one-period lagged level variables in the UECM exceeds the upper critical value at the 5% significance level. Consequently, the null hypothesis suggesting no cointegration among the variables can be rejected. This finding, indicating that the variables move together in the long run, is considered reliable in terms of diagnostic tests as well.

|

Estimated Model (T=64) |

F-Statistics |

Critical Values |

Lower Limit |

Upper Limit |

Result |

|

FIII(lnexp/lnuwp, lnrwp, lnbwp, lnexc) |

3.85243* |

1% |

3.29 |

4.37 |

H0 rejected |

|

5% |

2.56 |

3.49 |

|||

|

10% |

2.2 |

3.09 |

|||

|

Diagnostic Tests: χ2(1)S.C.= 0.184 –(0.7563), χ2 (1)Het.= 0.683 (0.7487), FRes= 0.159 (0.6912), J.-B.Nor= 1.499 (0.4724) |

|||||

After confirming the presence of a long-term relationship among the variables following the boundary test, the second stage of the ARDL procedure can be initiated. In this phase, the general ARDL model is estimated using the OLS technique to compute the long-term coefficients [Model (1)]. Accordingly, the general ARDL model was estimated with a maximum lag length of 8 based on the Schwarz information criterion. The most suitable model, with lag lengths of ARDL(3,0,3,8,1), was identified, and Model (1) was computed using the coefficients from this equation. Subsequently, to obtain the short-term dynamics related to the long-term model, an error correction model was estimated. The estimates of the coefficients for both the long and short terms are presented in Table 6 and Table 7.

|

Variable |

Coeffecient |

Std. Error |

t-statistic |

Probability |

|

C |

8.026.896 |

3.080.787 |

2.605.470 |

0.0125 |

|

lnexp(-1)* |

-0.557846 |

0.175782 |

-3.173.516 |

0.0027 |

|

lnrwp** |

0.696004 |

0.462927 |

1.503.486 |

0.1399 |

|

lnuwp(-1) |

-1.941.850 |

0.763622 |

-2.542.948 |

0.0146 |

|

lnbwp(-1) |

0.538170 |

0.640923 |

0.839680 |

0.4056 |

|

lnexc(-1) |

0.577258 |

0.185079 |

3.118.978 |

0.0032 |

|

d(lnexp(-1)) |

-0.597062 |

0.157226 |

-3.797.484 |

0.0004 |

|

d(lnexp(-2)) |

-0.289753 |

0.119571 |

-2.423.264 |

0.0196 |

|

d(lnuwp) |

0.285215 |

0.523147 |

0.545190 |

0.5884 |

|

d(lnuwp(-1)) |

1.880.433 |

0.661128 |

2.844.278 |

0.0067 |

|

d(lnuwp(-2)) |

1.982.191 |

0.555310 |

3.569.521 |

0.0009 |

|

d(lnbwp) |

-1.106.616 |

0.526083 |

-2.103.501 |

0.0412 |

|

d(lnbwp(-1)) |

-1.028.258 |

0.776665 |

-1.323.941 |

0.1924 |

|

d(lnbwp(-2)) |

-1.678.892 |

0.591130 |

-2.840.141 |

0.0068 |

|

d(lnbwp(-3)) |

-0.417869 |

0.391608 |

-1.067.059 |

0.2918 |

|

d(lnbwp(-4)) |

0.826844 |

0.382548 |

2.161.416 |

0.0361 |

|

d(lnbwp(-5)) |

0.177388 |

0.409107 |

0.433599 |

0.6667 |

|

d(lnbwp(-6)) |

0.358109 |

0.454355 |

0.788169 |

0.4348 |

|

d(lnbwp(-7)) |

1.299.144 |

0.463824 |

2.800.940 |

0.0075 |

|

d(lnexc) |

0.000488 |

0.261315 |

0.001869 |

0.9985 |

|

Variable |

Long Term |

|||

|

Coeffecient |

Std. Error |

t-statistic |

Probability |

|

|

lnrwp |

1.247.663 |

1.025.459 |

1.216.687 |

0.2302 |

|

lnuwp |

-3.480.980 |

1.759.751 |

-1.978.109 |

0.0542 |

|

lnbwp |

0.964729 |

1.143.444 |

0.843705 |

0.4034 |

|

lnexc |

1.034.799 |

0.308430 |

3.355.052 |

0.0016 |

|

c |

1.438.910 |

1.569.258 |

9.169.362 |

0.0000 |

According to the calculated long-term coefficients in Table 4, it’s found that the lnrwp, lnuwp, and lnbwp do not have a significant impact on lnexp. However, an increase in the lnexc positively and significantly affects lnexp. Therefore, as the exchange rate rises, pasta exports also increase. This result is in line with international economic theories. In the third stage of the ARDL approach, short-term relationships are being investigated. Within this context, the short-term model is estimated by including lagged values of the error terms of the model estimated as ARDL (3,0,3,8,1). The estimation results can be seen in Table 7.

|

Variable |

Short Term |

|||

|

Coeffecient |

Std. Error |

t-statistic |

Prob. |

|

|

d(lnexp(-1)) |

-0.597062 |

0.122159 |

-4.887.576 |

0.0000 |

|

d(lnexp(-2)) |

-0.289753 |

0.104373 |

-2.776.133 |

0.0080 |

|

d(lnuwp) |

0.285215 |

0.442762 |

0.644171 |

0.5228 |

|

d(lnuwp(-1)) |

1.880.433 |

0.514834 |

3.652.504 |

0.0007 |

|

d(lnuwp(-2)) |

1.982.191 |

0.487012 |

4.070.104 |

0.0002 |

|

d(lnbwp) |

-1.106.616 |

0.474261 |

-2.333.349 |

0.0243 |

|

d(lnbwp(-1)) |

-1.028.258 |

0.526935 |

-1.951.392 |

0.0574 |

|

d(lnbwp(-2)) |

-1.678.892 |

0.469658 |

-3.574.715 |

0.0009 |

|

d(lnbwp(-3)) |

-0.417869 |

0.349538 |

-1.195.490 |

0.2383 |

|

d(lnbwp(-4)) |

0.826844 |

0.333052 |

2.482.628 |

0.0169 |

|

d(lnbwp(-5)) |

0.177388 |

0.357356 |

0.496391 |

0.6221 |

|

d(lnbwp(-6)) |

0.358109 |

0.372532 |

0.961283 |

0.3417 |

|

d(lnbwp(-7)) |

1.299.144 |

0.374517 |

3.468.849 |

0.0012 |

|

d(lnexc) |

0.000488 |

0.220901 |

0.002210 |

0.9982 |

|

ECM (t-1) |

-0.557846 |

0.109951 |

-5.073.582 |

0.0000 |

According to the results obtained, it is observed that lagged values related to lnexp have a significant negative impact at a 5% significance level in the short term. This effect continues for two months. While the changes in lnuwp do not have any significant effect on lnexp at a 5% significance level in the first month, it is observed that despite the increase in wheat prices in the following two months, Türkiye’s pasta exports have increased. There is no apparent effect of lnrwp. Regarding lnbwp, there is no significant effect in the short term in the first two months; however, in subsequent months, it is observed that sometimes price increases negatively affect lnexp, and sometimes they have a positive impact. Exchange rate changes do not seem to have any short-term effects. To strengthen the validity of these findings, a robustness check was also conducted using the Fully Modified Ordinary Least Squares (FMOLS)and Dynamic Ordinary Least Squares (DOLS) method.

In the initial model of the study, cointegration relationships among the series were identified using the ARDL method. In this section, to enhance the reliability and validity of the findings, the robustness of the results was tested using two separate models. The first of these methods is the FMOLS approach. This approach helps validate the results obtained from cointegration tests (Zimon et al., 2023). The formula for this approach, as utilized by Hansen and Phillips (1990) to amalgamate the most precise cointegration measures, is presented below:

(5)

(5)

As a second robustness test, the DOLS approach was utilized. The DOLS procedure involves incorporating exogenous variables along with their first-difference expressions to address endogeneity and calculate standard errors using a covariance matrix of errors that is robust to autocorrelation. DOLS estimators provide a reliable measure of statistical significance. Assessing the impact of the endogenous indicator on exogenous indicators in levels, leads, and lags is an effective method for dealing with various integration orders (Pattak et al., 2023). This approach enables the integration of different factors into the cointegrated framework (Dogan and Seker, 2016). The calculation for the DOLS method can also be considered based on Formula 5 above. The results for both approaches are presented in the table below.

When examining the results of the analysis conducted for robustness checking, it is observed that the long-term findings of the ARDL model align with the same conclusions. Accordingly, while no significant effects of imported wheat prices are observed, a 1% increase in the exchange rate is found to increase Türkiye’s pasta exports by approximately 0.6454% according to the FMOLS model and by approximately 0.6658% according to the DOLS model.

|

Variable |

FMOLS |

DOLS |

||||||

|

Coefficient |

Std. Error |

t-Statistic |

Prob. |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

|

lnrwp |

-0.3601 |

0.4306 |

-0.8363 |

0.4060 |

-0.7350 |

0.6287 |

-1.1690 |

0.2477 |

|

lnuwp |

-0.2347 |

0.5294 |

-0.4434 |

0.6589 |

-0.0559 |

0.9649 |

-0.0579 |

0.9540 |

|

lnbwp |

0.0803 |

0.4504 |

0.1783 |

0.8591 |

0.2929 |

0.7193 |

0.4072 |

0.6856 |

|

lnexc |

0.6454 |

0.1120 |

5.7617 |

0.0000 |

0.6658 |

0.1642 |

4.0551 |

0.0002 |

|

C |

16.5059 |

0.5855 |

28.1917 |

0.0000 |

16.5165 |

0.8194 |

20.1561 |

0.0000 |

|

R- Squared |

0.571442 |

0.65487 |

||||||

In today’s context, where food supply is of utmost importance, this research, recognizing the significance of wheat as a raw material in the production of some of the most fundamental food products, highlights the need for a multifaceted examination. The study aims to determine whether Türkiye’s pasta exports, which are based on wheat, are related to the prices of imported wheat. According to the factor endowment theory, countries export based on the production factors they possess. This study reveals that in the long term, Türkiye’s possession of wheat, whether domestic or imported, serves as a crucial factor in pasta production, contributing to averting crises in exports. It’s evident that short-term crises based on occasional fluctuations in imported product prices do not have lasting effects, and Türkiye’s pasta exports successfully navigate through these short-lived shocks. Even with an increase in the imported wheat price, Türkiye manages to increase its pasta exports by utilizing the purchased wheat. This study shows some similarities with the studies in literature review. Studies explaining the relationship between raw material prices and exports of commodity such as (Nikonenko et al., 2020; McGregor, 2017; Jawaid and Waheed, 2011) have similar results like this research.

As of 2022, Türkiye stands fourth in global pasta exports and similarly holds the fourth position in global wheat imports. Despite this balance between production capabilities and exports, Türkiye does engage in wheat exports, albeit in small quantities, as observed from statistical data. Some studies mentioned in the introduction section of this research suggest that raw material prices influence product exports across various industries (Schmitt-Grohe & Uribe, 2018). However, this study focused on Türkiye indicates that imported wheat prices don’t significantly affect pasta exports in the long term. Still, it aligns with similar short-term shock scenarios documented in literature. When considering the wheat supply for pasta exports highlighted in past studies, the occurrence of short-term shocks becomes an explanatory aspect. Evidently, Türkiye’s pasta exports exhibit a dependence on imported wheat. Hence, despite price fluctuations, wheat procurement continues to support pasta exports. In this context, one of the most critical aspects for Türkiye is the necessity to increase wheat production and, when insufficient, supplement it with imported wheat to sustain exports. Because as Tiess (2010) mentioned price of raw material does not always fit to competition.

Another finding of this study is the effect of exchange rates on pasta exports. The studies that found that the exchange rate increases exports (Kasman & Kasman, 2005; Kılıç and Yıldırım, 2015; Nazlıoğlu, 2013; Karakaş & Erdal, 2017) have reached a similar conclusion to this research. On the other hand, studies that have observed the negative impact of the exchange rate on exports (Baak et al., 2007; Cheung & Sengupta, 2023; Uysal & Doğru, 2013) have yielded contradictory results thus far. The comparison with the results obtained from this study and the past studies in literature are briefly summarized in the table below.

|

Research |

Findings |

Similarity Assestment |

|

|

Short Run |

Long Run |

||

|

Kasman & Kasman, 2005 |

Exchange rate increase -> exports (+) |

Contradictory |

Similar |

|

Baak et al., 2007 |

Exchange rate volatility -> foreign trade (-) |

Contradictory |

Contradictory |

|

Tiess, 2010 |

Price increases -> international competition (-) |

Similar |

Contradictory |

|

Cheung & Sengupta, 2013 |

Exchange rate volatility -> foreign trade (-) |

Contradictory |

Contradictory |

|

Uysal & Doğru, 2013 |

Exchange rate increase -> exports (-) |

Contradictory |

Contradictory |

|

Kılıç & Yıldırım, 2015 |

Exchange rate increase -> exports (+) |

Contradictory |

Similar |

|

Khalifa, 2016 |

Raw material prices -> commodity exports (-) |

Similar |

Contradictory |

|

Karakaş & Erdal, 2017 |

Exchange rate increase -> exports (+) |

Contradictory |

Similar |

|

Niemi, 2018 |

price increases -> commodity export (-) |

Similar |

Contradictory |

|

Golikova et al., 2020 |

Raw material prices -> commodity exports (-) |

Similar |

Contradictory |

|

Nikonenko et al., 2020 |

Raw material prices -> commodity exports (-) |

Similar |

Contradictory |

In addition to the results of these studies, it is also possible to discuss the findings in terms of the factor endowment theory and the Marshall-Lerner condition. Accordingly, based on theories from previous years, it is possible to say that Türkiye’s pasta exports are not affected by imported input prices in the long run, due to the strength derived from the current factor conditions. On the other hand, it is observed that an increase in the exchange rate also boosts pasta exports, almost as if fulfilling a classic economic prophecy.

In the literature review section of the study, it is observed that the quality of wheat concerning pasta exports is a topic of interest. The research can be considered limited due to the absence of a variable indicating quality among the variables used in this study. Additionally, since the study is conducted specifically for Türkiye, the three neighboring countries with the highest exports have been selected. For studies involving different countries, wheat prices from additional importing countries could also be considered. From a theoretical perspective, the inability to measure the effect of price elasticity on the relationship between exchange rates and exports within the context of the Marshall-Lerner condition can also be considered as another limitation of the study.

The data set used in the study was selected based on common and up-to-date time intervals. Access to longer-term and broader data sets could be achieved if all countries had complete data entries in the ITC Trademap database. The dataset for the 72-month time series used in the research can also be considered a constraint in this context. The exclusion of data, such as monthly wheat and pasta consumption, among the study variables has hindered the establishment of a more comprehensive model. However, it is worth noting that such data could not be included in the model due to their unavailability on a monthly basis.

Findings of this study suggest that Türkiye’s pasta export is not significantly influenced by the price of the imported wheat in the long term. In the short term, while there seems to be no effect observed from Russia’s wheat export prices, the occasional increase in Ukraine’s wheat price appears to increase pasta exports, potentially due to Türkiye being both a producer and importer of wheat from various countries. Similarly, examining the effects of Bulgaria’s wheat prices on Turkish pasta exports reveals that price increases sometimes reduce pasta exports and sometimes increase them. However, research findings indicate that all these effects are short-lived. In the long term, it has been observed that Türkiye’s pasta exports are positively affected only by increases in the exchange rate. The fact that Türkiye’s pasta exports are not significantly affected in the long term by the wheat prices from the countries it primarily sources wheat from can be considered a significant opportunity.

It has been determined that increases in the exchange rate lead to an increase in Türkiye’s pasta exports in the long run. Considering Türkiye’s status as a developing country, it is natural for businesses to focus on exports to take advantage of the rising exchange rate. Indeed, as can be seen in the relevant figure, the exchange rate has been consistently increasing in Türkiye in recent years. Additionally, given that Türkiye’s trade deficit is a chronic issue, it can be argued that generating foreign currency income is a valid motive for all businesses capable of exporting. In other words, in a developing country where exports cannot meet imports, businesses also seek to position themselves advantageously under the assumption that the exchange rate increase will be persistent. Furthermore, another aspect of the increase in the exchange rate is that businesses exporting from Türkiye may have a price advantage in global competition compared to their international competitors.

The findings obtained with the model established in this study are significant for international trade, economics, agricultural economics, and macroeconomics research. Particularly noteworthy is the scarcity of studies that examine international trade at the product and product group levels, as well as the limited research that presents the impact of supply and raw material variables at the macro level on exported products. In this context, the research findings suggest that delayed effects may be present, especially in the short term. Therefore, it is recommended to conduct similar studies in various countries and with different product groups. Especially within the framework of factor endowment theory, it is observed that traditional international trade theories still hold explanatory power for today’s trade. Additionally price elasticity variables could be used in future studies if available. Therefore, researchers are encouraged to focus on studies that integrate historical theories (such as Factor Endowment Theory and Marshall-Lerner Condition) with contemporary approaches. Particularly, it is believed that research on the export products of developing countries to various countries, goods, and time periods, tested with diverse methods, should be encouraged to enhance the understanding of international trade. In addition to all this, it is recommended not to overlook the exchange rate variable in export studies, considering that the classic economic view, which suggests that exports also increase with an increase in the exchange rate is once again proven correct.

The research results suggest that there is not only a responsibility for pasta producers but also for policymakers. Although not included in the model of this study, it can be said that considering the emphasized quality of raw materials in the literature, imported wheat should also be carefully selected for the country in this regard. It is accurate to say that the price of wheat to be imported into the country need to be inspected, and tariff measures should be taken to ensure that local wheat producers can compete without being harmed. Furthermore, considering Türkiye’s consumption of wheat-based products from a health perspective, wheat imports should be shaped according to the health certificate requirements of leading countries in the world.

In addition, considering the long-term impact of the exchange rate on pasta exports, Türkiye’s monetary and fiscal policies regarding the exchange rate are noteworthy. Indeed, although the sudden increases seen in recent years may present a positive picture in terms of foreign currency earnings for exporters, it can be said that proper decisions need to be made considering the possibility of increased costs being covered with foreign currency. Since the competitive performance of exporters in the international market will also depend on the balance of income and expenses, effective management of the exchange rate is crucial for both governments and companies to minimize risks.

Acibuca, V. (2021). Mardin ilinde makarnalık buğday üretimi ve üreticilerin sorunları. MAS Journal of Applied Sciences, 6(4), 977-987.

Aksoylu, D., & Karaalp-Orhan, H. S. (2022). AB ortak tarim politikasi çerçevesinde Türkiye ve seçili doğu avrupa ülkeleri karşilaştirilmali bir analiz. Mehmet Akif Ersoy Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 9(1), 172-201.

Aktaş, C. (2010). Türkiye’de Reel Döviz Kuru İle İhracat ve İthalat Arasindaki İlişkinin VAR Tekniğiyle Analizi. Uluslararası Yönetim İktisat ve İşletme Dergisi, 6(11), 123-140.

Altıntaş, H. (2013). Türkiye’de petrol fiyatları, ihracat ve reel döviz kuru ilişkisi: ARDL sınır testi yaklaşımı ve dinamik nedensellik analizi. Uluslararası Yönetim İktisat ve İşletme Dergisi 9(19), 1–30.

Andrade-Sanchez, P., & Ottman, M. J. (2014). Determination of optimal planting configuration of low ınput and organic barley and wheat production in Arizona. College of Agriculture, University of Arizona: Tucson, AZ, USA.

Baak, S. J., Al-Mahmood, M. A., & Vixathep, S. (2007). Exchange rate volatility and exports from East Asian countries to Japan and the USA. Applied Economics, 39(8), 947-959.

Bahmani, M., Harvey, H., & Hegerty, S. W. (2013). Empirical tests of the Marshall‐Lerner condition: a literature review. Journal of Economic Studies, 40(3), 411-443.

Bayır, M. & Kutlu, Ş., Ş. (2019). Mesleki eğitim ve üniversite eğitiminin genç işsizlik üzerindeki etkisi: Türkiye üzerine ampirik bir analiz. KAÜİİBFD, 10(20), 787-806.

Bruneel, C., Pareyt, B., Brijs, K., & Delcour, J. A. (2010). The impact of the protein network on the pasting and cooking properties of dry pasta products. Food Chemistry, 120(2), 371-378.

Cacchiarelli, L., & Sorrentino, A. (2018). Market power in food supply chain: Evidence from Italian pasta chain. British Food Journal, 120(9), 2129-2141.

Cheung, Y. W., & Sengupta, R. (2013). Impact of exchange rate movements on exports: An analysis of Indian non-financial sector firms. Journal of International Money and Finance, 39, 231-245.

Çetin, R. (2020). Türkiye tarim ürünleri bakimindan hala kendi kendine yeterli mi? Diş ticaret verileri yoluyla bir analiz. Sakarya İktisat Dergisi, 9(2), 160-173.

Çığ, F., Toprak, Ç.C., & Erden, Z. (2022). Agrıcultural relatıons wıth turkey, russıa, and ukraıne, the effects of the war on the wheat crısıs: Turkey’s posıtıon in Agriculture: Currrent Challenges and Solution Suggests, IKSAD Publishing Home, Ankara, Türkiye

Çiftci, F., & Yıldız, R. (2015). Doğrudan yabancı yatırımların ekonomik belirleyicileri: Türkiye ekonomisi üzerine bir zaman serisi analizi. Business & Economics Research Journal, 6(4).

Dogan, E., & Seker, F. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074-1085.

Dölekoğlu, C. Ö., Giray, F. H., & Şahin, A. (2014). Mutfaktan çöpe ekmek: Tüketim ve değerlendirme. Akademik Bakış Uluslararası Hakemli Sosyal Bilimler Dergisi, (44).

Duru, S., Gül, A., & Hayran, S., (2019). Türkiye’de buğday ve buğday mamulleri dış ticaret yapısı. Bilecik Şeyh Edebali Üniversitesi Sosyal Bilimler Dergisi, 4(2), 552-564.

Engle, R.F. & Granger, C.W.J. (1987). Co-integration and error correction: Representation, estimation and testing. Econometrica, 55(2), 251-276.

Golikova, G. V., Shishkina, N. V., Golikova, N. V., Sabetova, T. V., & Smarchkova, L. V. (2020, January). The price fluctuations in the regional agricultural markets and their effect on agricultural production planning. Advances in Economics, Business and Management Research, 110 special issue, 397-404.

Gülümser, A. (2016). Dünyada ve Türkiye’de yemeklik dane baklagillerin durumu. Tarla Bitkileri Merkez Araştırma Enstitüsü Dergisi, 25(1), 292-298.

Gündüz, O. (2021). Türkiye’de ayçiçek yağı fiyatı niçin artıyor: Kısa ve uzun dönem dinamik analizi. Gaziosmanpaşa Bilimsel Araştırma Dergisi, 10(1), 30-48.

Hansen, B., & Phillips, P. C. B. (1990). Estimation and inference in models of cointegration: A simulation study. In Advances in Econometrics: Cointegration, Spurious Regressions and Unit Roots (Vol. 8). JA Press.

Hare, R. (2017). Durum wheat: Grain-quality characteristics and management of quality requirements. In Cereal Grains (pp. 135-151). Woodhead Publishing.

Hatipoğlu, A. (2021), Covid-19 pandemisinin küresel gıda tedarik zincirine etkileri, ed. Karabulut, Ş. İktisadi Teori ve Gelişmelere Gelenekçi ve Yenilikçi Yaklaşimlar, Gazi Kitabevi, 335-261.

Heckscher, E. (1919). The effect of foreign trade on the distribution of income, in H. S. Ellis, L. Z. Metzler (eds) 1966. Readings in the Theory of International Trade, London: George Allen and Unwin.

Hirschman, A. O. (1949). Devaluation and the trade balance: A note. The Review of Economics and Statistics, 31(1), 50-53.

ITC, (2024a). The Countries from Which Turkey Imports the Most Wheat (Accessed at: https://www.trademap.org/Country_SelProductCountry.aspx?nvpm=1%7c792%7c%7c%7c%7c1001%7c%7c%7c4%7c1%7c1%7c1%7c1%7c%7c2%7c1%7c%7c1, Access date: 13.04.2024).

ITC, (2024b). The Pasta Market Leaders of the World (Accessed at: https://www.trademap.org/Country_SelProduct.aspx?nvpm=1%7c%7c%7c%7c%7c1902%7c%7c%7c4%7c1%7c1%7c2%7c1%7c%7c2%7c1%7c%7c1, Access date: 13.04.2024).

Jawaid, S. T., & Waheed, A. (2011). Effects of terms of trade and its volatility on economic growth: a cross country empirical investigation. Transition Studies Review, 18, 217-229.

Karakaş, G., & Erdal, G. (2017). Döviz Kuru Oynaklığının Türkiye ’nin Tarımsal Dış Ticaretine Etkisi. Turkish Journal of Agriculture-Food Science And Technology, 5(6), 668-675.

Kasman, A., & Kasman, S. (2005). Exchange rate uncertainty in Turkey and its impact on export volume. METU Studies in Development, 32(1), 41.

Keskin, B., & Demirbaş, N. (2011). Türkiye’nin işlenmiş organik gıda üretiminde potansiyele sahip sektörlerinin incelenmesi. MKU Ziraat Fakültesi Dergisi, 16(1), 19-30.

Khalifa, E. A. (2016). Economics of non-oil exports of Sudan. Russian Journal of Agricultural and Socio-Economic Sciences, 58(10), 45-54.

Kılıç, E., & Yıldırım, K. (2015). Sektörel reel döviz kuru volatilitesinin Türk imalat sanayi ihracatı üzerine etkileri. Anadolu Üniversitesi Sosyal Bilimler Dergisi, 15(1), 13–25.

Koca, N., & Yazici, H. (2014). Coğrafi faktörlerin Türkiye ekmek kültürü üzerindeki etkileri. Electronic Turkish Studies, 9(8).

Lee, K. W., & Masih, M. (2018). Investigating the causal relationship between exchange rate variability and palm oil export: evidence from Malaysia based on ARDL and nonlinear ARDL approaches (No. 91801). University Library of Munich, Germany.

McGregor, T. (2017). Commodity price shocks, growth and structural transformation inflow-income countries. The Quarterly Review of Economics and Finance, 65, 285–303.

Menesatti, P., & Bucarelli, A. (2007, October). Quality classification of Italian wheat durum spaghetti by means of different spectrophometric techniques. In Optics for Natural Resources, Agriculture, and Foods II (Vol. 6761, pp. 50-56). SPIE.

Mukhametzyanov, R. R., Zaretskaya, A. S., Dzhancharova, G. K., Platonovskiy, N. G., & Arzamastseva, N. V. (2022). Production and export potential of the grain sub-complex of the EAEU countries. In International Scientific and Practical Conference Strategy of Development of Regional Ecosystems “Education-Science-Industry”(ISPCR 2021) (pp. 324-330).

Nazlioglu, S. (2013). Exchange rate volatility and Turkish industry-level export: Panel cointegration analysis. The Journal of International Trade & Economic Development, 22(7), 1088-1107.

Niemi, J. (2018). European market for Mercosur agricultural exports: An econometric study of commodity trade flows. 30th International Conference of Agricultural Economists Proceedings Book, July 28- August 2, 2018, pp. 2423-2433

Nikonenko, U., Hanushchyn, S., Boikivska, G., Andriichuk, Y., & Kokhan, V. (2020). Influence of world commodity prices on the dynamics of income of exporting countries of natural resources under globalization. Business: Theory and Practice, 21(1), 440-451.

Ohlin B. (1933), International and Interregional Trade, Harvard University Press

Özaydin, G., & Karakayaci, Z. (2023). Türkiye’de un ve unlu mamuller sanayinin mevcut yapisi ve gida sanayi içerisindeki yeri. Wheat Studies, 12(1), 1-14.

Pattak, D. C., Tahrim, F., Salehi, M., Voumik, L. C., Akter, S., Ridwan, M., ... & Zimon, G. (2023). The driving factors of Italy’s CO2 emissions based on the STIRPAT model: ARDL, FMOLS, DOLS, and CCR approaches. Energies, 16(15), 5845.

Pesaran, M. H., Shin Y., & Smith R. S. (2001) .Bound testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Pesaran, M.H. & Shin, Y. (1998). An autoregressive distributed-lag modelling approach to cointegration analysis. (Ed.) S. Strom, Econometrics and Economic Theory in the 20th Century (pp. 371-413). Cambridge: Cambridge University Press.

Recchia, L., Cappelli, A., Cini, E., Garbati Pegna, F., & Boncinelli, P. (2019). Environmental sustainability of pasta production chains: An integrated approach for comparing local and global chains. Resources, 8(1), 56.

Robinson, J. (1937), Essays in the Theory of Employment, Macmillan, New York, NY

Samson, M. F., André, C., Audigeos, D., Besombes, C., Braun, P., Cassan, D., ... Kessler, J. P. (2016). Durum wheat pasta with a good quality and a reduced nitrogen fertilization: Is it possible? In Proceedings of the 15th International Cereal and Bread Congress (ICBC 2016), Istanbul, Turkey, 18–21 April 2016.

Schmitt-Grohe, S., & Uribe, M. (2018). How important are terms of trade shocks? International Economic Review, 59(1), 85–111.

Simeone, M., Marotta, G., & Rotondo, G. (2015). Competitive strategies in the Italian pasta industry. Agricultural Economics Review, 16(389-2016-23518), 73-87.

Sugözü, İ. H., & Hüseyni, İ. (2017). Tarımsal destekleme politikaları ve kırdan kente göç üzerindeki etkisi: 1986-2015 Dönemi Türkiye örneği. Electronic Turkish Studies, 12(31).

Sulaiman, C., & Abdul-Rahim, A. S. (2018). Population growth and CO2 emission in Nigeria: a recursive ARDL approach. Sage Open, 8(2), 2158244018765916.

Taşcı, R., Tarhan, S., Söylemez, E., Özercan, B., et al. (2023). Üreticilerin kırsaldan göç etme düşünceleri ve buğday üretimi üzerine olası etkisi. Türk Tarım ve Doğa Bilimleri Dergisi, 10(4), 865-875.

Tiess, G. (2010). Minerals policy in Europe: Some recent developments. Resources Policy, 35(3), 190-198.

TMO, (2021). 2020 Yılı Bakliyat Sektörü Raporu, (Erişim Tarihi: 18.03.2024, Erişim Linki: https://www.tmo.gov.tr/Upload/Document/sektorraporlari/bakliyat2020.pdf)

Turhan, Ş. (2008). Türkiye’de makarna sektörünün rekabet gücü açısından değerlendirilmesi. Verimlilik Dergisi, (4), 115-125.

Uysal, M., & Doğru, B. (2013). Efektif euro kurundaki belirsizliğin euro bölgesi ihracatına etkisi. Atatürk Üniversitesi İktisadi ve İdari Bilimler Dergisi, 27(3), 245-262.

Varlik, M. B. (2021). Türkiye’de makarna sanayiinin geçmişi üzerine birkaç not. Kebikec: Insan Bilimleri Icin Kaynak Arastirmali Dergisi, (51).

Włodarczyk, B. (2017). Price volatility in the commodity market and the bank’s risk. Problemy Zarządzania-Management Issues, 15(1 (66),107-124.

Yenginar, A. (2022). Rusya-Ukrayna savaşının bir sonucu olarak imzalanan tahıl koridoru anlaşmasının montrö boğazlar sözleşmesi çerçevesinde değerlendirilmesi. Journal of Marine and Engineering Technology, 2(2), 101-110.

Zamani, Z., Tayebi, S. K., & Yazdan, N. (2013). Internationalization of SMEs and Their Income-Price Effects on Export Market: a Case of the Selected Asian Countries. International Economics Studies, 42(1), 13-21.

Zimon, G., Pattak, D. C., Voumik, L. C., Akter, S., Kaya, F., Walasek, R., & Kochański, K. (2023). The Impact of Fossil Fuels, Renewable Energy, and Nuclear Energy on South Korea’s Environment Based on the STIRPAT Model: ARDL, FMOLS, and CCR Approaches. Energies, 16(17), 6198.