Ekonomika ISSN 1392-1258 eISSN 2424-6166

2024, vol. 103(2), pp. 6–23 DOI: https://doi.org/10.15388/Ekon.2024.104.2.1

Vitalija Gabnytė-Baranauskė

Vilnius University, Lithuania

Email: vitalija.gabnyte@evaf.vu.lt

ORCID: https://orcid.org/0000-0002-2232-2399

Abstract. In general, the social protection (SP) system consists of two main blocks: social insurance (SI) and social assistance (SA). The main idea of SP is to leave no one behind, support in times of social risks. However, SI and SA systems are usually developed and improved separately. Organization for Economic Cooperation and Development (OECD) and European Commission (EC) often emphasise that expenditure on the SP system in Lithuania is scarce, income poverty and inequality are critical, not improving. This raises the question of whether both elements of SP in Lithuania are based on the same criteria to achieve consolidated SP and avoid its gaps. This paper aims to identify evaluation criteria, look at the Lithuanian SP system through its main benefits, and identify whether people are protected. The analysis consists of a literature review, which helps identify evaluation criteria for the SP system, and Lithuanian analysis based on evaluation criteria for 2018–2022 policy years. Three main criteria for SP benefits evaluation are identified: coverage, adequacy, and incentives to work. To make an in-depth analysis of the SP system in Lithuania, the tax-benefit microsimulation model EUROMOD is used to analyse different households’ poverty and unemployment traps and test whether the current SP system contributes to them. It was expected that this research would help to shed a light on how well Lithuanian SI and SA function simultaneously. Results show that SP system compatibility in Lithuania is above average, the weakest part is coverage.

Keywords: social protection system consolidation, evaluation, coverage, adequacy, incentives to work

_______

ACKNOWLEDGMENT. The results presented here are based on EUROMOD version 3.6.2. Originally maintained, developed, and managed by the Institute for Social and Economic Research (ISER), since 2021 EUROMOD is maintained, developed, and managed by the Joint Research Centre (JRC) of the European Commission, in collaboration with Eurostat and national teams from the EU countries. We are indebted to the many people who have contributed to the development of EUROMOD. The results and their interpretation are the author’s responsibility.

Received: 22/12/2023. Revised: 03/04/2024. Accepted: 29/04/2024

Copyright © 2024 Vitalija Gabnytė-Baranauskė Published by Vilnius University Press

This is an Open Access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

While countries’ economies are growing, their populations’ quality of life is also improving. However, poverty and income protection are still an issue in modern society. Rawl’s (1999) Theory of Justice states that despite a person’s primary goods, equality and justice should be ensured for all, with no one left behind. One way to solve those problems would be state intervention in redistributing income through the social protection (SP) system.

State intervention through SP helps to ensure that individuals are secured from potential risks and supported when loss of job, sickness, childcare, etc. do occur. The concept of SP varies widely between different researchers and organisations (Devereux, 2021a; Hanna and Karlan, 2017; Johnson and Muthoora, 2021; Gataūlinas and Zabarauskaitė, 2014; Robalino et al., 2012; World Bank, 2022), but it can be seen as a general concept: SP refers to the intervention of the state through various institutions and programs with the common goal of safeguarding the income of the population when faced with particular risks (e.g., unemployment) and when already in poverty.

The EC (2019) and OECD (2022) have noticed that Lithuania has recently extended SP system. Despite efforts to address income inequality and poverty, they are not decreasing, and there is a lack of funds allocated towards improving the system. The latest official statistics show that the at-risk-of-poverty rate in Lithuania in 2022 was 20.9%, income inequality (S80/S20) was 6.4, while the European Union (EU) average for poverty was 16.5%, and the S80/S20 was 4.7 (Eurostat, 2023a; Eurostat, 2023b). In the aftermath of a pandemic and in times of inflation, the SP system sustainability and compatibility question takes on even greater significance. It is worth studying the ways to improve the Lithuanian SP system and identify why the anticipated outcomes have not been achieved despite system expansion.

Two main SP components are crucial to mitigate poverty and inequality: social insurance (SI) system and social assistance (SA) one. These two systems should be analysed based on the same criteria. Coordination between SI and SA systems can help to create adequate support and income protection for individuals participating (or previously participating) in the labour market through SI and the rest through the SA system. Various authors analyse SI and SA systems (Aaron, 2011; Addati, 2015; Navicke, 2015; Marx et al., 2016; Vliet & Wang, 2019) and their redistributive effect on population income, but no consolidated evaluation criteria for these programs have been suggested.

This paper aims to identify evaluation criteria for the SP system (SI and SA), look at the Lithuanian SP system through its main benefits, and identify to what extent people are protected.

The object of this study is SP system benefits. In this paper, literature review helps to identify main components for evaluating SP system benefits. It shows that three main elements should be kept together when analysing the social protection system: coverage, adequacy, and incentives to work. To evaluate the Lithuanian SP system, SP compatibility (SPC) evaluation index is constructed based on the literature review and partly on the Human Development Index methodology. For SPC Index results, legislative information, statistical information is used from 2018 to 2022. The SPC index is applied to SI and SA systems and for consolidated SP system. The SPC Index helps to identify which elements in the index are stronger/weaker. The poverty and unemployment trap methodology is presented to make a deeper analysis of SP benefit compatibility. Poverty and unemployment traps are calculated using the tax-benefit microsimulation model EUROMOD and additional components for Lithuania developed by the Ministry of Social Security and Labour of the Republic of Lithuania and the Hypothetical Household Tool (HHT). The use of microsimulation helps to include the most recent changes in fiscal policy in the analysis and to see how or if the SP system protects families from poverty and unemployment traps.

The paper is developed as follows: literature review is provided in section 2, section 3 presents methodology for evaluating SP benefits compatibility, section 4 analyses results from SPC index and poverty and unemployment traps and the last section provides conclusions, recommendations, and further improvements.

The SP system consists of formal public programs: SI, SA programs, and passive and active labour market policy (ALMP) programs (Hanna and Karlan, 2017; Dutzler et al., 2021). Each of it has different aim: SI programs are fundamentally linked to protecting income and consumption in case of specific shocks such as illness, unemployment, disability, and old age, e.g., income support and income redistribution in the event of risks; SA programs protect against poverty by providing benefits to people experiencing this risk or helps to reduce additional cost for specific needs; passive and ALMP measures focus on the aim to improve income opportunities and help individuals function effectively in the labour market (Robalino et al., 2012; Nguyen et al., 2023). Usually, the latter measures are included in SA system as a condition for receiving benefit.

Income protection, poverty and additional costs reduction can be ensured through social benefits. There are three benefit schemes in SP system: SI benefits, categorical (universal) benefits, and means-tested benefits (Nelson, 2007; Lazutka et al., 2013). Social benefits can either be universal or targeted, or the balance between the two (Cremer and Pastieau, 2003). To better understand SP system, SI and SA systems benefits are presented further. Passive and ALMP systems are not discussed here as a separate part since they are included in previous systems to ensure participation in the labour market. SI and SA systems analysis can help to identify main evaluation criteria for both systems that later could be applied to overall SP system.

SI benefits include SI benefit schemes. SI benefits can be evaluated according to their characteristics and principles. According to Aaron (2011), SI benefits must have the following characteristics: benefits are combined with other existing benefits (e.g., old-age and disability pensions, widow’s pensions, can be paid simultaneously); redistributive benefit formula; indexation for inflation. Therefore, SI benefits must ensure income replacement in the event of a specific risk. The relationship between the replacement rate of the benefit and former income, protection against poverty must be assessed. At the same time, it must ensure that the benefits provided are progressive, linked to past income (benefits are higher for those who received higher working income) and benefits should not be determined by age. If the conditions for receiving the benefit are met (e.g., required insurance period), regardless of age, the person is entitled to receive the full benefit or pension. These benefits must not depreciate over time and their purchasing power must be maintained, but also it should ensure that work incentives are kept (Aaron, 2011; O’Donoghue, 2011). Benefit amount should be adequate to protect against poverty, but its amount should not be higher than work income. SI benefits are generally evaluated based on their coverage, adequacy (income replacement rate in relation to protect against poverty) and incentives to work.

SA benefits include both universal (categorical) and means-tested schemes. SA is provided regardless of whether the person participated in the labour market. It is used as a last-resort source of income for those who are not entitled to unemployment protection (SI benefit) or who need additional state support (Garland, 2014; Lorentzen et al., 2014; Goedemé and Marchal, 2016). SA programs can be called the guaranteed minimum income (Bergmark and Stranz, 2023). SA usually consists of basic cash benefits for daily living expenses and housing costs (means-tested benefits). It also includes additional support to cover the household’s special needs (categorical benefits) (Lorentzen et al., 2014). SA benefits are generally smaller than SI (Addati, 2015). This aims to maintain the distinction between SI and SA systems and encourage people, receiving SA benefits, to join the labour market eventually.

Although means-tested benefits are considered an adequate measure of helping the poorest, it has drawbacks. Means-tested benefits can create a stigma for recipients and lead to a low level of benefit take-up (Garland, 2014; Marx et al., 2016; Gabnytė et al., 2020; Roelen, 2020). Any system that attempts to detect those individuals who unlawfully receive benefit, might make errors, and unintentionally neglect those who genuinely require the assistance (Sen, 1992). To avoid Type II error (including noneligible with eligible), excluding those who need the most help, can lead to Type I errors. This creates an even greater stigma, as those entitled to benefits are more closely monitored. The stigma associated with receiving benefits, coupled with the intrusive monitoring of individuals and their households to determine eligibility, can discourage people from seeking assistance, even if they require it. Also, means-tested benefits are expensive regarding their administration since a monitoring mechanism must constantly operate. Means-tested benefits can create unemployment and poverty traps; it must be assessed whether the amount of the benefit provided is adequate to ensure the satisfaction of living needs and, at the same time, whether it is sufficiently motivating to leave the SA system. Means-tested benefits should be evaluated through coverage, adequacy, and through incentives to work (exit SA system and participate in the labour market).

Another part of SA benefits is categorical benefits. These benefits are programs where eligibility is based on universal criteria such as citizenship, age. Categorical targeting in SA means that it reaches groups most in need of income protection and support, they are not means-tested (Devereux, 2021b). These types of benefits take a large part of the share of total social costs, i.e., due to their universality, they are expensive, and the payment amounts are standardized and flat (Lazutka et al., 2013; Schüring, 2021), but they are simpler to administer and avoid Type I and II errors since the target group is easy to identify. This benefit can be and is combined with other benefits. For example, if means-tested benefits are provided, universal benefits are generally not included in the income-test list. The purpose of universal benefit is to contribute to mitigating additional costs incurred by the target group. The adequacy and coverage of the benefit remains essential. Adequacy here means that the payment contributes at least partially to mitigating the additional costs incurred; it is not directed to reduce poverty. The assessment of coverage is based on whether all eligible individuals are receiving the benefit. Also, there is no goal to increase incentives to work through these benefits, since they are paid to the most vulnerable groups to relief part of the additional expenses due to their situation. The criteria for categorical SA benefits evaluation are coverage and adequacy.

Both SI and SA programs aim to protect household income from income loss shocks and poverty (Vliet and Wang, 2019; Spies-Butcher et al., 2020). However, SI covers only those who have accumulated sufficient working experience, i.e., only those who participated in the labour market for a certain period. Those who cannot apply for SI benefits, can rely on the SA system. Coordination of SI and SA benefits is important to ensure that the entire population is protected (Bierbaum and Wodsak, 2021). This means that those, who can participate in the SI system, participate in it, whether by entering the labour market, receiving benefits, or by participating in employment programs. The SA system ensures basic income protection for all residents, regardless of whether a person participates in the labour market or not. These programs are universal (e.g., health care), categorical (e.g., child benefits) or means-tested (e.g., the cash SA benefit). The balance of the two systems’ benefits and their amounts is essential: if SI programs offer benefits that are marginally higher than SA programs, this creates low incentives to work, or may even lead individuals to work in the informal economy. The amounts of SI benefits must be higher than SA benefits. Such a distinction from SA payments would encourage individuals to participate in the labour market transparently while ensuring they meet their basic needs (Bierbaum and Wodsak, 2021).

To ensure adequate minimum income in the European Union, European Commission released Council Recommendation 2023/C 41/01 of 30 January 2023 on the adequate minimum income ensuring active inclusion (Council Recommendation, 2023). This recommendation states that minimum income should be adequate, the eligibility requirements should be simplified to reach all target groups and benefits should be encouraging enough to participate in the labour market. Even though these criteria are proposed for the minimum income protection, these criteria are relevant for the overall SP system. Adequacy, coverage, and incentives to work are interconnected and should be analysed together. Coverage and adequacy are essential to the SI and SA systems. At the same time, incentives to work are significant to the SI system and a part of the SA system (means-tested benefits).

SP system compatibility index (SPC Index). From the literature analysis, three main evaluation criteria can be distinguished: coverage, adequacy, and incentives to work. We evaluate SI, SA and coordination between these systems (SP overall). The SA system is analysed by considering both means-tested and categorical benefits. SI system evaluation is presented for the minimum benefit amounts to make it comparable with SA system and to see if there is a difference between minimum SI benefits and SA benefits. An explanation of each criteria in the Index is presented below.

Coverage is the proportion of the population entitled to the benefit to all individuals receiving the benefit. For example, in the case of SI unemployment benefits, the actual coverage is how many unemployed receive unemployment SI benefit. The coverage of means-tested benefits can be measured by the proportion of individuals who receive benefit to all persons below the poverty line (or other established national thresholds (NT)). Categorical SA benefits are assessed through the reach of the target group. For example, in the case of child benefit – all children should receive it.

Adequacy refers to the benefit amount that ensures protection against poverty or meets the minimum needs determined by the country’s NT. For this case, we are using the same NT for both systems – minimum consumption needs basket (MCNB). SI benefits are evaluated using their minimum amounts in relation to MCNB.

In general, both the SI and the SA (means-tested) systems must ensure a horizontal principle – incentives to work. The benefits provided cannot exceed the potential working income. To make comparisons between SI, SA and SP more consistent, we are using the same threshold – net minimum monthly salary (MMS): benefits are compared in relation to net MMS. SI benefits are evaluated using their minimum amounts in relation to MMS. For the incentives to work, old-age pensions and categorical benefits are excluded from the analysis, since their goal is not to incentivize to return to labour market.

Table 1 summarises MCNB and net MMS amounts during 2018–2022 and Table 2 summarises which questions are answered by SI and SA systems and overall SP coordination.

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

MCNB |

245 |

251 |

257 |

260 |

267 |

|

Net MMS |

361 |

395.8 |

447.2 |

468.4 |

549.7 |

|

Criteria |

Social |

Means-tested social |

Categorical social assistance |

Coordination |

|

|

Coverage |

What proportion of individuals are receiving benefit in relation to target group? |

Are all residents protected through SI and SA systems? |

|||

|

Adequacy |

Does benefits ensure minimum consumption needs? |

Is the benefit sufficient to cover the additional costs incurred by the target group? |

Do benefits ensure minimum consumption needs? Are SI benefits greater than SA? |

||

|

Incentives to work |

Are minimum benefits lower than net minimum monthly salary? |

Are minimum benefits lower than net minimum monthly salary? |

|||

We evaluate each system separately and together based on these criteria to identify which components need improvement for a more coordinated and compatible SP system. The Lithuanian SP system has been evaluated for the 2018–2022 period. A meta-document analysis of the laws governing the SP system has been conducted to identify the rules governing the main benefits. Next, we use administrative data and official statistics to evaluate those benefits’ coverage, adequacy, and incentives to work. The results of meta-document analysis and administrative data are presented in Annex 1. Table 3 shows the benefits that are included in the analysis.

|

System |

Benefits |

|

Social insurance |

Old-age contributory pension, sickness benefit, maternity benefit, paternity benefit, childcare benefit, unemployment benefit. |

|

Means-tested and categorical social assistance |

Cash social assistance, additional child benefit, child benefit, pregnancy grant, student’s childcare benefit, old-age assistance pension. |

Later, SP system compatibility is evaluated on the constructed index (SPC Index) based partly on the Human Development index methodology (Sen and Anand, 1994). All initial values are expressed as percentages (see Annex 1 Tables 2–4). These values are normalised using categorical scales (OECD/European Union/EC-JRC, 2008), which gives a maximum value of 10 and a minimum value of 0. For the coverage and adequacy criteria – the higher the value, the higher the category – while in the incentives to work criteria, value categories are in reverse order (i.e., the higher the value, the lower category). Table 4 shows categories for SPC Index criteria.

|

Categories |

Coverage/adequacy |

Incentives to work |

|

0 |

(-∞;10%) |

[100%; +∞) |

|

1 |

[10%; 20%) |

[90%; 100%) |

|

2 |

[20%; 30%) |

[80%; 90%) |

|

3 |

[30%; 40%) |

[70%; 80%) |

|

4 |

[40%; 50%) |

[60%; 70%) |

|

5 |

[50%; 60%) |

[50%; 60%) |

|

6 |

[60%; 70%) |

[40%; 50%) |

|

7 |

[70%; 80%) |

[30%; 40%) |

|

8 |

[80%; 90%) |

[20%; 30%) |

|

9 |

[90%; 100%) |

[10%; 20%) |

|

10 |

[100%; +∞) |

(-∞; 10%) |

Next, for each criteria (coverage, adequacy, incentives to work) in the index, the arithmetic mean (AM) is calculated:

where X̅c is the AM of each criteria, Xi is the sum of observations values (benefit values), N is the total number of observations in particular criteria. Detailed description of benefits used in each criteria are presented in Annex 1 Table 1.

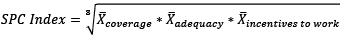

SPC Index is calculated as a geometric mean of coverage, adequacy, and incentives to work since the criteria weight in the SPC Index is equal. Indicator weights within each criteria are also distributed equally, but weight for each indicators depends on the number of indicators within each criteria. Detailed weight distribution is presented in Annex 1 Table 1. The SPC Index is calculated for SI, SA, and consolidated SP systems:

where X̅coverage is AM of benefits in coverage criteria, X̅adequacy is AM of benefits in adequacy criteria and X̅incentives to work is AM of benefits in incentives to work criteria.

The SPC Index is calculated for aggregated benefit groups for the consolidated SP system: old-age, childcare/sickness, and poverty/unemployment. These groups are aggregated from SI and SA systems evaluations.

Since SPC Index calculations are based on the minimum SI benefits amounts (to make it more consistent with the SA benefits), to better show incentives to work, poverty and unemployment traps are calculated if one person of the household starts working for MMS and average monthly salary (AMS).

Poverty and unemployment traps calculation. Poverty and unemployment traps are calculated using the tax-benefit microsimulation model EUROMOD and its additional component of the Hypothetical Household Tool (HHT) for 2018–2022. The application of microsimulations is a useful analytical tool to analyse tax-benefit policy reforms in light of societal socioeconomic changes and how these affect income distribution and redistribution (Herault and Azpitarte, 2016). EUROMOD is a static microsimulation model of the EU. This model links statutory tax and social benefit rules with representative survey micro-level data on households and their income structure (Sutherland and Figari, 2013). The static nature of the model means that the first-order effect is analysed, i.e. what would be the effect of a specific policy before people’s behaviour changes. EUROMOD analyses taxes, SI contributions, and cash payments and how all these components affect each other. HHT allows generating hypothetical households based on various conditions: household members, age, educational attainment, employment situation, and employment income. HHT generates data (input data) for simulations based on the household type, which is later used with the basic EUROMOD model. This allows to analyse how countries’ tax-benefit policies affect hypothetical households: for what benefits they are entitled to or not.

The poverty trap shows whether it is worthwhile for nonworking recipients of cash SA in households of different compositions to start working and at what wage. Poverty trap calculations were performed for seven hypothetical household types: single person, two adults without children, a lone parent with 1 child, a lone parent with 2 children, 2 adults with 1 child, 2 adults with 2 children, 2 adults with 3 children. The poverty trap reflects the percentage of household income received from the cash SA system compared to income when one person from the household is employed for MMS and AMS. The higher this ratio, the greater the poverty trap and the lower the incentives to work. Adults are not eligible for unemployment SI benefit in the unemployment situation. Indicators of poverty trap are calculated after evaluating the procedure for providing cash SA and the additional support provided after employment.

The unemployment trap shows whether unemployed people entitled to unemployment benefits who live in households of different composition pay to start working and at what wages. For unemployment trap, calculations were made for average unemployment traps, i.e., the situation of the unemployed person’s family without working for 9 months is compared with the situation if he/she worked during that period (9 months are chosen because in Lithuania, if a person is eligible for unemployment SI benefit, total duration of benefit payment is 9 months). Calculations and comparisons are made if a person is employed for MMS and AMS to a situation if he/she receives the benefit. The same seven households as in the calculation of poverty traps were used. When calculating unemployment trap, there is an assumption that only one adult in the household starts working, and the other one is unemployed and not eligible for the unemployment SI benefit.

Table 5 shows the results of the SPC Index and its components in SI, SA systems, and system coordination for 2018–2022. SPC index components are values in coverage, adequacy, and incentives to work areas. The higher the value of each component, the better its situation.

|

Social insurance system |

Social assistance system |

System coordination |

|||||||||||||

|

2018 |

2019 |

2020 |

2021 |

2022 |

2018 |

2019 |

2020 |

2021 |

2022 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Coverage |

6.0 |

5.8 |

6.0 |

6.5 |

6.7 |

4.5 |

4.0 |

5.0 |

5.5 |

5.8 |

4.3 |

4.3 |

4.7 |

5.0 |

5.3 |

|

Adequacy |

6.0 |

6.5 |

6.8 |

7.0 |

7.7 |

3.8 |

3.8 |

5.3 |

5.3 |

6.2 |

4.7 |

5.7 |

6.3 |

6.3 |

7.3 |

|

Incentives to work |

6.4 |

6.6 |

6.6 |

6.4 |

7.2 |

8.5 |

8.5 |

8.5 |

8.5 |

8.5 |

7.0 |

7.0 |

7.0 |

7.0 |

7.0 |

|

SPC |

6.1 |

6.3 |

6.5 |

6.6 |

7.2 |

5.3 |

5.1 |

6.1 |

6.3 |

6.7 |

5.2 |

5.6 |

5.9 |

6.1 |

6.5 |

The SPC Index in system coordination has improved during 2018 to 2022: SPC Index value increased by 1.3 points and reached 6.5. Since the maximum value of the Index is 10, we can see that Lithuanian SP system coordination performs better than average. Based on the values of each criteria, the weakest part in the overall system is coverage, followed by incentives to work. Even though the incentives to work are above average and reaches 7 points, there is no improvement during the period.

Monitoring SI and SA systems separately, it is observed that SI system performs better: highest difference is seen in adequacy and incentives to work criteria. Even though results show that SI system better performs in adequacy, some SA benefits are higher: since 2019 contributory minimum maternity, paternity and childcare benefits are lower than SA pregnancy grant or students’ childcare benefit, because personal income tax is applied to SI benefits (see Annex 1 Tables 2–3). Incentives to work in SA system performs relatively better. This can be related to very low SA benefits amounts in relation to net MMS. Since SA benefits are very low, incentives to work persist. Coverage is the weakest part in SA system and reaches 5.8 in 2022.

There is an increase in SI, SA systems and system coordination in adequacy criteria between 2021 and 2022: it can be explained by the fact that due to highly rising prices in Lithuania in 2022, there was a government decision to additionally increase social benefit amounts and additionally indexed old-age pensions in the middle of the year. These changes positively impacted on the SA system benefit growth and increased the lowest SI benefits (if floors are applicable). However, most of the minimum benefits in both systems remain relatively low compared to Lithuania’s MCNB. Despite the changes in 2022, coverage and adequacy criteria in SA system performs worse than in SI system.

To conclude, SPC Index in Lithuania improved in all criteria during 2018-2022, although overall system SPC Index value remains below 7 points (of maximum 10). We can see that incentives to work criteria could be improved in the SI system, which could allow better SPC Index performance. Although, it should be kept in mind that these changes should not be made at the cost of benefit adequacy. Also, SPC Index evaluates separate benefits, while household (or single person) might receive more than one benefit at a time, depending on household structure and work income.

SPC Index results showed that coverage is the weakest part in the Index, also incentives to work remain the same during the year if we are comparing minimum SI benefits and SA benefits amounts to net MMS. To analyse work incentives further and investigate how different benefits create incentives to work for different households, poverty and unemployment traps are presented below. Table 6 presents poverty trap and Table 7 unemployment trap in Lithuania during 2018 to 2022. Poverty trap help to explore the SA system and whether it encourage people to participate in the labour market. The analysis of unemployment trap shows if SI (and SA, if person/household is eligible) system encourages return to labour market.

|

|

MMS |

AMS |

||||||||

|

2018 (400 EUR) |

2019 (555 EUR) |

2020 (607 EUR) |

2021 (642 EUR) |

2022 (730 EUR) |

2018 (808.7 EUR) |

2019 (1136.4 EUR) |

2020 (1241.4 EUR) |

2021 (1352.7 EUR) |

2022 (1504.1 EUR) |

|

|

Single person |

31% |

27% |

26% |

28% |

27% |

19% |

17% |

16% |

19% |

19% |

|

2 adults without children |

52% |

43% |

42% |

41% |

38% |

34% |

30% |

29% |

31% |

30% |

|

Lone parent with 1 child |

57% |

52% |

51% |

49% |

47% |

39% |

37% |

39% |

40% |

40% |

|

Lone parent with 2 children |

63% |

58% |

61% |

56% |

55% |

56% |

54% |

58% |

58% |

58% |

|

2 adults with 1 child |

64% |

57% |

58% |

53% |

52% |

52% |

48% |

49% |

51% |

50% |

|

2 adults with 2 children |

68% |

61% |

63% |

58% |

57% |

66% |

61% |

62% |

63% |

62% |

|

2 adults with 3 children |

69% |

63% |

65% |

60% |

59% |

70% |

69% |

71% |

70% |

70% |

Results for single person household shows, that during 2018–2022 poverty traps are very low if a person starts working for the MMS and these traps are further decreasing and reaching 27% in 2022. If a single person starts working for AMS, poverty trap decreases further, not reaching 20%. Poverty trap also decreases for 2 adults without children, if one of the adults starts working for MMS or AMS. These households remain low in poverty trap because they are only eligible for cash SA and the benefit amount decreases as employment income increases. Further results show that higher poverty traps are among households with children because these households are eligible for categorical child benefit and means-tested cash SA and additional child benefit. Poverty trap for these households decline further as employment income rises. When one adult in the household starts working for MMS, the highest poverty trap is among the 2 adults with 3 children. It reaches 59% in 2022, which means that if families rely only on the SA system, they receive 59% of net MMS, it increases up to 70% if one adult gets net AMS.

Poverty trap and SPC Index results show that the adequacy of SA benefits should be improved, but incentives to work should also remain. Although, incentives to work should not be increased on account of benefit size.

|

|

MMS |

AMS |

||||||||

|

2018 (400 EUR) |

2019 (555 EUR) |

2020 (607 EUR) |

2021 (642 EUR) |

2022 (730 EUR) |

2018 (808.7 EUR) |

2019 (1136.4 EUR) |

2020 (1241.4 EUR) |

2021 (1352.7 EUR) |

2022 (1504.1 EUR) |

|

|

Single person |

60% |

76% |

92% |

74% |

72% |

55% |

66% |

83% |

65% |

66% |

|

2 adults without children |

66% |

76% |

92% |

74% |

72% |

55% |

66% |

82% |

65% |

66% |

|

Lone parent with 1 child |

70% |

83% |

93% |

79% |

77% |

59% |

68% |

84% |

68% |

68% |

|

Lone parent with 2 children |

79% |

81% |

85% |

80% |

79% |

65% |

75% |

95% |

78% |

79% |

|

2 adults with 1 child |

82% |

84% |

88% |

81% |

80% |

61% |

70% |

88% |

72% |

73% |

|

2 adults with 2 children |

86% |

88% |

90% |

86% |

85% |

75% |

72% |

87% |

72% |

73% |

|

2 adults with 3 children |

87% |

88% |

91% |

87% |

87% |

79% |

80% |

84% |

79% |

79% |

Unemployment trap is very high (reaches up to 87%) for all households with children if one adult previously worked for MMS and could get a similar job in 2022 in Lithuania. Unemployment trap reaches 72% for households without children if one person is employed for MMS. Even though salary increases, unemployment trap remains high for all households and varies from 66% to 87% if one adult receives from MMS to AMS. The dynamics of unemployment trap during 2018–2022 for some households increased.

High rate of unemployment trap is determined by the size of the unemployment benefit and other social benefits (means-tested) received in addition to unemployment benefit. The unemployment benefit design is made of 2 parts: the basic benefit part, which is a flat rate and the variable part, which depends on previous employment income, but with a cap of 58.18% of AMS. It is worth noting that unemployment benefit is limited to 9 months, and it decreases every 3 months, which leads to work incentives rising as the period of benefit payment ends.

This paper analysed SP benefits compatibility and evaluation criteria in Lithuania for 2018–2022. The paper unites literature analysis on SP system evaluation and its main components. It contributes to the attempt to use the same evaluation criteria for SI, SA systems and the comprehensive assessment of SP compatibility through coverage, adequacy, and incentives to work.

Literature analysis showed that coverage, adequacy and incentives to work are the main elements to evaluate if a benefit is sufficient and if the overall SP system is compatible. A compatible SP system should ensure that if a person needs support, they should get it through SI or SA systems, e.g., all people from the targeted group should receive support. Compatible SP system benefits should be adequate, but there should be a difference between SI and SA benefits. Adequacy should ensure that benefits are sufficient to replace income due to social risks or are sufficient to maintain basic needs. Incentives to work criteria show that people in need should get adequate support, but at the same time, incentives to stay on or return to labour market should be kept.

The analysis of Lithuanian SP system compatibility showed that there is still a room for improvement: the adequacy of SI should be improved as some of the minimum benefits are lower than SA. Adequacy of SA benefits are also scarce since benefits amounts are lower than the MCNB. When improving benefit adequacy, work incentives should be kept in mind. Further, as calculations based on the EUROMOD model and HHT showed, poverty and unemployment traps are high in Lithuania during 2018–2022 for households with children if one adult in the household starts working for the MMS even though incentives to work should not be increased in the cost of benefit adequacy, which in Lithuania is relatively low.

SPC Index in SI and SA systems shows that SI system performs relatively better in Lithuania; however, SPC Index values are still low (coverage and adequacy criteria performs worse than in SI system). The weakest part of the Index is coverage reaching 5.3 points (while it reaches 6.7 in SI and 5.8 in SA). Incentives to work are improving in SI system during 2018–2022, but in SA and system coordination situation stagnates at 7 points out of 10. SPC Index for system coordination receives 6.5 points out of 10. Index can be improved by further analysis of benefit non-take-up in SI and especially in SA systems. This can be done by reviewing why targeted groups are not fully reached. Incentives to work should be revised, setting the goals up to what amount benefits could be adequate, but still encouraging to work.

Further improvements should be made when analysing SP system compatibility by incorporating additional benefit types, evaluating more criteria, adjusting the weighting of evaluation criteria within the methodology. Moreover, to expand the scope of the analysis and improve its accuracy, cross-country analysis would help identify where the Lithuanian SP system stands compared to other countries.

Aaron, H. J. (2011). Social Security Reconsidered. National Tax Journal, 64(2), 385–414. https://doi.org/10.17310/ntj.2011.2.06.

Addati, L. (2015). Extending maternity protection to all women: Trends, challenges and opportunities. Int Soc Secur Rev, 68, 69-93. https://doi.org/10.1111/issr.12060.

Anand, S., & Sen, A. (1994). Human Development Index: Methodology and Measurement.

Bergmark, Å, & Stranz, H. (2023). A safety net for all? – Vignette-based assessments of Swedish social assistance over three decades. Journal of Social Policy, 1-18. https://doi.org/10.1017/S0047279422000988.

Bierbaum, M. ir Wodsak, V. (2021). Coordination of different instruments. In Handbook on Social Protection Systems. Edward Elgar Publishing.

Council Recommendation of 30 January 2023 on adequate minimum income ensuring active inclusion (2023/C 41/01) OJ C 41, 3.2.2023, p. 1–12.

Cremer, H., & Pestieau, P. (2003). Social insurance competition between Bismarck and Beveridge. Journal of Urban Economics, 54(1), 181-196. https://doi.org/10.1016/S0094-1190(03)00042-1.

Devereux, S. (2021a). Social protection responses to COVID-19 in Africa. Global Social Policy, 21(3), 421-447. https://doi.org/10.1177/14680181211021260.

Devereux, S. (2021b). Targeting. In Handbook on Social Protection Systems. Edward Elgar Publishing.

Dutzler, B., Johnson, S., & Muthoora, P. (2021). The Political Economy of Inclusive Growth: A Review (March 1, 2021). IMF Working Paper No. 2021/082, SSRN: https://ssrn.com/abstract=4026258.

European Commission. (2019). Recommendation for a Council Recommendation on the 2019 National Reform Programme of Lithuania and delivering a Council opinion on the 2019 Stability Programme of Lithuania. https://eur-lex.europa.eu/legal-content/LT/TXT/PDF/?uri=CELEX:52019DC0515&from=EN.

Eurostat. (2023a). At-risk-of-poverty rate by poverty threshold, age and sex - EU-SILC and ECHP surveys [ILC_LI02]: https://ec.europa.eu/eurostat/databrowser/bookmark/ae2c1e21-be61-41b3-8348-47c49b7efb0e?lang=en.

Eurostat. (2023b). Income quintile share ratio (S80/S20) by sex [TESSI180]: https://ec.europa.eu/eurostat/databrowser/bookmark/ef99a5b1-b587-46b7-8d09-4885fc18e8fe?lang=en.

Gabnytė V., Vencius T., & Navickė J. (2020). The Benefit non-take-up in the Context of Cash Social Assistance Reform in Lithuania. Socialinė Teorija, Empirija, Politika Ir Praktika, 21, 96-121. https://doi.org/10.15388/STEPP.2020.25.

Garland, D. (2014). The Welfare State: A Fundamental Dimension of Modern Government. European Journal of Sociology, 55(3), 327-364. https://doi.org/10.1017/S0003975614000162.

Gataūlinas, A., Zabarauskaitė, R. (2014). Socialinės apsaugos sistemos formos įtaka gyvenimo lygiui (lyginamoji šalių analizė). Ekonomika ir vadyba: aktualijos ir perspektyvos, 1(33), 33–43.

Goedemé, T. and Marchal, S. (2016). Trends in non-contributory pensions in Europe. International Journal of Social Welfare, 25, 161-175. https://doi.org/10.1111/ijsw.12189.

Hanna, R. and Karlan, D. (2017). Designing social protection programs: using theory and experimentation to understand how to help combat poverty. In Handbook of Economic Field Experiments (Vol. 2, pp. 515-553). North-Holland. http://dx.doi.org/10.1016/bs.hefe.2016.07.002.

Herault, N., & Azpitarte, F. (2016). Understanding changes in the distribution and redistribution of income: a unifying decomposition framework. Review of Income and Wealth, 62(2), 266-282. http://dx.doi.org/10.1111/roiw.12160.

Johnson, S., & Muthoora, P. S. (2021). The Political Economy of Inclusive Growth: A Review1, IMF Working Papers, 2021(082). https://doi.org/10.5089/9781513574189.001.

Lazutka, R., Skučienė, D., Černiauskas, G., Bartkus, A., Navickė, J., & Junevičienė, J. (2013). Socialinis draudimas Lietuvoje: kontekstas, raida, rezultatai. LSTC: Vilnius.

Lorentzen, T., Angelin, A., Dahl, E., Kauppinen, T., Moisio, P., & Salonen, T. (2014). Unemployment and economic security for young adults in Finland, Norway and Sweden: From unemployment protection to poverty relief. International Journal of Social Welfare, 23(1), 41-51. https://doi.org/10.1111/ijsw.12006.

Marx, I., Salanauskaite, L., & Verbist, G. (2016). For the poor, but not only the poor: on optimal pro-poorness in redistributive policies. Social Forces, 95(1), 1-24. https://doi.org/10.1093/sf/sow058.

Navickė J. (2015). Between a risk society and a welfare state: social risk resilience and vulnerability to poverty in Lithuania. Socialinė Teorija, Empirija, Politika Ir Praktika, 10, 95-109. https://doi.org/10.15388/STEPP.2015.10.4861.

Nelson, K. (2007), Universalism versus targeting: The vulnerability of social insurance and means-tested minimum income protection in 18 countries, 1990-2002. International Social Security Review, 60, 33-58. https://doi.org/10.1111/j.1468-246X.2007.00259.x.

Nguyen, P., Putra, F., Considine, M., & Sanusi, A. (2023). Activation through welfare conditionality and marketisation in active labour market policies: Evidence from Indonesia. Australian Journal of Public Administration, 82, 488–506. https://doi.org/10.1111/1467-8500.12602.

O’Donoghue, C. (2011). Do Tax–Benefit Systems Cause High Replacement Rates? A Decompositional Analysis Using EUROMOD. Labour, 25(1), 126-151. https://doi.org/10.1111/j.1467-9914.2010.00501.x.

OECD/European Union/EC-JRC (2008), Handbook on Constructing Composite Indicators: Methodology and User Guide, OECD Publishing, Paris, https://doi.org/10.1787/9789264043466-en.

OECD. (2022). OECD Tax Policy Reviews: Lithuania 2022, OECD Tax Policy Reviews, OECD Publishing, Paris, https://doi.org/10.1787/53952224-en.

Rawls, J. (1999). The Theory of Justice. Revised Edition. The Belknap Press of Harvard University Press Cambridge, Massachusetts.

Robalino, D.A., Rawlings, L., Walker, Ian. (2012). Building Social Protection and Labor Systems: Concepts and Operational Implications. Social Protection and Labor Discussion Paper; No. 1202. World Bank, Washington, DC. © World Bank. https://openknowledge.worldbank.org/handle/10986/13554 License: CC BY 3.0 IGO.

Roelen, K. (2020). Receiving Social Assistance in Low- and Middle-Income Countries: Negating Shame or Producing Stigma? Journal of Social Policy, 49(4), 705-723. https://doi.org/10.1017/S0047279419000709.

Schüring, E. (2021). Social transfers. In Handbook on Social Protection Systems. Edward Elgar Publishing.

Sen, A. (1992). The political economy of targeting. Washington, DC: World Bank.

Spies-Butcher, B., Phillips, B., & Henderson, T. (2020). Between universalism and targeting: Exploring policy pathways for an Australian Basic Income. The Economic and Labour Relations Review, 31(4), 502-523. https://doi.org/10.1177/1035304620964272.

Sutherland, H. and F. Figari (2013). EUROMOD: the European Union tax-benefit microsimulation model. International Journal of Microsimulation, 6(1), 4–26. http://dx.doi.org/10.34196/ijm.00075

Vliet O. van & Wang J. (2019). The Political Economy of Social Assistance and Minimum Income Benefits: A Comparative Analysis across 26 OECD Countries, Comparative European Politics, 17(1): 49-71. https://doi.org/10.1057/s41295-017-0109-7.

World Bank Group. (2022). Charting a Course Towards Universal Social Protection: Resilience, Equity, and Opportunity for All. © World Bank Group, Washington, DC. http://hdl.handle.net/10986/38031 License: CC BY 3.0 IGO.

|

Indicators |

Indicator weight |

Overall |

|

|

Social insurance |

|||

|

Coverage in: |

Old-age contributory pension |

0.555 |

3.33 |

|

Sickness benefit |

0.555 |

||

|

Maternity benefit |

0.555 |

||

|

Paternity benefit |

0.555 |

||

|

Childcare benefit |

0.555 |

||

|

Unemployment benefit |

0.555 |

||

|

Adequacy in: |

Old-age contributory pension |

0.555 |

3.33 |

|

Sickness benefit |

0.555 |

||

|

Maternity benefit |

0.555 |

||

|

Paternity benefit |

0.555 |

||

|

Childcare benefit |

0.555 |

||

|

Unemployment benefit |

0.555 |

||

|

Incentives to work in: |

Sickness benefit |

0.666 |

3.33 |

|

Maternity benefit |

0.666 |

||

|

Paternity benefit |

0.666 |

||

|

Childcare benefit |

0.666 |

||

|

Unemployment benefit |

0.666 |

||

|

Social assistance |

|||

|

Coverage in: |

Cash social assistance |

0.555 |

3.33 |

|

Additional child benefit |

0.555 |

||

|

Child benefit |

0.555 |

||

|

Pregnancy grant |

0.555 |

||

|

Student’s childcare benefit |

0.555 |

||

|

Old-age assistance pension |

0.555 |

||

|

Adequacy in: |

Cash social assistance |

0.555 |

3.33 |

|

Additional child benefit |

0.555 |

||

|

Child benefit |

0.555 |

||

|

Pregnancy grant |

0.555 |

||

|

Student’s childcare benefit |

0.555 |

||

|

Old-age assistance pension |

0.555 |

||

|

Incentives to work in: |

Cash social assistance |

1.665 |

3.33 |

|

Additional child benefit |

1.665 |

||

|

System coordination |

|||

|

Coverage in: |

Old-age (Old-age contributory pension, Old-age assistance pension) |

1.11 |

3.33 |

|

Childcare/ sickness (Sickness benefit, Maternity benefit, Paternity benefit, Childcare benefit, Additional child benefit, Child benefit, Pregnancy grant, Student’s childcare benefit) |

1.11 |

||

|

Unemployment/ poverty (Unemployment benefit, Cash social assistance) |

1.11 |

||

|

Adequacy in: |

Old-age |

1.11 |

3.33 |

|

Childcare/ sickness |

1.11 |

||

|

Unemployment/ poverty |

1.11 |

||

|

Incentives to work in: |

Childcare/ sickness |

1.665 |

3.33 |

|

Unemployment/ poverty |

1.665 |

||

|

Evaluation criteria/ benefit type |

Coverage |

Adequacy |

Incentives to work |

||||||||||||

|

2018 |

2019 |

2020 |

2021 |

2022 |

2018 |

2019 |

2020 |

2021 |

2022 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Means-tested benefits |

|||||||||||||||

|

Cash social assistance |

11.1 |

11.2 |

9.6 |

11.9 |

11 |

49.8 |

48.6 |

68.1 |

68.9 |

77.1 |

33.8 |

30.8 |

39.1 |

38.3 |

37.4 |

|

Additional child benefit |

80.6 |

84.1 |

105.5 |

114.4 |

119 |

11.6 |

8 |

15.6 |

15.8 |

17.7 |

7.9 |

5.1 |

9 |

8.8 |

8.6 |

|

Categorical |

|||||||||||||||

|

Child benefit |

78.3 |

83.3 |

84.4 |

85.4 |

82.1 |

12.3 |

20 |

23.4 |

26.9 |

30.1 |

|||||

|

Pregnancy grant |

101.2 |

57.9 |

84 |

146.8 |

107.2 |

31 |

30.3 |

97.6 |

98.9 |

110.8 |

|||||

|

Student’s childcare benefit |

3.4 |

2.5 |

3.7 |

5.2 |

6 |

93.1 |

90.8 |

91.1 |

92.3 |

103.4 |

|||||

|

Old-age social assistance pension |

19.3 |

28.5 |

41 |

55 |

62.3 |

53.1 |

52.6 |

54.5 |

55 |

64.8 |

|||||

|

Evaluation criteria/ benefit type |

Coverage |

Adequacy |

Incentives to work |

||||||||||||

|

2018 |

2019 |

2020 |

2021 |

2022 |

2018 |

2019 |

2020 |

2021 |

2022 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Old-age contributory pension |

91.7 |

95.4 |

96.7 |

96.6 |

97.4 |

62.4 |

95 |

100 |

100 |

100 |

|||||

|

Sickness benefit |

49.6 |

47.6 |

54.7 |

52.4 |

64.9 |

52.1 |

43.4 |

59.7 |

65.1 |

69.7 |

30 |

23.4 |

29.1 |

30.7 |

28.8 |

|

Maternity benefit |

85.3 |

76.7 |

76.7 |

90 |

86.1 |

73.5 |

71.8 |

71.9 |

72.9 |

81.7 |

49.9 |

45.5 |

41.3 |

40.5 |

39.7 |

|

Paternity benefit |

54.7 |

54.8 |

55.3 |

63 |

66.6 |

73.5 |

71.8 |

71.9 |

72.9 |

81.7 |

49.9 |

45.5 |

41.3 |

40.5 |

39.7 |

|

Childcare benefit |

75.3 |

69.1 |

71.1 |

73.9 |

76.6 |

73.5 |

71.8 |

71.9 |

72.9 |

81.7 |

49.9 |

45.5 |

41.3 |

40.5 |

39.7 |

|

Unemployment benefit |

39 |

41.4 |

38 |

32.6 |

42.6 |

49 |

51.5 |

55 |

57.5 |

63.6 |

33.2 |

32.6 |

31.6 |

31.9 |

30.9 |

|

Evaluation criteria/ benefit type |

Coverage |

Adequacy |

Incentives to work |

||||||||||||

|

2018 |

2019 |

2020 |

2021 |

2022 |

2018 |

2019 |

2020 |

2021 |

2022 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Old-age |

55.4 |

61.9 |

68.8 |

69.4 |

79.8 |

57.7 |

73.8 |

77.2 |

77.5 |

82.4 |

|||||

|

Childcare/ sickness |

66 |

59.5 |

66.9 |

78.9 |

76.1 |

52.6 |

51 |

62.9 |

64.7 |

72.1 |

37.5 |

33 |

32.4 |

32.2 |

31.3 |

|

Unemployment/poverty |

25 |

26.3 |

23.8 |

22.2 |

26.8 |

49.4 |

50 |

61.5 |

63.2 |

70.4 |

33.5 |

31.7 |

35.4 |

35.1 |

34.2 |