Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(2), pp. 66–89 DOI: https://doi.org/10.15388/Ekon.2024.103.2.4

Arintoko Arintoko*

Universitas Jenderal Soedirman, Purwokerto,

Indonesia

Email: arintoko@unsoed.ac.id

ORCID: https://orcid.org/0000-0002-7246-546X

Lilis Siti Badriah

Universitas Jenderal Soedirman, Purwokerto,

Indonesia

Email: lilis.badriah@unsoed.ac.id

ORCID: https://orcid.org/0000-0001-8402-148X

Nunik Kadarwati

Universitas Jenderal Soedirman, Purwokerto,

Indonesia

Email: nunik.kadarwati@unsoed.ac.id

ORCID: https://orcid.org/0000-0001-5738-9772

Abstract. This research analyzes the asymmetric effects of global energy and food prices and monetary variables, including the exchange rate and money supply, on the consumer price index (CPI). The model is intended to differentiate the influence of increases and decreases in global energy and food prices, exchange rates, and money supply which cause inflation/deflation from changes in the CPI. The analysis uses the Nonlinear Autoregressive Distributed Lag (NARDL) and Quantile Regression models on data from January 2001 to February 2023. The study results show that the decline in global energy prices significantly reduces the CPI in the long run. Energy subsidies allow increases in international energy prices not to increase the CPI significantly. Meanwhile, the increase in global food prices causes inflation in the short run. The exchange rate has the most significant effect on the CPI. Depreciation of the rupiah significantly increases the CPI, which means it causes inflation, while appreciation of the rupiah does not have a significant effect. Finally, increases and decreases in the money supply have a considerable positive effect on the CPI, which confirms the logic of the monetarist view that inflation is a monetary phenomenon. Efforts to reduce dependence on imports of food and energy commodities are the key to reducing risks when importing energy and food due to rupiah depreciation. Efforts to consistently stabilize the exchange rate can support controlling and stabilizing import prices. Energy and food subsidy policies are vital in controlling inflation due to increased world energy and food prices.

Keywords: asymmetric effects; global energy and food prices; Consumer Price Index; Nonlinear Autoregressive Distributed Lag model; Quantile Regression model

________

Acknowledgement. This research was funded by the Institute for Research and Community Service at Universitas Jenderal Soedirman under the Institutional Research scheme 2023, with contract number 6.8/UN23.37/PT.01.03/IV/2023.

* Correspondent author.

Received: 25/12/2023. Revised: 04/05/2024. Accepted: 22/05/2024

Copyright © 2024 Arintoko Arintoko, Lilis Siti Badriah, Nunik Kadarwati. Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

The dynamics of the global economy are increasingly inseparable from the global economic crisis in the last decade. These global economic dynamics are increasingly impacting a country’s economy. A country’s openness to facing an increasingly dynamic global environment will make it vulnerable to changes in external factors. Changes that make an economy vulnerable increasingly receive attention from researchers and policymakers.

One of the critical problems that has received world attention is the issue of inflation and rising energy and food prices, which have a greater impact, especially on developing countries. One of the global issues related to soaring global energy and food prices is inflation. World price fluctuations can spill over into a country’s domestic inflation (Bäurle et al., 2021). Recently, inflation has become a primary global concern. The IMF, World Bank, and economists believe that rising inflation due to rising energy and food prices will encourage an increase in interest rates to control high inflation, which can hamper aggregate demand. Crises that may arise due to soaring world energy and food prices are more likely to occur in countries that depend on energy and food imports, especially developing countries.

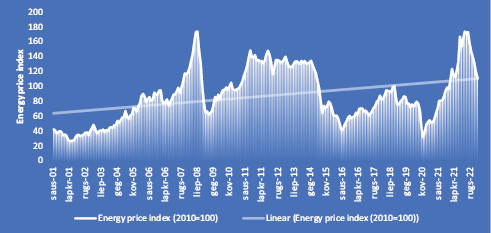

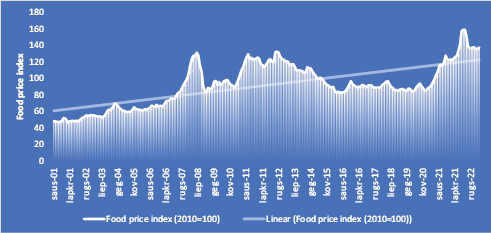

The dynamics of world energy prices in more than two decades are characterized by the frequency of energy price spikes being more frequent than declines, as shown in Figure 1. As a representation of global energy prices, the price index shown is a composite of crude oil, natural gas, and coal prices, with the largest weighting being crude oil. Meanwhile, the dynamics of global food prices are characterized by fluctuations in food prices with an increasing trend in the long term, as shown in Figure 2. Global food prices are a composite price index consisting of oils and meals, cereals, and other foods. More frequent increases in energy prices and fluctuations in food prices, which tend to rise in the long term, are severe challenges for countries that depend on energy and food imports in general, which can then threaten domestic food security.

The energy and food crises are characterized by soaring world energy and food prices due to limited supply, which can then increase the burden on household income (Guan et al., 2023). In countries focusing on inflation, monetary policymakers are always alert to external factors that can impact domestic inflation (Rachman, 2015). Even though countries are increasingly integrated with the global economy, the influence of monetary policymakers still plays an essential role in domestic inflation dynamics (Bems et al., 2022). In countries that implement inflation targeting in their monetary policy, inflation stabilization becomes the main focus of their targets.

Indonesia, a nation that implements inflation targeting, is a case in point. With its high openness, characterized by extensive export and import activities, Indonesia is inextricably linked to the issue of domestic inflation due to the surge in global energy and food prices. Particularly for energy and food imports, which remain substantial, Indonesia is at risk when there is a hike in energy and food prices and a depreciation of the rupiah, highlighting the complex challenges it faces.

Main external factors, such as global energy and food prices, which could cause inflation in Indonesia, need to be researched as potential sources of domestic supply shocks. The increase in global energy and food prices, which triggers global inflation, can also cause domestic inflation through changes in import prices, which are passed on to changes in consumer prices. Literature documentation from previous empirical studies states that global commodity prices and changes in domestic currency exchange rates are proven to be factors that have a significant contribution to inflation in a country among existing external factors (including Naghdi & Kaghazian, 2015; Rizvi & Sahminan, 2020; Kayamo, 2021; Yan & Bian, 2022). Changes in energy and food prices impact changes in import prices of final products and inputs, which in turn affect the CPI. Meanwhile, changes in exchange rates based on the exchange rate pass-through model affect import prices. The degree of ERPT will impact the level of inflation transmission to domestic inflation through international trade. Therefore, in this relationship, the exchange rate influences inflation.

Apart from being related to global commodity prices, preliminary studies on the influence of exchange rates on various aspects of the economy have been carried out in various countries. Among the main macroeconomic variables, the exchange rate has a significant contribution to influencing the domestic economy. In the literature, the exchange rate influences economic growth (including Morina et al., 2020; Karahan, 2020; and Utomo and Saadah, 2022) and also influences inflation (including Fetai et al., 2016; Monfared & Akin, 2017; Sharma & Dahiya, 2023) and is a significant issue especially in countries that focus on inflation (López-Villavicencio & Pourroy, 2019; Valogo et al., 2023).

From various previous studies and research on the influence of global commodity prices and exchange rates by joint modeling of monetary variables, most of the analysis assumes that the effects are symmetrical and apply equally to increases and decreases. However, changes between increases and decreases in the independent variable are not always responded to by changes in the dependent variable symmetrically or equally. It may be asymmetric, which means that the effect of an increase differs from that of a decrease, which is related to the nature of price rigidity. Price rigidity can prevent price fluctuations. Price rigidity can occur because firms can maintain fixed prices due to market power (Anders et al., 2023). However, price rigidity can partly occur, called asymmetric price rigidity, where prices are more rigid upward than downward (Levy et al., 2020), and price declines were common occurrence outside the services sector (Visockytė, 2018). Asymmetric price rigidity can support asymmetric price behavior, which encourages asymmetric effects from price changes in price pass-through from world commodity prices to import prices and CPI. Even though there has been research with asymmetric influence analysis, the analysis is carried out partially and only analyzes certain variables, which are the model’s primary focus. Likewise, the effects of asymmetry or differences in estimated parameters are only analyzed between increases and decreases. Meanwhile, the CPI is not affected in the same magnitude or constant at various CPI levels based on changes in energy and food prices, exchange rates, and money supply, where monetary policy will generally boil down to adjusting the money supply to stabilize inflation and output.

This research develops a model to analyze changes in global energy and food prices, exchange rates, and money supply on CPI. This research proposes a dynamic model that aims to develop the Autoregressive Distributed Lag (ARDL) model into a Nonlinear Autoregressive Distributed Lag model to differentiate the effect of increasing and decreasing independent variables on the response variable. The NARDL model analyzes the asymmetric influence between global energy and food prices by involving exchange rates and money supply as monetary variables. Meanwhile, quantile regression models were estimated to analyze the differences in influence between various CPI levels, i.e., low, moderate, and high CPIs.

Furthermore, after Section 1, which provides an introduction, this paper is structured according to its objectives: Section 2 outlines a brief of theoretical basis and literature review relating global energy and food prices to inflation and the relationship between the exchange rate and money supply to CPI. Section 3 explains the data and methodology. Section 4 presents the empirical findings and discussion. Finally, section 5 provides conclusions and policy implications.

This study analyzes the effect of world energy and food prices and exchange rates based on the microeconomic theory foundation for producer behavior with flexible prices. As in Adolfson (2001, 2007), the open economy’s aggregate supply and demand model adjusted for incomplete exchange rate pass-through is based on the optimization behavior of domestic producers in the open economy. The prices of imported goods charged to the domestic market are flexible with no nominal rigidities.

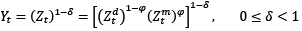

In this model, domestic producers in the production of goods (Y) are assumed to use composite inputs consisting of domestic intermediate goods (Zd) and imported goods (Zm). The production function following the Cobb-Douglas production function is as follows.

(1)

(1)

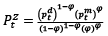

The price of composite intermediate input in domestic currency is expressed as follows.

(2)

(2)

where  denotes price of domestic intermediate goods,

denotes price of domestic intermediate goods,  denotes price of imported goods, φ denotes imported inputs share in the domestic production. The firm maximizes profits assuming an imperfectly competitive market with flexible prices, which is expressed by

denotes price of imported goods, φ denotes imported inputs share in the domestic production. The firm maximizes profits assuming an imperfectly competitive market with flexible prices, which is expressed by

(3)

(3)

(4)

(4)

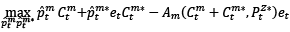

Aggregate domestic and foreign consumption is assumed to follow the constant elasticity of substitution (CES) function. Producers meet demand for domestic products equivalent to Y = Cd + Cd*, which means domestic demand plus foreign demand. Meanwhile, et represents the exchange rate, expressed as the domestic currency per unit of foreign currency. Ct is the domestic aggregate consumption index, a combination of the consumption bundle of domestic and foreign goods, and p̂t is the corresponding price index. The asterisk represents the foreign counterpart. This model also assumes that there is no strategic interaction because the goods are well differentiated allowing producers to ignore their influence on aggregate prices and take competitors’ prices, in this case the prices of imported goods ( ), as fixed.

), as fixed.

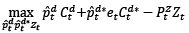

Based on the first-order conditions, flexible prices are imposed on the domestic and foreign markets, so each price can be stated as follows.

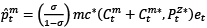

(5)

(5)

(6)

(6)

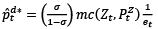

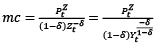

σ is a constant price elasticity which is positive. Marginal cost (mc) is as follows

(7)

(7)

Therefore, the price charged on the domestic market as in equation (5) can be expressed as

(8)

(8)

Thus, the domestic equilibrium price of a good with flexible prices consists of a constant and identical markup over marginal cost. With a constant markup as implied in the CES function, as stated by Adolfson (2001), the influence of the exchange rate on prices charged on the domestic market is only through its influence on the marginal costs of domestic producers, which is through its influence on imported intermediate inputs used in the production of domestic goods.

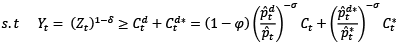

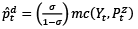

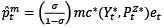

For imported goods, the behavior of foreign producers in the optimization problem is equivalent to domestic producers in producing domestic goods using imported intermediate goods. Foreign producers face the following optimization problem.

(9)

(9)

(10)

(10)

Where  is the price of foreign goods charged in the domestic market and denoted in domestic currency,

is the price of foreign goods charged in the domestic market and denoted in domestic currency,  * is the price of foreign goods charged in the foreign market and denoted in foreign currency, Am denotes total cost function of foreign producer,

* is the price of foreign goods charged in the foreign market and denoted in foreign currency, Am denotes total cost function of foreign producer,  is the input prices for foreign producers denoted in foreign currency, ω denotes the share of imported foreign goods of domestic consumption, and σ denotes the constant price elasticity of demand. The first order condition of profit maximization of foreign producers results in the prices charged on the domestic market.

is the input prices for foreign producers denoted in foreign currency, ω denotes the share of imported foreign goods of domestic consumption, and σ denotes the constant price elasticity of demand. The first order condition of profit maximization of foreign producers results in the prices charged on the domestic market.

(11)

(11)

and since total demand for foreign goods,  , then equation (11) can be expressed as

, then equation (11) can be expressed as

(12)

(12)

This means that the world market price for domestic imported goods is equal to the aggregate foreign price level,  .

.

Based on equations (8) and (12), the domestic aggregate price level is a composite of the price of domestic goods using imported intermediate inputs and the price of final imported goods charged in the domestic market. From the composite between  and

and  , with the incomplete exchange rate pass-through model, the aggregate price level

, with the incomplete exchange rate pass-through model, the aggregate price level

( ) can be determined by the price of domestic goods using imported inputs (

) can be determined by the price of domestic goods using imported inputs ( ) and the exchange rate (et), which influences the prices of imported input and final goods (

) and the exchange rate (et), which influences the prices of imported input and final goods ( ). World commodity prices such as oil and food, as modeled in a study by Carri’ere-Swallow et al. (2021), are the commodity prices determined on the world market and expressed in US dollar denominations. In this study, aggregate price modeling involves world energy prices as an extension of oil commodities, and world food prices and exchange rates. Therefore, with the incomplete exchange rate pass-through model, domestic aggregate price is a function of world energy prices, world food prices, and the exchange rate.

). World commodity prices such as oil and food, as modeled in a study by Carri’ere-Swallow et al. (2021), are the commodity prices determined on the world market and expressed in US dollar denominations. In this study, aggregate price modeling involves world energy prices as an extension of oil commodities, and world food prices and exchange rates. Therefore, with the incomplete exchange rate pass-through model, domestic aggregate price is a function of world energy prices, world food prices, and the exchange rate.

(13)

(13)

The increase in energy prices through world oil, gas, and coal prices will increase domestic fuel, gas, and coal prices and production costs for industries that generally require energy as a supporting material. The increase in energy prices for households will directly impact the rise in CPI, which is contributed by household fuel expenditure and indirectly transportation expenditure and expenditure on commodities whose production processes use energy. Meanwhile, the increase in world food prices will have a direct impact on the rise in the price of directly imported food and the increase in the price of domestic food made from imported food raw materials, and this will contribute to the rise in the CPI through household spending on food and beverage. The effect of a decrease in global energy and food prices can have the opposite impact, with the magnitude of the effect not being similar.

Domestic currency depreciation will increase import prices, which in turn will increase the CPI from rising prices of imported goods in domestic currency. The effect of domestic currency appreciation can reduce import prices and CPI, but with a non-identical effect size, allowing asymmetric exchange rate pass-through.

In a monetary policy environment that focuses on stabilizing inflation, domestic aggregate price modeling is completed by involving the monetary aggregate, i.e., the money supply, as a monetary variable that also influences inflation. Inflation, as a monetary phenomenon in Friedman’s view, is caused by the money supply, which drives aggregate demand. The encouragement of aggregate demand that continues in the long run will only cause inflation.

As Nguyen et al. (2022) point out, an excess of aggregate demand compared to aggregate supply due to excess money in circulation will cause inflation. There is a one-way relationship between money supply and inflation, not vice versa. Ryczkowski (2021) states that empirically there is a causality between money growth and inflation, and supports a return to a monetary framework that controls the money supply to control inflation. An increase in money supply will cause an imbalance between money supply and money demand, a situation that can have significant economic implications. To return to balance, some of the excess money will be used to purchase goods and services. An increase in demand for goods that cannot be met by the supply side will cause excess demand which then drives inflation.

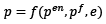

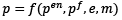

Irving Fisher’s exchange equation, MV = PY where M is the volume of currency traded, V is currency velocity, P is the price of goods, and Y is the level of real income (output), meaning that there is a direct link between money and inflation (Sultana et al., 2018). Because V is relatively stable over time, as the monetarist view, money growth that is faster than output will only result in inflation. The monetarist view implies that tightening monetary policy to control inflation is the key to monetary action through controlling the money supply. As a further development of equation (13), the following function expresses domestic aggregate price modeling as an empirical strategy with incomplete exchange rate pass-through in a monetary policy environment that focuses on inflation stabilization.

(14)

(14)

where pen denotes world energy price which is a composite of oil, natural gas and coal, Pf denotes world food price which is a composite of oils and meals, cereals and other foods, e denotes the domestic exchange rate against the US dollar. The monetary aggregate variable (m) chosen in this model is M1 which represents more transactional money. Assuming asymmetric effects, the influence of global energy and food prices, exchange rates and money supply on domestic prices is differentiated between increases and decreases. To represent inflation, prices are expressed in natural logarithms, the change in which means inflation/deflation.

Implementation of monetary policy in countries that focus on inflation will always be oriented towards stabilizing inflation. Stabilization of domestic inflation is often faced with the challenges of a dynamic global economy. Rapid changes in global commodity prices increasingly characterize the dynamism of the global economy. The increase in inflation today is increasingly evident due to the rise in global commodity prices, especially global energy prices. Several studies have documented the positive impact of rising global energy prices on domestic inflation in advanced developing countries (emerging markets), including a study by Rizvi and Sahminan (2020). The increase in oil and energy prices increases inflation significantly; this can be caused by inflation originating from sectors that utilize energy, especially oil, gas, and coal., which can be caused by inflation originating from sectors that utilize energy, mainly oil, gas, and coal. Oil prices have an asymmetric influence, as Sek (2022) and Arintoko et al. (2023) provide their empirical findings. Oil prices have an asymmetric impact on domestic inflation, which occurs through increases in consumer prices, producer prices, and industrial prices. The rise in oil prices significantly impacts inflation by increasing the transportation consumer price index (CPI). Ayisi (2019) and Bawa et al. (2020) also provide evidence of the asymmetric effect of changes in oil prices on inflation.

Sek (2019) discusses the concept of price rigidities, which can occur due to effective monetary policy. This policy can lead to asymmetric effects from changes in oil prices. Energy prices, represented by crude oil, natural gas, and coal, can influence inflation. Binder (2018) and Zhang et al. (2017) provide empirical evidence that an increase in natural gas prices leads to inflation. Guo et al. (2016) empirically demonstrate that coal prices have a positive and asymmetric impact on inflation, as measured by the CPI.

Besides energy prices, global commodity prices and food prices can also impact domestic inflation, especially in countries that import food commodities. Furceri et al. (2016) prove that the increase in global food inflation impacts domestic inflation from cross-country studies in developed and developing countries. The increase in global food inflation has a more significant impact on developing countries than developed ones. Rising inflation has significantly impacted global food prices in developing countries such as Indonesia and India (Rizvi & Shaminan, 2020). Specifically, changes in international food prices have driven considerably domestic food inflation, as a study by Samal et al. (2022) provides empirical evidence.

Apart from global commodity prices, exchange rates can influence inflation. Sek (2022) proves that the exchange rate predominantly influences domestic inflation, so the exchange rate is the main factor that significantly influences domestic inflation. The exchange rate influences inflation through changes in import prices in sectors that use imported inputs. Inflation and exchange rates have also been proven to have a relationship in the short run, as proven by Sharma and Dahiya (2023). Monfarid and Akin (2017), Omolade et al. (2019), and Ugwu et al. (2021) also prove that empirical changes in exchange rates encourage inflation.

Kassi et al. (2019) and Fandamu et al. (2023) provide empirical evidence that the influence of the exchange rate on consumer prices occurs through incomplete and asymmetric exchange rate pass-through. Depreciation of the domestic currency has a more significant impact on changes in consumer prices than appreciation. The study by Hong et al. (2022) shows that the existence of asymmetry in exchange rate pass-through implies that local currency depreciation is a challenge in price stabilization.

Regarding monetary variables, inflation modeling by Chen et al. (2020) involves the money supply as a monetary variable, which is hypothesized to affect inflation positively. Empirical results show that the money supply positively affects CPI inflation apart from oil prices. The same results were stated by Samal et al. (2022), who noted that the money supply as a monetary policy variable influences inflation positively. Roshan (2014), Kugler and Reynard (2022), and Madurapperuma (2023) also provide evidence that an increase in the money supply causes inflation. According to the Monetarist view, an increase in the money supply encourages household aggregate demand to increase, which causes prices to rise.

With a focus on inflation, monetary policy generally aims to stabilize inflation. In implementing monetary tightening to control inflation, monetary policy is not recommended to be aimed solely at controlling the influence of rising energy prices, which impact inflation, because it can cause monetary policy to become counterproductive (Atiq-ur-Rehman, 2013).

According to the developed model, consumer price index in the natural logarithm is involved as the dependent variable in this research. Meanwhile, the independent variables include energy prices, food prices, exchange rates, and money supply as monetary policy variables. Prices are expressed in terms of the natural logarithm of the CPI, whose changes express inflation. CPI is based on the base year 2012 (2012=100). Energy prices are expressed in a monthly index, a combination of the prices of crude oil, natural gas, and coal with a weight of 84.6, 10.8, and 4.6 percent each, based on 2010 US dollar nominal = 100. The energy price index is analyzed using the natural logarithm (ln) which is abbreviated to PEN. Food prices are expressed in a monthly index, a combination of oils and meals, cereals, and other foods weighing 40.75 each, 28.25, and 31 percent, based on 2010 US dollar nominal = 100. The food price index is analyzed using natural logarithm (ln) which is abbreviated to PF. The exchange rate is measured in IDR/USD. The analyzed data is expressed in natural logarithms (ln) and shortened to ER. Finally, the money supply is calculated by M1 (narrow money), which is more liquid and transactional. M1 is measured in billions of rupiah, expressed in natural logarithms (ln), and abbreviated to MS depicted in the model.

The period analyzed in this research is January 2001 to February 2023. Analysis of changes in global energy and food prices in influencing CPI is modeled with monetary variables, including exchange rates and money supply. Data was accessed from online sources, such as Bank Indonesia for CPI, exchange rate, and money supply, and the World Bank for data on energy and food prices.

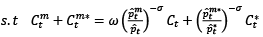

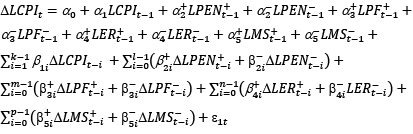

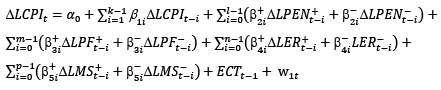

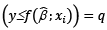

This research estimates the CPI equation, a Nonlinear Autoregressive Distributed Lag (NARDL), and a Quantile Regression (QR) model. Explanatory variables include global energy and food prices, exchange rates, and money supply, which are differentiated between increases (x+) and decreases (x-) through positive and negative partial decomposition. This model is the application of the NARDL model developed by Shin et al. (2014), and several variations of the model have been applied in several previous studies, including Arintoko (2021a) and Arintoko (2021b). Equation (15) is a developed model to analyze the influence of increases and decreases in global energy and food prices, exchange rates, and money supply on CPI. CPI changes in the natural logarithm reflect inflation.

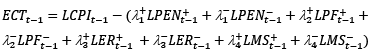

(15)

(15)

Note:

(16a)

(16a)

(16b)

(16b)

The decomposition of positive and negative partial sum decompositions for other variables, namely LPF, LER, and LMS, is calculated similarly to equations (16a) and (16b).

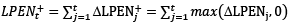

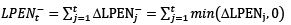

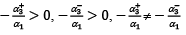

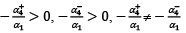

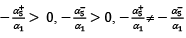

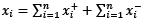

The expected long-run parameters and asymmetric effects of equation (15) are as follows:

(17a)

(17a)

(17b)

(17b)

(17c)

(17c)

(17d)

(17d)

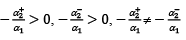

For short-run parameter estimation of the NARDL model and the accompanying error correction term (ECT), the NARDL model is also expressed in equations (18) and (19) for the following.

(18)

(18)

with:

(19)

(19)

The expected value for ECT is between -1 and 0.

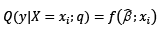

The relationship between the ARDL model and quantile regression estimation has also been developed by Cho et al. (2023). The purpose of applying quantile regression is to analyze differences in the influence of independent variables on response variables between quantiles with a model that can overcome the problems of heteroscedasticity and non-normality because it is not sensitive to outliers (Huang et al., 2017). The application of quantile regression is suitable because there are possible differences in the influence of changes in energy prices, food prices, exchange rates, and money supply on CPI at different CPI levels between low CPI (low quantiles), moderate CPI (middle quantiles) and high CPI (upper quantiles). The quantile regression model is generally stated as follows.

(20)

(20)

With probability  and

and

(21)

(21)

x’s are independent variables and y is a response variable.

A statistical description of the variables analyzed in this study is presented briefly in Table 1. The CPI has a similar statistical figure with a higher mean than the median with global energy and food prices. However, the CPI has the smallest range during the study period. This characteristic indicates a tendency for higher prices to increase in the second half of the study period for CPI, global energy, and food prices.

|

Variable |

Minimum |

Maximum |

Mean |

Median |

Std. Dev. |

|

CPI |

41.6400 |

152.8200 |

98.4459 |

97.9150 |

33.3655 |

|

PEN |

26.2500 |

173.4800 |

86.963 |

81.4500 |

36.2373 |

|

PF |

46.7900 |

159.0400 |

91.748 |

90.5250 |

26.0480 |

|

ER |

8,279.00 |

16,367.00 |

11,276.37 |

10,259.00 |

2,329.571 |

|

MS |

145,345.0 |

2,608,797 |

855,993.6 |

705,248.0 |

624,908.0 |

As a trigger for CPI increases, global energy prices have a relatively high standard deviation, which indicates high price variations or fluctuations. However, energy prices appear more variable than global food prices, with a higher standard deviation. The range of minimum and maximum energy prices is higher than that of food prices. This condition indicates that energy price movements are more volatile than food prices. However, with the same base year, 2010=100, the mean of global food prices is higher than energy prices, so the impact on domestic food prices is also significant. The increase in food prices was contributed mainly by oils and meals, and cereals, while energy prices were mostly contributed by crude oil.

Based on summary statistics, the exchange rate measured in rupiah per US dollar shows high variations with a range of lowest and highest values, where the highest value is almost twice the lowest value. An increase in the exchange rate means a depreciation of the rupiah, and vice versa. During the research period, the exchange rate tended to increase, meaning the rupiah tended to depreciate against the US dollar.

The money supply, measured in billions of rupiah of M1, shows higher variations in the exchange rate with a range of minimum and maximum values, where the maximum value is 17.95 times the minimum value. The median value is far from the average value, so the standard deviation is also very high, close to the median value. This statistical picture indicates that the variation in the money supply is very high. During the research period, there was a tendency to increase the money supply by M1.

Furthermore, in applying the NARDL model, such as in the ARDL model, the characteristics of data stationarity of the variables analyzed in the model need to be tested through the unit root test. Unit root tests apply the Augmented Dickey-Fuller (ADF) test, and DF GLS, which is a modification of the ADF test. The application of the ARDL model can be justified if all variables are stationary at the first level or difference or a combination thereof without any variables being stationary at the second difference. The results of the unit root test on the variables in this research model are presented in Table 2.

The unit root test results test via the ADF and DF GLS tests for all variables are stationary at the first difference or can be expressed as I(1). All variables in the model are I(1) without I(2) so that the NARDL model application can be carried out.

The NARDL model specification in this study positions CPI as an endogenous variable or response variable based on theoretical grounds and empirical studies; meanwhile global energy and food prices, exchange rates and money supply as exogenous variables. By separating the increase and decrease in global energy and food prices, exchange rates and money supply, a model is formulated to capture asymmetry effects into the NARDL model. With a model specification where CPI is the endogenous variable, the selection of the optimum lag is based on the minimum AIC value. The model with the optimum lag which has the minimum AIC value is the selected econometric model because it has the minimum error with the model specifications by theory. The selected model is ARDL(3, 0, 1, 1, 0, 2, 2, 1, 1).

|

Variable |

ADF Test |

DF GLS test |

|

|

In level |

LCPI |

-1.3896 |

0.0566 |

|

LPEN+ |

-1.3611 |

-1.2782 |

|

|

LPEN- |

-2.9518 |

-2.9111* |

|

|

LPF+ |

-1.4201 |

-1.2661 |

|

|

LPF- |

-2.6218 |

-2.2636 |

|

|

LER+ |

-3.5338** |

-2.0086 |

|

|

LER- |

-3.6743** |

-0.5116 |

|

|

LMS+ |

-1.9799 |

-1.9818 |

|

|

LMS- |

-3.0726 |

-1.9393 |

|

|

In first difference |

∆LCPI |

-13.0540*** |

-13.0965*** |

|

∆LPEN+ |

-13.2000*** |

-12.1875*** |

|

|

∆LPEN- |

-10.0332*** |

-8.4359*** |

|

|

∆LPF+ |

-10.9556*** |

-10.2144*** |

|

|

∆LPF- |

-10.2303*** |

-10.2189*** |

|

|

∆LER+ |

-12.5601*** |

-4.38651*** |

|

|

∆LER- |

-14.2403*** |

-13.0727*** |

|

|

∆LMS+ |

-4.0294*** |

-6.4099*** |

|

|

∆LMS- |

-6.7164*** |

-9.3188*** |

|

An essential element in the ARDL and NARDL models is a long-run relationship between the response variable and the independent variables, reflecting the theoretical or expected relationship between variables. A bound test is applied to test whether there is a long-run relationship. The test result via bound tests for the model is presented in Table 3.

|

F-statistic |

Sig. |

Lower Bound |

Upper Bound |

Conclusion |

|

6.3865 |

10% |

1.85 |

2.85 |

There is a long-run relationship |

|

5% |

2.11 |

3.15 |

||

|

1% |

2.62 |

3.77 |

From the tests carried out through the bounds test, as summarized in Table 3, the F-statistic is significant at = 1 percent to reject the null hypothesis. It can be concluded that the model has a long-run relationship. A long-run relationship exists in the model between CPI and the independent variables, including energy prices, food prices, exchange rates, and the money supply, each increasing and decreasing. The model has a significant long-run relationship at = 1 percent. This conclusion is based on the F-statistic value exceeding the upper bound, which means bound test results reject the null hypothesis, which states no long-run relationship.

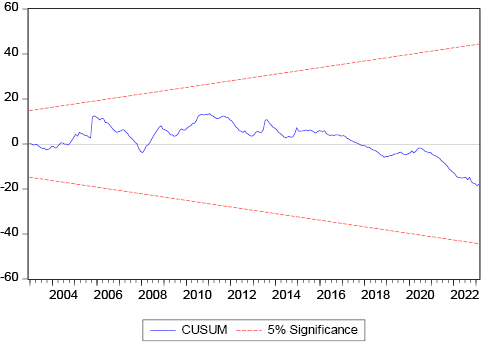

The expected model stability of the selected model based on the CUSUM test is fulfilled. The CUSUM test results depicted graphically do not exceed the significance limit of 5 percent (see Figure 3). This result means that the model chosen as the best model was tested for stability for the specified research period. A model analysis using a quantile regression model approach will complement the discussion of the ARDL model estimation results regarding stability and non-normality issues.

Based on the estimates of the best NARDL models, the results of estimating the long-run effects of the model are presented in Table 4. Energy prices affect the CPI positively, but only when energy prices fall significantly reduce prices in the long run. A decrease in energy prices (LPEN-) reduces CPI significantly with a larger coefficient than an increase in energy prices (LPEN+) at α = 1 percent. A decrease in energy prices reduces the CPI, which has a relatively large and significant impact compared to an increase in energy prices which increases the CPI. This result means that a decrease in energy prices impacts deflation, while an increase in energy prices does not significantly cause inflation. Therefore, energy prices have an asymmetric effect on inflation. Meanwhile, global food prices do not significantly influence CPI in the long run, for increases (LPF+) and decreases (LPF-).

Exchange rate has a positive effect on CPI. An asymmetric effect is found in this model where a reduction in the exchange rate (LER-) or appreciation does not significantly reduce CPI. On the contrary, an increase in the exchange rate (LER+) or depreciation of the rupiah significantly increases CPI, which means it causes inflation. With α = 1 percent, an increase in the exchange rate or depreciation of the rupiah significantly causes inflation with a more significant coefficient. This result means that rupiah depreciation significantly affects rising CPI more than rupiah appreciation in decreasing CPI. In other words, the depreciation of the rupiah is more significant in causing inflation than the appreciation of the rupiah in causing deflation.

The money supply, as measured by M1, which shows the level of economic liquidity, has a significant impact on increasing the CPI. Monetary expansion, characterized by an increase in the money supply (LMS+), increases the CPI significantly, which means it causes inflation. Likewise, a monetary contraction indicated by a decrease in the money supply (LMS-) also significantly reduces the CPI, which means it causes deflation. The difference in coefficients for increases and decreases in money supply indicates a positive asymmetric effect on increases and decreases in CPI.

|

Variable |

Coefficient |

Conclusion |

|

LPEN+ |

0.0641 |

Not significant |

|

LPEN- |

0.1775*** |

Significant at α = 1 percent and in line with expected positive value |

|

LPF+ |

0.0647 |

Not significant |

|

LPF- |

0.0007 |

Not significant |

|

LER+ |

0.8252*** |

Significant at α = 1 percent and in line with expected positive value |

|

LER- |

0.4690 |

Not significant |

|

LMS+ |

0.5402*** |

Significant at α = 1 percent and in line with expected positive value |

|

LMS- |

1.0948*** |

Significant at α = 1 percent and in line with expected positive value |

The regression results with the quantile regression model are added to complete the discussion of the long-run NARDL model regression results. The aim is to enrich the discussion by demonstrating that asymmetric effects are possible not only between the effects of increases and decreases in global energy and food prices, exchange rates, and money supply but also differences in effects between CPI levels, which are differentiated between quantiles. Applying quantile regression can also overcome heteroscedasticity and non-normality problems in the model. The regression results with the quantile regression model are presented in Table 5.

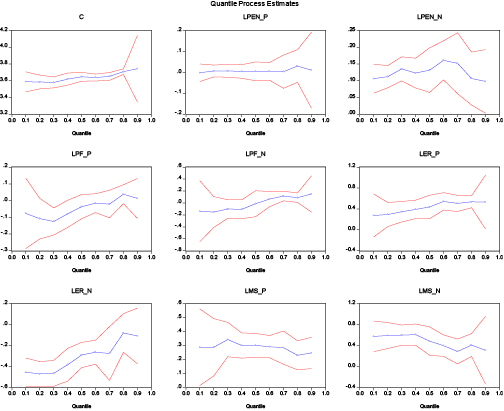

The quantile regression with the middle quantile (median) shows that only a decrease in global energy prices significantly affects decreasing CPI and not an increase in energy prices, which increases CPI. These results confirm the estimation results of the NARDL model and show the existence of an asymmetric effect of changes in global energy prices on changes in CPI. Figure 4 shows that in almost all quantiles, increases in energy prices (LPEN+) do not significantly influence the increase in CPI and have low coefficients that are close to zero. Meanwhile, decreases in energy prices (PEN-) significantly reduce CPI and have a relatively high coefficient compared to the coefficient for increases in global energy prices. These results confirm the results of the NARDL model that changes in international energy prices have an asymmetric positive influence on CPI in the long run.

|

Variable |

Coefficient |

Conclusion |

|

C |

3.6460 |

|

|

LPEN+ |

0.0044 |

Not significant |

|

LPEN- |

0.1314*** |

Significant at α = 1 percent and in line with expected positive value |

|

LPF+ |

-0.0362 |

Not significant |

|

LPF- |

-0.0117 |

Not significant |

|

LER+ |

0.4378*** |

Significant at α = 1 percent and in line with expected positive value |

|

LER- |

-0.2910*** |

Significant at α = 1 percent but not in line with expected positive value |

|

LMS+ |

0.3011*** |

Significant at α = 1 percent and in line with expected positive value |

|

LMS- |

0.4845*** |

Significant at α = 1 percent and in line with expected positive value |

The increase in global food prices (LPF+) did not significantly affect the rise in CPI in all quantiles, with most coefficients below zero. Meanwhile, the decline in global food prices (LPF-) significantly impacted the decline in CPI only in the upper quantiles, especially the 7th and 8th quantiles. In general, these results also confirm the results of the NARDL model estimation for the insignificant effect of global food prices on CPI for both increases and decreases in the long run.

An increasing exchange rate (LER+) or depreciation of the rupiah in almost all quantiles, except the first quantile, significantly increases the CPI, which means it causes inflation. The positive coefficients confirm the impact of rupiah depreciation, which can cause inflation as estimated by NARDL, and provide additional information that significant rupiah depreciation causes inflation to occur at almost all CPI levels. Meanwhile, due to the negative coefficients, the appreciation of the rupiah exchange rate (LER-) did not reduce the CPI significantly as expected. In conclusion, the rupiah exchange rate has an asymmetric effect on the CPI, and an asymmetric exchange rate pass-through occurs. Exchange rate pass-through is only significant when the rupiah depreciates against an increase in CPI.

From the monetary side, a significant increase in money supply (LMS+) increases the CPI, which means it causes inflation. Likewise, a substantial decrease in money supply (LMS-) reduces the CPI, which means it causes deflation. With positive coefficients but with a different size, the money supply has an asymmetric effect on CPI, confirming the NARDL model’s estimation results. Reducing monetary aggregates through M1 significantly reduces CPI in the long run with a more significant impact than increasing monetary aggregates, which increases CPI.

The short-run effects captured by the NARDL model estimates are presented in Table 6. As expected, the decline in global energy prices (LPEN-) did not significantly reduce the CPI in the short run. Meanwhile, the increase in world food prices (LPF+) significantly caused inflation in the short run. In the short run, the effect of rupiah depreciation (LER+) was distributed for two months with a total negative effect on CPI changes and not meeting expectations. On the other hand, the appreciation of the rupiah (LER-) had effects distributed over two months, but the total effect was positive on changes in CPI. So, the rupiah appreciation significantly reduces CPI or can cause deflation. From the monetary side, only an increase in money supply (LMS+) significantly influences changes in CPI, while a decrease in money supply (LMS-) has no significant effect. There is a symmetric effect in the short run where an increase in money supply (M1) significantly increases CPI or causes inflation, while a decrease in M1 does not significantly reduce CPI.

The ECT coefficient in the model is significant, with negative values less than zero and higher than -1. This result means that CPI level will move towards long-run equilibrium when CPI deviations in the short run are corrected.

|

Variable |

Coefficient |

Conclusion |

|

∆DLCPIt-1 |

0.1517** |

Significant at α = 5 percent and in line with expected positive value |

|

∆DLCPIt-2 |

-0.1138** |

Significant at α = 5 percent but not in line with expected positive value |

|

∆LPEN-t |

-0.0138* |

Significant at α = 10 percent but not in line with expected positive value |

|

∆LPF+t |

0.0422** |

Significant at α = 5 percent and in line with expected positive value |

|

∆LER+t |

-0.0177 |

Not significant |

|

∆LER+t-1 |

-0.0582*** |

Significant at α = 1 percent but not in line with expected positive value |

|

∆LER-t |

0.0038 |

Not significant |

|

∆LER-t-1 |

0.0656*** |

Significant at α = 1 percent and in line with expected positive value |

|

∆LMS+t |

0.0547*** |

Significant at α = 1 percent and in line with expected positive value |

|

∆LMS-t |

-0.0181 |

Not significant |

|

ECTt-1 |

-0.0398*** |

Significant at α = 1 percent and in line with expected value |

Global energy prices have asymmetric effects on CPI. The increase in global energy prices, mainly caused by rising oil prices, does not significantly increase the CPI in the long run. The role of energy subsidies, especially fuel and gas subsidies for households, makes it possible to inhibit the significant increase in CPI due to rising global energy prices. The policy simulation in the study conducted by Akhmad et al. (2023) shows that an increase in fuel prices without being supported by an increase in subsidies will impact increasing inflation in Indonesia. Results of the study conducted by Murjani (2022) confirm that energy subsidies significantly reduce CPI in Indonesia in the short and long run. The increase in world oil prices is the most critical contributor to the increase in domestic fuel prices.

On the other hand, a significant decrease in energy prices reduces the CPI in the long run with a coefficient greater than the coefficient for an increase in energy prices. The decline in world energy prices creates favorable conditions for controlling domestic inflation. The empirical finding that a significant effect is only proven for a decrease in global energy prices on a decrease in CPI rather than an increase in energy prices on an increase in CPI, in the long run, is possible because of the nature of asymmetric price rigidity as stated by Levy et al. (2020). The impact of energy subsidies allows prices to be more rigid upward rather than downward. The findings of the asymmetric effect complement the results of research conducted by Bala and Chin (2018), which shows that in the short and long run, the asymmetric effect of changes in energy prices influences domestic inflation.

The estimation results of the ARDL and Quantile Regression models show that overall increases and decreases in world food prices do not significantly increase or decrease CPI in the long run. The role of food subsidies, such as rice subsidies and market operations by BULOG, a state-owned public company engaged in food logistics, helps stabilize food prices so that stable prices can be maintained from increases and decreases in global food prices in the long run. Food subsidies effectively control consumer prices, as supported by a study by Ginn and Pourroy (2022), which found that food subsidies can reduce inflation volatility. Food subsidies can also create food price rigidity. Meanwhile, food price fluctuations that affect the CPI are also largely caused by domestic factors related to food production and availability disruptions. Therefore, increases and decreases in global food prices do not significantly increase and decrease CPI in Indonesia in the long run. The increase in global food prices significantly increases the CPI in the short run. The primary commodities that Indonesia still imports include wheat, rice, sugar, soybeans, milk, beef, and garlic. Domestic consumption needs cannot be immediately met by production but by imports, allowing the effects of rising global food prices to be passed through to consumer prices in the short run. The finding of this asymmetric effect complements the results of research conducted by Furceri et al. (2016), Samal et al. (2022), and Arintoko et al. (2023) that in addition to the long run, global food prices have a positive impact on domestic inflation in the short run.

Apart from rising global energy and food prices, exchange rate depreciation can also cause import prices to increase, which can further increase the CPI, which means inflation. Oil and food import activities when the rupiah depreciates will significantly impact the increase in domestic food prices contributing the increase in CPI. The exchange rate is the most dominant and considerable factor causing inflation in this research and confirms previous studies, including those by Fetai et al. (2016) and Sek (2022). In the long run, rupiah appreciation does not significantly reduce CPI, while depreciation significantly increases CPI. Therefore, there is an asymmetric exchange rate pass-through in the long run. Depreciation of the rupiah rather than appreciation, which is passed on to the CPI through import prices, which is usually called asymmetric exchange rate pass-through, has been widely proven in several previous studies, including research by Kassi et al. (2019), Musti (2020), and Fandamu et al. (2023).

Our study uncovers asymmetric exchange rate effects in the short run. Unlike the long run, a significant appreciation of the rupiah leads to a reduction in CPI, while depreciation does not show a substantial increase in CPI. Rupiah appreciation has a more pronounced impact on decreasing CPI than depreciation’s impact on increasing CPI. Therefore, we can empirically demonstrate the asymmetric effect of exchange rates on CPI in both the short and long run, albeit under different circumstances.

Money supply by M1 has a significant effect on CPI both when M1 increases and decreases. A significantly growing M1 increases the CPI in the long run, while a diminishing M1 decreases the CPI. This indication shows that inflation as a monetary phenomenon is supported in this study. In the long run, an increase in the money supply increases the CPI, which means it causes inflation. Conversely, a decrease in the money supply reduces the CPI. Increases and decreases in money supply due to adjustments through monetary policy significantly affect CPI. Therefore, inflation is directly related to monetary aggregates, which increase in the long run. These results confirm previous empirical findings, including studies conducted by Roshan (2014), Kugler and Reynard (2022), and Madurapperuma (2023). Meanwhile, in the short run, only an increase in M1 causes a significant rise in CPI, while a decrease in M1 does not. The implication is that when the money supply increases, the monetary authority will focus on monetary control to stabilize prices in the short run.

This research aims to analyze the asymmetric influence of changes in global energy and food prices and monetary variables, including the exchange rate and money supply, on the CPI. Overall, the research results summarize that global energy prices have an asymmetric positive impact on CPI in the long run. The increase in energy prices does not have a significant effect on increasing the CPI. On the other hand, the decline in global energy prices significantly reduces the CPI. Energy subsidies to households have a direct impact by inhibiting increases in consumer prices amidst rising global energy prices, which have the potential to be passed through to consumer prices.

The asymmetric influence of food prices on CPI only occurs in the short run. Food subsidies allow domestic consumer prices to experience rigidity so that they have no significant impact on CPI, either increasing or decreasing in the long run. In the short run, global food prices significantly increase the CPI.

The exchange rate has a positive influence on CPI. The asymmetric effect of the exchange rate is characterized by a more significant impact of rupiah depreciation on changes in CPI in the long run. Depreciation of the rupiah increases import prices, which is then transmitted to an increase in the CPI, which causes inflation. Meanwhile, in the short run, the appreciation of the rupiah significantly impacted the decline in CPI. The impact of the exchange rate on CPI has a significant positive effect. The effect of the exchange rate also has a significant influence with differences in coefficients between various CPI levels identified through quantile regression.

Money supply as a monetary aggregate through M1 is proven to have a significant positive influence on CPI in the short and long run, according to theoretical expectations. The increase in CPI means that inflation is still a monetary phenomenon, despite other causal factors.

The monetary authority is the monetary policy maker that implements its policies to control inflation and does not only focus on the targeted monetary aggregate. However, in implementing monetary policy, the central bank must also pay attention to the causes of inflation from the supply side. Inflation originating from the supply side is strongly influenced by changes in global energy, food prices, and exchange rates. The synergy of policies and inflation control efforts carried out by the central bank is essential. This plays a vital role by increasingly coordinating and communicating with the central and regional governments to stabilize inflation. Efforts that can be increased could be more focused on the availability and adequacy of energy and food supplies. Apart from that, efforts are also needed to reduce dependence on food and energy imports to minimize risks when there is an increase in global energy and food prices. Subsidies are essential to prevent rising inflation, but they must also be accompanied by efforts to provide renewable energy as an alternative for future energy consumption. Finally, it is essential for exchange rate stabilization efforts to remain focused on controlling and stabilizing import prices.

Adolfson, M. (2001). Monetary policy with incomplete exchange rate pass-through. Sveriges Riksbank Working Paper Series, No. 127, Sveriges Riksbank, Stockholm.

Adolfson, M. (2007). Incomplete exchange rate pass-through and simple monetary policy rules. Journal of International Money and Finance, 26(3), 468-494. https://doi.org/10.1016/j.jimonfin.2007.01.005

Akhmad, A., Asse, A., Nursalam, N., Ibrahim, I., Bunyamin, B., Ansaar, A., & Sahajuddin, S. (2023). The impact of the increase of oil fuel price and government subsidy on Indonesia’s economic performance. International Journal of Energy Economics and Policy, 13(6), 547-557. https://doi.org/10.32479/ijeep.15033

Anders, S., Volpe, R., & Bittmann, T. (2023). Price rigidity, wholesale price passthrough, and quality-tiered private labels. Managerial and Decision Economics, 44, 3002-3015. https://doi.org/10.1002/mde.3859

Arintoko, A. (2021a). The stock price response of palm oil companies to industry and economic fundamentals. Journal of Asian Finance, Economics and Business, 8(3), 99–110. https://doi.org/10.13106/jafeb.2021.vol8.no3.0099

Arintoko, A. (2021b). Internal factors affecting commercial bank lending: Symmetric and asymmetric effects of macro-level data evidence. Jurnal Keuangan dan Perbankan, 25(3), 717-733. https://doi.org/10.26905/jkdp.v25i3.5760

Arintoko, A., Badriah, L.S., Rahajuni, D., Kadarwati, N., Priyono, R., & Hasan, M.A. (2023). Asymmetric effects of world energy prices on inflation in Indonesia. International Journal of Energy Economics and Policy, 13(6), 185-193. https://doi.org/10.32479/ijeep.14731

Atiq-ur-Rehman. (2013). Relationship between energy prices, monetary policy and inflation; A case study of South Asian economies. Journal of Central Banking Theory and Practice, 3(1), 43-58. https://doi.org/10.2478/jcbtp-2014-0004

Ayisi, R.K. (2021). The asymmetry effect of oil price changes on inflation, and the welfare implication for Ghana. African Journal of Economic and Management Studies, 12(1), 55-70. https://doi.org/10.1108/AJEMS-01-2020-0009

Bala, U., & Chin, L. (2018). Asymmetric impacts of oil price on inflation: An empirical study of African OPEC member countries. Energies, 11, 3017, 21 pages. https://doi.org/10.3390/en11113017

B¨aurle, G., Gubler, M., K¨anzig, D.R. (2021). International inflation spillovers: The role of different shocks. International Journal of Central Banking, 17(1), 191-230.

Bawa, S., Abdullahi, I.S., Tukur, D., Barda, S.I., & Adams, Y.J. (2020). Asymmetric impact of oil price on inflation in Nigeria, CBN Journal of Applied Statistics, 11(2), 85-113, https://doi.org/10.33429/Cjas.11220.4/8

Bems, R., Caselli, F., Grogoli, F., & Gruss, B. (2022). Is inflation domestic or global? Evidence from emerging markets. International Journal of Central Banking, 18(4), 125-163.

Binder, C.C. (2018). Inflation expectations and the price at the pump. Journal of Macroeconomics, 58, 1-18. https://doi.org/10.1016/j.jmacro.2018.08.006

Carri`ere-Swallow, Y., Gruss, B., Magud, N.E., & Valencia, F. (2021). Monetary policy credibility and exchange rate pass-through. International Journal of Central Banking, 17(3), 61-94.

Chen, S., Ouyang, S., & Dong, H. (2020). Oil price pass-through into consumer and producer prices with monetary policy in China: Are there non-linear and mediating effects. Frontiers in Energy Research, 8(35), 16 pages. https://doi.org/10.3389/fenrg.2020.00035

Cho, J.S., Greenwood-Nimmo, M., & Shin, Y. (2023), Recent developments of the autoregressive distributed lag modelling framework. Journal of Economics Surveys, 37(1), 7-32. https://doi.org/10.1111/joes.12450

Fandamu, H., Ndulo, M., Mudenda, D., & Fandamu, M. (2023). Asymmetric exchange rate pass through to consumer prices: Evidence from Zambia. Foreign Trade Review, 58(4), 504-523. https://doi.org/10.1177/00157325221143886

Fetai, B., Koku, P.S., Caushi, A., & Fetai, A. (2016). The relationship between exchange rate and inflation: the Case of Western Balkans Countries. Journal of Business, Economics and Finance, 5(4), 360-364. https://doi.org/10.17261/Pressacademia.2017.358

Furceri, D., Loungani, P., Simon, J., & Wachter, S.M. (2016). Global food prices and domestic inflation: some cross-country evidence. Oxford Economic Papers, 68(3), 665-687.

Ginn, W., & Pourroy, M. (2022). The contribution of food subsidy policy to monetary policy in India. Economic Modelling, 113, 105904. https://doi.org/10.1016/j.econmod.2022.105904

Guan, Y., Yan, J., Shan, Y., Zhou, Y., Hang, Y., Li, R., Liu, Y., Liu, B., Nie, Q., Bruckner, B., Feng, K., & Hubacek, K. (2023), Burden of the global energy price crisis on households. Nature Energy, 8, 304-316. https://doi.org/10.1038/s41560-023-01209-8

Guo, J., Zheng, X., & Chen, Z-M. (2016). How does coal price drive up inflation? Reexamining the relationship between coal price and general price level in China. Energy Economics, 57, 265-276. https://doi.org/10.1016/j.eneco.2016.06.001

Hong, N.N., Kim, L.V.T., Hoang, A.P., & Khanh, C.T.Q. (2022). Understanding exchange rate pass-through in Vietnam. Cogent Economics & Finance, 10, 2139916. https://doi.org/10.1080/23322039.2022.213991

Karahan, Ö. (2020). Influence of exchange rate on the economic growth in the Turkish economy. Financial Asset and Investing, 11(1), 21-34. https://doi.org/10.5817/FAI2020-1-2

Kassi, D.F., Rathnayake, D.N., Edjoukou, A.J.R., Gnangoin, Y.T., Louembe, P.A., Ding, N, & Sun, G. (2019). Asymmetry in Exchange Rate Pass-Through to Consumer Prices: New Perspective from Sub-Saharan African Countries. Economies, 7(5), 33 pages. https://doi.org/10.3390/economies7010005

Kayamo, S.E. (2021). Asymmetric impact of real exchange rate on inflation in Ethiopia: a non-linear ARDL approach. Cogent Economics & Finance, 9(1), 1986931. https://doi.org/10.1080/23322039.2021.1986931

Kugler, P., & Reynard, S. (2022). Money and inflation in Switzerland. Swiss Journal of Economics and Statistics, 158(1), 13 pages. https://doi.org/10.1186/s41937-021-00081-1

Levy, D., Snir, A., Gotler A., & Chen, H. (2020). Not all price endings are created equal: Price points and asymmetric price rigidity. Journal of Monetary Economics, 110, 33-49. https://doi.org/10.1016/j.jmoneco.2019.01.005

López-Villavicencio, A., & Pourroy, M. (2019). Does inflation targeting always matter for the ERPT? A robust approach. Journal of Macroeconomics, 60, 360-377. https://doi.org/10.1016/j.jmacro.2019.04.004

Madurapperuma, W. (2023). Money supply, inflation and economic growth of Sri Lanka: co-integration and causality analysis. Journal of Money and Business, 3(2), 227-236. https://doi.org/10.1108/JMB-08-2022-0039

Murjani, A. (2022). Energy subsidy and price dynamics in Indonesia. International Journal of Business and Society, 23(3), 1342-1359. https://doi.org/10.33736/ijbs.5167.2022

Musti, B.M. (2020). Nonlinear and asymmetric exchange rate pass-through to consumer prices in Nigeria: Evidence from a smooth transition auto-regressive model. International Journal of Development and Economic Sustainability, 8(3), 1-26.

Monfared, S.S., & Akin, F. (2017). The relationship between exchange rates and inflation: The case of Iran. European Journal of Sustainable Development, 6(4), 329-340. https://doi.org/10.14207/ejsd.2017.v6n4p329

Morina, F., Hysa, E., Ergün, U., Panait, M., & Voica, M.C. (2020). The effect of exchange rate volatility on economic growth: Case of the CEE countries. Journal of Risk and Financial Management, 13(177), 13 pages. https://doi.org/10.3390/jrfm13080177

Naghdi, Y., & Kaghazian, S. (2015). The effects of asymmetric transmission of exchange rate on inflation in Iran: Application of threshold models. Studies in Business and Economics, 10(2), 99-113. https://doi.org/10.1515/sbe-2015-0023

Nguyen, V.A.T., Hoang, T.T., & Le, D.A. (2022). A study on the relationship between money supply and inflation in Vietnam from 2005 to 2021. Accounting, 8, 395-402. https://doi.org/10.5267/j.ac.2022.7.001

Omolade, A., Nwosa, P., & Ngalawa, H. (2019). Monetary transmission channel, oil price shock and the manufacturing sector in Nigeria. Folia Oeconomica Stetinensia, 19(1), 89-113. https://doi.org/10.2478/foli-2019-0007

Rachman, F. (2015). Does Inflation Targeting Framework Make a Significant Difference in Lowering Price Level? What is Its Implication to Indonesia’s Inflation Rate? Economics and Finance in Indonesia, 61(2), 131-147. https://doi.org/10.47291/efi.v61i2.508

Rizvi, S.A.R., & Sahminan, S. (2020). Commodity price and inflation dynamics: Evidence from BRIICS. Bulletin of Monetary Economics and Banking, 23(4), 485-500. https://doi.org/10.21098/bemp.v23i4.1418

Roshan, S.A. (2014). Inflation and money supply growth in Iran: Empirical evidences from cointegration and causality. Iranian Economic Review, 18(1), 131-152.

Ryczkowski, M. (2021). Money and inflation in inflation-targeting regimes – new evidence from time–frequency analysis. Journal of Applied Economics, 24(1), 17-44. https://doi.org/10.1080/15140326.2020.1830461

Samal, A., Ummalla, M., & Goyari, P. (20222). The impact of macroeconomic factors on food price inflation: an Evidence from India. Future Business Journal, 8(15), 14 pages. https://doi.org/10.1186/s43093-022-00127-7

Sek, S.K. (2019). Effect of oil price pass-through on domestic price inflation: Evidence from nonlinear ARDL models. Panoeconomicus, 66(1), 69-91. https://doi.org/10.2298/PAN160511021S

Sek, S. K. (2022). A new look at asymmetric effect of oil price changes on inflation: Evidence from Malaysia. Energy & Environment, 0(0). https://doi.org/10.1177/0958305X221077336

Sharma, S., & Dahiya, M. (2023). Analysis of the effect of currency exchange rate, broad money (M3) and oil prices on inflation in India. International Journal of Economics and Financial Issues, 13(3), 158-168. https://doi.org/10.32479/ijefi.14304

Shin, Y., Yu, B., & Greenwood-Nimmo, M. (2014). Modelling asymmetric cointegration and dynamic multi-pliers in a nonlinear ARDL framework in R. Sickles, & W. Horrace (Eds.), Festschrift in honor of Peter Schmidt, Springer, New York, NY

Sultana, N., Koli, R., & Firoj, M. (2018). Causal relationship of money supply and inflation: A study of Bangladesh. Asian Economic and Financial Review, 9(1), 42-51. https://doi.org/10.18488/journal.aefr.2019.91.42.51

Tang, C.F., & Ozturk, I. (2017). Can inflation be claimed as a monetary phenomenon? the Malaysian experience. International Journal of Economics and Financial Issues, 7(3), 453-460.

Ugwu, E., Amassoma, D., & Ehinomen, C. (2021). Investigating exchange rate pass-through to consumer prices in Nigeria. Folia Oeconomica Stetinensia, 21(1), 105-121. https://doi.org/10.2478/foli-2021-0008

Utomo, F.G.R., & Saadah, S. (2022). Exchange rate volatility and economic growth: Managed floating and free-floating regime. Jurnal Keuangan dan Perbankan, 26(1), 173-183. https://doi.org/10.26905/jkdp.v26i1.5878

Valogo, M.K., Duodu, E., Yusif, H., & Baidoo, S.T. (2023). Effect of exchange rate on inflation in the inflation targeting framework: Is the threshold level relevant? Research in Globalization, 6, 10019, 10 pages. https://doi.org/10.1016/j.resglo.2023.100119

Visockytė, L. (2018). Price Rigidity in Norway in the nineteenth century. EKONOMIKA, 97(1), 32-46. https://doi.org/10.15388/Ekon.2018.1.11777

Yan, G., & Bian, W. (2023). The impact of relative energy prices on industrial energy consumption in China: a consideration of inflation costs. Economic Research-Ekonomska Istraživanja, 36(3), 2154238. https://doi.org/10.1080/1331677X.2022.2154238

Zhang, W., Yang, J., Zhang, Z., & Shackman, J.D. (2017). Natural gas price effects in China based on the CGE model. Journal of Cleaner Production, 147, 497-505. https://doi.org/10.1016/j.jclepro.2017.01.109